Globally, there is a robust growth in demand in the packaging foam market due to the increasing transition towards protective,lightweight, and eco-sustainable packaging solutions. Packaging foam secures products in industries like e-commerce, electronics, food & beverage, pharmaceuticals, and automotive during storage and transit.

The industry is evolving with newer formulations of foams that comply to performance and environmental standards due to heightened demand for cheaper-but-still-shock-absorbent, temperature-resistant protective materials.

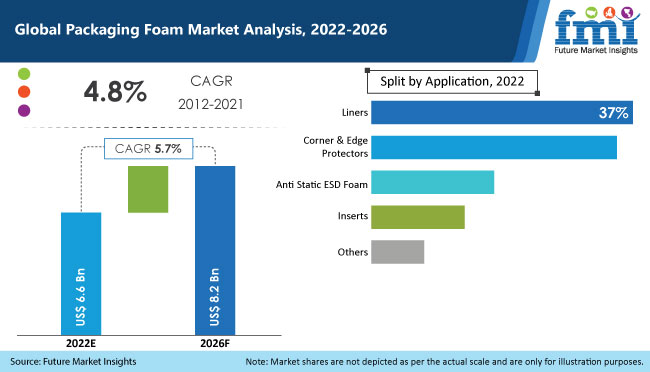

The packaging foam industry's market size, in value terms, was projected to be USD 6.9 Billion in 2025, growing at a CAGR of 5.9% to reach USD 13.7 Billion by 2035.

Increasing international trade, skyrocketing growth of e-commerce, and rising demand for biodegradable, recyclable, and high-performance packaging foams are some of the factors driving this rise. Stricter laws about single-use plastics and manufacturer sustainability goals are helping spur the ramp up of them to develop compostable, bio-based foams, plus recycled-content foams.

Direct AI investments into the production process of foam manufacturing, innovative polymer blends, and automation are all industry trends. The demand for temperature-controlled packaging in pharmaceuticals, light-weight protecting foams in fragile electronics, and impact-resistant solutions for industrial shipments, together with developments in foam recycling, closed-loop systems, and reusable foam packaging solutions, are propelling market developments.

Massively flourishing e-commerce and rapid urbanization, together with increased production of consumer goods, primarily drive the packaging foam market in Asia-Pacific. There is a sudden demand for lightweight impact-resistant foam packaging across the logistics, food delivery, and electronics sectors in countries like China, India, and Japan.

Then, manufacturers are innovating with cost-effective recyclable and bio-based foams while complying satisfactorily with regulatory and environmental demands. An initiative enforced by the governments to prohibit conventional plastic packaging has fueled the widespread shift toward compostable and water-soluble foam alternatives. AI-enabled quality control systems and enhanced automation are aiding local producers in optimizing production efficiencies without compromising sustainability.

North America is the foremost player in the foam packaging market as it derives strong demand from the pharmaceutical, food service, and high-tech industries. The United States and Canada have taken the lead in developing sustainable foam packaging in such a way as to develop methods that can reduce carbon footprints while providing alternatives like molded fiber foam or starch-based foam instead.

Firms are launching smart packaging solutions that have IoT-enabled packaging foam for perishable items with temperature sensitivity. The push for practices towards circular economy is preferred by higher investments in closed-loop foam recycling programs and reusable packaging foam solutions. Furthermore, companies are investing in AI-automated defect detection and production lines to boost quality and reduce material waste.

They've set a high standard in Europe when it comes to sustainable packaging foam-with tough legal restrictions pushing companies to go for biodegradable, recyclable, and reusable packaging options. These two policy instruments-the EU Green Deal and the Circular Economy Action Plan-have now put pressure on big markets such as Germany, France, and the UK, which are all leading in R&D in sustainable packaging, to innovate compostable foam alternatives.

Such improvements include the setting up of barometer standards for high barrier, moisture-resistant, and compostable foams meant for food packaging and pharmacy usages. AI-powered optimization of supply chain process and robotic automation in foam manufacturing are also making the processes more efficient. As green packaging finds greater demand, European companies are gearing up for reusing their services: designing the very foams that will use the least amount of materials without compromising protection.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial bans on EPS and traditional plastic foam in select regions. |

| Material and Formulation Innovations | Early adoption of plant-based and fiber-based foams. |

| Industry Adoption | Growth in e-commerce and food delivery packaging foam. |

| Market Competition | Dominated by traditional packaging manufacturers. |

| Market Growth Drivers | Demand for lightweight, impact-resistant packaging foams. |

| Sustainability and Environmental Impact | Early-stage adoption of circular economy principles. |

| Integration of AI and Process Optimization | Limited AI use in foam manufacturing and recycling processes. |

| Advancements in Packaging Technology | Basic improvements in foam cushioning and protective properties. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating fully compostable and recyclable foam packaging. |

| Material and Formulation Innovations | Expansion of AI-driven, biodegradable, and smart foam packaging technologies. |

| Industry Adoption | Increased adoption in reusable industrial packaging, AI-powered logistics, and sustainable food packaging. |

| Market Competition | Rise of sustainability-driven startups and AI-powered foam processing firms. |

| Market Growth Drivers | Market expansion fueled by automation, AI integration, and zero-waste packaging solutions. |

| Sustainability and Environmental Impact | Large-scale transition to fully biodegradable and reusable foam packaging solutions. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, automated defect detection, and real-time monitoring of sustainable materials. |

| Advancements in Packaging Technology | Development of smart foams with RFID tracking, IoT-enabled monitoring, and compostable high-performance solutions. |

As the country's largest market for packaging foams, the growing demand from industries, namely food & beverages, electronics, healthcare, and e-commerce, for lightweight, durable, and protective packaging solutions is seen in the United States. Rising consumer inclination toward sustainable biodegradable foam alternatives pushes manufacturers toward bio-based recyclable and compostable foam materials.

Besides, government restrictions against non-compostable single-use plastics continue to incentivize businesses to adopt green alternatives such as starch, polylactic acid (PLA), and biodegradable polyurethane.

E-commerce and continued growth in requirements for impact-resistant packaging materials drive advanced research and development in developing shock-absorbing moisture-resistant thermally insulated foam packaging. Moreover, companies are integrating AI-driven practices for quality control, automation in foam manufacturing, and nanotechnology to improve foam structure and performance while lessening environmental damage.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

UK packaging foam sector is increasing as companies turn their focus toward regulatory compliance, sustainability, and cost-efficient modes of protective packaging. Government decrees for a reduction in plastics, the schemes of extended producer responsibility (EPR), and circular economy incentives have hastened the introduction of biodegradable and recyclable foam packaging. Companies are investing in high-performance polyurethane, polyethylene, and polystyrene foams with enhanced impact resistance, thermal insulation, and moisture barrier properties.

Increasing demand for flexible and rigid foam packaging in e-commerce, healthcare, and logistics sectors drives growth in this market. The drive for durability and efficiency is supported by advances in closed-cell foam technologies, low-density foams, and high-performance cushioning solutions. Companies also strive for smart foam packaging that integrates RFID tracking, self-healing capabilities, and bio-based compositions to enhance supply chain transparency and sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

The packaging foam market in Japan is continuously developing because of the growing demand for high-quality lightweight and shock-absorbing foam materials in the electronics, automotive, and food packaging sectors. Stringent government regulations on the waste and recycling of plastics are pushing companies to the development of more sustainable alternatives to existing non-toxic foams. Among others, high-performance expanded poystyrene (EPS), polyethylene (EPE), and polypropylene (EPP) foams with improved cushioning, heat resistance, and recyclability are focused on by the manufacturers.

In addition, the innovations in anti-static foam packaging for sensitive electronic components, temperature-controlled foam insulation for food packaging, and high-density foam solutions for industrial applications are driving the growth of the market. Businesses are enhancing their manufacturing efficacies and sustainability through AI defect detection, robotic automation, and advanced material engineering.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The very fast growth of South Korea's packaging foam market is rooted in increased demand for protection, weight savings, and environmentally-friendly packaging products. The rising trend of online retail, growing exports, and government initiatives in sustainable packaging are contributing to the growth of this market. Companies are now working on high-performance foam packaging with enhanced recyclability, durability, and cushioning properties. Innovations in foam-in-place packaging, biodegradable foams, and smart foam materials make packaging even more efficient and sustainable.

This is further backed by advanced molding technologies, digital printing on foam surfaces, and hybrid foam composites and will drive product innovation. To enhance sustainability and reduce packaging waste, businesses are investing in AI-driven supply chain optimization, biodegradable polymer foams, and closed-loop recycling systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The flexible, rigid, and biodegradable foam segments are driving market expansion as industries seek lightweight, impact-resistant, and environmentally friendly packaging solutions. Manufacturers are focusing on developing high-resilience, temperature-resistant, and recyclable foam materials to meet evolving industry standards. Additionally, companies are investing in energy-efficient foam processing, bio-based foam composites, and nanotechnology to enhance product durability, cost-effectiveness, and sustainability.

