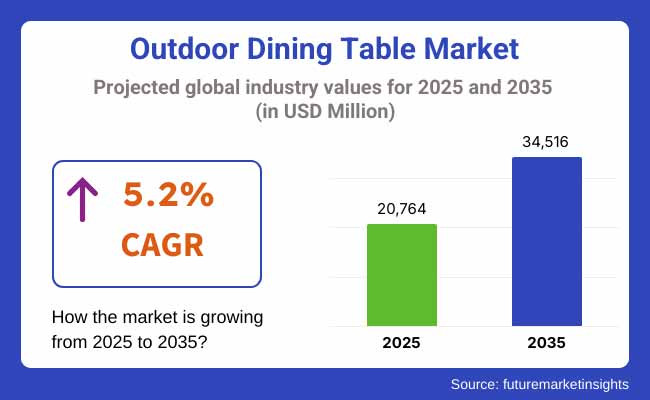

Outdoor dining table market will witness phenomenal growth from 2025 to 2035 due to the rising need for outdoor dining area, home renovation, and growing hospitality. Market will be USD 20,764 million in 2025 and will reach USD 34,516 million in 2035 with a compound annual growth rate (CAGR) of 5.2% for the forecast period.

The industry is undergoing change on the back of certain drivers. Some of the major driving forces include growing demand for outdoor furniture in households and businesses. Consumers are now more interested in the comfort and atmosphere of outdoors and thus are asking for more of high-end outdoor dining tables with durable material such as teak, aluminium, and synthetic rattan. Restaurants, resorts, and cafes are also opening more outdoor areas to provide improved customer experiences and thereby driving the market further.

Outdoor dining table industry is headed towards varied material and styles. Most common forms of material are plastic, metal, glass, and wood. Teakwood dinner tables are in great demand as they are weather-resistant and resistant to wear and tear. Aluminium dinner tables, being light in weight and rust-resistant, are greatly utilized for office settings. High strength tempered glass dinner tables also provide a stylish look to modern outdoor spaces.

Outdoor tables are made to be appropriate for various consumer segments such as residential consumers, hospitality companies, and offices. Patio and garden table buyers are homeowners who are design- and functionality-oriented, whereas hospitality companies need enormous amounts of weather resistance products. Expandable and modular outdoor tables are also a business trend that affects the company since customers also desire flexibility to modify furniture.

North America is one of the most powerful markets for outdoor dining tables given the depth of home improvement culture and increased demand for premium outdoor living rooms. In the United States and Canada, it is powered by massive consumer expenditure on patio furniture and garden furniture, and the market leaders are Brown Jordan and Tropitone. Popularity expansion with urban and suburban dwellers of al fresco eating has motivated cafe and restaurant firms to make investments in patio furniture that withstands weather conditions.

Sustainability is the most significant concern within North America, and firms incorporate green elements such as recycled plastic and FSC wood into product offerings. Water-resistant coating and UV-stable topcoat finishes are extending products' life span, and selling volumes are improving.

Europe is dominating the outdoor dining table market, especially with high demand from Germany, France, and Italy markets. Stylishness combined with sustainability drive the European market. Italian design dominates the outdoor luxury furniture market, and among the preferred designers are Ethimo and Unopiù.

European hospitality industry is the biggest consumer of outdoor dining tables with hotels, resorts, and bistros also enjoying fashionable and functional outdoor areas. With eco-friendly consumerism taking wings in Europe, corporate establishments in the region have also started marketing green products, such as bamboo and reclaimed wood tables, with a minimal footprint without compromising on the quality level.

Asia-Pacific will witness the most rapid growth in the outdoor dining table market with urbanization, rising disposable income, and growth in the tourism industry. China, India, Japan, and Australia are the drivers of growth with more and more households investing in outdoor furniture for balconies, terraces, and gardens.

China has a monopoly in the production as well as the demand for every type and price of outdoor dining tables. India's growing middle class is driven by demand for high-quality furniture, and the demand in urban areas where outdoor dining is gaining momentum at a fast pace. Apart from that, Australia's intense outdoor living and its extremely high level of tourist travel result in consistent demand for weather-resistance dining tables from hospitality operators.

Challenge: Weather Resilience and Upkeep

Outdoor dining tables should be weather resilient to tolerate changing weather, such as sunshine, rain, and snow. Wooden tables, for instance, have to be maintained periodically to avoid warping and cracking, whereas metal tables rust if not maintained in the appropriate way. Firms have to fight against these issues by making weather-proof items, using corrosion-proof paint, and making low-maintenance items.

Opportunity: Smart and Eco-Friendly Outdoor Dining Tables

Growing demand for smart furniture is a wonderful opportunity for outdoor dining table companies. Built-in LED lights, solar charging capability, and foldable or height-adjustable designs are being introduced by companies to make them as efficient as possible. Also, green technologies like biodegradable composite materials and energy-generating production processes are transforming the sector with the world's move towards green technology.

Throughout 2020 to 2024, the outdoor dining table market grew significantly mainly because of rising home remodelling activity and the pandemic-induced trend of dining outdoors. People were vexed with making their patios, balconies, and backyards better and therefore creating demand for outdoor dining tables that were not only strong but also attractive.

Future up to 2025 to 2035, the market will expand on the basis of trends like space efficiency and module designs, more use of intelligent furniture, and weather-resistant and recyclable materials. Lifestyle and urbanization will lead to multi-functional outdoor spaces driving product development, and the outdoor dining table would be the biggest investment by homeowners and business organizations globally.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Consumer Preferences | Consumers opted for collapsible and portable outdoor dining tables due to the small spaces within urban homes. Demand for rustic and weather-resistant wooden tables took off. |

| Material Innovations | Teak and wrought iron remained the top picks, with powder-coated aluminium also gaining traction for being light and corrosion-resistant. |

| Smart Integration | Limited technology applications, with tables featuring LED lighting and basic weatherproofing functions. |

| Sustainability Trends | Reclaimed wood and green sealants gained moderate popularity, with some businesses adopting FSC-certified products. |

| Outdoor Living Culture | The pandemic-driven home repairs created a boom in demand for patio furniture, including dining tables. |

| Regional Production Shifts | North America and Europe relied on imports from China and Southeast Asia due to the lower production costs. |

| Retail & E-Commerce Growth | Physical stores dominated high-ticket purchases, while online shopping gained momentum for middle-ranged products. |

| Market Growth Drivers | Outgrowth of expanding outdoor dining habit, rising disposable incomes, and demand for trendy, durable outdoor furniture. |

| Market Shift | 2025 to 2035 |

|---|---|

| Consumer Preferences | Longer, extendable, and modular dining tables become trendy, keeping up with outdoor entertaining trends. Bamboo and recycled plastics are the sustainable materials that rule the market. |

| Material Innovations | Composite materials with UV-resistant coatings and self-healing surfaces become trendy. Graphene-enriched outdoor tables offer superior durability and heat resistance. |

| Smart Integration | Intelligent outdoor dining tables with integrated wireless charging, temperature control, and solar-powered lighting become the norm. IoT-enabled tables integrate with smart home systems. |

| Sustainability Trends | Completely biodegradable and carbon-free dining tables appear on the market. Circular economy solutions like refurbishing and recycling become the norm for all manufacturers. Outside dining areas become the norm in home design, with integrated dining options designed into decks and gardens. Urban rooftops and shared dining areas fuel innovation. |

| Outdoor Living Culture | Localized manufacturing in the USA and Europe rises with the efforts of reshoring and sustainability legislation. Transparency of supply chains and ethical sourcing turn into essential competitive strengths. |

| Regional Production Shifts | Virtual showrooms and AR-driven customization tools facilitate an entirely digitalized shopping experience. Direct-to-consumer brands challenge traditional retail models. |

| Retail & E-Commerce Growth | Sustainable designs, intelligent integration of technology, and city parks drive market growth. Smart city programs further enhance demand for multi-purpose outdoor furniture. |

| Market Growth Drivers | Longer, extendable, and modular dining tables become trendy, keeping up with outdoor entertaining trends. Bamboo and recycled plastics are the sustainable materials that rule the market. |

The USA outdoor dining table industry is growing steadily as backyard overhauls and outdoor living areas become more popular. Heavy-duty, weather-resistant materials such as aluminium, teak, and polymer composites fuel demand, as more Americans get on the alfresco bandwagon. Large, modular outdoor dining tables are becoming the norm in homes and business complexes.

Growing Demand from Hospitality: Restaurants and hotels have been major growth drivers for the market. Outdoor spaces have remained at the forefront of dining experience during the pandemic era, thus generating demand for low-maintenance UV-resistant outdoor tables for dining. Intelligent outdoor tables with integrated heating and charging facilities are also becoming popular in upscale hospitality settings.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

UK outdoor dining tables market is developing positively as a result of increased home improvement spending and improved outdoor dining for hospitality. Carbon-neutral furniture trends go hand-in-hand with government aspirations for a carbon-neutral 2050.

Sustainable innovations fuel expansion: Companies sell wood certified under FSC, recycled plastic, and low-impact paint. Folding and retracting dining tables are also appealing to the city consumer with no or little outdoor space. Expansion is fueled by growing demand for dining outdoors in collective plots and communal spaces for housing.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

The EU outdoor dining tables market is one that has been characterized by rigorous green regulation, adopting circular economy and sustainable material use. Induced demand caused by increasing outdoor dining culture in countries like Germany, France, and Italy, particularly in urban centers where public dining spaces are being increasingly sought, is clear.

Technology-Embedded Designs: Multifunctional tables incorporating an integrated LED light and solar panel are greatly demanded by European consumers. 3D printed furniture based on biodegradable materials becomes mainstream, and EU green design policies encourage firms to realize green innovation.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

Japanese outdoor tables market is growing with the rising need for space-saving, foldable designs to fit small-sized outdoor spaces. Balcony dining and rooftop garden fashion generates need for stackable, fold-down, and lightweight tables.

Technology-Driven Innovation: Japan leads the innovation race when it comes to technology-driven outdoor furniture with tables that incorporate built-in touchscreens, self-cleaning coatings, and heat-resistant finishes. Weatherproof bamboo composites and corrosion-resistant alloys are the most sought-after materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

South Korea's outdoor dining table industry is expanding with outdoor café life, rooftop restaurants, and intelligent urban furniture technology gaining momentum. South Korea's high-tech and innovation-driven approach leads to highly long-lasting, multi-functional outdoor furniture.

Green Production & Intelligent Designs: Furniture is motivated to be green produced with the help of government incentives, and the customer driver is demand based on necessity for small and modular dining tables. Anti-microbial coating and UV resistant coating are essential requirements that go hand-in-hand with luxury outdoor dining tables.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Wood is the most popular material to be used for outdoor dining tables because of their natural beauty, hardness, and usability in adjusting to outdoors. Teak, acacia, and eucalyptus are most requested because they are better resistant to moisture, termites, and the weather. Gloster and Kingsley Bate are among those high-end outdoor furniture manufacturers who produce teak dining tables, and people who require strong quality patio furniture place orders for them.

Increased demand for green furniture by consumers has also increased the demand for wooden outdoor tables. FSC wood is now a sought-after product among manufacturers as a means of appealing to green consumers. The second factor is the new fashion of having handmade and artisanal-produced furniture, which has elevated solid wood tables to one of the upscale outdoor dining area solutions.

Metal patio dining tables are in great demand, particularly for commercial applications on roof-top restaurants, hotel patios, and off-premises cafes. Most in demand are the aluminium and stainless steel types for light weight, weather resistance, and contemporary appearance. Between the two producers of powder-coated aluminium dining tables whose durability and sharp contemporary appearance is ideal for hip city-dining spaces are Fermob and Emu.

Wrought iron dining tables, while heavier, are still a top choice for elegant outdoor dining at garden restaurants and luxury boutique hotels. Light designs and strength make them stronger outside. With commercial establishments seeking furniture that would hold up to heavy usage without compromising appearance, the demand for metal outdoor dining tables just keeps on growing.

Lightweight patio plastic tables are appealing to price-sensitive customers, particularly for home use. Ease of cleaning, light weight, and affordable prices are a cost-effective feature that homeowners can enjoy from patio furniture sets. Brand name weather-resistant polypropylene and recyclable plastic tables become suitable for outdoor casual dining.

Also, the focus towards sustainability has also impacted the production of ocean plastic tables and post-consumer waste, both of which are made up of recyclable plastics. The pieces of furniture are eco-friendly and produce long-lasting, UV-resistant pieces of furniture to be utilized outdoors.

The residential economy is a sales driver for outdoor dining tables, and homeowners are still open to spending on enhancing outdoor living space. With demand for backyard makeovers, deck building, and garden restaurants in high demand, consumers need fashion-forward, weather-proof outdoor furniture that will enhance contemporary outdoor design.

Fashion high-end furniture manufacturers like Brown Jordan and Dedon offer designer high-end patio dining sets to high-end home owners, while mass producers like IKEA and Home Depot offer mass economy models.

Also, the staycation and al fresco entertainment movement has also pushed the outdoor dining tables industry to provide dining tables which possess the aspect of serving multiple purposes through the extendable and fold-down designs. Homeowners prefer having dining tables that are convenient to use and thus allow them to hold small family dinners and large social gatherings.

The market for the business has the food and hospitality industry occupying the largest share of the outdoor dining table market. Restaurants, hotels, and event spaces need to have dining tables that are low maintenance, durable, and heavy-duty since they directly face the outdoor environment. There are companies such as RH Commercial and Tropitone that make weatherproof dining tables that remain fashionable even after facing sun, rain, and temperature for long hours.

Increased orders of business outdoor tables due to outdoor dining area order boosts as a result of restaurant consumer post-pandemic demand for dining al fresco, drove this increase. Business has gravitated towards the use of such a material due to powder-coated metal, pressure-treated wood, and HDPE plastic owing to its toughness along with minimal maintenance requirements.

The world outdoor dining table market is competitive and changing with world leaders and domestic producers meeting various consumer demands. Some leading key brands possess enormous market share and dictate design trends in material, weatherproof technology, and fashion.

They are concerned about sustainability, modular customizability, and luxury beauty appeal to cater to residential consumers as well as commercial consumers. The established furniture giants and upstart players with a huge fan base control the market share and attribute industry trends.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Ashley Furniture Industries | 10-15% |

| Brown Jordan | 8-12% |

| Lloyd Flanders | 6-10% |

| Trex Company, Inc. | 5-9% |

| Kettal | 4-7% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Ashley Furniture Industries | Manufactures affordable yet durable outdoor dining tables with a focus on weather-resistant materials such as aluminium and acacia wood. Integrates smart features like extendable tabletops. |

| Brown Jordan | Specializes in high-end, luxury outdoor furniture made from premium materials such as teak and stainless steel. Collaborates with renowned designers to create contemporary collections. |

| Lloyd Flanders | Produces handwoven wicker outdoor dining tables with all-weather durability. Uses proprietary Comfort Plush cushions for added consumer appeal. |

| Trex Company, Inc. | Develops eco-friendly composite outdoor dining tables using recycled plastic and wood fibers. Focuses on sustainability and low-maintenance designs. |

| Kettal | Offers modern, European-style outdoor dining tables featuring powder-coated aluminium and ceramic surfaces. Focuses on modular customization to fit diverse spaces. |

Key Company Insights

Ashley Furniture Industries (10-15%)

Ashley Furniture Industries is the monarch of the outdoor dining table market with its gigantic line of fashion-oriented and budget-friendly furniture items. Ashley Furniture employs weather-proof materials such as eucalyptus wood and rust-resistant aluminium to offer maximum product lifespan.

shley Furniture possesses an international distribution system, and hence products reach on a large scale to residential customers and business customers. Ashley Furniture never invests in space-saving features and ergonomics-based designs such as foldable and extendable tables to enhance outdoor dining experience.

Brown Jordan (8-12%)

Brown Jordan is a premium brand in the outdoor furniture industry with beautiful dining tables constructed of materials such as marine-grade stainless steel, powder-coated aluminium, and sustainably harvested teak. Brown Jordan collaborates with world-class designers to introduce refined, contemporary collections to high-end consumers and hospitality markets. Brown Jordan emphasizes ultimate care to craftsmanship and durability so that its outdoor furniture continues to be weather-resistant.

Lloyd Flanders (6-10%)

Lloyd Flanders sweeps handwoven patio dining furniture with the union of classic and modern looks. The company is most popularly known for its patented Durium finish that resists wicker from extreme weather conditions. Lloyd Flanders addresses home owners, boutique resorts, and resort markets with luxury comfort through all-weather wicker furniture and soft cushioned seating.

Trex Company, Inc. (5-9%)

Trex Company, Inc. has set itself in the market by concentrating on green composite patio furniture. It produces dining tables from recycled plastic and recycled wood, which are durable and provide zero degradation of the environment. Trex products are easy to maintain and resistant to stain, fade, and warp and therefore the green conscious consumer's choice of first resort. The focus by the company on greenness is in line with increasing demand for green outdoor furniture solutions.

Kettal (4-7%)

Kettal is a European luxury garden furniture designer specializing in creating beautiful looks and modular outdoor dining tables. Kettal uses luxury materials such as anodized aluminium, ceramic, and synthetic rope to create fashionable and very functional pieces of furniture. Private homes and business companies can accommodate Kettal customization with flexibility option in terms of size and look. Excess focus on design innovation has seen Kettal open offices globally.

Other Key Players (50-60% Combined)

There are some other players combined with the outdoor dining table market by emphasizing low-price production, innovative new product design, and new product material innovation. They command competition by emphasizing niche customer groups and higher product variety. Notable brands include:

The overall market size for outdoor dining tables was USD 20,764 million in 2025.

The outdoor dining table market is projected to reach USD 34,516 million by 2035.

The increasing trend of outdoor living spaces, coupled with a rise in home improvement projects and a growing preference for outdoor dining experiences, is expected to drive the demand for outdoor dining tables during the forecast period.

The top 5 regions contributing to the development of the outdoor dining table market are North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

On the basis of material, the wood segment is expected to command a significant share over the forecast period, owing to its aesthetic appeal and durability.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Power Equipment Market Analysis Size and Share Forecast Outlook 2025 to 2035

Outdoor Living Structure Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Outdoor Bar Furniture Market

Outdoor Cat Houses & Furniture Market

Outdoor TV Market Analysis – Growth & Forecast 2022 to 2032

Outdoor Noise Barrier Market

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA