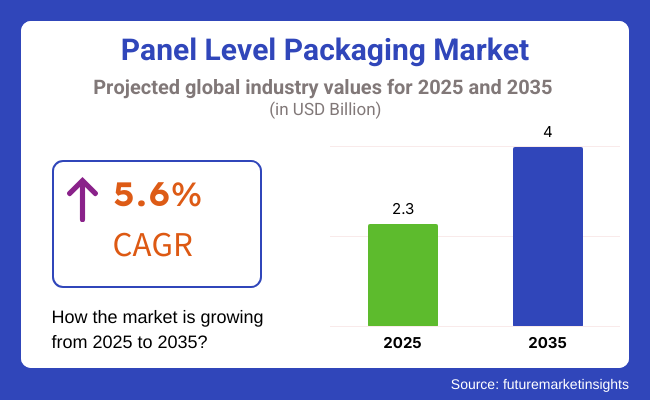

The global panel level packaging market is expected to reach USD 2.3 billion by 2025 and is projected to be valued at USD 4.0 billion by 2035, expanding at a CAGR of 5.6% from 2025 to 2035. The semiconductor industries favor panel-level packaging due to benefits like larger form factors, higher I/O capability, and better performance compared to wafer-level packaging.

It provides cost-effective scalability, advancing consumer electronics and automotive. Demand for consumer electronics, as well as the proliferation of 5G, IoT, and electric vehicles, is driving demand for panel-level packaging solutions.

In the panel-level packaging type, PLFO packaging is projected to dominate and hold less than 50% of the market. PLFO has become the protocol of choice for the high-dimension devices because it performs better and has good scalability.

It provides higher I/O densities paired with better thermal and electrical performances, which is why this technology is widely adopted in the semiconductor sector. In particular, PLFO packaging is vital for applications like memory, sensors, and automotive components that require advanced packaging solutions for device miniaturization and enhanced functions.

There will be profitable opportunities in the panel-level packaging market as it is set to display an incremental opportunity of USD 1.7 billion, growing 2.0x in value during the forecasted period and eventually amounting to 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global panel level packaging market over several semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 5.8% (2024 to 2034) |

| H1 | 5.5% (2025 to 2035) |

| H2 | 6.6% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly lower growth rate of 5.8% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.5% in the first half and rise to 6.6% in the second half. In the first half (H1) the market witnessed a decrease of 80 BPS, while in the second half (H2), the market witnessed an increase of 80 BPS.

Rising Demand for Miniaturized Devices and Advanced Electronics is Driving Growth

Several industries are adopting panel-level packaging solutions to meet the increasing demand for small, high-performing products. Panel-level packaging is now crucial for advanced electronics, including wearables, smartphones, and automotive electronics, due to the combination of heterogeneous technology within a single integrated circuit and research efforts centered on low-cost and high I/O density technologies.

New packaging requirements will drive performance as 5G networks and IoT devices grow, creating numerous opportunities for panel-level packaging to be utilized as a means of facilitating this evolution.

Shift Toward Cost-Effective, Scalable Packaging Solutions Supports Growth

When compared to conventional packaging techniques, panel level packaging in particular, fan-out technologies offers notable benefits in terms of scalability and cost effectiveness then . Semiconductor companies are able to meet the demands of high-volume consumer electronics applications while lowering costs and improving performance which is the ability to produce larger batches of components at a lower cost.

Challenges in Integration and Material Costs Limit Market Growth

The market for panel level packaging has bright futures, but integration complexity and raw material costs are obstacles. High-quality materials and sophisticated manufacturing techniques are needed to produce panel-level packages, which can be expensive. Furthermore, the integration of panel-level packaging solutions with existing semiconductor manufacturing processes poses technical challenges, which may slow market adoption.

The global panel-level packaging market saw a moderate CAGR of 4.5% between 2020 and 2024, reaching a value of USD 2.2 billion in 2024 from USD 1.8 billion in 2020. Growth was largely driven by the increasing miniaturization of electronic devices and demand for lightweight, cost-efficient, and reliable packaging solutions.

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Rapid expansion (~5.6% CAGR) fueled by IoT, 5G, and smart device demand. |

| Sustainability Push | Full transition to recyclable and biodegradable packaging for electronics. |

| Raw Materials | Increased use of sustainable materials like biodegradable plastics and organic substrates. |

| Technology & Automation | High automation and AI in manufacturing for faster, scalable production. |

| Product Innovation | Advanced packaging solutions for 5G and IoT, offering higher density and reliability. |

| Cost & Pricing | Cost reduction through automation and advanced manufacturing technologies. |

| Industry Adoption | Broader adoption across automotive, IoT devices, and medical devices. |

| Customization | High level of customization for individual consumer electronics, automotive, and IoT. |

| Regulatory Influence | Tightened regulations driving mandatory adoption of eco-friendly packaging. |

| E-commerce Influence | The increasing role of PLP in e-commerce and direct-to-consumer electronic packaging. |

| Circular Economy | Comprehensive circular economy models adopted, with closed-loop systems for PLP materials. |

| Factor | Consumer Priorities (2020 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Cost & Pricing |

|

| Performance (Durability) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Food Safety & Hygiene |

|

| Reusability & Circular Economy |

|

Tier 1 companies include global market leaders with significant market share in the global PLP market. They are known for their strong manufacturing capabilities, product breadth, and geographical presence. Their high-volume manufacturing capabilities offer varied PLP, including high-end FO-WLP solutions and processes to ensure meeting the demands of high-volume production with advanced technology.

They are leaders in applying rigorous industry standard like reliability and performance in areas like consumer electronics, automotive, and telecom. ASE Group, Amkor Technology, JCET Group, SPIL Tianshui Huatian Technology Co. Ltd. (China), and STATS ChipPAC are some of the key players in Tier 1.

Tier 2 mid-sized businesses are very influential locally, but they don't always have the same production capacity or worldwide reach as their Tier 1 counterparts. They have a strong regional presence and are renowned for their excellent customer service. Tongfu Microelectronics, Oplon Electronics, Kyocera Corporation, Unimicron Technology Corporation, LTCC Technologies, and Itotera Memories, Inc. are important participants in Tier 2.

Tier 3 consists of small-scale companies operating in niche markets and regions, often catering to local demand for specific PLP solutions. These companies generally lack advanced technology and infrastructure compared to the larger companies and focus on regional or custom applications. The market in this tier is fragmented, with companies serving smaller volumes and specific sectors such as IoT and small consumer electronics.

Canada's panel-level packaging market is expanding moderately, driven primarily by the country's expanding semiconductor research sector and the demands of 5G and IoT applications. The market is expected to grow from USD 120 million in 2024 to USD 126 million in 2025. AI startup presence, expansion of telecommunication infrastructure, and government incentives for semiconductor technology are major growth drivers.

Whereas Canada has limited large-scale manufacturing plants of chips, close business relations with the United States as well as alliances with worldwide semiconductor companies are helping drive incremental deployment of state-of-the-art packaging technologies, including panel-level packaging solutions.

Panel level packaging within the United Kingdom market is building momentum as the result of investing in research about semiconductors as well as incorporating artificial intelligence. The size of the market was USD 160 million in 2024 and was anticipated to grow to USD 168 million by 2025. The efforts of the UK government to enhance domestic semiconductor capability via funding programs and partnerships are favoring the PLP industry.

Increasing demand for data centers, IoT technology, and the emerging wireless communication technologies are also driving market growth. In spite of Brexit-induced supply chain issues, the UK remains a destination for foreign investments, driving innovation in cutting-edge packaging technologies.

The market for panel-level packaging is expanding in France thanks to government initiatives that encourage investments in the production of electronic components and semiconductors. The market was estimated to be worth USD 150 million in 2024 and is expected to grow to USD 158 million in the future.

The European Chips Act is also a considerable push towards establishing a local semiconductor supply chain catering to advanced architecture packaging like PLP. Also fueling demand are the rollout of automotive semiconductors and 5G, as well as artificial intelligence integration in France. Furthermore, the partnerships between STMicroelectronics and international chip makers are driving innovation in panel-level packaging.

Germany, which is a top semiconductor hub in Europe, is witnessing strong growth of panel-level packaging because of its prominent automotive and industrial electronics industries. The market was worth USD 180 million in 2024 and is expected to reach USD 190 million in 2025.

With an impetus for intelligent manufacturing, electric vehicles (EVs), and AI-based technologies, Germany's need for high-performance semiconductors is increasing. The presence of leading companies such as Infineon Technologies and rising government support in the form of European semiconductor initiatives are further enhancing the country's PLP market growth.

The panel-level packaging market in South Korea is expanding quickly as a result of high demand from domestic chip giants like Samsung and SK Hynix. The market is anticipated to grow from its 2024 valuation of USD 310 million to USD 328 million in 2025.

The need for more advanced (as in unlikely to be cooled) PLP and similar types of packaging solutions are largely attributed to the Korean memory chip companies as they continue to dominate the front end of the industry along with their leading edges in AI and 5G structures. Due to its consistent investment in R&D for the semiconductor industry and another notable international cooperation in chip production, South Korea has been placed in a leading position in the advanced packaging industry.

Japan's panel-level packaging industry is growing consistently owing to its experience in precision engineering and semiconductor materials. The size of the market was USD 220 million in 2024 and is expected to grow to USD 232 million in 2025. The emphasis of Japan on automotive chips, consumer electronics, and AI-based semiconductor solutions is driving the growth of PLP adoption. Top companies such as Renesas, Toshiba, and Sony are still pushing the boundaries with advanced packaging technologies, while government policies promoting semiconductor self-reliance are also driving the market further.

China continues to be among the world's fastest-growing panel-level packaging markets, fueled by its plans to aggressively expand semiconductors. China's market in 2024 was USD 480 million and is projected to grow to USD 505 million by 2025.

Domestic chip manufacturing, 5G networks, and AI-based applications are raising the demand for sophisticated packaging technologies in China. With high government investment and key players such as SMIC and Huawei pouring money into semiconductor self-sufficiency, the PLP market in China will continue to experience explosive growth.

In addition, the growing production of electronics in India as well as the strengthening of semiconductor policies provide a strong background for the Indian panel-level packaging market becoming a serious player over time. The 2024 market size is USD 140 million and will grow to USD 148 million (2025). PLP adoption is increasing as a result of the Indian government's semiconductor mission to promote domestic chip manufacturing.

Due to the growing demand for smartphones, Internet of Things devices, and automotive electronics, India is drawing more foreign investment than ever before in the packaging and manufacturing of semiconductors. This is setting the stage for long-term industry growth in advanced packaging solutions.

The USA is witnessing a growing demand for rugged and durable packaging, especially in the electronics, automotive, and healthcare industries. Also, as the need for more protective and shock-absorbent packaging rises, the demand for high-performance packaged-level packaging (PLP), such as fan-out wafer-level packaging (FO-WLP), continues to soar. Demand is being led by the move to 5G infrastructure and autonomous vehicles.

PLP solutions provide the protection required during the transportation of medical devices and pharmaceuticals while being weight and cost efficient.

The reasons to adopt PLP in Germany are heavily influenced by sustainability. Sustainability is a major factor in Germany's adoption of PLP since the nation wants to reduce its carbon footprint and promote the use of eco-friendly materials, and there is a growing demand for packaging options that are biodegradable and recyclable.

The forces behind the consumer electronics and automotive industries meet PLP's green needs. Businesses are using green packaging solutions as a result of German consumers' growing environmental consciousness. The adoption of PLP in Germany is significantly impacted by the advancement of 5G and EVs.

By 2035, the panel-level packaging market's recycled materials segment is expected to grow to a minimum of USD 11 billion. This is due to the growing adoption of sustainable practices in all sectors of the economy. Manufacturers integrate recycled materials into their products to reduce the environmental impact of packaging production and the amount of virgin resources used. Making use of recycled materials also helps get ready for future legal changes and consumer demands for environmentally friendly products.

This trend toward sustainability not only helps to cut waste but also provides packaging manufacturers with affordable options, especially in places where laws promote the use of recycled materials. Additionally, the market is expanding due to the growing trend toward green and circular economy initiatives, which fuels the need for recyclable materials.

The market for panel-level packaging is expected to be dominated by rigid panels by 2035. These packaging options are appropriate for industries that require these kinds of packaging due to their exceptional protection and structural soundness. In the electronics and automotive industries, rigid panels are especially crucial for protecting delicate components and machinery during transit.

Rigid panels are fashionably becoming one of the most preferable options in the consumer goods sector owing to their durability and safety. Demand for rigid panels has also been fueled by the growth of e-commerce, as businesses require reliable and secure packaging to protect products during transit.

MATERIALS: This product fulfills expectations in terms of quality and reliability thanks to its high resistance to impact, stacking stability, and moisture protection.Additionally, the rising need for smart packaging solutions will push rigid panels to incorporate cutting-edge technologies such as NFC, RFID, and QR codes, thus benefiting the market even more.

In 2025, the panel-level packaging market remains highly consolidated, with around 10% of total sales attributed to Tier 1 players. Most of the major semiconductor packaging companies remain at the front end owing to their advanced technology experience, massive R&D investments, and advanced manufacturing technologies.

Local players are limited and involved due due the barriers to entry to the market, like high capital investment, complex intellectual property (IP) as well as requirements associated with the supply chain. However, a few mid-tier and startup companies are gradually paving their way into the market by focusing on niche applications, lower-cost packaging options, and collaborations with larger industry players.

Some of the leading turbocharger manufacturers in the market in 2025 are Intel, Samsung Electronics, TSMC, ASE Group, Amkor Technology, Powertech Technology Inc., and JCET Group. The year also witnessed some important trends in the industry, such as TSMC expanding its advanced 3D packaging capabilities, Samsung expanding its panel-level packaging (PLP) capacity to meet AI and HPC demand, and Amkor investing in eco-friendly packaging technologies.

At the same time, Intel's push for heterogeneous integration and AI chip packaging has added further teeth to the competition. And hence, 2025 is indeed a very important year for technology advancements in panel-level packaging, as the industry continues to focus on energy efficiency, cost-effective production processes, and sustainability.

Key Developments in Panel Level Packaging Market

The SUSS MicroTec system for panel-level packaging enhances the reliability and performance of semiconductor devices. The solution supports larger panel sizes for mass production and cost-effective scaling, addressing the growing demand for high-performance chips.

Industry innovations have been powered by strategic partnerships. WeAMP use with Process Development of ACEE black tool in this way ASE Group and Applied Materials are co-organizing weAMP applications on next-generation panel-level packaging technology to facilitate the production capacity rise for next-generation consumer electronics.

Another big growth driver has been acquisitions. To fortify its strength in panel-level packaging for power electronics applications, TSMC acquired VisIC Technologies, a leader in wide-bandgap power semiconductors. Samsung Electronics also has purchased a quantum technology startup called Qnami to accelerate quantum panel-level packaging technologies for next-generation use cases.

By securing ISO 9001:2015 certification for the panel-level packaging plant, Intel Corporation has further demonstrated its commitment to superior manufacturing practices. Amkor Technology expanded its market share and enhanced its panel-level packaging capabilities in the consumer electronics and automotive sectors with the purchase of SPIL (Siliconware Precision Industries). The industry's rapid technological advancements and competitive expansion are demonstrated by these strategic acquisitions.

Vendor Insights in Panel Level Packaging Industry

Several panel-level packaging industry key players drive innovation in product developments by implementing R&D, forming strategic partnerships, and acquiring businesses. Despite the competition, Intel Corporation remains at the forefront through persistent investments in research and development, leading to innovative solutions for packaging in consumer electronics.

Recent partnerships and acquisitions have allowed TSMC to rapidly broaden its PLP portfolio, especially in power electronics. Likewise, ASE Group continues to lead in high-performance computing, automotive, and consumer electronics packaging, while Amkor Technology has been making strides in growing its PLP options for the automotive market to meet the increasing demand for compact and power-efficient semiconductor solutions.

Samsung Electronics also improved its share by succeeding at semiconductor and consumer electronics panel-level packaging breakthroughs. On the other hand, PLP portfolio expansion at Broadcom Inc. focuses on telecommunication and consumer electronics applications.

Advertisement Qualcomm has built on its leadership in mobile and telecom packaging technologies, and NXP Semiconductors and STMicroelectronics have made big spends in the automotive and industrial applications areas. Furthermore, Kyocera Corporation has enhanced its PLP applications in consumer electronics as well as industrial segments that have experienced substantial growth in the market, cementing progress across all sectors.

Road Ahead: Future Consideration for Stakeholders

The panel-level packaging market is poised for significant growth due to the increasing demand for miniaturization, higher performance, and cost-effective packaging solutions in consumer electronics, automotive, and telecommunications sectors. To capitalize on this momentum, stakeholders should focus on:

The panel-level packaging industry is expected to witness a CAGR of 5.6% from 2025 to 2035.

The global panel-level packaging industry stood at USD 2.3 billion in 2025.

The global panel-level packaging industry is anticipated to reach USD 4.0 billion by 2035 end.

Which region will showcase the highest CAGR during the forecast period?

Some key players operating in the panel-level packaging industry include TSMC, Intel Corporation, ASE Group, and Amkor Technology.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.