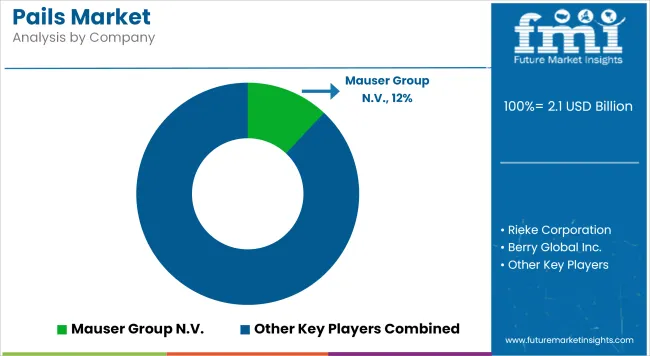

The pails market is projected to grow from USD 2.1 billion in 2025 to USD 3.2 billion by 2035, registering a CAGR of 4.1% during the forecast period. Sales in 2024 reached USD 2.0 billion, driven by consistent demand across industrial coatings, food processing, and agrochemical sectors.

The market has benefited from enhanced durability standards and logistical efficiency associated with stackable, reusable pail formats, especially in bulk storage and transport use cases. Growth has also been enabled by the rising preference for food-grade plastic and metal pails due to regulatory emphasis on hygienic transport. Long-term traction is expected from their rising integration in decentralized warehousing and farm packaging systems globally.

Plast-Box one of the leading manufacturers of plastic packaging opened another modern production and warehouse facility in Slupsk. New facility showcases advanced infrastructure that successfully combines advanced technology with efficiency. By using modern solutions such as the automation of processes, Plast-Box is set to increase production efficiency and flexibility. “This investment allows us to respond even faster and more accurately to the needs of our customers, wherever they are located in Europe, says Artur R. Skonieczny, Chief Commercial Officer of Plast-Box Group. ‘The modern facility in Slupsk enables us not only to boost our production capacity, but also to introduce greater flexibility in order management, which is crucial in today’s dynamic market reality. For our business partners, this means shorter lead times and still higher service quality for us, this is an opportunity to continue to reinforce our leadership position in the packaging industry”.

Eco-regulatory pressure has led to increased adoption of high-density polyethylene (HDPE) and polypropylene pails that meet both recyclability and food safety requirements. Innovations have focused on tamper-evident closures and odor-resistant interiors suitable for chemicals and edible contents. These design upgrades have improved shelf life, user confidence, and handling ease. Biodegradable coating integrations and solvent-free production lines have also been introduced to meet compliance in food and pharmaceutical packaging scenarios.

The market outlook for pails remains favorable as diversification into food, lubricant, and construction segments accelerates. Emphasis has been placed on product standardization for international bulk supply chains. Moreover, smart inventory tracking features and RFID integration are expected to support the shift toward automation-friendly packaging. Leading suppliers are likely to focus on product reusability, labor-saving ergonomic designs, and alignment with global safety and logistics mandates. Competitive positioning will depend on portfolio diversification, recyclability assurance, and end-user customization. Higher performance expectations will reshape product development strategies through 2035.

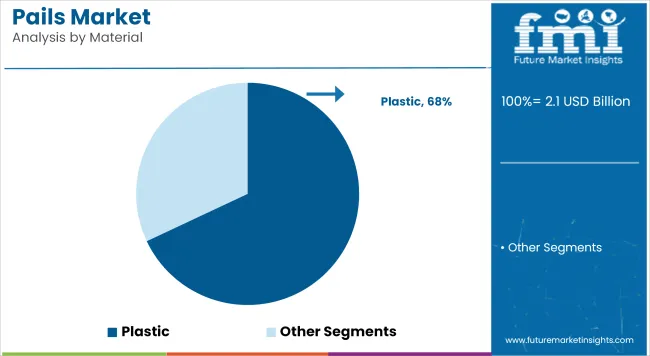

The market is segmented based on material, capacity, end use, and region. Materials primarily include plastic and metal, selected for their durability, chemical resistance, and compatibility with industrial and food-grade contents. These materials cater to both lightweight and heavy-duty applications, depending on the sector’s safety and shelf-life requirements.

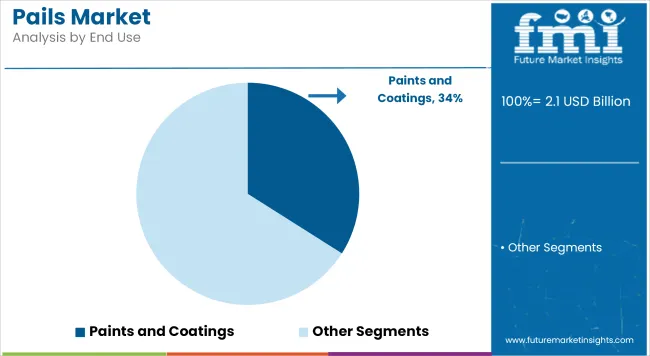

Capacity segments range from up to 5 liters, 6-10 liters, 11-20 liters, and above 20 liters, aligning with transportation, dispensing, and storage demands across industries. End-use sectors include paints & coatings, inks, dyes & pigments, petroleum & lubricants, agrochemicals & fertilizers, food & beverage, and other industrial applications. Regional coverage includes North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Plastic is estimated to account for around 68% of the pails market in 2025, due to its durability and cost-efficiency. High-density polyethylene and polypropylene have been predominantly used for their chemical resistance and lightweight characteristics. Their recyclability and impact strength have favored widespread use across construction and chemical sectors. Plastic pails have been chosen for both industrial-grade and consumer-grade products due to their sealing ability and ease of transportation. Advanced molding techniques have enabled custom sizes and shapes suitable for diverse product viscosities.

UV-resistant and food-grade variants have been incorporated for agrochemical and food applications respectively. Increasing demand for sustainable materials has led to the introduction of bio-based and PCR-content plastic pails. Manufacturers have offered tamper-evident and stackable designs to align with logistics and safety protocols.

Plastic pails have remained popular in paints, adhesives, lubricants, and sealants due to their compatibility with both hot and cold fill products. The option for high-resolution printing has improved shelf appeal in retail settings. Regulatory compliance and reduced per-unit cost have strengthened their preference in high-volume production. Global players have developed hybrid solutions combining rigid outer plastic layers with lightweight liners for reduced material consumption. The dominance of plastic pails is expected to continue as industries prioritize reusable and recyclable formats.

Regional packaging laws and plastic bans have influenced material innovations rather than complete shifts. Light weighting and barrier enhancements have improved sustainability metrics. Cost-effectiveness, transport efficiency, and compatibility with filling lines have ensured their continued relevance.

Paints and coatings are projected to hold the highest share of approximately 34% in the pails market by 2025. The segment has required pails with high stacking strength and chemical resistance for bulk handling. Both water-based and solvent-based formulations have been packed using airtight plastic or metal pails. Easy pouring spouts and Snap-On lids have supported efficiency in commercial and retail sales channels.

The surge in residential construction and renovation has driven demand for decorative paint pails. Industrial paints and automotive coatings have also contributed to high-volume packaging needs. In-mold labeling and color-coded packaging have been used for product differentiation in multiband portfolios. Pails with built-in liners and dual-layer structures have ensured compatibility with reactive chemical systems.

Paints have required packaging formats resistant to UV, corrosion, and temperature fluctuation. Pails designed with anti-leak features and ergonomic handles have improved end-user safety and ease of use. Market demand has pushed manufacturers to develop pails that comply with strict UN and DOT regulations. The inclusion of tinting and remix features has further diversified product needs.

Global infrastructure expansion, particularly in Asia-Pacific, has maintained growth momentum in the segment. OEMs and paint companies have collaborated to create custom packaging tailored for specific application needs. Innovations such as resalable lids and tamper-evident locking have boosted trust among both DIY and professional users. Paints & coatings are expected to remain the primary driver of unit sales in the industrial pails market.

Fluctuating Raw Material Prices and Supply Chain Issues

The Pails Market, plagued by uneven raw material prices, particularly those of metal and plastic (which are both sensitive to world economic ebbs and flows), has been substantially affected. Fluctuations in these prices effect the costs of manufacture and therefore also the pricing strategy of pail producers. Moreover, in the current climate of geopolitical tensions, trade restrictions and logistical bottlenecks affecting supply chains, both lead times and costs for production have become inconsistent.

Environmental Regulations and Sustainability Pressure

With an increased emphasis on global environmental protection, there are ever-denuding regulations surrounding plastic use and garbage management. Demand for ecological, recyclable and biodegradable pail options is on the increase, however changing over to durable and cost-effective, sustainable materials remains an issue faced by the manufacturers.

Rising Demand from Food and Chemical Industries

The demand for sturdy, high quality pails in the food processing, chemicals, paints and construction industries is in any event propelling the market on all its fronts. The availability of pails in which liquid as well as solid materials can be put, together with innovations such as tamper-evident features and improved sealing properties furthers market potential.

Shift toward Sustainable and Customizable Solutions

Growing demand from consumers for sustainable packaging, manufacturers are turning to sustainable materials and business methods that close the loop rather than extend it. Also, the demand for custom pails with branding and ergonomic design has offered an eye-catching way of breaking through to new sources of growth. In some sectors like food packaging or consumer goods sub-divisions, this gives manufacturers the opportunity to innovate.

In the United States, a market for pails is gradually taking shape. Several industries--from food processing to chemicals and construction--already have proven demands and are gradually expanding their scale of use. Sustainable and reusable packaging solutions is another trend driving the current vogue of pail models being mooted by business enterprises all over China as green ideas. Also, with materials such as high-density polystyrene the industry is developing still further.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.0% |

In the UK, the pails market is fueled by growing needs for food & beverage storage solutions as well as for paints and coatings storage vessels. An ongoing effort to cut down on packaging waste through recycle and reuse products has given rise to increasing demand in these areas. And with logistics needs in mind, manufacturers are also looking to the lighter weight and greater stack ability of pails today.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The European Union pails market is showing robust growth with the ongoing expansion of its chemical, pharmaceutical and food sectors, the European Union's pails market is booming. Germany and France are leading countries in implementing high-quality, regulation-compliant pail solutions. At the same time, the region-wide tendency to adopt circular economy practices gives us another shot in the arm for our market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

South Korea's pails market has been strongly growing, both in its overall scope and as regards individual application sectors like chemicals or heavy industry. An increasing demand for industrial grade products and a move towards environmentally friendly packaging solutions stand as key drivers. Plus, we see a steady improvement in pail designs: with every year that passes, technology gives more spill- and tamper-proof options of models on the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The pails market is witnessing steady growth due to rising demand across industries such as chemicals, food & beverage, agriculture, and construction. These containers are essential for storage, transport, and handling of liquids, semi-solids, and granular products. Growth is further supported by increasing demand for sustainable and reusable packaging solutions.

The overall market size for the pails market was USD 2.1 billion in 2025.

The pails market is expected to reach USD 3.2 billion in 2035.

The demand for pails will be driven by rising consumption in paints & coatings, petroleum & lubricants, and agrochemicals industries, alongside growing preference for durable plastic pails and eco-friendly metal alternatives in food, beverage, and other industrial applications.

The top 5 countries which drives the development of pails market are USA, European Union, Japan, South Korea and UK.

Plastic Pails demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Square Pails Market Size and Share Forecast Outlook 2025 to 2035

Plastic Pails Market Growth - Demand & Forecast 2025 to 2035

Conipack Pails Market Size and Share Forecast Outlook 2025 to 2035

Screw Top Pails Market

Industrial Pails & Drums Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA