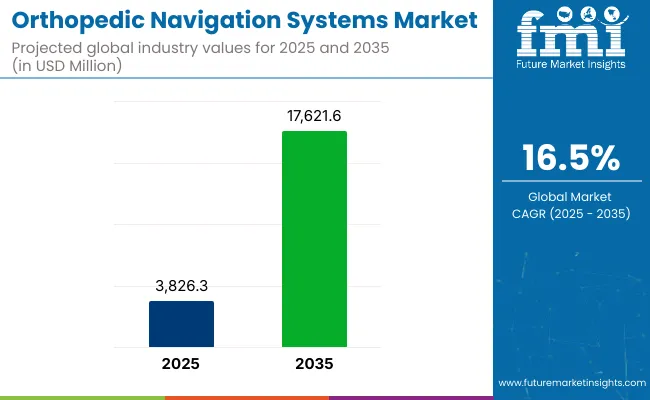

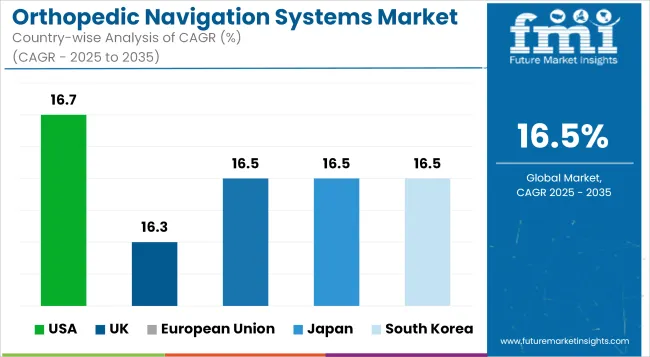

The global Orthopedic Navigation Systems Market is estimated to be valued at USD 3,826.3 million in 2025 and is projected to reach USD 17,621.6 million by 2035, registering a compound annual growth rate of 16.5% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,826.3 million |

| Industry Value (2035F) | USD 17,621.6 million |

| CAGR (2025 to 2035) | 16.5% |

The Orthopedic Navigation Systems market is evolving rapidly due to the rising demand for precision-based surgeries and the shift toward minimally invasive orthopedic procedures. Driven by an aging population and increasing musculoskeletal disorders, hospitals and surgical centers are adopting advanced navigation tools to improve clinical outcomes and reduce surgical errors. Integration of AI and real-time imaging into navigation platforms is enhancing intraoperative decision-making.

Moreover, the market is witnessing a transition toward ambulatory surgical centers where compact, user-friendly systems are gaining preference. Regulatory acceptance, surgeon training, and the push for patient-centric care models are further supporting adoption. These trends, coupled with advancements in software capabilities and workflow automation, are laying the foundation for sustainable, long-term growth in this market.

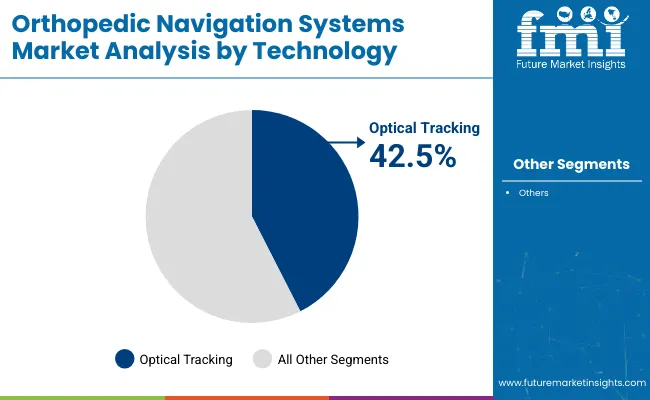

Optical tracking has been positioned as the leading technology segment in the orthopedic navigation systems market, capturing 42.5% of the revenue share in 2025. This dominance has been attributed to its high accuracy and real-time 3D visualization during surgery, which enhances intraoperative decision-making.

Optical systems have been increasingly integrated with high-definition cameras and infrared sensors, enabling precise localization of surgical instruments without physical contact. Additionally, their ability to minimize radiation exposure compared to fluoroscopy has encouraged adoption in hospital settings. The segment’s growth has also been influenced by technological compatibility with robotic-assisted surgeries and AI-enhanced imaging platforms.

Demand has surged in complex orthopedic procedures such as joint replacements and spinal surgeries where anatomical accuracy is critical. Furthermore, surgeons' preference for non-invasive, user-friendly, and repeatable systems has amplified the value of optical technologies. Regulatory support and growing clinical validation have also contributed to the reliability and scalability of these platforms across regions.

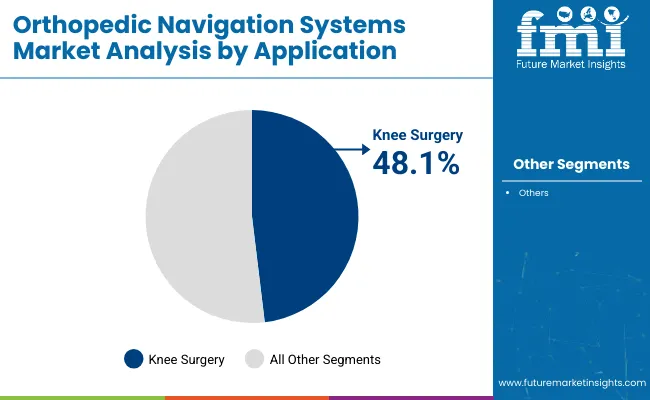

The knee surgery application segment has accounted for the largest revenue share of 48.1% in 2025 within the orthopedic navigation systems market. This growth has been driven by the high global prevalence of osteoarthritis and increasing demand for total and partial knee arthroplasty procedures. Navigation-assisted knee surgeries have been associated with improved prosthetic alignment and reduced implant revision rates, which have elevated their clinical acceptance.

A shift toward value-based care and improved patient satisfaction scores has supported the integration of navigation in knee procedures. Moreover, the rise in geriatric population and obesity-related joint degradation has led to a higher number of knee surgeries worldwide.

Technological advances in image-guided navigation and robot-compatible systems have further streamlined knee procedures, making them more accurate and repeatable. Preference among surgeons for precision and reduced intraoperative errors has further validated the utility of navigation systems in this segment.

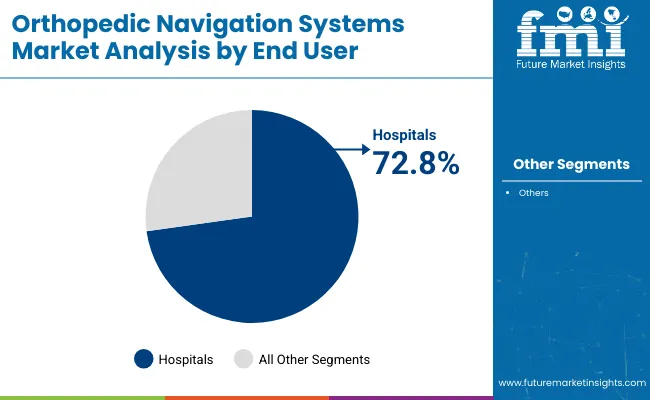

Hospitals have maintained a dominant position in the end user segment, accounting for 72.8% of the overall orthopedic navigation systems market revenue in 2025. This segment's leadership has been driven by the availability of advanced surgical infrastructure, experienced surgical teams, and larger capital investment capacity.

Complex procedures such as joint replacements and spinal corrections which require real-time imaging and navigation are primarily performed in hospital settings due to the requirement for sterile operating theaters and post-operative care units.

Hospital adoption has also been supported by integration with electronic health records (EHRs) and AI-driven imaging platforms, improving workflow efficiencies and patient tracking. Moreover, government and private investments in multispecialty hospitals, particularly in urban centers, have expanded the deployment of navigation-assisted systems. Higher patient footfall, insurance reimbursement, and regulatory compliance in hospitals have further reinforced their role as primary adopters of orthopedic navigation technologies.

High Implementation Costs and Workflow Integration Barriers

High initial costs and complexity of surgical workflows surge; rugged orthopedic navigation systems market key challenge. These systems are expensive to adopt, requiring sophisticated imaging systems, specialized software interfaces and trained operators all major cost factors, especially in the current environment of mid-size hospitals and surgical centers.

In addition, existing navigation technologies may be compatible with traditional operating room (OR) setups, hospital information systems (HIS), and electronic health records (EHRs), which can cause problems with compatibility and disruption of workflows. Surgeons have to get used to this, and because of limited interoperability between systems, the technology may be too late or not used at all in real-time orthopedic surgeries.

Demand for Precision, Minimally Invasive Surgery, and Aging Population

Minimally invasive orthopedic methods guided by precision medicine roughly reflect the looming worldwide market for navigation systems. Due to the increasing incidence of musculoskeletal disorders, osteoarthritis, and traumatic injuries, primarily in the elderly population, hospitals now tend towards navigation systems to ensure greater surgical precision, alignment of the implant, and overall patient progress.

Joint replacements, spine surgeries and trauma cases are increasingly treated with navigation technologies, with benefits that include fewer revisions, faster recovery and lower radiation exposure. Advances in robot-assisted technologies, AI-enabled imaging, and mobile navigation systems are bolstering uptake among high volume surgical centres as well as those with specific specialties.

The United States orthopedic navigation systems industry expands quickly because doctors use modern surgical guidance technology more often and surgeons pursue minimally invasive procedures for orthopedic patients while people suffer from more joint conditions.

The growing number of surgical centers and hospitals purchase computer-assisted and image-guided navigation systems because these systems improve medical precision and they minimize recovery time and lead to better health results for patients.

Following the high rate of hip and knee replacement surgeries and the positive payment systems and dominant position of medical technology companiesadoption is swiftly increasing. Both robotic-assisted orthopedic platforms and real-time imaging software receive ongoing innovation that drives the expansion of the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.7% |

UK orthopedic navigation systems market will thrive on increasing use of digital appliances in surgical orthopedic, rising emphasis on minimizing the chances of revision surgeries and NHS backing precision care-based solutions. With respect to orthopedic procedures, intraoperative navigation systems are used by surgeons for improved alignment and implant placement.

In addition, the increasing prevalence of osteoarthritis and sports-related injuries, coupled with technological advancements in robotic-assisted joint surgeries, is creating demand for navigation-enabled surgical platforms. Investments in smart operating rooms and orthopedic robotics are also driving adoption across public and private hospitals.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 16.3% |

The European Union orthopedic navigation systems market is driven by demographic trends, such as an aging population and high rates of orthopedic surgeries, as well as government initiatives to promote healthcare digitization. Europe has seen early adoption of AI-assisted and sensor-integrated navigation tools in orthopedic operating rooms, with countries such as Germany, France, and Netherlands leading the way.

European medtech companies are pouring millions into the development of augmented reality (AR), 3D imaging, and preoperative planning software that helps surgeons translate mapping to very complex and precise procedures. A yet another factor adding to market growth across orthopedic clinics and surgical centers is the region-wise focus on value-based care, patient safety, as well as outcome optimization.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 16.5% |

Japan is showing moderate growth in the orthopedic navigation systems industry due to an aging population, high prevalence of degenerative joint diseases, and support for precision medicine. In Japan, orthopedic surgeons are incorporating navigation systems and robotics into their operating procedures, performing work such as spinal surgeries and total joint replacements.

As minimally invasive techniques and patient-specific instrumentation in surgery continue to be at the forefront of research, the demand for real-time image-guided platforms as well as smart navigation devices will be driven to demonstrate that their use can significantly affect the surgical process in the context of Japanese hospitals. Japanese local medical device makers are also developing compact, highly accurate navigation systems that best suit Japan’s health care system.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 16.5% |

The South Korea orthopedic navigation systems market is expected to grow in the forecast period owing to the factors such as an increase in smart hospitals investment, a growing acceptance of robotic-assisted surgery and an increase in orthopedic disease burden. On the surgery side, hospitals are employing navigation systems that leverage 3D imaging and intraoperative sensors to optimize surgical precision and minimize complication rates.

South Korea is taking on the role as market edifice in the field of other adaptive approaches to surgical procedure, like spine alignment, trauma reconstruction and knee arthroplasty, benefitting from the leadership in medical robotics and digital surgery platforms. Adoption across the country is also being accelerated by government initiatives driving digitized healthcare and surgical innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.5% |

The orthopedic navigation systems market is highly competitive, driven by innovation, strategic collaborations, and integration with emerging technologies. Companies are increasingly incorporating AI, robotics, and real-time imaging to enhance surgical precision and system performance. Competitive dynamics are further intensified by global expansion strategies and regulatory approvals aimed at strengthening presence in high-demand regions.

A notable trend includes the development of compact, affordable systems suited for outpatient and ambulatory surgical settings. Strategic alliances with hospitals and digital health platforms are enabling broader clinical adoption.

Additionally, product differentiation through improved user interfaces and workflow automation is influencing purchasing decisions. The market is also witnessing consolidation through acquisitions, allowing firms to scale operations and diversify their offerings, thereby strengthening their foothold in this rapidly evolving segment.

Key Development

In 2024, Globus Medical launched ExcelsiusHub™, a new freehand navigation system for spine surgery. It enhances the Excelsius™ ecosystem by providing real-time instrument visualization, potentially reducing X-ray reliance and improving accuracy and safety for various spinal procedures in both hospitals and ASCs.

In 2025, Medivis Inc. received FDA 510(k) clearance and commercially launched its Spine Navigation platform in the USA This technology uses augmented reality (AR) and artificial intelligence (AI) to provide surgeons with holographic navigation, enhancing precision and efficiency in both open and minimally invasive spine procedures. It features surgical intelligence, ergonomic AR hardware, and seamless integration with existing operating room equipment.

The overall market size for the orthopedic navigation systems market was USD 3,826.3 million in 2025.

The orthopedic navigation systems market is expected to reach USD 17,621.6 million in 2035.

The increasing demand for precision in joint replacement surgeries, rising adoption of minimally invasive procedures, and growing use of advanced optical technologies fuel the orthopedic navigation systems market during the forecast period.

The top 5 countries driving the development of the orthopedic navigation systems market are the USA, UK, European Union, Japan, and South Korea.

Knee navigation systems and optical technologies lead market growth to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthopedic Titanium Plate with Loop Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Braces and Support Market Forecast and Outlook 2025 to 2035

Orthopedic Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Contract Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Digit Implants Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Prosthetic Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orthopedic Splints Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Software Market Size and Share Forecast Outlook 2025 to 2035

Orthopedic Trauma Device Market Trends - Size, Share & Forecast 2025 to 2035

Orthopedic Insole Market Analysis – Size & Industry Trends 2025–2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

A Global Brand Share Analysis for Orthopedic Insole Market

Orthopedic Consumables Market Trends – Industry Growth & Forecast 2024 to 2034

3D Orthopedic Scanning Systems Market

Smart Orthopedic Implants Market

Canine Orthopedic Implants Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Market Overview – Trends, Applications & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA