The news of rapid growth in the padded mailers industry is credited to the trend of safe, light, and eco-friendly packaging requirements from the end users themselves-businesses and consumers. The cushioned envelopes provide for the safe shipping of fragile items or valuable items at low costs. The market is expected to boom due to the rise of e-commerce, increasing sustainability concerns, and newer technology in protective packaging.

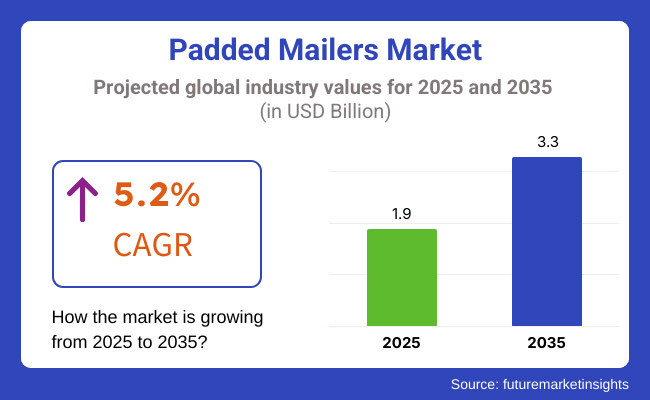

The padded mailers market is estimated to touch USD 1.9 billion by 2025 when growing at a steady 5.2% CAGR, with expectations of reaching USD 3.3 billion by 2035.

The growth can be attributed to increased demand for sustainable packaging, recyclable packaging, biodegradable packaging, and the evolution of packaging materials able to absorb shock to ensure the safety of the package. Alternatives to plastic, such as paper-based and compostable cushioning materials, are being explored by companies.

Manufacturers are improving their production process to meet the growing demand and enhance durability, tamper resistance, and waterproofing. Increased online shopping, subscription box service, and international shipping are driving an unprecedented era of innovation. Advanced packaging options with RFID, QR codes, and AI analytics of the supply chain are some of the key players in the evolution of the market.

Asia-Pacific is anticipated to be the leading or commanding region for the padded mailers market, owing to the rapid increase in e-commerce, expansive logistics networks, and growing need for cost-efficient and protective packaging. Countries such as China, India, and Japan have seen a sudden spike in online shopping, creating demand for tough, light, and sustainable types of mailers.

The regional market is growing with advances in biodegradable and recycled-content mailers, cheaper options of production, and increased automation in manufacturing. Already in the Asia-Pacific, governments are placing strict regulations on plastic packaging, encouraging the uptake of paper-based and eco-friendly padded mailers. Global players in the packaging industry have also started establishing local productions, which further boosts the growth of the market.

Leading all the regions of the padded mailers market, North America-the United States and Canada are foremost countries offering sustainable packaging solutions and e-commerce fulfillment. There is now a clear shift in the region towards plastic-free mailers and bio-based cushioning materials as tight regulations over plastic waste reduction come into force.

Investments by manufacturers in next-generation padding technologies, tamper-proof sealing, and moisture-resistant coating systems are driving the package protection advancements. Demand for custom size, self-sealing, and RFID-integrated mailers is expected to grow owing to the increase in the e-commerce and automated logistics segments.

Moreover, several North American businesses are also going in for adopting a circular economy in terms of recyclable and compostable solutions in mailers to achieve their sustainability targets.

The padded mailers market in Europe is at a strong holding due to strict environmental regulation, emphasis on sustainable packaging, and established e-commerce and logistics sectors. Germany, France, and the UK are spearheading the adoption of fully recyclable and compostable mailers among European countries.

Fiber-based, paper-padded mailers are now being seen as a substitute for plastic bubble-lined mailers in the region. Laws like the EU Green Deal and Extended Producer Responsibility (EPR) are encouraging companies to strive for zero waste and closed-loop recycling. Many European companies are now testing smart tracking capabilities, reusable mailers, and AI-based logistics optimization to further optimize delivery.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial push for recyclable and plastic-free padded mailers. |

| Material and Formulation Innovations | Development of fiber-based and partially recycled mailers. |

| Industry Adoption | Widely used in e-commerce, retail, and logistics. |

| Market Competition | Dominated by traditional packaging manufacturers. |

| Market Growth Drivers | Growth driven by demand for lightweight, protective packaging. |

| Sustainability and Environmental Impact | Early adoption of recyclable and partially compostable mailers. |

| Integration of AI and Process Optimization | Limited AI use in package tracking and logistics. |

