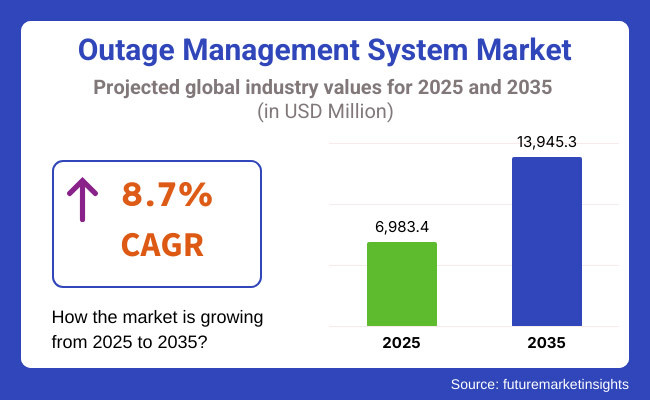

The global Outage Management System market is projected to grow significantly, from USD 6,983.4 Million in 2025 to USD 13,945.3 Million by 2035 an it is reflecting a strong CAGR of 8.7%.

The growth of contact centers to handle automated, real-time outage detection and automated restoration through Outage Management Systems (OMS) and predictive analytics capabilities among utilities. Utilities are adopting OMS following digital transformation initiatives, such as advanced grid infrastructure, to enhance grid reliability and operational efficiency. These solutions minimize downtime, improve power distribution, and deliver better customer service.

In the USA, strict regulatory mandates driven by, but not limited to, FERC regulations and energy policies across Europe are the key drivers for the adoption of OMS. Utilities must respond to outages efficiently, as governments and regulatory bodies mandate energy reliability standards that utilities must meet. OMS: Outage Management Systems–OPG Set integrated with SCADA, ADMS, and GISmakes outage and restoration processes seamless.

The transition towards smart grids and distributed energy resources (DERs) have led to more complex power distribution networks. OMS is also needed by utilities for renewable energy sources management, decentralized power generation, and maintaining grid stability. In modern grids, OMS is crucial for real-time monitoring, fault detection, and automated restoration, enabling smooth energy distribution.

With the increasing cybersecurity threats and aging infrastructure, utilities need secure and scalable OMS solutions to succeed. As such, they are rapidly migrating towards cloud-based OMS which offers remote access, improved data security and enhanced operational flexibility. As organizations build their cyber resilience, utilities are adopting sophisticated OMS solutions with real-time monitoring and threat detection functionalities.

The North America region holds the leading market position owing to rigid regulatory frameworks, vigorous grid modernization, and heavy utility capital investments in OMS solutions. At the same time, nations, such as India and Australia, are experiencing greater uptake of OMS to boost grid resilience and reduce the impact of outages. Increased energy sector and growing digital economy in these regions drive demand for modern OMS solutions.

| Company | General Electric Company |

|---|---|

| Contract/Development Details | Secured a contract with a regional utility provider to implement an outage management system, aiming to improve response times and communication during power outages. |

| Date | January 2024 |

| Contract Value (USD Million) | Approximately USD 30 |

| Renewal Period | 6 years |

| Company | Oracle Corporation |

|---|---|

| Contract/Development Details | Partnered with a municipal electricity provider to deploy an outage management platform, enhancing grid reliability and customer satisfaction through real-time outage information. |

| Date | October 2024 |

| Contract Value (USD Million) | Approximately USD 35 |

| Renewal Period | 5 years |

Rising adoption of smart grids and distributed energy resources (DERs)

The efficient power generation and distribution have become the need of the hour, the global utility sector is in a race to implement smart grids and Distributed Energy Resources (DERs). Smart grids amend outage management and improve uptime by with real-time data analytics, automation, and advanced sensors.

As more solar, wind and battery storage are integrated into the transmission grid, utilities are challenged to manage increasingly complex power flows. This role of DER coordination is vital, as OMS helps to identify faults in the grid, optimize load balancing, and automate restoration.

Aging infrastructure is being modernized as governments are investing millions in smart grid projects. For example, as an initiative to improve grid reliability and DER integration in 2023, the USA Department of Energy (DOE) dedicated USD 3.5 billion under the Grid Resilience and Innovation Partnerships (GRIP) program.

The initiative is an effort to help utilities deploy OMS solutions with the operational capabilities to manage real-time power fluctuations and outage mitigation strategies. Likewise, Germany intends to meet the plan's target of 80% renewable electricity as soon as 2030, and so the advanced OMS must to stabilize Peano's personnel during this process.

Shift toward cloud-based OMS for remote access and scalability

Utilities are replacing on premise Outage Management Systems (OMS) with cloud-based systems to manage the new era of grid disruptions. Traditional OMS solutions are hosted on premises, making it difficult for companies to scale, access and manage the data in the system remotely, or share the data in real time across the company.

Cloud-based OMS solutions help utilities visualize outages in real-time, streamline processes through automation, and proactively deploy predictive analytics to prevent grid failure before it occurs. Cloud-based OMS are flexible and scalable, which enable utilities to recover more quickly from outages and make better use of resources.

To improve resilience to disruptions, governments are encouraging the adoption of the cloud in critical infrastructure. To enhance the digital security and operational efficiency of utilities, the UK’s National Cyber Security Centre (NCSC)492023 introduced a cloud-first strategy for utilities.

India’s Ministry of Power also introduced the Revamped Distribution Sector Scheme (RDSS) with a USD 40 billion budget, urging state utilities to adopt cloud-based technologies like OMS to improve their response to outages, as well as enhance grid automation.

Rising adoption of multi-utility OMS platforms for enhanced efficiency

Utilities trends toward comprehensive solutions for electricity, water, and gas distribution in the same environment have contributed to momentum for multi-utility OMS platforms. Traditional OMS solutions focused on power outages only, but with urban infrastructure growing more complex, utilities are bringing in multi-utility OMS to simplify operations, cut costs and improve service reliability. These platforms allow data to be shared across sectors thereby enabling utilities to find, fix and follow outages faster across services.

Multi-Utility Management: Governments acknowledge the need for multi-utility management, resulting in financing of joint management projects. Smart infrastructure projects received €1.1 billion in funding across Europe in 2023 from the European Commission, promoting the use of OMS solutions to manage the delivery of electricity, gas and water under a single umbrella.

Similarly, Australia’s Smart Cities Plan targets progress through digitization in multi-utility monitoring to improve resource management and outage response in urban spaces. As these initiatives demonstrate, the role of multi-utility OMS solutions in enhancing resilience, optimizing resource allocation, and maintaining seamless services is only becoming more pronounced.

High implementation costs hinder adoption among small and mid-sized utilities

The high expenses associated with their implementation that many smaller and midsized utilities cannot afford. Due to the costs of hardware, software, system integration, training, and ongoing maintenance, these utilities find it challenging to dedicate budgets to OMS deployment. As compared to larger utility companies with greater access to significant funding and advanced infrastructures, smaller utilities in many cases struggle with limited funding and, therefore, have trouble investing in 21st century outage management technologies.

Moreover, they also demand considerable capital investments for their initial configuration and customization, particularly with respect to integrating the system with existing SCADA, GIS, and customer information systems (CIS). Many utilities are run on archaic infrastructure that needs to be heavily upgraded before OMS can be rolled out effectively. Such upgrades are an additional cost to implement, and delays on adoption.

Moreover, subscription-based cloud OMS solutions, though lowering initial costs, come with long-term costs that can be a barrier for smaller utilities with lean operational budgets.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments mandated real-time outage reporting and grid modernization. |

| AI & Predictive Analytics | AI-driven outage detection improved restoration times. |

| Cloud-Based OMS Solutions | Cloud integration improved data accessibility and outage reporting. |

| IoT & Smart Grid Integration | IoT sensors enhanced outage diagnostics and fault detection. |

| Market Growth Drivers | Rising demand for uninterrupted power supply and grid resilience. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven smart grid automation predicts and prevents power outages. |

| AI & Predictive Analytics | Quantum-powered predictive analytics ensure real-time fault isolation and response. |

| Cloud-Based OMS Solutions | AI-powered decentralized energy management optimizes grid resilience. |

| IoT & Smart Grid Integration | AI-driven energy orchestration autonomously manages grid restoration. |

| Market Growth Drivers | AI-powered self-healing grids revolutionize outage management. |

The section highlights the CAGRs of countries experiencing growth in the Outage Management System market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 11.3% |

| China | 10.2% |

| Germany | 6.4% |

| Japan | 8.7% |

| United States | 7.9% |

According to data obtained until October 2023, China has been taking steps to enhance Outage Management Systems (OMS) by expanding them in rural areas to have a better electrical infrastructure and help shorten blackout times. Many remote villages and underdeveloped provinces still endure regular power outages from older infrastructure and natural calamities.

As part of specific initiatives such as the State Grid Corporation of China’s (SGCC) Smart Grid Plan to urbanize rural power distribution networks, electrification programs have been developed by the Chinese government, expanding access to electricity. Such efforts include integrating OMS along with advanced sensors and automated fault detection systems to respond to outages and restore the grid faster.

China has committed more than USD 15 billion to rural grid upgrades, including a push to deploy OMS to underserved areas. The move towards rural electrification is part of the more general “New Infrastructure” approach where smart grids are a major area of investment. Rural electrification projects have already made power supply reliability easier in more than 50,000 villages where resulting average outage times have been cut by 30%, according to government statistics.

The various utilities of Indian power sector states that a sizeable number of utilities have begun migrating from traditional Outage Management Systems (OMS) to cloud-based solutions which promote greater scalability and efficiency across operations.

The Indian government, via the Revamped Distribution Sector Scheme (RDSS), emphasized the need for modernizing the power distribution networks and has also encouraged cloud-based solutions for real-time tracking of outages and response mechanisms. These systems facilitate utilities’ in-person grid health monitoring and minimize asset downtime using AI-powered fault detection and predictive maintenance.

For power distribution modernization alone, USD 37 billion were earmarked by the Indian government, with a large part of this budget focused on building a digital grid. This consists of incentives for utilities that are embracing an OMS in the cloud to decrease infrastructure costs while increasing operational agility.

India’s smart grid initiatives, according to their official estimates, have improved outage response times by 40% in pilot projects implemented in major cities like Delhi, Mumbai and Bengaluru.

There is a growing trend in some regions of the United States, particularly those susceptible to disasters, toward the deployment of Outage Management Systems (OMS) - a vital mechanism during severe weather events - designed to prevent the consequences of power outages.

Hurricanes, wildfires and winter storms regularly upend the USA power grid, resulting in economic losses in the billions of dollars and threatening safety. The federal and state governments have specifically targeted investing in grid resilience technologies, such as OMS, to help with real-time outage tracking and fast restoration of services.

The USA Department of Energy (DOE) recently earmarked USD 13 billion to spend under the Bipartisan Infrastructure Law to make the grid more resilient, with specific Deployment of OMS in such high-risk markets as California, Texas, and Florida.

Some of those outages in recent years have been among the worst in the nation, with the wildfires in California alone knocking out power to more than 2.5 million people. AI-based weather prediction is now integrated into OMS solutions and these are being deployed to predict outages and act upon them automatically even before the severe weather strikes.

The section contains information about the leading segments in the industry. By Type, the Standalone OMS segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by End User, Public Utilities segment hold dominant share in 2025.

| Type | CAGR (2025 to 2035) |

|---|---|

| Standalone OMS | 10.7% |

The growing adoption as utilities recognize the value of having solutions that are dedicated to making the grid more reliable and responding to outages in a timely manner. Standalone OMS, as opposed to integrated OMS that are part of larger utility management systems, uniquely provide real-time outage detection, analysis and restoration management capabilities.

Standalone solutions that operate independently and are highly effective without the need for third-party integrations are gaining traction among utilities, driven by the growing complexity of power distribution networks and the rising frequency of extreme weather events.

The DOE announced a total of USD 3.5 billion toward grid modernization projects, focusing on the use of advanced OMS solutions to strengthen outage response and resiliency. The systems' effectiveness has led to lines of data indicating that areas where standalone OMS is implemented are restoring power to affected customers at a 25% faster rate than traditional outage management methods.

On the same note, China’s National Energy Administration (NEA) has initiated a smart grid pilot program deploying more than USD 5 billion into upgrading power infrastructure, emphasizing a standalone OMS in urbanizing regions to provide greater resiliency to the grid.

| End User | Value Share (2025) |

|---|---|

| Public Utilities | 56.2% |

Outage Management Systems (OMS) Value Share Currently Led by Public Utilities - Government-Funded Power Providers Most Invested in Grid Resilience, Smart Technology, Automation Public utilities operate extensive power distribution systems catering to millions of customers in urban and rural areas, underscoring the importance of OMS implementation for maintaining a stable and efficient electricity distribution system.

The increase in natural disasters, cyber threats, and aging infrastructure is propelling the deployment of OMS solutions across public utility grids.

In India, 37 billion dollars has been budgeted under the government’s Revamped Distribution Sector Scheme (RDSS) to overhaul state-run power distribution networks, where OMS integration is one of the key focus area. This plan is designed to boost the efficiency of the grid and reduce outage time by 30 percent over the next 10 years.

Broadly, the same is happening in the European Union, where public utilities are getting capital backing through the Green Deal Investment Plan, which recently allocated €1.5 billion to processes of digital transformation, including the implementation of automated OMS to ensure center line stability.

Insulation gas based detection is anticipated to hold the significant share in the global Outage Management System (OMS) market for the forecast period of 2023-2033. As grid modernization efforts ramp up and smart grids become more widespread, the top technology providers are embedding artificial intelligence (AI), machine learning and predictive analytics within OMS platforms. This includes industry leaders, and emerging players, striving to improve power distribution reliability and efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| General Electric (GE) | 20-25% |

| Siemens AG | 15-20% |

| Schneider Electric | 12-17% |

| Oracle Corporation | 10-15% |

| ABB Ltd. | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| General Electric (GE) | Provides AI-powered outage prediction, real-time grid monitoring, and advanced fault detection. Focuses on smart grid integration and automation. |

| Siemens AG | Offers cloud-based OMS solutions with AI-driven analytics, real-time event processing, and distributed energy resource (DER) integration. |

| Schneider Electric | Develops intelligent OMS platforms integrated with SCADA and ADMS, ensuring predictive analytics and fast restoration capabilities. |

| Oracle Corporation | Specializes in cloud-native OMS with machine learning-driven outage detection and response, optimizing grid reliability. |

| ABB Ltd. | Focuses on modular OMS systems with advanced automation, predictive maintenance, and high-performance fault localization. |

Strategic Outlook

General Electric (GE) (20-25%)

OMS market leader GE offers AI-powered outage prediction and real-time monitoring solutions. It integrates smart grid technology with advanced analytics to help utilities reduce downtime and decrease response times. Its continued investment in grid automation and predictive outage management help reinforce its market share dominance.

Siemens AG (15-20%)

Siemens AG, a leading company in the OMS sector, provides cloud-based solutions with real-time event processing and AI-driven analytics. The company claims easy integration with both distributed energy resources (DERs) and SCADA systems making the grid more resilient. 5 Healthcare: Siemens adds to its existing AI-based fault detection and restoration tools to support improved outage management.

Schneider Electric (12-17%)

Intelligent OMS platform is distinguishing Schneider Electric amongst the competitors, particularly due to integration with SCADA & ADMS. By emphasizing predictive analytics and automation across the lifecycle of data visibility, its platform helps to resolve and restore faster, which leads to reduced outage times. By investing in its digital transformation and acquiring AI-driven forecasting and adaptive response mechanisms for its OMS solutions, the company.

Oracle Corporation (10-15%)

The cloud-native offerings, such as their OMS leveraging both AI & machine learning for outage detection and response as well as customer engagement set Oracle apart. Its grid reliability solutions ensure that utilities know how to coordinate with field crews. Oracle is a leader in next-generation OMS technology with their investment in cloud-based grid management.

ABB Ltd. (8-12%)

ABB delivers modular OMS systems, strong automation features and predictive maintenance. The company has next-gen fault localization technology that makes the grid more stable, both bringing the grid back more quickly. ABB Advances AI-Powered Predictive Analytics for Proactive Utility Outage Management.

Other Key Players (25-35% Combined)

Some smaller companies, including Eaton Corporation, CGI Inc., Itron Inc., OSIsoft (AVEVA), and Hexagon AB, account for a significant share of the OMS market. These companies are solely focused on certain solutions such as grid data-based monitoring, cloud OMS and AI-based fault analytics. They help to foster innovation in the sector, providing innovative solutions for utilities at every stage of development.

In terms of Type, the segment is segregated into Standalone OMS and Integrated OMS.

In terms of Component, the segment is segregated into Software System and Communication System.

In terms of End User, it is distributed into Public Utilities and Private Utilities.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Outage Management System industry is projected to witness CAGR of 8.7% between 2025 and 2035.

The Global Outage Management System industry stood at USD 6,983.4 million in 2025.

The Global Outage Management System industry is anticipated to reach USD 13,945.3 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 9.8% in the assessment period.

The key players operating in the Global Outage Management System Industry General Electric (GE), Siemens AG, Schneider Electric, Oracle Corporation, ABB Ltd., Eaton Corporation, CGI Inc., Itron Inc., OSIsoft (AVEVA), Hexagon AB.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA