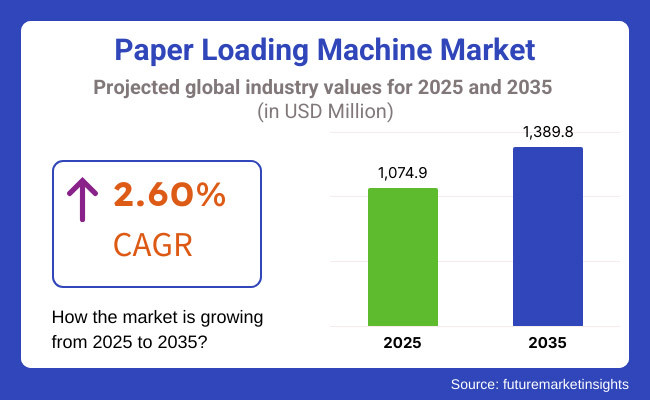

The global paper loading machine industry is projected to exceed USD 1,389.8 million by 2035, with a CAGR of 2.60% from USD 1,074.9 million in 2025.

Companies are consistently putting efforts into integration services to maximize efficiency in production which is eventually boosting the adoption of paper loading machines, as this technology blends perfectly with Industry 4.0 technologies and traditional manufacturing systems.

This trend meets the rising demand for effective, integrated production atmosphere with minimal downtime. Furthermore, this technology also comes with end-to-end lifecycle advantages like installation, maintenance, upgrades, and decommissioning making it a profitable opportunity.

In addition, the industry’s continuous shift towards human-centric design, operators are rapidly becoming central to industrial activities and businesses are investing in creative and specialized solutions that enhance productivity. The trend is complemented by employee well-being and productivity, asserting the interest of the industry in ongoing improvement and retention of employees.

Explore FMI!

Book a free demo

From 2020 to 2024, the paper loading machine industry worldwide expanded as the adoption of automation and Industry 4.0 technology picked up pace. The emphasis from manufacturers was the incorporation of intelligent systems to improve productivity and efficiency.

Sophisticated sensors and real-time monitoring have been implemented, enabling businesses to streamline operations and minimize downtime. The increasing need for high-speed, accurate paper handling solutions resulted in the use of robotics and AI-based mechanisms, enhancing precision and workflow automation.

During this time duration, there was increased focused on cost savings that made firms to invest in efficient models that had low operational expenses.

From 2025 to 2035, the sector will change dramatically with a shift towards sustainability and human-centered design for better ergonomics or machine operation for human workers.The industries will shift to green innovations, creating energy-efficient machines that align with international carbon reduction targets.

Recyclable products and biodegradable lubricants will be adopted extremely in adherence to the environmental responsibility of the industry. Producers will concentrate on maximizing ergonomics and user friendliness through embedding intuitive controls, AI-driven automation, and higher safety features.

Furthermore, prioritizing the well-being of workers will further enrich the industry growth and develop the design of machines that cause minimal physical discomfort and provide higher efficiency. This advancement will also help in establishing industry’s momentum towards a sustainable and human-centered industrial future.

| Key Drivers | Key Restraints |

|---|---|

| Increased use of automation and Industry 4.0 - Industries are increasingly adopting automation and intelligent technologies to improve efficiency, minimize labor dependency, and enhance accuracy in paper handling. Sophisticated robotics and AI-based solutions are fueling demand for automated paper loading machines. | High upfront costs and maintenance fees - It is expensive for SMEs to make the upfront capital investment required by advanced paper loading machines. High maintenance fees can also be expected for sophisticated systems. |

| Growing emphasis on energy efficiency and sustainability - Growing pressure from the environment and regulations is making manufacturers introduce energy-efficient, eco-friendly paper loading machines. Manufacturers are placing bets on green solutions that can cut energy expenditure and waste. | Shortage of trained workforce - The operation and maintenance of sophisticated paper loading machines demand trained professionals. The lack of trained personnel becomes a hindrance to industries aiming to incorporate automated solutions. |

| Advances in robotics and AI for precision handling - The establishment of AI-based automation and robot-assisted paper loading technology is enhancing precision, minimizing errors, and increasing productivity, thus attracting industries to such machines. | Heavy reliance on raw material prices - The industry is subject to heavy reliance on the movement of raw material prices, like metals and electronics components, which affect manufacturing expenses and machine affordability in general. |

| Growth of packaging and printing sectors - The swift expansion of e-commerce, digital printing, and eco-friendly packaging solutions is fueling the need for paper loading machines that facilitate mass production. | Gradual adoption in small and medium businesses (SMEs) - Most SMEs are budget-strapped and would not necessarily choose to invest in high-end paper loading machines, thus experiencing delayed adoption rates over large-scale businesses. |

| Focus on worker safety and ergonomics - The sector is increasingly placing emphasis on human-oriented designs with user-friendly controls and safety aspects that minimize workplace accidents and enhance operational effectiveness. | Regulatory issues and compliance needs - Companies have to comply with strict regulations concerning workplace safety, environmental effects, and product quality, which can act as a hindrance to industry growth. |

| Key Driver | Impact Level |

|---|---|

| Growing adoption of automation and Industry 4.0 | High |

| Increasing focus on sustainability and energy efficiency | Medium |

| Advancements in AI and robotics for precision handling | High |

| Expansion of packaging and printing industries | High |

| Emphasis on worker safety and ergonomics | Medium |

| Key Restraint | Impact Level |

|---|---|

| High initial investment and maintenance costs | High |

| Limited availability of skilled workforce | Medium |

| High dependency on raw material costs | High |

| Slower adoption in small and medium enterprises (SMEs) | Medium |

| Regulatory challenges and compliance requirements | Medium |

Roll loading machines will play a crucial role in refining the industry landscape, retaining a value share of nearly 25% in 2025. These machines are extensively used in mass production printing and packaging activities as they are efficient in managing continuous rolls of paper.

Sheet loading machines will remain a vital component, especially in bookbinding and printing industries, where accuracy in cutting and positioning is paramount. Other models, such as web-fed loading machines, will experience consistent demand, especially in newspaper printing and specialty paper use.

With the upcoming technological refinements and Industry 4.0 integration by 2035, these machines will become smarter, responding quickly and efficiently to the production settings. The surge in the demand of high-speed, automated systems will further foster the development of paper loading machines, curating a more integrated and productive industry landscape.

The book binding industry will be the leading contributor, accounting for close to 30% of the industry value share in 2025. Growth in the demand for quality printed products, such as books, magazines, and journals, will continue to drive the demand for sophisticated paper loading solutions.

Printing and packaging sectors will continue to be the prime drivers, as companies look for quicker and more accurate paper-handling solutions to satisfy increasing consumer demands. Publication print will have a consistent landscape standing, though emerging trends in electronic media will touch its long-run growth.

Industries like labeling and converting will have more use of specialized loading machinery designed for custom applications. Throughout all end-user segments, greater integration of automation and smart technology will be featured in the marketplace by 2035, offering greater efficiency as well as reducing operational expenses.

Environmental issues will also push innovation, creating environment-friendly machine design in line with international environmental standards.

Manual loading machines will remain relevant to small-scale businesses where automation does not pay off. Semi-automatic loading machines, however, will become popular with manufacturers who look for a middle ground between being affordable and being efficient.

The demand for fully automatic loading machines will increase the most, with companies opting for automation to drive productivity and reduce human error. By 2025, businesses will increasingly invest in semi-automatic and fully automatic solutions to optimize paper handling in high-output settings.

By 2035, development in AI and IoT will further enhance fully automatic loading machines, allowing predictive maintenance, real-time monitoring, and effortless integration with other intelligent factory systems.

The transition towards automation will aid companies in maximizing production, curbing wastage, and enhancing safety within the workplace, making automatic paper loading solutions a prime catalyst for industry change in the forecast period.

Small-sized machines will persist in serving niche sectors and low-volume operations, especially in small printing companies and specialized bookbinding uses. Medium-sized machines will be the most common category, offering a compromise of efficiency, versatility, and affordability for mid-sized producers.

Large-sized machines will see considerable demand in high-output sectors, especially in large-scale printing and packaging operations where high-speed, bulk paper handling is critical. Through 2025, producers will prioritize improving machine performance regardless of size category, incorporating intelligent technologies for increased precision and efficiency.

Through 2035, automation and Industry 4.0 connectivity will be standard on medium and large-sized machines, allowing real-time tracking of data and process optimization. The growing demand for scalability and flexibility in production lines will propel developments in machine size and capacity, allowing manufacturers to respond to changing sector needs more efficiently.

Traditional loading machines will still be utilized in industries where adoption of automation is slower due to cost constraints or outdated systems. Automated loading machines will, however, experience significant growth as companies become more focused on efficiency and accuracy in handling paper.

Companies will spend extensively on intelligent and networked machines that embrace Industry 4.0 technologies in 2025, enabling them to monitor in real-time, predict maintenance, and integrate workflow seamlessly. By 2035, the use of AI-driven, smart paper loading machines will gain momentum, revolutionizing production environments with data-driven automation and improved operational insights.

The demand for lower labor dependency and maximized resource utilization will propel the transition to connected machines, providing greater productivity and cost savings. As industries transition to fully automated solutions, paper loading machines will become part of highly efficient, interconnected manufacturing ecosystems.

The United States paper loading machine sector will grow at a CAGR of 2.20% between 2025 and 2035. The consistent demand for automation in bookbinding, packaging, and printing industries will propel industry growth. The USA. industry will witness a sharp transition towards Industry 4.0 integration, with companies implementing AI-based and fully automated loading systems to boost efficiency.

Sustainability issues will also drive market trends, with firms investing in energy-efficient and environmentally friendly paper handling equipment. The expanding e-commerce and packaging industry will drive demand for high-speed, precision-based machines.

Yet, issues such as high upfront investment costs and labor shortages can hinder adoption by small and medium-sized enterprises. By 2035, advancements in technology and regulation according to sustainability standards will continue to mold industry trends, making smart and automatic paper loading machines a norm in industrial operations in the country.

The United Kingdom's paper loading machine industry is likely to expand at a CAGR of 2.20% during the period 2025 to 2035. The rising focus on automation and efficiency in packaging and print industries will propel the market. Smart, connected paper loading solutions are likely to be embraced by British manufacturers to optimize processes and mitigate labor dependency.

Sustainability will be one of the major concerns, with companies looking for energy-efficient and recyclable products to use in production processes. Increasing demand for quality bookbinding solutions will also drive industry growth.

The UK industry will see widespread use of AI-driven automation and Industry 4.0 integration by 2035, enhancing efficiency and cutting operational expenses. Government incentives supporting the adoption of green technology will also define the direction of the market during the forecast period.

Germany's paper loading machine industry is projected to grow at a CAGR of 2.30% during the period from 2025 to 2035, thanks to the nation's robust manufacturing base and advances in technology. Increasing demand for efficient paper handling systems in the printing, packaging, and newspaper segments will drive growth.

German industry players will continue to dominate in precision engineering, creating intelligent and automated paper loading machines with AI-enabled features. Sustainability programs will become significant, as firms embrace recyclable and energy-efficient materials in order to conform to stringent green laws.

Implementation of Industry 4.0 technologies will increase machine efficiency through real-time tracking and predictive maintenance. Challenges related to increasing cost of production and lack of skilled workers can negatively affect the rate of growth in the industry.

By 2035, the German paper loading machine industry will be characterized by highly automated, environmentally friendly production techniques and high adherence to European sustainable standards.

India's paper loading machine industry will register a CAGR of 3.30% between 2025 and 2035, becoming one of the world's fastest-growing sectors. The speedy growth of the printing and packaging sectors, driven by growing consumer demand and rising e-commerce, will fuel impressive sector development.

Indian manufacturers are increasingly turning to automated and semi-automated loading technologies to enhance efficiency and minimize operating costs. Government policies supporting digitalization and green manufacturing will further drive demand for smart and energy-saving paper loading machines.

Nevertheless, issues like high upfront investment and infrastructural constraints could hinder the use of completely automated solutions. India's segment will see a shift by 2035 with higher automation, more emphasis on sustainability, and widespread use of AI-based loading machines to improve productivity in mass-scale industrial processes.