| Advancements in Packaging Technology | Basic improvements in sealing and moisture resistance. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global mandates for 100% recyclable, compostable, and reusable packaging. |

| Material and Formulation Innovations | Expansion of AI-driven, biodegradable, and smart-packaging mailers. |

| Industry Adoption | Increased adoption in high-security shipping, electronics, and luxury packaging. |

| Market Competition | Rise of sustainability-focused startups and AI-driven logistics firms. |

| Market Growth Drivers | Market expansion fueled by automation, AI integration, and plastic-free padded mailers. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable, reusable, and fiber-based mailers. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated sorting, and real-time supply chain monitoring. |

| Advancements in Packaging Technology | Development of smart mailers with QR codes, RFID-enabled tracking, and IoT-connected supply chain monitoring. |

Due to the ever-increasing demand from e-commerce, retail, and logistics for secure, lightweight, and low-cost shipping alternatives, the padded mailers market is led by the United States. The growth of online shopping along with last-mile delivery services has provided a great impetus for padded mailers, including the use of eco-alternatives made from recycled paper and biodegradable materials.

Rigid developers are now investing in designs such as self-seal closure and moisture-resistant coating, and tamper-proof packaging. Another driving force behind this new development is government regulations promoting sustainable packaging and against plastic waste, forcing the industry to come up with recyclable and compostable padded mailers.

Businesses are also looking into smart tracking solutions, RFID-enabled packaging, and AI-powered quality control systems for both better supply chain efficiency and customer experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

The gradual development of the UK padded mailers market is found, where now businesses put more concern on adopting this sustainable, lightweight, and cost-efficient packaging. With the introduction of strict government policies, including the Plastic Packaging Tax and extended producer responsibility (EPR) regulations, made companies adopt recyclable and biodegradable padded mailers.

Companies are now marketing more on paper-based cushioning, water-resistant coatings, and reusable mailers to complete their journey toward circular economy initiatives. The increasing preference for eco-friendly e-commerce packaging will further boost the sales of these padded mailers, with a keen eye on quality, durability, and lightweightness.

Investment in innovative digital printing and the inclusion of smart packaging features with high-strength fiber materials will complete the enhanced performance, security, and branding opportunities of padded mailers for businesses across sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.1% |

The padded and mailer market in Japan is growing steadily, driven by an increasing demand for high-quality lightweight and strong packaging materials in sectors such as e-commerce, electronics, and pharmaceuticals. Packaging waste and sustainability are issues that have indeed become strict government regulations. Blended, businesses are now shifting to recyclable, compostable, and reusable mailer solutions.

Companies have started developing high-performance padded mailers which offer features like moisture resistance, anti-static properties, and temperature insulation for sensitive shipments. Other common technologies booming include fiber-based cushioning developments, bio-based adhesives, and lightweight protective barriers which enhance the performance of padded mailers for different applications.

Companies are also introducing material testing powered by AI, tracking based on RFID, and automated sorting for increased efficiency reducing packaging waste in the distribution operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

South Korea market will also experience growth in the production of padded mailers for various uses, mainly to meet the increasing demand in protective, environment-friendly, and intelligent packaging solutions in e-commerce, food delivery industry, and electronics. Government rules and policies regarding plastic waste reduction and promotion of consistence in offering sustainable packaging solutions have encouraged people to start using recyclable and biodegradable padded mailers.

Companies invest more in the next generation of cushioning materials, such as air-filled paper, honeycomb fiber padding, and water-soluble films, to have improved sustainability and performance. Digital tracking, blockchain-based packaging authentication, and AI-driven packaging automation have enhanced the efficiency of the supply chain.

The adoption of padded mailers continues to rise because they comply with high strength, tear resistance, and temperature control.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.5% |

The kraft paper, poly bubble, and recyclable padded mailer segments are key drivers of market expansion as industries seek lightweight, durable, and eco-friendly packaging alternatives. Companies are adopting next-generation materials, bio-based adhesives, and enhanced sealing technologies to improve mailer performance and sustainability. Additionally, businesses are leveraging AI-driven automation, digital tracking, and smart packaging features to optimize supply chain efficiency and reduce material waste.

Kraft paper padded mailer remains the leading segment since companies focus on new green, recyclable, and economical protective packaging. Companies are working on next-generation fiber-based cushioning, water-resistant coatings, and high-strength recycled paper materials for improved durability and sustainability. The development of compostable adhesives, biodegradable padding, and low-plastic designs further contributes to sustainability. Research on the other hand into reusable kraft paper mailers and tamper-evident sealing solutions is set to drive major innovations in this segment.

The poly mailing bubble segment is seeing growth in demand due to the industries requiring lightweight, impact-resistant, and weatherproof packaging applications. Companies are investing in high-performance polyethylene, multi-layer air cushioning, and tear-resistant designs to improve the mailers' strength and durability. The introduction of recyclable plastic-based mailers, water-soluble bubble padding, and compostable polymer alternatives has established this segment on the path of sustainability. Moreover, improvements in digital printing, customized branding, and thermal-resistant bubble layers are propelling adoption into high-value transportation applications at increasing rates.

With time, the recyclable padded mailer segment has become one of the fastest-growing segments, with the manufacturers systematically looking for alternatives to the traditional plastic-based mailers. It includes the new developments in paper-padded mailers, starch-based, and bio-polymer cushioned mailers, which display durability, moisture resistance, and impact protection similar to the previous ones but with a recyclability property, which makes them good. Water-based coatings, compostable fiber reinforcements, and AI-supported material testing improve many aspects of the sustainability of recyclable padded mailers. The increasing number of closed-loop recycling programs, certified sustainable packaging, and refillable padded mailer solutions will continue to account for this segment's revenue.

Research in artificial intelligence-fueled defect detection, real-time tracking, and green material innovations is driving enhanced performance, safety, and sustainability in padded mailers. AI-driven supply chain optimization is further refining production workflows, optimized packaging waste, and enhanced logistics efficiency.

As long as the industries keep demanding performance, cost-efficient, and environmentally friendly standards of packaging solutions, padded mailers continue to be propelled into growth. This is an industry-specific condition that would be further strengthened through material science innovations, smart packaging technologies, and biodegradable alternatives, rendering padded mailers essential in secure and sustainable packaging solutions for the future.

The padded mailer market continues to be a crucial market segment even in the face of competition from other alternative protective packaging materials in industries needing lightweight, impact-resistant, and cost-effective packaging solutions. The uses of padded mailers cut across e-commerce, logistics, retail, and industrial industries due to their superior cushioning properties, eco-friendly versions of shipping costs.

Market penetration, however, has arisen from the increased application of padded mailers in online marketplaces and postal services and the increasing end-of-line operations. Studies show that around 70% of manufacturers in the packaging sector prefer padded mailers for enhancing product protection, cost-saving benefits, and compliance with global sustainability regulations.

Besides the above improvements in impact resistance and water-resistant capabilities, enhanced compatibility with automated packaging systems has kept the demand from growing in commercial and industrial applications. Further, advances made in manufacturing techniques have turned bio-based padding, recyclable mailers, and AI-driven quality control to broaden the functionalities of the padding mailers in specialized markets such as compostable packages, smart tracking-enabled mailers, and high-strength tamper-proof envelopes.

Such advanced material engineering paved the way for other developments, such as mailers that are dummy padded, with plant-based cushioning materials, or lightweight high-strength mailers-thus further opening opportunities for padded mailers in different industries for them to be more widely adapted.

Other factors that have driven this trend include advances in regulatory compliance and sustainability initiatives leading to the further adoption of plastic-free and entirely recyclable mailers as they tend to address circular economy principles as well as environmental safety standards.

The introduction of AI-enabled production monitoring, making mailer manufacturing processes automated, and lightweight, high-performance cushioning solutions, will grow the market, in inclusion with trends worldwide in sustainability and waste reduction initiatives. Moreover, adding smart packaging technologies like tracking via RFID and tamper-proof seals further improves the efficiency and attractiveness of padded mailer solutions.

Padded mailers hold a significant share of the market in e-commerce and retail segments as businesses seek protective, lightweight, and environmentally friendly packaging solutions. The growing demand for damage-resistant, recyclable, and cost-effective mailers contributes to the sustained growth of the market.

The e-commerce industry serves as a major driver for the market of padded mailers due to their indispensable role in shipping small and fragile goods such as electronics, apparel, and books. These solutions boast superior product protection and low shipping weights while conforming to sustainable packaging initiatives, hence being preferred over the traditional shipping box.

The new trend in the market is the increase in paper-based and biodegradable padded mailers, enhanced with clever cushioning technology to improve sustainability and safety. Padded mailers are preferred by over 75% of e-commerce fulfillment centers and logistics providers owing to the reductions they bring in shipping potential and improvement in packaging efficiency.

