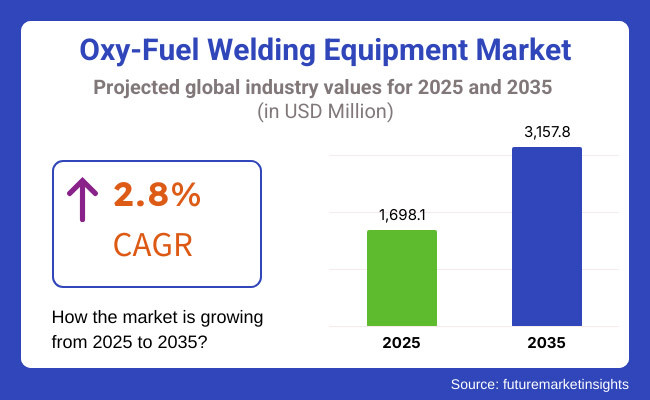

The Oxy-Fuel Welding Equipment Market is expected to grow from USD 1,698.1 million in 2025 to USD 3,157.8 million by 2035, registering a CAGR of 2.8% over the forecast period. The increasing demand for cost-effective welding solutions in metal fabrication, construction, and automotive industries is driving market growth.

Oxy-fuel welding remains a versatile and efficient technique for joining metals, particularly in industries requiring precision welding, cutting, and brazing. The rising adoption of automated oxy-fuel welding systems, coupled with advancements in gas control technology, is further contributing to market expansion. Additionally, growth in infrastructure projects, shipbuilding, and industrial manufacturing is fueling demand for high-performance welding equipment.

The oxy-fuel welding equipment market is experiencing persistent growth iterate due to its cost-effectiveness, portability, and versatility across various industrial applications. In contrast to other welding techniques, oxy-fuel welding necessitates no electricity, which makes it a perfect choice for remote locations, pipeline repairs, and field operations. The increasing implementation of oxy-fuel cutting systems in steel and metal fabrication is also an important factor that influences the market's demand.

One of the major technological advancements is the incorporation of precision flame control and gas-flow optimization along with the development of AI-integrated welding systems that lead to improved efficiency and reduced gas consumption. Also, the alternative fuel gas development, especially propane and hydrogen is taking a step ahead in making welding operations more sustainable. The government is expected to make market growth stronger through investments in infrastructure, energy and manufacturing sectors stimulating it for the next decade.

Explore FMI!

Book a free demo

The North American market is experiencing consistent growth, which can be attributed to the flourishing metal fabrication, automotive, and construction sectors. The USA and Canada are directing funds towards the rehabilitation of infrastructure and the implementation of manufacturing innovation, thus, increasing the demand for high-precision welding solutions.

The trend of using automated oxy-fuel welding equipment in aerospace, shipbuilding, and energy sectors is on the rise, which consequently results in higher productivity. Nevertheless, the safety issues, the strict welding emissions regulations, and the threat of going ahead with new technologies, like the fully automated laser welding, are mentioned as the main bottlenecks in the market. The increasing number of gas blends that are not only cost-effective but also eco-friendly, will be the main driver for the future development of sustainable oxy-fuel welding machines.

The European market is pulling by the advancement in industrial automation, aerospace, and metal fabrication sector. For instance, Germany, France, and the UK are focusing on shipbuilding, car production, and civil construction, hence, the demand for top-notch welding machines is multiplied. With machinery being the primary source of air pollution, manufacturers are paradoxically persuading the development of oxy-fuel welding technologies that have lower emissions.

Hydrogen-based welding gases and AI-controlled welding machines are the changing factors in this industry. Yet, the competition from laser and plasma welding technologies, along with the price fluctuations of raw materials, are the main sticking points. The market expansion is projected to be bolstered by investments in welding training programs and digital welding solutions.

The Asia-Pacific area has the highest market growth rate due to the acceleration of industrialization, urbanization, and infrastructure development. Countries like China, India, and Japan are the leading ones in oxy-fuel welding equipment demand in the construction, shipbuilding, and heavy machinery sectors. Government funds in the area of smart manufacturing and automotive production are boosting market supply.

Moreover, the emergence of hydrogen-based oxy-fuel welding technologies is driving the environmental footprint. However, the main issues that bring down the market performance are the mighty rivalry with electric arc welding technologies, fuel price volatility, and safety concerns. The region is expected to gain from the use of automation, AI-driven welding processes, and portable oxy-fuel welding solutions which would increase the overall efficiency in the market.

The Middle East & Africa (MEA) market growth is pivoted to the expansion of oil & gas, energy, and infrastructure sectors. Countries such as Saudi Arabia and the UAE are channeling funds into the construction of pipelines, the tractable maintenance of refineries, and the industrial sector, which consequently boosts the demand for high-performance oxy-fuel welding equipment.

Africa is now seeing the rise of mining and power plants projects, which require long-lasting welding tools for maintenance and fabrication. The hurdles faced in terms of under-provision of quality welding materials, skills mismatches, and unpredictable economic conditions are affecting the market's upward growth. The adoption of inexpensive and versatile oxy-fuel welding solutions is anticipated to be a key driver of industrial development in this region.

The oxy-fuel welding equipment market in Latin America is on the upswing on the back of growing industrialization, the expansion of automotive manufacturing, and the laying of new infrastructure. Regions like Brazil, Mexico, and Argentina, which are on the construction and shipbuilding rat race, thus the rise in demand for welding technologies. Government incentives for the industrial sector's upgrade and programs for training the workforce are the ones that drive the market.

On the flip side, the market is still hampered by the reality of import tariffs, the ups and downs of gas prices, and the hardly processed advanced welding technologies. The market is projected to benefit from the arrival of new welding technologies, digital automation, and furthering the distribution of gases, hence the availability and efficiency of oxy-fuel welding will be improved.

Challenges

Safety Risks and Environmental Concerns

Oxy-fuel welding is a process that places the operator at risk of fire hazards, explosion risks, and toxic gases as it uses combustible gases and has open flames, in addition to operating at high temperatures. Safety management workers have to deal with the ventilation problems, the invalid gas handling equipment, and the repair issues that may cause the gas leak.

The laws enacted by the government regarding workplace safety can be demanding, as they require the wearing of protective gear, the installation of a gas leak detection system, and workers' knowledge of emergency shut-down protocols. On top of that, oxy-fuel emissions are one of the air pollutants, and hence, environmental regulations have been set to mitigate this by promoting the adoption of lower and cleaner emissions gas. Manufacturers must follow guidelines regarding occupational safety and environmental impact and achieve emission reductions, as noncompliance can cause them to be fined, face operational interruptions, and incur litigation.

Competition from Advanced Welding Technologies

The oxy-fuel welding sector is facing a pressure on the importance of this welding method due to the arrival of professional tools like MIG, TIG, laser, and plasma welding machines that have less errors and consume a smaller amount of gas. The use of these alternative procedures has the advantage of welding stronger joint bolts because there is no heat distortion, and thus, these are the most preferred choices for those industries that accord more attention to the time and quality of the product.

Traditional oxy-fuel techniques are becoming obsolete, alongside which called frogbots and AI-driven automated systems are developing further. The oxy-fuel welding technique is still a significant process when applied in field operations and metal cutting, however, it is adapting much slower in the industries moving to computer numerical control and laser welding methods of mass production and industrial automation.

Fluctuating Fuel Costs and Supply Chain Challenges

Oxy-fuel welding is dependent on acetylene, propane, and oxygen, which are among the factors contributing to price fluctuations, supply chain breakdowns, and transportation problems. Fuel price swings are influenced both by the world market conditions and political wars between countries and the industrial gas industry is becoming more expensive thus affecting the availability of these gases.

The long delays in shipping and the problems in distribution that are faced in the many parts of the world are evidenced in the shortage of gas in big industrial scale plants. Furthermore, the rigid laws regarding the storage and transport of toxic gas increase the costs that compliance costs incur. Companies and clients are studying other fuel resources as a part of the gas mix of the future which includes the utilization of more efficient systems and the establishment of local production facilities.

Opportunities

Technological Advancements in Smart Welding Solutions

Machine learning software is being developed alongside IoT technologies that welders will be able to control online, which is a big step forward in the oxy-fuel welding business. Portable oxy-fuel webbing kits, which are from the start fitted with sensors for real-time gas monitoring and digital controllers are breaking the market entry barriers for building sites where the job is done far from the home base and mobile welding applications.

With the uptake of digitally connected welding equipment, operators will be able to keep a tab on their gas usage, preempt leaks, and we teed off on the flame settings, save resources, and money. Production companies are stepping up their green game and entertain machines that deliver a peak performance at a low cost will be the focus of the sales trend thus your company will be on the top of it only if you introduce the smart welding debits and automation.

Adoption of Hydrogen-Based and Alternative Fuel Gases

Going on hydrogen energy sources is an option for structural and constructional welding that companies are increasingly taking as they look for the environment-saving solution harder than acetylene and propane. Hydrogen by combustion is clean, which means lower emissions of carbon, therefore, it turns the process of welding more efficient, thus it is in line with the initiatives for the use of green energy all over the world. The findings in the gas mixtures have been addressed of which the use of biodegradable and synthetic gas as fuel is one of them, which also results in eco-friendly welding.

The market for hydrogen-compatible welding devices is expected to grow because of the ongoing transition to hydrogen-based energy and the development of hydrogen infrastructure by the government and industries. The move to hydrogen and other gases as alternatives will comply with environmental regulations, improve fuel efficiency, and will further promote operational sustainability in oxy-fuel welding operations, as a result.

Expansion in Infrastructure, Automotive, and Shipbuilding Industries

The welding sector is booming due to a rise in the need for welding solutions in construction, automotive, and shipbuilding sectors. Mega projects involving the building of bridges, pipes, and railroads need a cheap, reliable, and effective method for joining and cutting metals, a field where oxy-fuel welding excels.

The automotive and aerospace sectors need precise welding for their components, hence they need high-quality welding torches and robotic oxy-fuel systems. The developing countries of the Asia-Pacific region, Africa, and Latin America are setting the pace for welding equipment manufacturers and distributors all over the world as they intensify their industrialization and manufacturing investments.

The oxy-fuel welding equipment market has experienced steady growth from 2020 to 2024, driven by increasing demand in metal fabrication, automotive repair, and construction industries. The affordability and versatility of oxy-fuel welding have maintained its relevance despite the rise of advanced welding technologies.

Additionally, regulatory measures aimed at workplace safety and emissions control have influenced equipment design and operational standards. Looking ahead to 2025 to 2035, the market is expected to witness innovations in fuel efficiency, automation, and integration with sustainable energy sources.

Comparative Market Analysis:

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter workplace safety regulations and emissions control measures affecting oxy-fuel gas usage. |

| Technological Advancements | Improvements in torch design, safety mechanisms, and gas efficiency. |

| Industry-Specific Demand | Continued reliance in metal fabrication, automotive, and construction sectors. |

| Sustainability & Circular Economy | Initial efforts to improve fuel efficiency and reduce gas waste. |

| Production & Supply Chain | Stable demand with regional production hubs for welding equipment. |

| Market Growth Drivers | Increased infrastructure development, cost-effective welding solutions, and industrial expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Enhanced environmental policies promoting cleaner fuel alternatives and emission-reducing technologies. |

| Technological Advancements | AI-assisted welding, smart monitoring systems, and eco-friendly oxy-fuel blends. |

| Industry-Specific Demand | Rising adoption in aerospace, renewable energy infrastructure, and precision manufacturing. |

| Sustainability & Circular Economy | Development of carbon-neutral fuels, recyclability of components, and energy-efficient welding techniques. |

| Production & Supply Chain | Growth in localized manufacturing, AI-driven supply chain optimization, and fuel distribution advancements. |

| Market Growth Drivers | Expansion of sustainable manufacturing, robotics integration, and advancements in oxy-hydrogen welding. |

The USA oxygen-fuel welding equipment market is on the growth trajectory due to the massive influx of funds in the infrastructure, industrial manufacturing, and military sectors.The surge in metal fabrication orders from the aerospace, shipbuilding, and automotive sectors is the principal factor propelling the market development.Besides, the construction.

UP turn that is driven by governmental infrastructure works is additionally raising the need of oxy-fuel welding and cutting tools. The formation of small and medium-scale welding companies, breeding the innovation of portable and energy-efficient welding technologies, is the main reason of the fast growth of the oxy-fuel welding system adoption all over the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The main economic sectors, including industrial manufacturing, construction, and shipbuilding have a tangible impact on the United Kingdom Oxy-Fuel Welding Equipment Market growth, which is seen to be progressing continually. The idea of having sustainable metal fabrication that is both efficient and safe is good for the UK.

The demand for that metal fabrication and precision welding in the aerospace and automotive industries is growing due to the UK goal of sustainability. The promotion of the projects, rail expansion, and transportation repair and maintenance investment, are the main factors that help with the product's growth. Furthermore, the promotion of lightweight and compact oxy-fuel welding alternatives selection is the major reason of start-ups and standalone businesses to change the product range.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

The European Union Oxy-Fuel Welding Equipment Market is showing a positive momentum brought about by the thriving construction, automotive, and heavy machinery industries. EU Member States, mainly Germany, France, and Italy, are the main drivers of market growth with the investments in metalworking, shipbuilding, and railway infrastructure projects.

The embracing of oxy-fuel cutting in steel fabrication has increased considerably the demand for equipment and tools. Moreover, the energy-efficient and sustainable welding techniques push, which are in line with the EU’s carbon-cutting objectives, support the start of the development of eco-friendly welding equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.3% |

The rapid growth of the China Oxy-Fuel Welding Equipment market is primarily attributed to the huge expansion being seen in the industrial construction and heavy manufacturing sectors. China leads the world in steel production, shipbuilding, and automotive manufacturing, thus creating the need for high-performance oxy-fuel welding solutions.

The government which is focusing on the development of infrastructure, and export-driven manufacturing will equate market expansion. Gradually, oxy-fuel welding is being used much more in precision metal cutting and structural fabrication thus adding to the growth factor.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.8% |

The Japan Oxy-Fuel Welding Equipment Market is witnessing strong growth, majorly due to the rising demand from automotive, aerospace, and high-precision manufacturing industries. The country's insistence on technological improvements in welding methodologies is thereby making the automated and robotic oxy-fuel welding systems more popular.

The aging infrastructure of Japan and the increasing number of smart construction projects are the other reasons for the pushing need for advanced welding solutions. Also, the new sustainable and eco-friendly welding materials' development reflects the ethos of the nation, which aims to reduce industrial emissions. The manufacturing sector of Japan has possessed its advantages due to specialized products like this oxygen welding.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korea Oxy-Fuel Welding Equipment Market is growing at a rapid pace due to the country’s robust shipping, automotive, and heavy machinery industries. The demand for oxy-fuel welding in marine and offshore fabrication is predominantly driven by the country’s preeminent role in shipbuilding. The creation of smart factories and the surge of automated metalworking facilities are additional factors that contribute to the progress of the market.

Besides, government measures targeted at industrial manufacturing modernization and financing in high-tech welding solutions are also beneficial for market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

Oxyacetylene Welding Segment Is Unmatched for Metal Joining Applications Due to Its Momentous Versatility

The oxyacetylene welding segment stands firmer than the oxy-fuel welding equipment market, which is indicative of its high-temperature flame that makes it possible to efficiently metal fusion over different thicknesses. This method is famously performed in metal fabrication, automotive repairs, and construction during cutting, brazing, and welding processes.

Oxyacetylene welding comes in as the best choice because of its affordability, portability, as well as it is applicable to both ferrous and nonferrous metals. Furthermore, the artistic metal-working and jewelry-making industries are some of the areas that need precise heat control and therefore they help maintain a high demand for ox mercury-based welding equipment. Indisputably, concerns about acetylene storage and handling safety are making companies rapidly adopt systems that entail safety features of welding.

Oxyhydrogen Welding Unfolds with Demand for Assured and Unblemished Welds

The oxyhydrogen welding segment keeps on being diffusion due to energetic penetrativeness metalsmiths in electricalponents, medical device businesses and aerospace etc. This procedure which makes use of hydrogen as the combustible source ice-zero waste emissions is an alternative to oxyacetylene though far more environmentally friendly.

Oxyhydrogen welding is now the sought form for welds out of pure materials that have to be joined together like aluminum and stainless steel in the aerospace sector and semiconductor factories. Environmental protection and the use of hydrogen instead of other forms of energy are becoming priorities for the world, hence involving oxyhydrogen welding in the manufacture of hydrogen-powered cars and other things will be paramount.

Pressure Gas Welding Enormously Popular with Expansion in Heavy-Duty Applications

The pressure gas welding segment continues making headway in the areas of engineering, machinery, and bridge works where potent strengths and distorted unifies are the only options to bring it to fruition. The specific welding procedure of gas pressure professing itself over a filler material leviathan fulfills the 'world-class' welding standards thus creating particular industrial applications like shuttering of pipeline, bridge pylon, and solid framing.

Pressure gas welding achieves a paramount place in utility sectors like water and gas, where pipelines and gas storage containers necessitate steadfast and long-term seals. Overall, the emergence of infrastructural renovation, and repeatable projects regarding renewable energy is expected to lead to the demand for high technology pressure gas welding systems.

Energy & Utilities Sector is the Growth Engine with the Demand for Pipeline and Infrastructure Welding

The energy and utilities segment is the one that significantly propels the oxy-fuel welding equipment market due to the consistent rise in demand for pipeline construction in the oil and gas and the renewable energy sector drivers.

The cohesive addition of liquefied natural gas (LNG) terminals, and hydrogen-liquid storage plants along with the laying of the power plant makes oxy-fuel welding stand at the forefront of sheet-metal structuring by applying high-pressure and high-temperature welding. The paradigm shift observed in remediation projects, besides ceasing the adoption of oxy-fuel cutting technologies in the maintenance of industrial plants, is causing the segment's growth to proceed at a remarkable pace.

Aerospace Industry Becomes a Potential with High-Precision Welding Applications

With the newfound power of oxy-fuel welding, the aerospace industry is Omni competent in aircraft maintenance, component fabrication, and structural repairs. Oxyhydrogen welding, more so, is the favorite method to join lightweight metals - in the case of aluminum and titanium, which are indispensable in eco-friendly designs for aircraft.

While the industry gravitates toward hydrogen-fueled aviation and environmentally friendly aircraft materials, the trend grows for unspoiled and high-precision welding techniques. To that extent, automatic oxy-fuel welding systems are being integrated by aerospace manufacturers for efficiency improvements, better performance, and repeatability in aircraft production.

Transportation Sector Increases with the Rising Demand for Railway and Shipbuilding Welding Solutions

The transportation sector, covering the areas of railways, shipping, and heavy-duty vehicle manufacturing, utilizes oxy-fuel welding for marking joints, mending structures, and producing cars. Among the features of railway construction, typically, pressure gas welding of track jointing is sought after to bring forth the seamless and strong rail joints.

The shipbuilding sector equally resorts to oxy-fuel cutting and welding techniques for hull fab and repair work, especially on marine vessels and offshore rigs. The ongoing "investment wave" in railway infrastructure upgrades and maritime projects will undoubtedly lead to the continually increasing demand for high-performance oxy-fuel welding tools.

Oxy-Fuel Welding Equipment Market is experiencing a positive development trajectory owing to the increasing requirement from metal fabrication, automotive, shipbuilding, and construction sectors. Oxy-fuel welding, which is also known as gas welding, is a process of using oxygen and fuel gases like acetylene, propane, or hydrogen to create a flame during welding, cutting, and brazing. The method stays the same because of its cost advantage, portability, and being a jack of all trades in the industry and repair work.

Continuous advancements in gas flow control, safety protocols, and sustainable fuel alternatives are the primary causes of the enlargement of this market. The market influencers approach this by concentrating on automation, precision control, and energy-efficient gas welding solutions to enhance performance and safety.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lincoln Electric Holdings, Inc. | 15-18% |

| ESAB (Colfax Corporation) | 12-15% |

| Illinois Tool Works (ITW) | 10-12% |

| The Harris Products Group | 8-10% |

| Koike Aronson, Inc. | 5-7% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lincoln Electric | Global leader in oxy-fuel welding solutions, offering high-performance torches, regulators, and gas control systems. |

| ESAB (Colfax Corporation) | Develops advanced welding and cutting equipment with precision gas control technology. |

| Illinois Tool Works (ITW) | Specializes in industrial oxy-fuel welding tools, emphasizing safety and efficiency. |

| The Harris Products Group | Offers durable oxy-fuel welding and cutting equipment for metal fabrication and maintenance. |

| Koike Aronson, Inc. | Provides heavy-duty oxy-fuel welding and cutting solutions for shipbuilding and construction. |

Key Company Insights

Lincoln Electric Holdings, Inc.

Lincoln Electric is the worldwide front-runner in welding technology, which offers excellent oxy-fuel torches, gas regulators, and welding kits. The firm's emphasis is placed on fine control of gases, energy efficiency, and better safety measures.

The company Lincoln Electric is supporting the development of the future generation of welding automation and gas monitoring systems that are smart in order to improve performance, durability, and operator safety. The oxy-fuel equipment that is manufactured by Lincoln Electric is commonly applied in the manufacturing, construction, and metal fabrication sectors.

ESAB (Colfax Corporation)

ESAB is dedicated to welding and cutting solutions, by presenting oxy-fuel welding systems that use highest efficiency torches and advanced gas mixing technology. The firm is making an effort to develop an eco-friendly and energy-efficient welding technology, through which customers will achieve better precision, minimal gas wastage, and enhanced safety. ESAB offers oxy-fuel products adapted for automotive, aerospace, and metalworking industries and provides versatile and reliable gas welding tools.

Illinois Tool Works (ITW)

ITW is a world-renowned vendor of industrial oxy-fuel welding and cutting equipment, distinguished by long-lasting and efficient units. The company employs high-tech gas flow control systems to increase welding effectiveness and exactness. ITW is growing its product range with feather-light ergonomic torch versions, meeting the needs of fabrication, repair, and heavy machine work.

The Harris Products Group

Lincoln Electric's subsidiary, the Harris Products Group, is a specialist in oxy-fuel welding, cutting, and brazing. The division is known for its specialty gas regulators, torches, and safety gear built around the core principles of durability and ease of use. Harris promotes the employment of green welding methods through the promotion of eco-friendly fuel gases and the assertion of efficient gas utilization techniques.

Koike Aronson, Inc.

Koike Aronson has built a strong reputation in the market of heavy-duty oxy-fuel welding and cutting machines for shipbuilding, construction, and metal processing. The company delivers high accuracy gas welding systems and introduces computer-controlled gas flow systems for the sake of even greater accuracy and efficiency. Koike is developing its line of automated welding facilities, resulting in increased productivity for industrial applications that operate at high volumes.

The global Oxy-Fuel Welding Equipment market is projected to reach USD 1,698.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 2.8% over the forecast period.

By 2035, the Oxy-Fuel Welding Equipment market is expected to reach USD 3,157.8 million.

The metal fabrication segment is expected to dominate due to the widespread use of oxy-fuel welding in industrial manufacturing, automotive repair, and construction applications.

Key players in the Oxy-Fuel Welding Equipment market include Lincoln Electric Holdings, Inc., Colfax Corporation, ESAB, Illinois Tool Works Inc., and Air Liquide.

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.