The panuveitis treatment market is valued at USD 4,310 million in 2025. As per FMI's analysis, the market will grow at a CAGR of 9.5% and reach USD 10,680 million by 2035. The global panuveitis treatment market experienced significant advancements in 2024, driven by increased awareness, improved diagnostic capabilities, and the rising adoption of biologics and immunosuppressive therapies.

FMI analysis found that corticosteroid-based treatment uses continued to rise during the year, while biologic agents were becoming a greater choice due to their effectiveness in the management of chronic inflammation. The prospects for successful treatment outcomes were further improved by the introduction of modern drug delivery systems like sustained-release implants.

Regulatory approval and extended indications for biologics were instrumental in altering treatment protocols in North America and Europe. FMI opines that emerging economies, especially in Asia-Pacific regions, had increased rates of patient diagnosis, thus encouraging treatment adoption.

Nevertheless, steep treatment costs and issues of accessibility remained the major challenges. In view of the anticipated innovations in immunomodulatory therapies and individualized treatment strategies, the coming years until 2025 and afterward will clearly propel the growth of this industry in a significant way.

FMI analysis suggests that others are engaged in developing targeted biologics and gene therapies that result in better patient outcomes in the long run. AI diagnostics and teleophthalmology will enhance avenues for early detection and treatment accessibility. In light of the increasing aging population and rising prevalence of the disease, this industry is going to witness massive growth in the next 10 years.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Industry Size in 2025 | USD 4,310 Million |

| Projected Industry Size in 2035 | USD 10,680 Million |

| CAGR (2025 to 2035) | 9.5% |

Explore FMI!

Book a free demo

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across pharmaceutical companies, healthcare professionals, hospitals, regulatory agencies, and patients in the USA, Western Europe, Japan, and South Korea.

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Pharmaceutical Companies:

Healthcare Providers:

Patients:

Alignment:

Divergence:

High Consensus:

Key Variances:

Strategic Insight:

A standardized treatment approach will not succeed. Regional adaptation-such as AI-assisted diagnostics in the USA, biosimilar-driven cost reduction in Europe, and combination therapy in Asia-is critical to ensuring effective panuveitis management.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA's Biologics License Application (BLA) and New Drug Application (NDA) processes impose stringent clinical trial and approval requirements, often delaying new treatments for ocular inflammation by several years. The Inflation Reduction Act is pushing for drug pricing reforms, potentially impacting biologic treatment affordability and reimbursement. |

| European Union | The European Medicines Agency (EMA) mandates centralized approval for biologics under the Marketing Authorization (MA) process. The EU’s Health Technology Assessment (HTA) framework influences reimbursement decisions, requiring companies to demonstrate cost-effectiveness for industry entry. |

| United Kingdom | The Medicines and Healthcare Products Regulatory Agency (MHRA) follows a fast-track approval pathway for innovative therapies post-Brexit but maintains strict safety and efficacy benchmarks. The National Institute for Health and Care Excellence (NICE) plays a crucial role in pricing and reimbursement decisions, emphasizing cost-effectiveness evaluations. |

| China | The National Medical Products Administration (NMPA) has streamlined drug approvals under its new priority review system for innovative therapies. However, stringent local clinical trial requirements and government-driven price negotiations often delay foreign drug entry. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) has introduced expedited approval pathways for rare and severe ocular inflammatory diseases. The national health insurance system aggressively negotiates drug prices, limiting high-cost biologic adoption. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) enforces strict clinical trial regulations but offers fast-track approvals for breakthrough therapies. The Health Insurance Review and Assessment Service (HIRA) plays a key role in reimbursement, focusing on cost-effectiveness. |

| Australia & New Zealand | The Therapeutic Goods Administration (TGA) and Medsafe require rigorous safety and efficacy data for approvals. Government subsidies under the Pharmaceutical Benefits Scheme (PBS) in Australia and PHARMAC in New Zealand significantly influence drug pricing and accessibility. |

The industry is on a strong growth trajectory, driven by rising disease prevalence, advancements in biological therapies, and improved diagnostic capabilities. MI analysis found that pharmaceutical companies developing targeted biologics and sustained-release drug delivery systems stand to benefit.

