Overwrapping machines market is showing stable growth as more demand in the food packaging, pharmaceutical, and industrial application increases. Innovation of automation, sustainability, and precision is revolutionizing the market with the adaptation to the ever-changing industry standards.

The focus on energy efficiency, material flexibility, and advanced wrapping solutions is positioned to enhance functionality while meeting environmental compliance and operational efficiency goals.

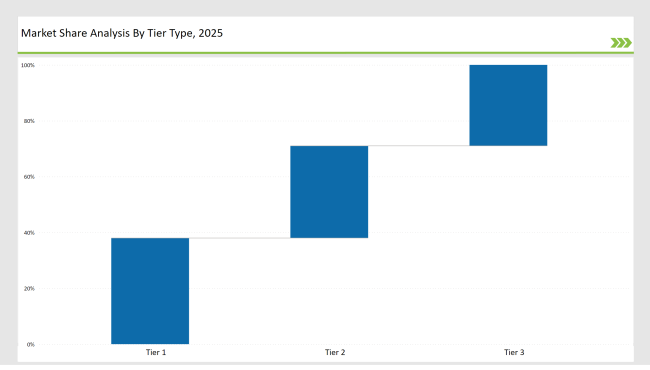

Tier 1: Leading manufacturers such as Ishida, Robert Bosch Packaging Technology, and Fuji Machinery Co. dominate 38% of the market. They leverage cutting-edge automation technology, extensive global distribution networks, and eco-friendly materials to maintain market leadership.

Tier 2: Companies like IMA S.p.A., Harpak-ULMA, and Syntegon Technology account for 33% of the market by specializing in cost-effective, highly customizable, and efficient overwrapping solutions tailored to diverse industries.

Tier 3: Regional and niche manufacturers comprise the remaining 29%, offering specialized solutions such as compact overwrapping machines, biodegradable material compatibility, and unique industry-specific innovations.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Ishida, Bosch, Fuji) | 18% |

| Rest of Top 5 (IMA, Harapak-ULMA) | 12% |

| Next 5 of Top 10 | 8% |

The increasing need for reliable, efficient, and sustainable overwrapping solutions across multiple industries is fueling growth

Manufacturers are focusing on innovative designs to cater to a broad spectrum of industries

Industry leaders are driving innovation by introducing energy-efficient systems, smart automation features, and eco-friendly wrapping solutions to meet market demands.

Year-on-Year Leaders

Suppliers should focus on automation, sustainability, and compatibility with advanced materials to make the overwrapping machines market more innovative. Investment in AI-based technology, eco-friendly materials, and user-centric designs are essential for future growth.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Ishida, Robert Bosch Packaging Technology, Fuji Machinery Co. |

| Tier 2 | IMA S.p.A., Harpak-ULMA, Syntegon Technology |

| Tier 3 | Cama Group, PFM Packaging, MEC Packaging |

Leading manufacturers are investing heavily in sustainability, automation, and IoT integration. Below are notable advancements:

| Manufacturer | Latest Developments |

|---|---|

| Ishida | Launched energy-efficient overwrapping solutions (March 2024). |

| Robert Bosch Packaging Technology | Expanded IoT-enabled diagnostic systems (August 2023). |

| Fuji Machinery Co. | Enhanced eco-friendly material compatibility (May 2024). |

| IMA S.p.A. | Developed biodegradable material-friendly machines (November 2023). |

| Harpak-ULMA | Introduced compact, multi-functional wrapping machines (February 2024). |

The overwrapping machines industry is evolving in the direction of automation, sustainability, and operation efficiency. Material compatibility and system design improvements made by vendors increase precision, minimize waste, and enhance productivity.

The overwrapping machines industry will continue to evolve toward advanced automation, eco-friendly materials, and smart diagnostics. Firms are likely to prioritize:

Rising demand for efficient, sustainable, and automated packaging solutions.

Ishida, Robert Bosch Packaging Technology, Fuji Machinery Co., IMA S.p.A., and Harpak-ULMA.

IoT integration, biodegradable material compatibility, and compact machine designs.

Asia-Pacific, North America, and Europe.

Companies are investing in energy-efficient systems, recyclable materials, and biodegradable solutions.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.