Sustainable, high-end, and aesthetically pleasing packaging and decorative solutions are in massive demand in the paper-based laminating industry these days. As demand swells in food & beverage, personal care, and industrial applications, manufacturers are pushing for more innovations in recyclable, lightweight, and durable laminate structures. Companies are also using moisture-resistant coatings, bio-based adhesives, and digital printing as their pathways to elevate performance and environmental compliance.

Manufacturers are focusing their attention on using AI systems in quality control, high-speed lamination technology, and water-based barrier coatings to enhance production and sustainability. The industry is becoming more aligned with compostable laminates, paper-based substitutes for plastics, and digitally enhanced textures for premium applications.

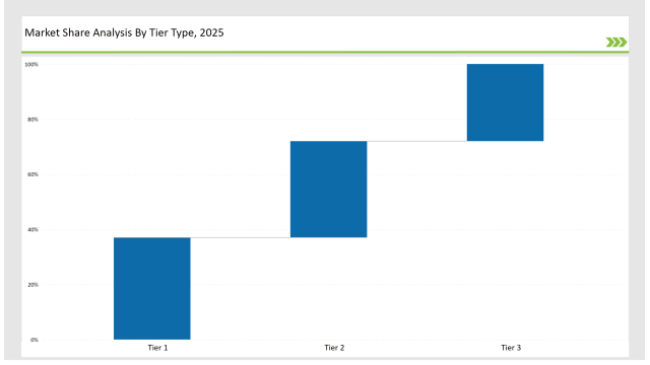

The leading Tier 1 players (Amcor, Mondi Group, WestRock), who lead in sustainable laminates, coating technology, and global distribution networks, hold 37% of the market.

Tier 2 companies, such as UPM-Kymmene, Sappi Limited, and BillerudKorsnäs, acquire 35% of the market by supplying high-quality, cost-effective, and customizable paper laminates for different applications.

Tier 3 consists of regional and niche players working with biodegradable, digitally printed, specialty paper laminated products, holding 28% of the market. They primarily focus on local production, blend innovative materials in their offerings, and equalize sustainability in packaging solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Mondi Group, WestRock) | 18% |

| Rest of Top 5 (UPM-Kymmene, Sappi Limited) | 11% |

| Next 5 of Top 10 (BillerudKorsnäs, Huhtamaki, Constantia Flexibles, Sonoco, Sealed Air) | 8% |

The paper-based laminate industry serves multiple sectors where sustainability, durability, and aesthetics are crucial. Companies are developing high-performance laminated materials to meet evolving consumer preferences.

Manufacturers are optimizing paper-based laminates with high-strength coatings, lightweight structures, and eco-friendly adhesives. They are incorporating advanced moisture-resistant layers to improve durability in high-humidity environments.

The laminate industry, traditionally dependent on paper, is transforming due to sustainability and digital transformation. AI-defect detection systems, bio-based polymer coatings, and lightweight laminate designs are being researched and applied to improve performance and recyclability. Smart laminated surfaces integrating RFID technology are being implemented to enhance tracking capabilities. Water-based adhesive systems are being researched to substitute the conventional solvent-based approaches. On top of this, companies are investing in anti-counterfeit labeling systems with digitally printed security features.

Technology suppliers should focus on automation, sustainable coatings, and digital printing advancements to support the evolving paper-based laminate market. Partnering with food, retail, and personal care brands will accelerate innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Mondi Group, WestRock |

| Tier 2 | UPM-Kymmene, Sappi Limited, BillerudKorsnäs |

| Tier 3 | Huhtamaki, Constantia Flexibles, Sonoco, Sealed Air |

Leading manufacturers are advancing paper laminate technology with AI-powered production, bio-based coatings, and enhanced recyclability. They are also improving heat-sealable paper laminates to replace plastic-based alternatives in food packaging applications.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched recyclable high-barrier laminates in March 2024. |

| Mondi Group | Developed compostable paper laminate alternatives in April 2024. |

| WestRock | Expanded fiber-based moisture-resistant laminates in May 2024. |

| UPM-Kymmene | Released water-based adhesive laminates in June 2024. |

| Sappi Limited | Strengthened premium decorative laminate offerings in July 2024. |

| BillerudKorsnäs | Introduced ultra-lightweight, high-strength laminated paper in August 2024. |

| Huhtamaki | Pioneered digitally printed laminated paper in September 2024. |

The paper laminate market continues to develop as companies research bio-based materials, implement artificial intelligence for defect detection, and create innovative packaging features. These modern innovations include increasingly thinner, stronger laminates that use less material while providing lasting durability. Manufacturers will continue developing antimicrobial coatings into food and medical packaging applications to enhance hygiene and safety.

Manufacturers will continue integrating AI-driven quality control, bio-based coatings, and high-speed lamination processes. Companies will refine lightweight designs to improve cost efficiency. Businesses will adopt compostable barrier layers to meet regulatory mandates. Firms will expand digital printing for high-definition branding. Smart packaging with QR and NFC-enabled authentication will enhance consumer interaction. Additionally, organizations will strengthen automated production lines to increase output and minimize waste.

Leading players include Amcor, Mondi Group, WestRock, UPM-Kymmene, Sappi Limited, BillerudKorsnäs, and Huhtamaki.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 37%.

Key drivers include sustainability, digital printing, high-barrier materials, and automation.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.