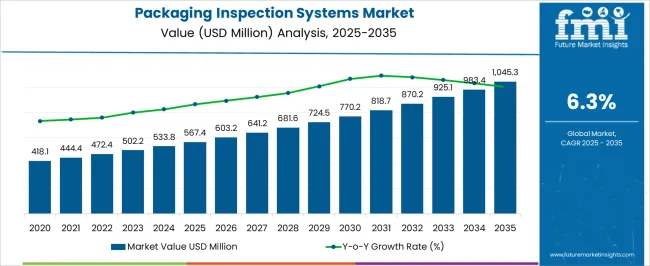

The Packaging Inspection Systems Market is estimated to be valued at USD 567.4 million in 2025 and is projected to reach USD 1045.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Packaging Inspection Systems Market Estimated Value in (2025 E) | USD 567.4 million |

| Packaging Inspection Systems Market Forecast Value in (2035 F) | USD 1045.3 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The packaging inspection systems market is witnessing robust growth as industries prioritize quality assurance and compliance with stringent safety standards. The increasing complexity of packaging formats and the rising demand for visually and structurally consistent packages have accelerated the adoption of automated inspection technologies. Manufacturers are investing in vision-based systems and sensor-integrated platforms that can identify defects such as mislabeling, leakage, contamination, and fill level discrepancies in real time.

Advancements in machine learning and edge computing have further enhanced inspection system accuracy and speed, allowing integration into high-throughput production environments. The expansion of packaged goods across global markets, especially in food, beverage, and pharmaceuticals, is encouraging investment in scalable inspection infrastructure.

Moreover, regulatory mandates related to traceability and product integrity are reinforcing the need for end-of-line inspection solutions As companies seek to reduce recalls, ensure brand integrity, and meet international compliance benchmarks, packaging inspection systems are expected to play a critical role in modern production ecosystems.

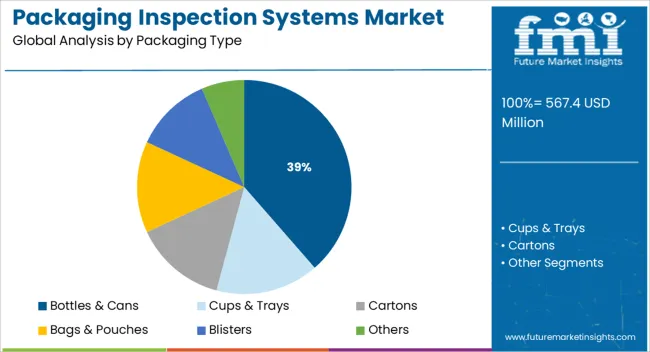

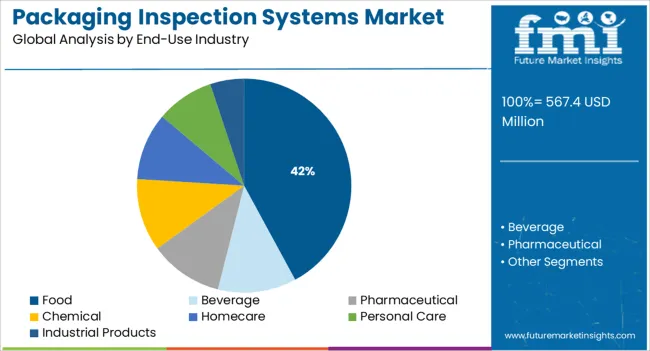

The market is segmented by Packaging Type and End-Use Industry and region. By Packaging Type, the market is divided into Bottles & Cans, Cups & Trays, Cartons, Bags & Pouches, Blisters, and Others. In terms of End-Use Industry, the market is classified into Food, Beverage, Pharmaceutical, Chemical, Homecare, Personal Care, and Industrial Products. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Bottles and cans are expected to account for 38.6% of the packaging inspection systems market revenue share in 2025, establishing them as the leading packaging type segment. The dominant position of this segment is driven by the widespread use of rigid containers in beverage, food, and pharmaceutical industries, where precision in sealing, fill level, and labeling is crucial. Inspection systems tailored for bottles and cans have evolved with capabilities such as high-speed imaging, X-ray detection, and laser-based surface scanning, enabling detection of micro-leaks, deformations, and misprints.

These formats are more susceptible to pressure-based inconsistencies and contamination, necessitating rigorous inspection protocols. Moreover, the shift toward sustainable packaging materials has increased the need for adaptive inspection systems that can accommodate varying opacity, material thickness, and shapes.

The requirement to ensure integrity under pressurized conditions in carbonated beverages and liquid pharmaceuticals further enhances the relevance of real-time inspection solutions for bottles and cans As high-speed bottling lines expand globally, the segment is anticipated to maintain its leadership.

The food industry is projected to represent 42.1% of the total revenue share in the packaging inspection systems market by 2025, making it the most significant end-use industry. This growth is primarily influenced by rising consumer expectations for food safety, freshness, and visual consistency, alongside strict regulatory guidelines for contamination control. Packaging inspection systems in the food sector are being widely deployed to verify seal integrity, detect foreign materials, confirm labeling accuracy, and ensure correct product placement.

The need for consistent quality in high-volume food packaging, especially in ready-to-eat meals, snacks, and dairy products, has driven the integration of multi-camera systems and hyperspectral imaging. Furthermore, the demand for traceability and digital records for audits and recall management has led to increased adoption of data-driven inspection platforms.

The evolution of packaging formats, including flexible pouches and modified atmosphere packaging, has added complexity, making advanced inspection systems essential As global food producers scale operations and invest in automation, the segment is expected to remain a key growth driver.

Verifying the quality of the product before dispatching it to the end user is one of the crucial tasks in every industry. For this purpose, every industry uses various techniques and methods for testing the quality of the product such as vision systems, x-ray machines, smart cameras and several other robotic technologies. Similarly, packaging inspection systems are used to check the quality of the packaging as well as the product packed into it.

The quality of the end product maintained by the firm is one of the major factors that define the position of the company among competitors. Various developments in the Packaging Inspection Systems have been introduced by the packaging machinery manufacturers to increase the inspection speed and reduce the response time of the machine.

Six Sigma technology is the term used for the machines that make error in the production with the frequency of only 3.4 defective products in a billion of products. The terms “six sigma technology” greatly impacts the image of the firm as a high-quality manufacturer, and to verify this, highly advanced packaging inspection systems are required. Thus, the market for packaging inspection systems seems to be evergreen.

The packaging, as well as inspection processes, tend to be highly productive with the reduced interference of the labour and highly automated packaging machinery and packaging inspection systems. This factor has set the trend to inspect each and every product by packaging inspection systems rather than checking anyone random product out of the complete batch by a quality inspector.

Various inspections such as leakage inspection, barcode inspection, inspection for production machines malfunction, colour inspection, seal inspection, metal detectors and much more. Thus, packaging inspection systems are now advanced to inspect the packaging in such ways in which a human is not capable of. Thus, the shift of trend towards automated factories has driven the demand for packaging inspection systems.

With globally increasing competition among various industries in terms of making packaging with high consumer convenience, longer shelf life and enhanced shelf appeal, the end-users are moving towards adopting six sigma technology and thus require highly advanced packaging technology to confirm the quality tag.

Thus, the fact that the manufacturers are competing in terms of enhanced quality of the end product and attain six sigma quality production has driven the packaging inspection systems market.

Some of the key players of the packaging inspection systems market are

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macroeconomic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global packaging inspection systems market is estimated to be valued at USD 567.4 million in 2025.

The market size for the packaging inspection systems market is projected to reach USD 1,045.3 million by 2035.

The packaging inspection systems market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in packaging inspection systems market are bottles & cans, cups & trays, cartons, bags & pouches, blisters and others.

In terms of end-use industry, food segment to command 42.1% share in the packaging inspection systems market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA