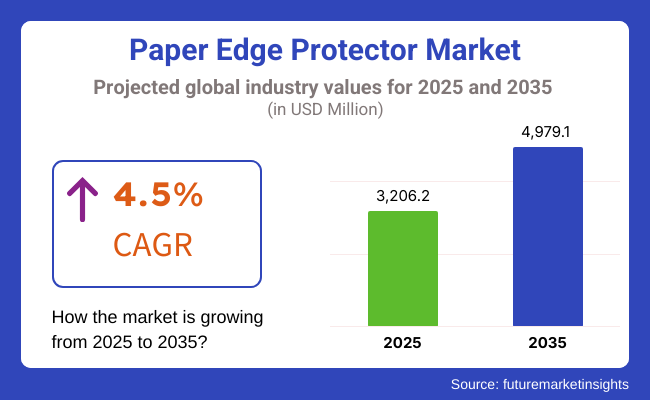

The global sales of paper edge protector are estimated to be worth USD 3,206.2 million in 2025 and anticipated to reach a value of USD 4,979.1 million by 2035. Sales are projected to rise at a CAGR of 4.5% over the forecast period between 2025 and 2035. The revenue generated by paper edge protector in 2024 was USD 3,112.8 million. The industry is anticipated to exhibit a Y-o-Y growth of 4.3% in 2025.

The logistics & transportation industry is driving strong demand for the paper edge protector market, and applications in end-uses are forecast to increase to USD 1,362.6 million in 2025 with over 40% of market share. This is dominated by increased demand for protection from damage, stabilization of loads, and cost-savings protective shipping packaging for palletized shipping, warehouse storage, and intermodal transport.

Products range from U-shaped and L-shaped edge protectors, which are widely applied for load securing of stretch-wrapped pallets, stacked carton protection, and strapped load reinforcement on e-commerce, FMCG, automotive, and industrial products transportation. Growing world trade and rising transit safety needs are also fueling this demand.

Recovered paperboard is projected to represent USD 2,209.1 million in 2025 because of its low-cost affordability, sustainability, and high-strength structure for cushion packaging. The product is utilized mostly in honeycomb pack packaging, paper edge protectors, and corner board, which are important in palletized loads protection, carton reinforcement, and strapping support in the logistic, food & beverages, consumer electronics, and industrial supplies industries.

Increased use of eco-friendly packaging materials, firm initiatives towards sustainability, and official push towards recycling alternatives continue to be key demand drivers for applications of recycled paperboard in storage containers in the warehouse and shipping containers.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global paper edge protector market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.5%, followed by a high growth rate of 5.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 3.5% (2024 to 2034) |

| H2 | 5.5% (2024 to 2034) |

| H1 | 4.2% (2025 to 2035) |

| H2 | 4.8% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2035, the CAGR is projected to increase to 4.2% in the first half and decrease to 4.4% in the second half. In the first half (H1) the market witnessed an increase of 70 BPS while in the second half (H2), the market witnessed a decrease of 70 BPS.

Manufacturing and Construction Sectors Drive Demand for Reinforced Edge Protectors

Increasing popularity of paper edge protectors in manufacturing and building & construction sector is influenced by the requirements of heavy-duty edge protection and product protection during storage and transit. Since transportation of prefabricated goods, metal parts, timber, tiles, glass doors, and prefabricated materials is increasing, companies are shifting their focus towards Solid Bleached Sulfate (SBS) protectors and Coated Unbleached Kraft Paperboard because they are highly durable, more resistant to compression, and better water-resistant.

These papers resist edge damage, improve pallet stability, and allow safer warehouse storage and long-distance transportation. More construction in developing economies and strict packaging regulation needs for delicate products are also adding fuel to demand. Moreover, automobile component makers, electric appliance makers, and machinery makers are increasingly using reinforced edge protectors to avoid transit damage loss, minimize the degree of wastage, and enhance overall supply chain efficiency overall.

Logistics Boom Drives Demand for Durable Paper Edge Protectors

Increased need in the logistics & transport industry is compelling the use of paper edge protectors mainly angular and round for the purpose of maintaining load stability and preventing injuries in palletized shipping and storage. With quick expansion of international trade and online business, there is a growing shift of consumer goods, industrial machinery, and sensitive cargo that demand safe and shock-absorbing packaging procedures.

Paper edge protectors strengthen pallet edges, avoid strapping damage, and enhance stacking strength, avoiding product damage during storage, transportation, and handling. Growth in cross-border trade, last-mile delivery companies, and third-party logistics (3PL) activities also stimulates demand, as companies look for cost-efficient and eco-friendly protective packaging to minimize product loss.

Furthermore, stricter shipping regulations and greater warehouse automation are forcing businesses to invest in robust, light, and recyclable edge protectors to improve packaging efficiency and supply chain resilience.

Recycled Paperboard Falls Short for Heavy-Duty Industrial Load Protection

While recycled paperboard is a cost-effective and environmentally friendly packaging material, its weakened strength in heavy-duty application is still the primary limitation, especially among high-weight load protection industries. Compared to Coated Unbleached Kraft Paperboard (CUK) or Solid Bleached Sulfate (SBS), recycled paperboard offers lower compression resistance and longevity and thus is less suited for cushioning heavy industrial goods, construction products, and large machinery during shipping.

In construction, automobile, and manufacturing industrial sectors, where deliveries can consist of metal beams, heavy-duty appliances, and oversize equipment, edge crushing, load shifting, or protector failure become more pronounced when recycled forms are utilized. Apart from this, it is further compromised with moisture or aggressive handling. Thus, companies transporting high-density material typically use stronger, laminated or reinforced edge protectors, limiting universal application of reclaimed paperboard to hostile, heavy-duty shipping applications.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Automated Packaging & Palletizing | Enhances efficiency in warehouses and distribution centers, ensuring consistent load stability and reduced product damage during high-speed packaging. |

| Sustainable & Recyclable Materials | Driven by corporate ESG goals and regulatory mandates, companies are shifting to eco-friendly, high-strength recycled paperboard edge protectors. |

| Customized & High-Performance Edge Protectors | Industries like automotive, pharmaceuticals, and heavy machinery require reinforced, moisture-resistant, and impact-absorbing edge protectors for specialized applications. |

| Cold Chain Logistics & Temperature-Sensitive Packaging | Growing demand in food & beverage, pharmaceuticals, and biotech drives investment in moisture-resistant and coated edge protectors to withstand refrigeration and humidity. |

| E-commerce & Last-Mile Logistics Solutions | The rapid expansion of online retail and direct-to-consumer (DTC) models is increasing the need for lightweight, durable, and protective edge solutions for fragile shipments. |

The global paper edge protector industry recorded a CAGR of 3.0% during the historical period between 2020 and 2024. The growth of the paper edge protector industry was positive as it reached a value of USD 3,112.8 million in 2024 from USD 2,765.7 million in 2020.

Global paper edge protector market has been growing steadily in recent years with the lead given by growing demand in the warehousing, logistics, and manufacturing industries. Growth in cross-border trade, 3PL business, and online shopping has been among the greatest drivers of surging demand for load stabilization as well as prevention of damage, especially in shipping on pallets and bulk carriage.

Compliance pressures and sustainability issues have also been driving demand for recycled paperboard-based edge protectors as manufacturers look for sustainable packaging alternatives. However, raw material price fluctuations in the market and competition from foam- and plastic-based protectors have been a dampener, balancing moderate growth in the market.

In spite of this, ongoing investment in robotically automated warehousing and enhanced supply chain operations has ensured angular and round paper edge protectors remain in constant demand in a number of industries.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Demand Drivers | Growth driven by e-commerce expansion, global trade, and warehouse automation. |

| Material Preference | Dominance of recycled paperboard due to cost-effectiveness, but SBS and CUK used for heavy-duty applications. |

| End-Use Industries | Logistics & transportation, warehousing, and manufacturing were key consumers. |

| Product Preference | Angular edge protectors dominated, widely used in palletizing and load securing. |

| Regulatory Impact | Sustainability mandates encouraged the shift toward eco-friendly materials. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Demand Drivers | Increasing focus on sustainable packaging, regulatory compliance, and AI-driven logistics. |

| Material Preference | High-performance, biodegradable coatings and moisture-resistant recycled materials gain traction. |

| End-Use Industries | EV battery transport, pharmaceutical cold chains, and advanced automation warehouses drive demand. |

| Product Preference | Increased adoption of custom-sized, impact-absorbing, and reinforced edge protectors for specialized applications. |

| Regulatory Impact | Stricter packaging waste regulations and carbon footprint reduction initiatives accelerate demand for fully recyclable solutions. |

Future markets will be compelled to growth unimaginable by advances in technology for protective packaging, stringent transit safety regulatory standards, and industrialization rate of growth in developing economies. Increased focus on green solutions in packaging will propel demand for recycled and biodegradable edge protectors in food & beverages, pharmaceuticals, and consumer electronics industry segments more and more.

In addition, rising adoption of automated logistics systems and inventory management systems driven by AI will enhance the demand for high-strength, low-cost edge protection products in a standardized format. Greater expansion of the automobile and construction industries and more export-oriented operations will also propel rising demand for reinforced heavy-duty edge protectors. As companies start paying attention to building supply chain resilience and packaging optimization, the industry is in for long-term growth, especially where there is continuous industrial growth and infrastructure development.

Tier 1 company leaders are distinguished by their extensive portfolio and use of advanced production technology. These market leaders are stand out because of their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They offer a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 include Smurfit Kappa Group PLC., Packaging Corporation of America, Sonoco Conitex, Rengo Co., Ltd., Pratt Industries, Inc. and VPK Packaging Group NV.

Tier 2 companies are defined by a strong presence overseas and in-depth market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in Tier 2 include Cascades Inc., Raja S.A., Napco National, Cordstrap B.V., Signode Industrial Group (Crown Holdings), Pactiv LLC.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | High demand from e-commerce, logistics, and warehouse automation. Sustainability regulations led to increased use of recycled paperboard protectors. |

| Europe | Strong adoption due to EU packaging waste directives. Heavy usage in automotive exports and industrial goods transportation. |

| Asia-Pacific | China and India led growth due to manufacturing and export demand. Increasing adoption in retail and FMCG sectors. |

| Latin America | Gradual market penetration, with Brazil and Mexico leading due to food & beverage and agricultural exports. |

| Middle East & Africa | Low adoption, primarily used in industrial packaging and bulk cargo shipments. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Stricter carbon footprint regulations will drive biodegradable and compostable edge protectors. Rising EV battery logistics will boost demand for impact-resistant solutions. |

| Europe | Circular economy policies will accelerate investment in fully recyclable and plastic-free edge protectors. Growth in renewable energy and EV sectors will drive custom protective solutions. |

| Asia-Pacific | Rising infrastructure projects and industrial expansion will fuel demand. Growing e-commerce penetration in Southeast Asia will further accelerate adoption. |

| Latin America | Expansion of regional logistics hubs and growth in construction materials export will drive demand for reinforced edge protectors. |

| Middle East & Africa | Growth in pharmaceutical cold chain logistics and construction material exports will boost demand. Sustainable packaging policies will encourage the use of recycled variants. |

The section below covers the industry analysis for the paper edge protector market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 4.8% through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 6.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| Canada | 3.2% |

| Brazil | 5.0% |

| Argentina | 3.7% |

| Germany | 2.4% |

| China | 6.4% |

| India | 6.8% |

The second major force behind the USA paper edge protector market is increasing demand for cold chain logistics in the food & beverage sector. With increasing numbers of consumers depending on fresh fruits and vegetables, dairy items, frozen foods, and temperature-sensitive drinks, customers are demanding pallet shipments and refrigerated transportation that require robust edge protection to ensure load stability during transit and in transit.

Paper edge protectors, particularly moisture-resistant coated unbleached kraft paperboard protectors, are commonly used to support shrink-wrapped pallets and corrugated cartons of food items. As big food distributors, supermarket retailers, and meal kit delivery businesses grow their supply chains, the demand for lightweight, durable, and recyclable protective products that meet FDA and USDA packaging safety tests increases.

Besides, expansion in direct-to-consumer grocery delivery food companies and food distribution center automation is also driving the use of custom-sized edge protectors for maximum load carrying.

One of the most important drivers in the Germany paper edge protector market is the growing automotive demand, especially for protection of components in export and just-in-time (JIT) production logistics. Germany is a world center of automobile production and precision engineering and is shipping engines, transmissions, body panels, and electronic modules which need secure, shock-resistant protection packaging during shipping.

Paper edge protectors, particularly reinforced angle protectors of solid bleached sulfate (SBS) and coated unbleached kraft paperboard, are gaining acceptance to avoid strap abrasion as well as edge crushing of heavy auto components transported in wood boxes and corrugated boxes.

With Germany's leading automakers and Tier-1 manufacturers demanding higher quality control for supply chain management, pallet shipments in bulk are secured by edge protectors that meet European transportation safety standards (DIN 55410). Electric vehicle (EV) battery logistics also drive the need for customized protective packaging to avoid shock and vibration damage.

The section contains information about the leading segments in the industry. By material type, recycled paperboard are projected to grow at a CAGR of 4.6% through 2025 to 2035. Additionally, logistics & transportation end uses are predicted to grow at a CAGR of 5.1%.

| Product Type | Value Share (2025) |

|---|---|

| Angular | 66.8% |

Angular paper edge protectors are poised to capture the market share in terms of value, led by their widespread application in palletized shipment security, heavy machinery packaging security, and warehouse storage reinforcement. Automotive, construction material, and consumer electronics industries depend on L-shaped and U-shaped angular protectors for edge crushing prevention, enhanced vertical stacking strength, and load stability during transit.

Also, angular protectors are the choice of primary logistics suppliers and third-party warehouse operators when securing strapped commodities and stretch-wrapped pallets due to minimizing damage to the products and optimizing adherence to shipping safety standards.

Increasing use of automatic palletization and robotic-based material handling solutions in large warehouses adds to demand because accurately cut and reinforced angular edge protectors maintain uniform protection for loads while maintaining operational effectiveness. The movement towards sustainable, high-strength paperboard substrates is also propelling premium-priced angular guards, cementing their market supremacy.

| End Use | Value Share (2025) |

|---|---|

| Warehousing | 30.4% |

Warehousing is the second most prevalent application of paper edge protectors due to heightened needs for protection of inventory, pallet storage capacity, and machine running of materials. Angle and round edge protectors paper is utilized by primary distribution centers, cold storage warehousing, and internet retailing fulfillment warehouses to cushion stacked materials, prevent carton distortion, and support pallet loads for long-term storage.

With the advent of automated storage and retrieval systems (ASRS) and high-bay racking systems, edge protectors ensure load integrity, minimize pressure damage caused by strapping, and ensure multi-level stacking stability. Proprietary edge protectors are utilized in fast-moving consumer goods (FMCG) warehouses, pharmaceutical warehouses, and bulk industrial products warehouses to reduce transit damage in warehouses and ease handling on robotic packaging lines.

The broader application of cross-docking operations and JIT supply chain practices even extends the definition of demand for the use of green, light weight, and durable protective materials in each warehouse logistics.

Key players operating in the paper edge protector market are investing in the development of innovative sustainable solutions and also entering into partnerships. Key paper edge protector providers have also been acquiring smaller players to grow their presence to further penetrate the paper edge protector market across multiple regions.

Recent Industry Developments in the Paper Edge Protector Market

| Manufacturer | Vendor Insights |

|---|---|

| Sonoco Products Company | Leading global supplier with a strong focus on recycled paperboard edge protectors. Investing in sustainable packaging solutions and customized protective packaging for heavy-duty applications. |

| Smurfit Kappa Group | Major player in Europe and North America, offering high-strength angular and round edge protectors. Focused on eco-friendly coatings and recyclable materials. |

| Pratt Industries | Specializes in 100% recycled paperboard edge protectors for logistics and e-commerce packaging. Expanding capacity in North America to meet growing demand. |

| Packaging Corporation of America | Strong presence in the USA industrial and consumer goods packaging market. Investing in lightweight yet durable edge protectors for automated warehousing solutions. |

| Eltete TPM Ltd. | Pioneer in sustainable transport packaging, providing heavy-duty edge protection solutions for automotive, construction, and logistics industries. |

The global paper edge protector industry is projected to witness CAGR of 4.5% between 2025 and 2035.

The global paper edge protector industry stood at USD 3,112.8 million in 2024.

The global paper edge protector industry is anticipated to reach USD 4,979.1 million by 2035 end.

South Asia & Pacific region is set to record the highest CAGR of 6.0% in the assessment period.

The key players operating in the global paper edge protector industry include Smurfit Kappa Group PLC., Packaging Corporation of America, Sonoco Conitex, Rengo Co., Ltd., Pratt Industries, Inc. and VPK Packaging Group NV.

In terms of material type, the industry is divided into solid bleached sulfate (SBS), coated unbleached kraft paperboard, recycled paperboard.

In terms of product type, the industry is segregated into angular and round.

The market is classified by end use such as logistics & transportation, warehousing, and manufacturing.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa have been covered in the report.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.