At the same time, patients in regions with limited healthcare access may face challenges due to high treatment costs. As innovation accelerates and awareness grows, the sector is set for significant expansion, particularly in developed regions and emerging economies with improving healthcare infrastructure.

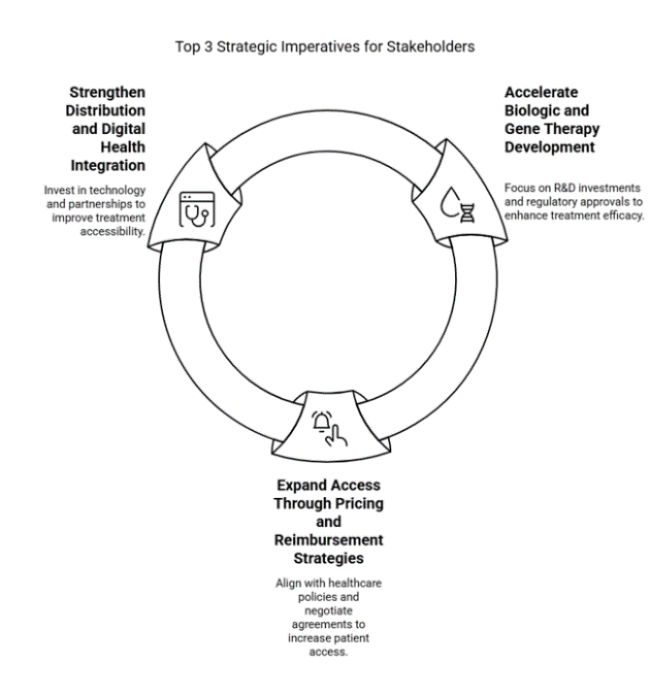

Accelerate Biologic and Gene Therapy Development

Pharmaceutical companies should prioritize R&D investments in biologics and gene therapies to enhance treatment efficacy and long-term disease management. Expanding clinical trials and securing regulatory approvals will be critical to gaining industry leadership.

Expand Access Through Pricing and Reimbursement Strategies

Aligning with evolving healthcare policies and negotiating favorable reimbursement agreements will help increase patient access to advanced treatments. Companies should explore tiered pricing models and strategic partnerships with healthcare providers to improve affordability in underserved regions.

Strengthen Distribution and Digital Health Integration

Investing in teleophthalmology, AI-driven diagnostics, and strategic distribution partnerships will enhance early detection and treatment accessibility. Expanding collaborations with hospitals, specialty clinics, and digital health platforms will be essential for maximizing industry penetration and improving patient outcomes.

| Risk Factor | Probability & Impact |

|---|---|

| High Treatment Costs Limiting Patient Access - Advanced biologic therapies can cost over USD 10,000 annually, making them inaccessible for uninsured patients and those in lower-income regions. Limited reimbursement coverage further exacerbates affordability issues. | High Probability - High Impact |

| Regulatory & Approval Delays - Strict FDA and EMA regulations for biologics and gene therapies can delay industry entry by 3-5 years. Extensive clinical trials and compliance requirements increase R&D costs and lengthen commercialization timelines. | Moderate Probability - High Impact |

| Supply Chain Disruptions-API shortages, geopolitical instability, and manufacturing constraints have delayed drug deliveries, increasing lead times by up to 30%. Heavy reliance on China and India for raw materials heightens vulnerability to export restrictions and production halts. | Moderate Probability - High Impact |

| Priority | Immediate Action |

|---|---|

| Expand Biologic & Gene Therapy Pipeline | Accelerate R&D on next-generation biologics and gene therapies to improve treatment efficacy and secure faster regulatory approvals. Develop innovative drug delivery systems, including sustained-release implants, to enhance patient outcomes and compliance. |

| Strengthen Pricing & Reimbursement Strategies | Engage with global healthcare regulators and insurers to establish tiered pricing models and expand reimbursement coverage for high-cost biologic treatments. Collaborate with government agencies and NGOs to improve patient affordability in emerging industries. |

| Enhance Supply Chain Resilience | Diversify API and raw material sourcing to reduce reliance on a few geographic regions. Establish long-term supplier agreements, explore localized manufacturing options, and invest in predictive analytics for inventory management to prevent disruptions. |

To stay ahead, companies must accelerate biologic and gene therapy development, strengthen pricing strategies, and enhance supply chain resilience. Investing in next-generation therapies with improved delivery mechanisms will drive competitive differentiation, while proactive engagement with regulators and insurers will expand patient access.

FMI analysis found that mitigating API shortages and diversifying supplier networks will be critical to maintaining steady production and cost control. Companies that act now to optimize R&D, pricing, and distribution will secure long-term industry leadership and capitalize on the sector’s sustained growth trajectory.

The anti-inflammatory segment is projected to grow at a CAGR of 8.9% from 2025 to 2035, driven by the widespread use of corticosteroids and nonsteroidal anti-inflammatory drugs (NSAIDs) as first-line treatments for panuveitis. FMI analysis found that corticosteroid injections and implants remain essential for managing acute inflammation, reducing the risk of vision loss.

However, long-term steroid use is associated with side effects, prompting research into safer alternatives. The adoption of sustained-release corticosteroid implants is improving treatment adherence, while AI-driven diagnostics are enhancing early detection. Despite advancements, reliance on conventional corticosteroids limits industry growth compared to biological and targeted therapies.

The oral administration segment is set to expand at a CAGR of 9.1% from 2025 to 2035, driven by the convenience and systemic effectiveness of oral immunosuppressants and corticosteroids. FMI analysis found that methotrexate, cyclosporine, and azathioprine remain key options for long-term disease management, particularly in chronic or recurrent cases.

However, systemic side effects, including gastrointestinal and liver complications, limit their prolonged use. The development of safer oral formulations and targeted small-molecule inhibitors is enhancing treatment precision. Growing investments in oral biologics are expected to support segment growth further, although concerns over side effects and therapy compliance remain.

The hospital pharmacy segment is anticipated to grow at a CAGR of 9.8% from 2025 to 2035, maintaining its position as the dominant distribution channel for treating ocular inflammatory conditions. FMI analysis found that hospital pharmacies account for the majority of biologic drug sales, as these specialized treatments require close medical supervision. The presence of trained pharmacists and ophthalmologists in hospitals enhances treatment accuracy and adherence.

Additionally, stringent hospital regulations ensure high-quality medication availability. However, pricing negotiations with healthcare providers and insurance limitations may restrict patient access to premium biologics. Despite this, rising hospital-based treatment preferences and collaborations with pharmaceutical firms will sustain robust growth.

The USA is set to grow at a CAGR of 10.2% from 2025 to 2035, driven by advancements in biologics and strong regulatory support. FMI analysis found that the USA leads global revenues due to high disease awareness, advanced healthcare infrastructure, and favorable reimbursement policies. The growing prevalence of autoimmune diseases has fueled demand for corticosteroid implants and immunosuppressants, with the FDA fast-tracking approvals for novel treatments.

FMI opines that strong insurance coverage supports patient adoption, though high drug prices remain a challenge under regulatory scrutiny. AI-assisted diagnostics and teleophthalmology are enhancing early detection while pharmaceutical firms expand R&D for gene therapies aimed at long-term disease remission. An aging population and rising disease burden are expected to sustain industry growth, keeping the USA at the forefront of industry innovation.