China's paper loading machine segment is anticipated to register a CAGR of 3.10% between 2025 and 2035, driven by the nation's robust industrial base and accelerated technological development. The increasing demand for high-speed and automated paper handling solutions across the packaging, bookbinding, and printing industries will drive segment growth.

Chinese producers are making significant investments in intelligent and networked paper loading machines, using AI and IoT technologies to improve efficiency and reduce waste. The drive for sustainability, aided by government policies encouraging energy-efficient production, will continue to propel industry trends.

Nevertheless, issues like volatile raw material prices and global trade policies could be challenging. Chinese industry will be characterized by sophisticated, fully automated equipment with smooth integration of Industry 4.0 by 2035, resulting in maximized production processes as well as increased operational efficiency both in domestic-oriented and export industries.

Canada's paper loading machine industry is anticipated to expand gradually throughout the forecast period, backed by growing automation across the printing and packaging sectors. Demand for precision-based and high-speed paper handling solutions will surge, especially in newspaper publishing and bookbinding.

Canadian industry players will make investments in AI-based and automated machines to enhance operational efficiency as well as support sustainability targets. Focus on green practices and energy-saving solutions will drive industry trends, with companies seeking to meet strict environmental norms.

Yet the steep price of sophisticated machinery and the scarcity of well-trained labor could prove difficult for smaller companies to meet. By 2035, the industry will see increased penetration of Industry 4.0-silos integrated machines, enabling manufacturers to optimize production and minimize shutdowns.

The growth in e-commerce and digital printing will continue to propel demand for intelligent and networked paper loading machines in the nation.

Japan's paper loading machine industry is forecast to change dramatically from 2025 to 2035 due to technological advancements and industrial manufacturing automation. The nation's sophisticated printing and packaging sectors will continue to require highly productive and precision-based paper loading machines.

Japanese companies will be at the forefront of creating high-speed, compact, and AI-integrated machines to boost productivity with minimal wastage. Sustainability programs will be at the forefront, as firms prioritize energy-efficient and recycled materials to become compliant with world environmental regulations.

Challenges of depleting demand for conventional print media and higher production expenses may affect industry development. By 2035, Japan's segment will witness stronger adoption of intelligent technologies, such as predictive upkeep and real-time monitoring, that will allow seamless workflow enhancement. The ongoing transition to digital printing and smart automation will continue to fuel the need for next-generation paper loading technologies.

South Korea's paper loading machine segment will witness consistent growth during the forecast period, driven by the nation's robust industrial base and emphasis on technological innovation. The printing and packaging sectors will propel demand for high-speed, automated paper handling solutions, with manufacturers looking to incorporate smart and connected machines into their production lines.

Sustainability will be the center of attention, prompting companies to develop energy-saving and eco-friendly paper loading equipment. The government's drive towards digitalization and intelligent manufacturing will also speed up industry uptake of Industry 4.0-integrated technologies.

But competition from foreign manufacturers and unstable raw material prices can pose a threat to industry growth. In South Korea by the year 2035, sectors will be defined by highly autonomous and AI-capable paper loading machines, guaranteed to enhance the efficiency and low operational costs for different industrial sectors. Digital printing and intelligent packaging will also determine the future directions of industrial growth.

The global paper loading machine market is characterized by a mix of established multinational corporations and specialized regional players, with the top 8-10 companies collectively holding a significant share of the market. Industry leaders such as Siemens AG, Bosch Rexroth, Mitsubishi Electric, and ABB dominate the high-end automation segment, leveraging advanced robotics, IoT integration, and precision engineering to cater to large-scale paper manufacturing and packaging industries.

These companies collectively account for approximately 45-50% of the global market share, driven by their extensive R&D investments, global distribution networks, and ability to deliver customized solutions for high-speed production lines.

Siemens, for instance, holds an estimated 12-15% share due to its strong foothold in Europe and North America, while Mitsubishi Electric and ABB command significant shares in Asia-Pacific markets, particularly in Japan and China, where automation adoption in paper mills is rapidly growing.

Specialized manufacturers like Voith Group, Böttcher Systems, and PMT Group focus on niche applications, such as heavy-duty paper roll handling and precision loading systems for sensitive materials. Voith, a German engineering giant, holds roughly 8-10% of the market, supported by its long-standing partnerships with pulp and paper mills and its emphasis on sustainability-driven innovations like energy-efficient loading systems.

Böttcher and PMT, though smaller, collectively account for 5-7% of the market, catering to mid-sized enterprises with modular, cost-effective solutions. These companies differentiate themselves through after-sales service, ease of integration with legacy systems, and expertise in handling specialty papers, such as coated or laminated variants.

Their regional dominance in Europe and selective emerging markets reinforces their competitive positioning against larger multinationals.

Regional players, including Kadant Inc. (USA), Valmet (Finland), and Andritz AG (Austria), further diversify the market landscape, collectively representing 15-20% of global shares. Kadant, for example, holds a strong presence in North America, offering tailored solutions for the corrugated packaging sector, which has seen surging demand due to e-commerce growth.

Valmet and Andritz, meanwhile, are key suppliers to the Nordic and Asian markets, integrating paper loading systems with broader production line automation. These companies often compete on price flexibility and localized customer support, appealing to cost-conscious manufacturers in developing economies.

However, their market share is fragmented regionally, with limited penetration in highly automated markets like Germany or Japan, where Siemens and Mitsubishi retain dominance.

The industry for paper loading machines is moderately concentrated to highly concentrated, with some major players controlling large industry share and many regional and specialty manufacturers present in certain niches.

Industry leaders are large multinational corporations, providing sophisticated automation, intelligent loading technology, and compatibility with Industry 4.0 technologies. Market fragmentation exists due to the presence of small regional manufacturers targeting cost-sensitive sectors.

The industry tilts toward consolidation because the expense of technology and human skills to produce complete automated and AI-based paper loading machines is prohibitively high. Large players undertake heavy R&D and innovation efforts, which place them far ahead in terms of technology that others find difficult to follow.

On top of this, rigorous regulation of machine safety, environmental concern, and power efficiency works to the advantage of established players that have the necessary means to ensure very high standards.

Simultaneously, fragmentation continues in some areas because of the lower costs of entry for semi-automatic and manual loading machines. Most small and medium-sized businesses (SMEs) address local needs, especially in emerging sectors where price sensitivity is still high.

Also, ease of financing with government subsidies and funding assistance programs makes it easier for regional competitors to set up and grow, further creating a diversified competitive landscape.

The international paper loading machine sector is becoming more competitive with long-established players emphasizing automation, smart integration, and sustainability. Innovative technology like AI-based monitoring, predictive maintenance, and Industry 4.0 integration are redefining the industry.

The emphasis is on research and development to make the machine more efficient, reduce downtime, and decrease operational costs. Increasing manufacturing bases in cost-effective areas is another strategic move to ensure competitiveness on a global scale.

Emerging players are gaining ground by providing modular, cost-efficient, and customizable solutions to meet small and medium-sized manufacturers' needs. Leasing models and cloud-based monitoring systems are being taken up by many, making automation more affordable. Joint ventures with local manufacturers and emphasis on energy efficiency are also assisting these players in gaining a ground in the sector.

As automation and sustainability push demand, the industry will keep changing. Old players will fortify their technology advantage, and new companies will differentiate based on affordability, adaptability, and innovation.

The demand is driven by automation, Industry 4.0 integration, and the need for efficient, high-speed production in industries like printing and packaging.

Companies are focusing on smart connectivity, AI-driven monitoring, energy efficiency, and customizable designs to cater to diverse industrial needs.

Key challenges include high initial investment costs, integration with existing systems, and meeting sustainability regulations.

Automation is making machines more efficient, reducing manual intervention, and enabling predictive maintenance, leading to cost savings and improved productivity.

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Neoprene Coffee Sleeves Market Growth - Demand & Forecast 2025 to 2035

Mailer Boxes Market Growth – Demand & Forecast 2025 to 2035

Metal Aerosol Packaging Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.