The packaging tapes industry is shifting as the business houses seek enhanced adhesion, strength, and sustainability in sealing products. As the e-commerce, logistics, and industrial applications rise, the companies are going forward with biodegradable adhesive, high-strength films, and smart tape technologies that augment security in packages. The users are placing significance on green packaging options over common plastic tapes, driving growth in paper-based and water-activated tapes.

Businesses are investing in solvent-free adhesives, artificial intelligence-based quality control, and anti-counterfeiting technology to enhance performance and regulatory compliance. The sector is moving toward pressure-sensitive tapes, tamper-evident designs, and moisture-resistant packaging solutions providing safe and effective packaging across global supply chains.

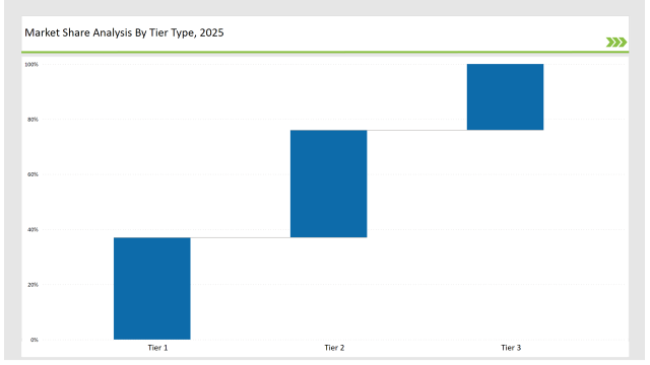

Tier 1 players like 3M, Intertape Polymer Group, and Tesa SE maintain 36% market share as a result of their technical capabilities in industrial- and consumer-quality tapes, huge distribution networks, and constant material innovations.

Tier 2 players like Avery Dennison, Berry Global, and Scapa Group maintain 39% market share through low-cost and high-strength tapes for packaging, shipping, and specialty applications.

Tier 3 regional and niche players with specialized experience in green packaging tapes, special branding solutions, and industrial strength adhesion account for 25% market share. They specialize in localized manufacturing, green material usage, and customized packaging.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Intertape Polymer Group, Tesa SE) | 18% |

| Rest of Top 5 (Avery Dennison, Berry Global) | 11% |

| Next 5 of Top 10 (Scapa Group, Shurtape Technologies, Nitto Denko, Lohmann Technologies, Saint-Gobain) | 7% |

The packaging tapes industry serves multiple sectors where secure sealing, branding, and environmental sustainability are essential. Companies are developing advanced adhesive technologies to meet evolving industry requirements.

Manufacturers are optimizing packaging tapes with sustainability, performance, and efficiency-driven innovations.

The packaging tapes market is being transformed by security and sustainability. Companies introduce features such as AI-enabled quality inspection, solvent-free adhesives, and customized branding solutions to maximize tape usage while minimizing waste. They also develop smart packaging tapes with scannable codes in order to improve supply chain transparency. Enterprises also develop smart packaging tapes integrated with scannable codes to enhance supply chain transparency. Enterprises formulate a compostable and water-based range of tapes to replace conventional plastic-based tapes. Moreover, ultra-durable reinforced tapes are developed that offer product load stability and deterrents against package tampering.

Technology suppliers should focus on automation, sustainable adhesive formulations, and anti-counterfeiting technologies to support the evolving packaging tapes market. Partnering with logistics and e-commerce brands will drive innovation and adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Intertape Polymer Group, Tesa SE |

| Tier 2 | Avery Dennison, Berry Global, Scapa Group |

| Tier 3 | Shurtape Technologies, Nitto Denko, Lohmann Technologies, Saint-Gobain |

Leading manufacturers are advancing packaging tape technology with AI-driven production, sustainable adhesives, and tamper-proof security innovations.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched solvent-free, industrial-strength tapes in March 2024. |

| Intertape Polymer Group | Developed reinforced, eco-friendly packaging tapes in April 2024. |

| Tesa SE | Expanded security-focused anti-counterfeit tapes in May 2024. |

| Avery Dennison | Released digital-printable branded tapes in June 2024. |

| Berry Global | Strengthened tamper-proof and high-strength adhesive production in July 2024. |

| Scapa Group | Developed freezer-safe, food-grade packaging tapes in August 2024. |

| Shurtape Technologies | Pioneered compostable, pressure-sensitive tapes in September 2024. |

The packaging tapes market is evolving as companies invest in sustainable adhesives, smart tracking solutions, and tamper-proof designs.

The industry will continue integrating AI-driven inspection, recyclable adhesives, and security-enhanced packaging tapes. Manufacturers will refine tamper-proof tapes to enhance supply chain security. Businesses will develop fully compostable tapes to meet sustainability mandates. Companies will integrate QR codes into smart packaging tapes for improved tracking. High-strength tapes will optimize e-commerce package durability. Additionally, firms will enhance automation in adhesive coating and application processes.

Leading players include 3M, Intertape Polymer Group, Tesa SE, Avery Dennison, Berry Global, Scapa Group, and Shurtape Technologies.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 36%.

Key drivers include sustainability, smart security features, adhesive performance, and automation.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA