The paper packaging industry is witnessing rapid growth as businesses switch to sustainable, biodegradable, and recyclable forms of packaging. Manufacturers are innovating in the fields of lightweight materials, water-resistant coatings, and smart packaging technologies in response to booming demand for packaging from the food & beverage, e-commerce, and retail industries. Stricter global regulations on sustainability have put plastic alternatives to the fore for plastic packaging, driving their uptake in favor of fiber-based solutions.

AI-assisted production, digital printing, and moisture-resistant paper coatings are some ways manufacturers are enhancing durability and product appeal. As such, the industry is moving toward recyclable options of corrugated boxes, molded pulp packaging, and plant-based coatings in order to meet consumer demand for greener alternatives.

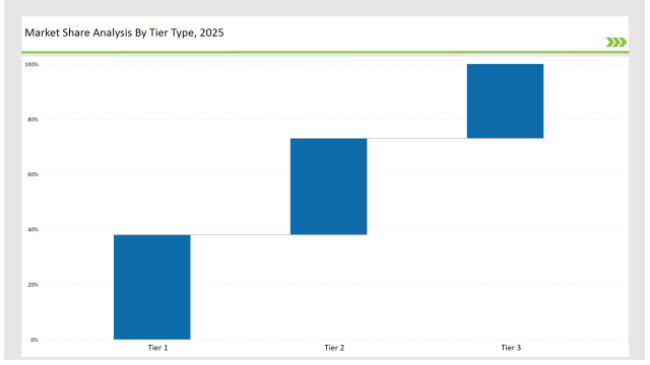

Distribution across the entire region is via the Tier 1 players, International Paper, WestRock, and Smurfit Kappa, owning 38% of the market because of the massive manufacturing capabilities, global distribution network, and leadership in sustainable fiber-based packaging.

Tier 2 companies like Mondi Group, DS Smith, and Stora Enso command 35% of the market by creating affordable and high-performing paper packaging solutions for various industries.

Together, Tier 3 holds 27% of the market, consisting of regional and niche players who specialize in customized, lightweight, digitally printed packaging solutions. These companies emphasize local production, smart-packaging integrations, and sustainable printing techniques.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (International Paper, WestRock, Smurfit Kappa) | 18% |

| Rest of Top 5 (Mondi Group, DS Smith) | 14% |

| Next 5 of Top 10 (Stora Enso, UPM-Kymmene, Pratt Industries, BillerudKorsnäs, Nippon Paper) | 6% |

Paper packaging is an industry that serves various sectors where sustainability, strength, and branding are key factors. Packaging companies are developing new packaging formats under demands of the industries. Incorporation of digital printing allows the creation of customized high-res designs that enhance brand recognition. Further, manufacturers are developing high-barrier moisture-resistant coatings for better protection of products and longer shelf life.

The manufacturers are optimizing their paper packaging with lightweight structures, hydrophobic coatings, and also smart packaging components. They are developing biodegradable coatings to substitute plastic films with the possibility of recycling and without compromising durability. The companies are in the installation of AI or algorithmic technology for precision cutting thus eliminating material wastage. Another feature nowadays is the installation of tamper-proof seals and anti-counterfeit elements in packaging for better security of the products.

The paper packaging sector is being transformed by sustainability and digital integration. To reduce material use, companies are building lightweight structures reinforced with bio-based coatings, are using AI for design optimization, and lightweight structures. More industries are investing in compostable adhesives and inks from plants to improve their recyclability. Manufacturers are launching smart paper packaging featuring embedded NFC tags for real-time tracking, while businesses are also investing in blockchain traceability for increased transparency in sourcing and production.

Technology suppliers should focus on automation, sustainable coatings, and digital connectivity to support the evolving paper packaging market. Partnering with e-commerce and food brands will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | International Paper, WestRock, Smurfit Kappa |

| Tier 2 | Mondi Group, DS Smith, Stora Enso |

| Tier 3 | UPM-Kymmene, Pratt Industries, BillerudKorsnäs, Nippon Paper |

Papers packaging technology is now progressed by the lead manufacturers through production by AI, using sustainable materials, and smart tracking features. They now use high-speed automation to augment efficiency and reduce material waste. The companies embed digital watermarks in their packages for better recyclability and material sorting. Firms are developing hybrid forms of packaging that would own the characteristics of strength and lower environmental impact.

| Manufacturer | Latest Developments |

|---|---|

| International Paper | Launched recyclable paper-based flexible packaging in March 2024. |

| WestRock | Developed plant-based coatings for moisture-resistant paper in April 2024. |

| Smurfit Kappa | Expanded digital printing for e-commerce packaging in May 2024. |

| Mondi Group | Released lightweight, high-barrier paper pouches in June 2024. |

| DS Smith | Strengthened QR-enabled smart packaging in July 2024. |

| Stora Enso | Introduced compostable medical-grade paper in August 2024. |

| UPM-Kymmene | Pioneered bio-based adhesives for full recyclability in September 2024. |

The paper packaging market is evolving as companies invest in sustainable materials, digital printing, and enhanced product protection.

The industry keeps on integrating AI-powered processes and smart tracking solutions with eco-coatings. Such light designs will allow manufacturers to minimize material use. Companies will start switching bio-based coatings to eliminate all plastic barriers. Brands will implant digital authentication features into luxury packaging. Enhanced consumer engagement and product security through smart NFC-enabled solutions will be added to the efforts. Further, firms will optimize supply chains through blockchain technology to promote sustainable sourcing.

Leading players include International Paper, WestRock, Smurfit Kappa, Mondi Group, DS Smith, Stora Enso, and UPM-Kymmene.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include sustainability, lightweight materials, digital printing, and smart packaging.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.