The market for oven bags is growing as food processors and consumers seek convenient, mess-free, and time-saving cooking methods. As demand increases in the household, foodservice, and ready-to-cook meal business, manufacturers are creating heat-resistant, non-toxic, and recyclable materials. High-barrier films, BPA-free formulations, and self-venting technology are being used by manufacturers to ensure improved performance and food safety.

Companies are adopting AI-based quality monitoring, heat-resistant coatings, and biodegradable alternatives to enhance production and sustainability. The industry is shifting towards oven-proof, greaseproof bags with better sealing mechanisms, eco-friendly materials, and anti-leak technology to meet evolving consumer preferences.

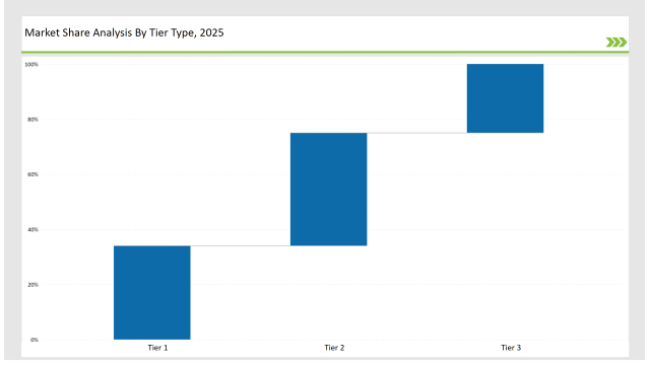

Tier 1 players like Sealed Air, Reynolds Consumer Products, and S. C. Johnson & Son dominate 34% of the market due to their dominance in food-safe packaging, large-scale production capabilities, and innovative material technology.

Tier 2 companies such as Sirane, M&Q Packaging, and Flexipol Packaging hold 41% of the market through high-performance oven bags with customization for commercial and retail use.

Tier 3 consists of regional and niche players that sell biodegradable, self-sealing, and specialty oven bags with 25% market share. They specialize in localized manufacturing, new material blends, and green packaging solutions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Sealed Air, Reynolds Consumer Products, S. C. Johnson & Son) | 16% |

| Rest of Top 5 (Sirane, M&Q Packaging) | 10% |

| Next 5 of Top 10 (Flexipol Packaging, Sunkey Plastic Packaging, Packit Gourmet, Suzhou Hengxin Packaging, Innovia Films) | 8% |

Market Concentration (2025E)

Oven bag manufacturing fulfills the requirements of different specialized areas, where convenience, durability, and safety are prerequisites for food preparation and storage. With that requirement in mind, companies are working to innovate their oven bag designs with improved performance. One of these innovations includes protecting products from grease by putting coatings that are resistant to the effects of grease in order to avoid accidental leaks and spills even during cooking. Some of the design features that typical oven bags have in order to withstand the high temperature and the heavy load of food include construction with seams reinforced for better strength and safety.

Manufacturers are also incorporating self-sealing mechanisms so that cooking convenience is improved, and spills avoided. As a result, oven bags provide more convenience during cooking. They have made them more transparent so that users can follow cooking progress without opening the bag. Apart from all this, they install multi-layered film structures in their bags to enhance heat resistance and food safety.

The world of oven bags is changing because of sustainability and smart packaging. Businesses are integrating AI-enabled defect technology and anti-grease coatings with recyclable polymer blends to enhance functionality. On that note, high-temperature, BPA-free oven bags are being developed by businesses to improve cooking efficiency at the same time ensuring food safety. Manufacturers are expanding their production capacities for biodegradable oven bags in line with global initiatives for sustainability. In addition, companies are adopting new seam technologies to enhance the integrity of seals and prevent leaks during high-temperature cooking.

Technology suppliers should focus on automation, heat-resistant polymers, and eco-friendly coatings to support the evolving oven bag market. Partnering with food manufacturers and meal kit companies will drive innovation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Sealed Air, Reynolds Consumer Products, S. C. Johnson & Son |

| Tier 2 | Sirane, M&Q Packaging, Flexipol Packaging |

| Tier 3 | Sunkey Plastic Packaging, Packit Gourmet, Suzhou Hengxin Packaging, Innovia Films |

The top manufacturers are combining AI defect detection, biodegradable materials, and heat-resistant polymer developments to further advance oven bags. They have created polymer blends with good heat resistance that add to the durability and efficiency of cooking on the bag. Furthermore, some companies are working on creating non-stick coatings to prevent food from sticking to the bag, providing for increased portability and usability.

| Manufacturer | Latest Developments |

|---|---|

| Sealed Air | Launched BPA-free, recyclable oven bags in March 2024. |

| Reynolds Consumer Products | Developed ultra-durable, puncture-resistant oven bags in April 2024. |

| S. C. Johnson & Son | Expanded biodegradable oven bag production in May 2024. |

| Sirane | Released self-venting, grease-resistant oven bags in June 2024. |

| M&Q Packaging | Strengthened high-temperature bag durability in July 2024. |

| Flexipol Packaging | Introduced leak-proof, heat-sealable oven bags in August 2024. |

| Sunkey Plastic Packaging | Pioneered anti-fog oven bags in September 2024. |

The oven bag industry is changing according to the different strategies adopted by important players in this market. Such strategies have included: sustainability, smart packaging, and modern heat-resistant materials that can allow players to hold their respective market positions. They are now producing ultra-thin and high-strength oven bags that cut down on material but at the same time maintain the toughness of the bag. Further, manufacturers are devising intelligent venting systems fitted within the oven bags, which regulate airflow according to the cooking conditions.

Manufacturers will continue integrating AI-powered defect detection, heat-resistant polymer coatings, and biodegradable materials. Companies will refine BPA-free compositions to enhance food safety. Businesses will adopt tamper-proof, self-venting technologies for better cooking convenience. Firms will expand smart label integration for temperature tracking. Digital printing will allow for high-quality branding and food safety instructions. Additionally, companies will optimize automated production to reduce costs and improve scalability.

Leading players include Sealed Air, Reynolds Consumer Products, S. C. Johnson & Son, Sirane, M&Q Packaging, Flexipol Packaging, and Sunkey Plastic Packaging.

The top 3 players collectively control 16% of the global market.

The market shows medium concentration, with top players holding 34%.

Key drivers include sustainability, heat-resistant materials, smart venting technology, and automation.

Explore Packaging Consumables and Supplies Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.