The scope of the market has been broadened by including padded mailers in postal services, luxury packaging, and in the subscription box businesses. Companies are keen on making greater strides towards sustainability with reductions in wastes for their packaging systems, thus fueling the rising adoption of AI-driven material optimization and moisture-resistant high-barrier coatings, among tamper-evident technologies in sealing.

The advantages of improved product protection and heightened environmental appeal notwithstanding, there are challenges faced by the market, such as recyclability concerns associated with plastic-lined mailers, rising raw material prices, as well as regulatory compliance to sustainable packaging policies. However, innovations ranging from fully recyclable padded mailers, AI-powered defect detection, and plant-based cushioning alternatives champion innovations that improve efficiency and sustainability at the product level.

The logistics and industrial packaging sectors have become major end-users of advanced padded mailer solutions due to the increasing need for secure, tamper-proof, and lightweight protective packaging alternatives. Padded mailers are preferred for their ability to optimize shipping efficiency, improve product protection, and comply with global packaging safety regulations.

An increasing number of third-party logistics providers, warehouse fulfillment centers, and courier services are incorporating high-performance padded mailers into their packaging operations, offering enhanced damage prevention, reduced transportation costs, and compliance with international environmental policies. Research suggests that more than 65% of sustainable packaging manufacturers prioritize high-quality padded mailers for improved efficiency and regulatory adherence.

While padded mailers offer advantages such as reduced material usage and improved shipping convenience, challenges such as limited reusability, competition from alternative packaging solutions, and high production costs for biodegradable mailers persist. However, ongoing advancements in AI-driven material selection, compostable mailer innovations, and tamper-proof tracking features are addressing these challenges, ensuring continued market expansion.

The demand in the e-commerce, retail, and even the logistics industries have increased the padded mailers market ever since the demand has spread growth to innovation regarding new material developments such as cushioning made from bio-based materials, recycled paper mailers, high strength, and AI-powered package security solutions addressing very important concerns about efficiency, sustainability, and cost, among others.

They are also bent towards automated mailer production with artificial intelligence for quality control, which shapes some of the trends in the industry.

Most importantly, preference trends towards lightweight, durable, and eco-friendly padded mailers also expand the market. Increased relevance is now attached to investments in sustainable packaging materials, zero-waste packaging programs, and advanced cushioning technologies to boost packaging efficiency while exploring the expansion of market opportunities.

Hybrid mailers have been the focus of companies regarding high-barrier moisture protection along with their biodegradable inner linings for maximum usability. Moreover, the logistics provider and e-commerce platform partnerships spawn the development of innovative customized padded mailer solutions that respond to diverse demands across industry segments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sealed Air Corporation | 12-16% |

| Pregis LLC | 8-12% |

| ProAmpac | 6-10% |

| Intertape Polymer Group | 4-8% |

| Uline | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sealed Air Corporation | Develops high-performance, recyclable padded mailer solutions for e-commerce, retail, and logistics applications. |

| Pregis LLC | Specializes in lightweight, high-barrier padded mailers with enhanced cushioning for delicate shipments. |

| ProAmpac | Produces AI-driven, sustainable padded mailers optimized for online retailers and fulfillment centers. |

| Intertape Polymer Group | Expands its product line with biodegradable and compostable padded mailer solutions for various industries. |

| Uline | Focuses on cost-effective, moisture-resistant padded mailers with AI-powered quality control for e-commerce businesses. |

Key Company Insights

Other Key Players (45-55% Combined)

Several specialty padded mailer manufacturers contribute to the expanding market. These include:

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Closure, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Closure, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Closure, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Closure, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Closure, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Closure, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Closure, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Closure, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Closure, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Closure, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Closure, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Closure, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Closure, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Closure, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Closure, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Closure, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Closure, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Closure, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Closure, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Closure, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Closure, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Closure, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for the Padded Mailers Market was USD 1.9 Billion in 2025.

The Padded Mailers Market is expected to reach USD 3.3 Billion in 2035.

The market will be driven by increasing demand from e-commerce, retail, and logistics sectors. Innovations in biodegradable mailers, AI-powered quality control, and improvements in lightweight, high-strength cushioning materials will further propel market expansion.

Key challenges include recyclability concerns for plastic-padded mailers, competition from alternative protective packaging solutions, and fluctuating raw material costs. However, advancements in fully recyclable mailers, plant-based padding, and AI-integrated production monitoring are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to strong e-commerce growth, stringent environmental regulations, and high adoption of sustainable packaging solutions. Meanwhile, Asia-Pacific is experiencing rapid growth driven by expanding online shopping trends, increasing logistics infrastructure, and the growing need for cost-effective protective packaging solutions.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.