The flexible and shock-absorbent segment of packaging foam will remain prominent since companies now require high-quality foams that are lightweight and versatile, presenting an all-in-one solution for their fragile products. New-polyurethanes, polyethylenes, and polystyrene foams are being developed by companies for next-generation applications that will enhance the cushioning properties of the foams while adding heat insulating and moisture-resistant qualities to them.

The efforts on offering recyclable, nontoxic, and food-safe foam are also a driver for sustainability efforts. Furthermore, research on smart foam package technology with real-time impact monitoring and self-healing properties increases market growth.

The rigid packaging foam segment is witnessing increased demand as industries seek durable, heat-resistant, and structurally stable foam solutions for industrial packaging, automotive components, and food insulation. Companies are investing in advanced closed-cell foam structures, lightweight reinforced foam composites, and solvent-free foam production technologies to improve performance and reduce environmental impact. Additionally, the rise of temperature-controlled and moisture-resistant rigid foam packaging solutions is driving innovation in this segment.

The biodegradable packaging foam segment is growing rapidly as manufacturers explore eco-friendly alternatives to traditional petroleum-based foams. Companies are developing starch-based, PLA, and cellulose-derived foams that offer comparable cushioning, thermal insulation, and moisture resistance while being fully compostable.

Additionally, advancements in bio-based polymer foams, water-soluble foams, and foam-reinforced recycled fibers are driving the sustainability of packaging solutions. The increasing adoption of biodegradable foams in food packaging, healthcare, and consumer electronics is further fueling demand for sustainable foam materials.

Research into AI-driven foam molding, enzyme-assisted polymer degradation, and energy-efficient foam production methods is improving the sustainability and usability of packaging foam solutions. AI-powered supply chain optimization is also enhancing production workflows and reducing material waste in foam manufacturing operations.

As industries continue to prioritize high-performance, cost-efficient, and environmentally friendly packaging solutions, the packaging foam market is expected to witness sustained growth. Innovations in material science, smart packaging technologies, and biodegradable foam alternatives will play a crucial role in shaping the future of this industry, making packaging foam an essential component across various consumer and industrial applications.

Despite competition from rigid packaging and alternative cushioning materials, the packaging foam market remains an essential segment in industries requiring lightweight, impact-resistant, and cost-efficient protective packaging solutions. Packaging foam is widely used in electronics, food & beverage, pharmaceuticals, and industrial packaging due to its superior shock absorption, insulation properties, and flexibility.

The increasing adoption of packaging foam across e-commerce, logistics, and automotive packaging has driven market penetration. Studies indicate that more than 70% of packaging manufacturers prefer packaging foam due to its ability to provide superior protection, lightweight design, and sustainability features while ensuring product safety during transportation.

With enhanced shock resistance, high-barrier capabilities, and compatibility with automated packaging systems, packaging foam continues to see demand growth in commercial and industrial applications. Advanced manufacturing techniques, including biodegradable foam, closed-cell polyethylene foam, and AI-driven quality control, have further expanded its functionality in specialized markets such as temperature-sensitive shipments, medical device packaging, and eco-friendly alternatives.

The innovation in material engineering has led to the development of plant-based foam, compostable foam cushioning, and energy-efficient foam molding, making packaging foam more appealing for various applications. Additionally, improvements in regulatory compliance and sustainability initiatives have increased the adoption of recyclable and biodegradable foam solutions, ensuring adherence to global packaging safety and environmental standards.

The introduction of AI-driven production monitoring, automation in foam molding processes, and lightweight, high-performance cushioning solutions has bolstered market growth while aligning with global sustainability trends and waste reduction initiatives. Additionally, the integration of smart packaging technologies, such as RFID-enabled tracking and tamper-proof foam inserts, is further enhancing the efficiency and appeal of packaging foam solutions.

Packaging foam holds a significant share of the market in e-commerce and electronics segments as businesses seek durable, cost-effective, and eco-friendly protective solutions. The growing demand for high-impact, lightweight, and recyclable packaging foam contributes to the sustained growth of the market.

With its essential role in shipping fragile goods, electronics, and delicate consumer products, the e-commerce industry remains a key driver of the packaging foam market. These solutions offer superior shock absorption, damage prevention, and compliance with global shipping regulations, making them superior to alternative cushioning materials.

Market trends indicate a shift toward bio-based and recyclable packaging foam, where innovative polymer blends enhance sustainability and product protection. Studies show that over 75% of e-commerce fulfillment centers and packaging suppliers prefer packaging foam due to its ability to ensure product integrity and customer satisfaction.

The adoption of packaging foam in medical devices, automotive components, and specialty food packaging has further expanded market opportunities. As businesses focus on improving packaging sustainability and reducing material waste, AI-driven foam molding optimization, high-barrier temperature-resistant foams, and lightweight protective inserts are becoming increasingly popular.

Despite advantages such as improved product safety and enhanced sustainability, the market faces challenges such as fluctuating raw material costs, regulatory restrictions on plastic-based foams, and difficulties in foam recycling. However, developments in biodegradable packaging foam, AI-powered defect detection, and plant-based foam cushioning are driving innovations that enhance product efficiency and environmental responsibility.

The food & beverage and industrial packaging sectors have become major end-users of advanced packaging foam solutions due to the increasing need for thermal insulation, contamination protection, and lightweight packaging alternatives. Packaging foam is preferred for its ability to optimize temperature-sensitive shipments, improve cushioning, and comply with global food safety and environmental sustainability standards.

An increasing number of food delivery services, industrial packaging providers, and cold chain logistics companies are incorporating high-performance packaging foam into their protective packaging operations, offering enhanced product safety, reduced transportation weight, and compliance with international packaging safety regulations. Research suggests that more than 65% of sustainable packaging manufacturers prioritize high-quality packaging foam for improved efficiency and environmental impact reduction.

While packaging foam offers advantages such as improved product protection and lightweight design, challenges such as recyclability limitations, high production costs for biodegradable foams, and regulatory restrictions persist. However, ongoing advancements in AI-driven foam production, compostable foam materials, and smart tracking-enabled protective inserts are addressing these challenges, ensuring continued market expansion.

The packaging foam market is influenced by rising demand in e-commerce, electronics, and food & beverage industries. The market is witnessing innovation through new material developments, such as bio-based foams, lightweight polymer blends, and AI-powered foam manufacturing optimization, addressing concerns about efficiency, sustainability, and recyclability.

Additionally, advancements in automated foam production and AI-driven quality control are further shaping industry trends. The rising preference for sustainable and recyclable packaging foam solutions is also contributing to market growth. Furthermore, increased investments in smart packaging integration and circular economy initiatives are improving product efficiency and expanding market opportunities.

Companies are also exploring hybrid foam solutions that integrate impact resistance with biodegradable materials for enhanced usability. Additionally, collaborations between packaging manufacturers and e-commerce brands are driving the development of customized packaging foam solutions tailored to diverse industry needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sealed Air Corporation | 12-16% |

| BASF SE | 8-12% |

| Zotefoams Plc | 6-10% |

| Sonoco Products Company | 4-8% |

| JSP Corporation | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sealed Air Corporation | Develops high-performance, recyclable packaging foam solutions for food, electronics, and industrial applications. |

| BASF SE | Specializes in lightweight, bio-based packaging foams with high-barrier and impact-resistant properties. |

| Zotefoams Plc | Produces AI-driven, high-performance foam packaging solutions optimized for e-commerce and logistics. |

| Sonoco Products Company | Expands its product line with sustainable and compostable packaging foam alternatives for various industries. |

| JSP Corporation | Focuses on innovative, eco-friendly packaging foam solutions with AI-powered quality control for protective packaging. |

Key Company Insights

Other Key Players (45-55% Combined)

Several specialty packaging foam manufacturers contribute to the expanding market. These include:

The overall market size for the Packaging Foam Market was USD 6.9 Billion in 2025.

The Packaging Foam Market is expected to reach USD 13.7 Billion in 2035.

The market will be driven by increasing demand from e-commerce, electronics, and food & beverage industries. Innovations in bio-based foams, AI-driven production optimization, and improvements in recyclable and compostable foam solutions will further propel market expansion.

Key challenges include recyclability limitations, high production costs for biodegradable foams, and regulatory restrictions on plastic-based foam materials. However, advancements in plant-based foam alternatives, AI-powered defect detection, and high-strength lightweight foams are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to strong environmental regulations, increased investment in sustainable packaging solutions, and high consumer demand for eco-friendly alternatives. Meanwhile, Asia-Pacific is experiencing rapid growth driven by the expansion of e-commerce, rising disposable incomes, and increased demand for protective packaging solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonpackaging Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam Packaging Inserts Market Analysis, Size, Share & Forecast 2025 to 2035

Biofoam Packaging Market

EPE Foam Packaging Market Size and Share Forecast Outlook 2025 to 2035

EPP Foam Packaging Market Growth – Demand & Forecast 2024-2034

Anti-Static Foam Packaging Market Size, Share & Forecast 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Trends and Growth 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA