The parental control software market is expected to grow at a moderate CAGR of 9.8% from around USD 1.7 billion in 2025 to USD 4.2 billion by 2035. As the number of children spending their time online goes up, parents and guardians have taken to using sophisticated monitoring systems to protect their families online.

Parents around the world use parental controls software on smartphones, tablets, gaming consoles, and PCs, being driven by growing concern about cyber-attack, screen dependency, and inadvertent exposure to undesirable material.

Parental control software helps parents and guardians monitor, manage, and restrict their online activity, making the digital terrain safe for them. Sure, such features as content filtering, screen time management, app-blocking, and real-time alerts are some of the features that ensure that children are safe from cyber risk in the form of cyberbullying, identity theft, and exposure to obscene content.

In this age of digital media, online education apps, and video games, the introduction of tighter parental control measures could not have come more in the nick of time. Regulatory bodies worldwide (for example, the GDPR in Europe and the USA Children's Online Privacy Protection Act (COPPA)) have strengthened an emerging trend for stricter online protection of minors.

There are a number of factors responsible for the soaring growth of the global parental control software market. The increased dependence on digital devices for everything from studying to recreation to socializing has also spurred heightened anxiety among parents about online safety.

Artificial intelligence (AI) and machine learning have made advanced high-tech monitoring systems possible for tracking suspicious behavior online and sending out real-time alerts. Also, the rise in awareness of cyber threats like online predators, phishing, and data breaches has further increased the demand for IA-based security solutions. In addition, due to the ease and convenience it offers, parental control has been made available in mobile applications (via their operating systems, browsers, etc.).

The growing industry has some challenges. Privacy concerns have inhibited the widespread adoption of parental control software, as sometimes trackers and activity monitors harvest data that could facilitate or enable monitoring of parents' devices. Smart children will bypass certain solutions, such as blocking software.

Another issue is low awareness in some regions, which could be a barrier to this technology, with digital literacy also being developed, which limits the penetration. As premium parental control software is costly, affordability is the most important concern in price-sensitive markets, and this may discourage some users.

As AI-based behavioral tracking and predictive analysis become increasingly what AIGS users experience, the sophistication of monitoring intelligence grows into action that actively targets online safety. Cloud-based parental control software, on the other hand, has boomed and allows long-ranging parents to control and monitor their kids from anywhere and at any time.

As more people sign up for the internet and savvy, safety-sensitive consumers learn more about how to stay secure online, growing economies such as Canada, Mexico, Australia, and India will see greater adoption. That logic, paired with increased demand for safer online spaces for children, puts the parental control software market on track for substantial growth through 2035.

| Attributes | Description |

|---|---|

| Industry Size (2025E) | USD 1.7 billion |

| Industry Size (2035F) | USD 4.2 billion |

| CAGR (2025 to 2035) | 9.8% CAGR |

Explore FMI!

Book a free demo

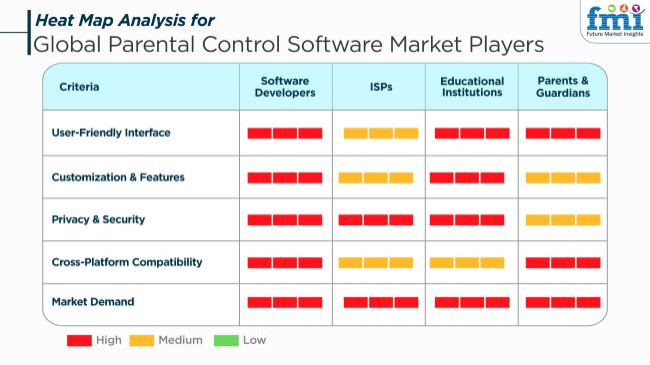

Worldwide sales of parental control software are currently in a state of rapid expansion due to the alarming rate of cyber threats, the necessity of screen time management, and the question of safety for children accessing the internet. Software developers emphasize feature-rich solutions like machine-learning-driven content filtering, monitoring in real-time, and geofencing in the provision of security at the advanced level.

Communication companies include parental controls in their services as a part of the process of making monitoring without installation easier. Academic institutions opt for these solutions to monitor students' use of digital content creators, and students apply knowledge to cybersecurity and safe browsing at the same time. Parents are concerned with user-friendliness, the price of the application, and the multi-device use that comes with it, thus being able to handle the children's screen time and online activities smartly.

The criteria for purchasing are modifications, simple usage, universal compatibility, and good privacy security. As long as cyber threats are present, the demand for parental control based on AI technology, cloud computing, and real-time will be on the rise, making these tools indispensable for the digital age of child safety.

Contracts & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Qustodio | 5 |

| Net Nanny | 20-50 |

| Kaspersky Safe Kids | 10&ndash25 |

From 2020 to 2024, parental control software demand grew at a constant pace. Several kids access the internet, and it becomes important to filter the content that they can see. As childhood is the stage where the right things need to be seen, parents are very cautious about what their children watch on the internet. Smartphone use can be dangerous if not done in the right way.

Educational institutions played their part in growing the industry due to being integrated into e-learning systems that provide parental control capabilities in a safe online learning environment. However, broader adoption of parental control solutions was hindered by factors like privacy issues, incompatibility across different electronic gadgets, and technology-savvy children outsmarting boundaries.

From 2025 to 2035, the software for parental control will transform with AI-based content moderation, real-time behavioral analysis, and hassle-free multi-device support. Cloud-based offerings will promote remote monitoring with more customization and emotion recognition. The growing popularity of immersive digital experiences like AR and VR will further fuel innovation in real-time monitoring and adaptive control systems.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments imposed stricter child protection laws, which resulted in compulsory parental control software for electronic devices. | AI-driven content moderation is everywhere, with global regulations imposing real-time surveillance and adaptive blocking. |

| Basic keyword and website blocking features evolved into AI-driven content filtering and screen time management products. | Advanced AI and ML-driven behavioral analysis complement predictive monitoring. Wearables and IoT integration guarantee end-to-end supervision. |

| Confined to PCs and smartphones, app-based solutions in command. | Upgraded to smart TVs, gaming consoles, and AR/VR platforms, providing consistent parental control on all digital interaction. |

| An increased focus on data privacy has introduced the regulation of parental consent. | Blockchain- and decentralized parental control solutions enable monitoring in which privacy is the main focus. |

| AI-driven monitoring apps introduced content limitations that were age-specific and based on child behavior. | AI-driven adaptive learning dynamically adjusts limitations based on behavioral data, guaranteeing responsible digital behavior. |

| Awareness grew, but adoption was still moderate owing to ease of use issues and kids going around limitations. | Parental control software has become mainstream, with pre-installed solutions mandatory in consumer electronics. |

| Increased screen usage among children and increased online threats drove the adoption of parental control software. | Interoperability with AI-based virtual parenting helpers and real-time monitoring across digital ecosystems enhances demand. |

The sector of parental control software is plagued with risks that come from the fact that this software has to cope with ever-evolving security issues, regulatory compliance, and technological adaptability.

Data privacy and security have been the greatest risks as parents have to allow the software to access sensitive information related to their children's online activities, their location, and the devices they use. A data breach or incorrect data usage can have legal consequences, affect one's reputation, and cause a loss of trust from the customers. The suffering employer must provide end-to-end encryption, offer transparent data policies, and comply with GDPR and COPPA regulations.

Moreover, competition for cyber threats contributes to this issue. Data breaches are ever-evolving as more and more cybercriminals and inappropriate content sources use new methods to slack off parental control. The software has to be equipped with these tools: AI-driven content filtering, and deep-learning-based anomaly detection, and real-time monitoring for its efficiency to remain at the top.

Regulatory compliance is quite heterogeneous depending on the region, some with highly stringent laws on child data protection, use of digital surveillance, and app permissions. The adaptation to newer data security laws and cross-border digital laws, which may be contrary to each other, will result in more legal expenses and software updates in a bid to avoid penalties.

The industry is aggressively competitive since it sees various players such as Qustodio, Norton Family, and Kaspersky Safe Kids, which carry a bunch of alternatives. In particular, gaining the consumers' trust and industry share primarily lies in distinguishing oneself through the facility of an AI-powered monitoring function, integrating cross-device functionality seamlessly, and offering friendly interfaces.

Tier 1 vendors are industry leaders with substantial shares, extensive global reach, and comprehensive product portfolios. These companies have established themselves as dominant players through continuous innovation, strategic partnerships, and robust customer bases. They often set industry standards and influence trends. While specific share percentages for individual companies are proprietary and not publicly disclosed, Tier 1 vendors collectively command a significant portion. Their revenues typically range in the hundreds of millions, reflecting their strong positions.

Tier 2 vendors are mid-sized companies with a notable presence in the parental control software market. They offer competitive products and have a substantial customer base, though their share and global reach are less extensive than Tier 1 vendors. These companies often focus on specific regions or niches, providing specialized solutions that cater to particular customer needs. Their revenues are generally in the tens of millions, indicating a solid position but with room for growth.

Tier 3 vendors consist of smaller companies, startups, or niche players with limited share and regional focus. They may offer innovative or specialized solutions but lack the extensive resources and global presence of Tier 1 and Tier 2 vendors. These companies often target specific demographics or address unique challenges within the parental control landscape. Their revenues are typically in the lower millions or below, reflecting their emerging status in the market.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 13.7% |

| China | 12.0% |

| Germany | 8.1% |

| Japan | 10.5% |

| The USA | 9.2% |

India witnessed aggressive adoption of smartphones by children with higher low-cost mobile phones and internet coverage. Social networks, educational sites, and apps are growing faster, and thereby, the risk of cybercrime and offensive content. Parents themselves choose in favor of monitoring solutions beforehand, particularly working professionals who require real-time monitoring solutions. FMI anticipates India's market to expand at 13.7% CAGR during the period of research.

Growth Factors in India.

| Key Drivers | Details |

|---|---|

| Smartphone adoption among children | Affordable mobile devices and widespread internet availability increase online engagement. |

| Digital learning expansion | Educational apps and platforms contribute to extended screen time. |

| Cyber threats and online safety concerns | A 40% rise in child-targeted cyber threats in 2023 highlights the need for monitoring solutions. |

| Government initiatives | Regulations such as the IT (Intermediary Guidelines and Digital Media Ethics Code) Rules promote online safety. |

Growing parental awareness of digital well-being has led to a growing use of monitoring software in the USA. The government has implemented strong child protection policies, including COPPA, with strict data privacy measures. Advanced parental control solutions provide real-time alerts and customized settings to address problems associated with cyberbullying, screen addiction, and online content. FMI&rsquos analysis says that the USA market will grow at a 9.2% CAGR during the research study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Digital well-being awareness | Parents actively monitor children&rsquos screen time and online interactions. |

| Government regulations | Laws like COPPA enforce strict data privacy measures for child-focused platforms. |

| Advanced monitoring tools | Real-time alerts and customizable restrictions increase adoption. |

| Legislative support | A proposed 2024 bill enforces default safety settings on social media for minors. |

China's booming EdTech industry has driven the surge in demand for parental control tools as students increasingly use online learning platforms. Parents look for means to manage digital distractions, over-screening, and app usage themselves to guarantee an undistracted learning experience.

The government also improved security under the "Double Reduction" policy and included parental control capabilities as a requirement in online learning platforms. According to FMI, China is set to expand at 12.0% CAGR during the forecast period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Expanding EdTech industry | Millions of students use online education platforms, increasing demand for monitoring tools. |

| Parental control integration | Educational applications incorporate monitoring features to regulate study schedules. |

| Government regulations | The "Double Reduction" policy reduces students' excessive reliance on digital tutoring. |

| Mandated parental controls | In 2023, authorities required all online education platforms to include monitoring settings. |

German stringent data privacy and its internet penetration level are reasons for rising demand for parental control software. Parents want to provide children with secure online spaces. With more powerful EdTech, schools implement online learning software, and this requires more monitoring solutions demand.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Stringent data protection laws | Germany enforces strict regulations on digital privacy and child safety online. |

| High internet penetration | A large percentage of children have internet access, increasing demand for monitoring software. |

| Parental awareness | Parents emphasize digital well-being and responsible internet use among children. |

| EdTech advancements | Schools integrate digital learning tools, making parental monitoring essential. |

Japan's digital security technological innovation has made parental control products better. With increasing screen time for children through smartphone and game console usage, parents have the pleasure of monitoring features. Digital literacy programs supported by the government aid in increasing safe internet use, further requiring efficient parental control software.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Technological advancements | Japan's innovation in digital security enhances parental control solutions. |

| Rising screen time among children | Increased use of smartphones and gaming consoles requires monitoring tools. |

| Government initiatives | Authorities implement digital literacy programs to promote safe internet usage. |

| Cybersecurity concerns | An uptick in cyber threats targeting children necessitates stricter online safety measures. |

Growing Android-based parental Control Software Adoption Surpasses System-Based Solutions.

The growth in the usage of smartphones and tablets by children has resulted in a boom in Android-based parental control software adoption. In contrast to system-based solutions, mobile apps provide real-time monitoring, location tracking, and app use limitations, thus proving to be more effective for parents.

With the rise of social media, gaming, and learning apps on the web, children spend more hours on mobile phones, which demands advanced parental control features that can be managed remotely.

The simplicity of use of mobile apps allows parents to monitor their child's internet activity at any given time, anywhere, contributing to their higher adoption rate. Governments have set up rules to improve the protection of children online through mobile phones.

The European Union, in 2023, revised its Digital Services Act to make it mandatory for mobile apps to have stricter parental control. An American bill also suggested that there should be a default parental control option on all mobile apps intended for children, citing the necessity of mobile-based solutions.

Increasing Need for Cloud-Based Parental Control Software

Parents were turning in greater numbers towards cloud-based parental control software as it is easier to use and more flexible. It enables them to keep tabs on their kid's online activity from any platform, anywhere, anytime. Nothing is needed no hardware and no complicated installation. So, when it comes to deployment, cloud-based parental control software is expanding.

With cloud deployment, parents can track apps, websites, and social media in real time. Sensitive data is kept secure, and auto-updates keep software running smoothly. Cloud solutions offer strong security and stable operation, which renders them a top choice for digital parenting. Due to the rise in online safety concerns, cloud-based parental control software leads the market.

There is a lot of competition in the parental control software market. Well-established cybersecurity companies and new technology entrants are competing with each other to get maximum profits. Companies show themselves to be different through AI-driven monitoring, real-time alerts, and cross-platform support to meet the growing need for online protection of children.

There are many market leaders, such as Qustodio, Net Nanny, and Norton Family, who dominate the market. They implement end-to-end digital parenting solutions based on built-in cybersecurity features. With their solutions, devices can be monitored, and content can be filtered. It can be checked what sites or pages on social media are being followed.

Several kids are using social media or the internet. There is an increased concern over digital wellness and strengthening regulatory policies. Merchants are incorporating machine learning, GPS tracking, and time management features to provide greater control to users.

Strategic drivers influencing competition are alliances with telecom operators, educational institutions, and device makers to promote adoption. Firms also concentrate on local compliance with data privacy regulations and subscription pricing models to ensure recurring revenues.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Qustodio | 20-25% |

| Net Nanny | 15-20% |

| Norton Family | 12-18% |

| Kaspersky Safe Kids | 10-15% |

| Mobicip | 8-12% |

| Other Players | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Qustodio | A leading provider of parental control solutions, offering real-time monitoring, screen time management, and social media tracking with multi-device compatibility. |

| Net Nanny | AI-driven content filtering, real-time alerts, and website blocking provide a highly customizable solution for digital parenting. |

| Norton Family | Part of Norton&rsquos cybersecurity suite, offering parental control features alongside advanced cyber protection for families. |

| Kaspersky Safe Kids | Focuses on secure browsing, GPS tracking, and device usage control, integrating cybersecurity measures into parental monitoring. |

| Mobicip | Provides cloud-based parental control solutions with app blocking, content filtering, and screen time management for mobile and desktop devices. |

Key Company Insights

Other Key Players (20-30% Combined)

The industry is projected to reach USD 1,663.3 million in 2025.

The industry is expected to grow significantly, reaching USD 4,236.2 million by 2035.

China is poised for the fastest growth, with a CAGR of 12.0% from 2025 to 2035.

Key companies in the market include Norton, Kaspersky Lab, Qustodio LLC, Mobicip, uKnow.com Inc., Salfeld Computer GmbH, FamilyTime, SafeDNS Inc., mSpy, BitDefender, Content Watch Holdings Inc., TeenSafe Inc., and Bark.

The smartphone segment (device access) is widely used, providing parental control solutions across Android, iOS, and Windows-based platforms.

By deployment, the market is segmented into on-premises parental control software and cloud parental control software.

By platform, the market is segmented into Android-based parental control software, iOS-based parental control software, and Windows-based parental control software.

By region, the market is segmented into North America, Latin America, Asia Pacific, Europe, and the Middle East and Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.