The UK is projected to expand at a CAGR of 9.4% from 2025 to 2035, driven by NHS-backed reimbursement for advanced biologic therapies. FMI analysis found that the MHRA’s streamlined post-Brexit drug approvals have accelerated industry entry, though NICE’s cost-effectiveness assessments impact high-cost biologic reimbursements.

FMI opines that increasing uveitis cases in older people are driving demand for corticosteroids and systemic immunosuppressants. AI-based diagnostic tools and teleophthalmology are improving patient management, while ongoing investments in gene therapies and long-acting drug delivery systems are shaping future treatment approaches. Supply chain challenges post-Brexit remain a hurdle, but digital health integration is expected to strengthen industry growth.

France is expected to grow at a CAGR of 9.1% from 2025 to 2035, driven by increased biologic adoption and government-backed healthcare programs. FMI analysis found that France’s robust public healthcare system ensures broad access to ophthalmic treatments, with evolving guidelines favoring biologics and targeted immunosuppressants.

FMI opines that ANSM’s stringent drug approval process supports safety but limits premium biologic pricing flexibility. Investments in AI-driven diagnostics and telemedicine are improving early detection, while public-private research partnerships accelerate clinical trials. Cost-control policies challenge profitability, yet digital health tools and patient support programs are enhancing treatment adherence, ensuring continued industry growth.

Germany is anticipated to expand at a CAGR of 9.3% from 2025 to 2035, backed by a strong pharmaceutical sector and advanced healthcare infrastructure. FMI analysis found that Germany is a leader in biologic therapy development, with statutory health insurance covering most ophthalmic treatments.

FMI opines that IQWiG’s cost-effectiveness evaluations influence reimbursement and impact pricing strategies. AI-assisted diagnostic tools and gene therapy research are improving early detection and treatment outcomes. Although stringent regulatory requirements can delay industry entry, expanding digital healthcare solutions and long-acting drug delivery implants are expected to drive steady industry growth.

Italy is set to grow at a CAGR of 8.9% from 2025 to 2035, driven by increasing disease prevalence and biologic therapy advancements. FMI analysis found that SSN ensures broad access to treatments, though regional disparities in reimbursement create accessibility challenges.

FMI opines that AIFA’s strict cost-effectiveness assessments impact new biologic approvals. Rising investments in ophthalmology research and collaborations with global pharmaceutical firms are enhancing treatment innovation. AI-driven diagnostic platforms are optimizing early detection, while patient assistance programs and telemedicine are improving accessibility, ensuring sustained industry growth despite regulatory complexities.

South Korea is projected to expand at a CAGR of 9.7% from 2025 to 2035, supported by strong pharmaceutical R&D and government healthcare investments. FMI analysis found that the country is a key hub for biological drug development, with domestic firms reducing reliance on imports.

FMI opines that gene therapy advancements and sustained-release corticosteroids are gaining traction, while MFDS regulatory streamlining accelerates novel therapy approvals. AI-enhanced ophthalmic diagnostics are improving early detection, and precision medicine is driving demand for personalized treatment regimens. Supply chain constraints and cost-containment policies pose challenges, but innovation-friendly regulations will sustain steady growth.

Japan is anticipated to grow at a CAGR of 9.5% from 2025 to 2035, fueled by an aging population and regulatory incentives for biologics. FMI analysis found that Japan’s fast-track approval pathways expedite entry for innovative ophthalmic treatments.

FMI opines that PMDA’s support for clinical research is accelerating high-efficacy therapy approvals. Regenerative medicine and AI-integrated ophthalmology are improving early detection and personalized treatment approaches. NHI’s strict pricing controls create cost pressures, but Japan’s focus on therapeutic innovation ensures steady industry expansion.

China is expected to grow at a CAGR of 10.1% from 2025 to 2035, making it one of the fastest-expanding regions. FMI analysis found that increasing disease diagnosis rates and government incentives for domestic biologic production are reducing import dependency and lowering treatment costs.

FMI opines that NMPA’s fast-tracked drug approvals are accelerating access to cutting-edge treatments. Research collaborations are driving monoclonal antibody and gene therapy development. Centralized drug procurement policies and rural healthcare disparities pose challenges, but strong government backing and rising patient awareness will sustain high industry growth.

Australia and New Zealand are projected to expand at a CAGR of 9.2% from 2025 to 2035, supported by government reimbursement programs and increasing biologic adoption. FMI analysis found that PBS in Australia and PHARMAC in New Zealand ensure affordable access to advanced therapies.

FMI opines that academic research collaborations are driving novel drug delivery development. AI-assisted diagnostics and teleophthalmology are improving early disease detection. Regulatory hurdles and rural healthcare disparities remain barriers, but strong government support and medical innovation investments will sustain industry expansion.

The panuveitis treatment market is projected to maintain steady growth in 2025, with biologic therapies continuing to dominate the landscape. Leading players such as Novartis, AbbVie, and Roche/Genentech are expected to retain their strong positions, which are supported by their established immunology portfolios and ongoing clinical advancements.

Novartis, with its blockbuster drug Cosentyx (secukinumab), is anticipated to hold the largest share (~30-35%) due to its expanding use in non-infectious uveitis and panuveitis. The company’s continued investment in clinical trials and potential label expansions further solidify its dominance in this space.

AbbVie is likely to secure the second-largest share (~20-25%), driven by the sustained use of Humira (adalimumab) in certain regions and the growing adoption of Rinvoq (upadacitinib) for refractory cases. Meanwhile, Roche/Genentech could capture ~15-20% of the industry if farcical (Vabysmo), currently in Phase 3 trials for uveitic macular edema, gains approval for panuveitis. This expansion would position Roche as a key competitor in the anti-VEGF and inflammatory uveitis segments.

Regeneron Pharmaceuticals is expected to hold a ~10-15% share, primarily due to Eylea (aflibercept), which is often used off-label for uveitis-related complications. Additionally, companies like Bausch Health, Santen, and Alimera Sciences collectively account for ~10-15% of the industry, leveraging steroid implants (e.g., Yutiq, Iluvien) and localized treatment options for chronic inflammation.

Emerging players, including EyePoint Pharmaceuticals and Clearside Biomedical, could disrupt the industry (~5-10% combined share) with innovative drug delivery systems such as EYP-1901, a sustained-release anti-VEGF therapy currently under Fast Track designation. If approved, these novel therapies may shift treatment paradigms, particularly for patients requiring long-term management.

The industry is projected to grow at a 7% CAGR in 2025, fueled by increasing biologic adoption, advancements in sustained-release formulations, and improved diagnostic rates in emerging economies. However, precise share distribution will depend on regulatory decisions, clinical trial outcomes, and potential new entrants.

Advancements in biologics, rising autoimmune disease prevalence, improved diagnostics, and expanding healthcare access are driving growth.

Corticosteroids, immunosuppressive drugs, biologics, and sustained-release implants are the primary treatment options.

AI-assisted diagnostics, teleophthalmology, gene therapies, and precision medicine are enhancing early detection and treatment outcomes.

High costs, strict regulatory approvals, supply chain issues, and healthcare budget constraints impact treatment availability.

North America, Europe, China, and Japan are leading in advanced therapy adoption due to strong healthcare systems and regulatory support.

By drug class, the industry is segmented into anti-inflammatory, antimicrobial drugs, and immunotherapy & targeted therapies.

In terms of the route of administration, the industry is segmented into oral and topical.

Based on the distribution channel, the industry is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Specialty Medical Chairs Market Trends - Size, Growth & Forecast 2025 to 2035

Surgical Drapes Market Overview - Growth, Demand & Forecast 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Remote Healthcare Market – Growth & Innovations 2025 to 2035

Prosthetics and Orthotics Market - Growth & Future Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.