The global orthopedic insole market is growing rapidly. This is mainly due to increasing awareness of foot health, a rising incidence of orthopedic conditions, and demand for customized comfort solutions. Market leaders include Dr. Scholl's, Superfeet, and Vionic, which have innovative insole designs to provide foot support and pain relief. They take the lion's share of 55% of the market. Regional players and niche brands focused on affordability and localized needs occupy 30%, while new startups, leveraging smart technology and sustainability, account for 15%.

Explore FMI!

Book a free demo

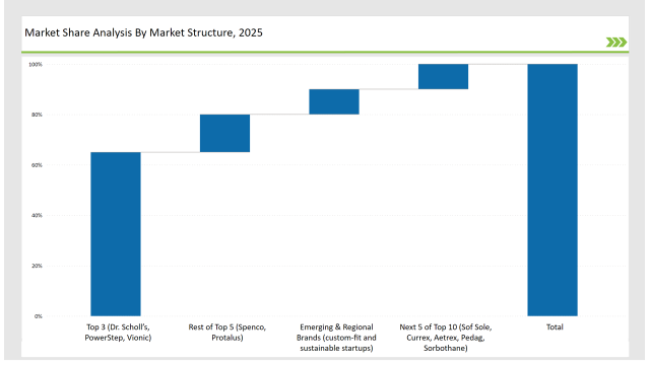

| Global Market Share, 2025 | Industry Share (%) |

|---|---|

| Top 3 (Dr. Scholl’s, PowerStep, Vionic) | 65% |

| Rest of Top 5 (Spenco, Protalus) | 15% |

| Next 5 of the Top 10 (Sof Sole, Currex, Aetrex, Pedag, Sorbothane) | 10% |

| Emerging & Regional Brands (custom-fit and sustainable startups) | 10% |

The orthopedic insole market in 2025 is moderately concentrated, with leading companies such as Dr. Scholl’s, Superfeet, and Powerstep capturing 40% to 60% of the market. While mass-market brands dominate retail distribution, specialized orthopedic providers and custom-fit solutions add to the competitive landscape. Rising awareness of foot health and orthopedic comfort fuels market expansion.

E-commerce platforms and DTC websites account for 50% of sales, mainly because of ease of access, variety of products, and options for customization. Retail pharmacies and medical supply stores account for 30%, as these are trusted recommendations for foot conditions. Specialty orthopedic clinics and podiatrist-recommended channels account for 15%, as these are professional advice and customized solutions. Mass-market retailers capture the remaining 5%, appealing to general consumers looking for basic orthopedic support.

The orthopedic insole market is broken into three parts: medical-grade orthotics, pain relief insoles, and daily comfort insoles. Medical-grade orthotics hold 55 percent of the market as they cure plantar fasciitis, flat feet, and other diabetes-related foot problems. Pain relief insoles hold 30 percent since they focus on shock absorption and arch support. Daily comfort insoles hold 15 percent and focus on supporting everyday use in comfort.

2024 has been a transformative year for the orthopedic insole market, marked by medical advancements, smart technology integration, and increasing consumer services demand for personalized comfort. Key contributors include:

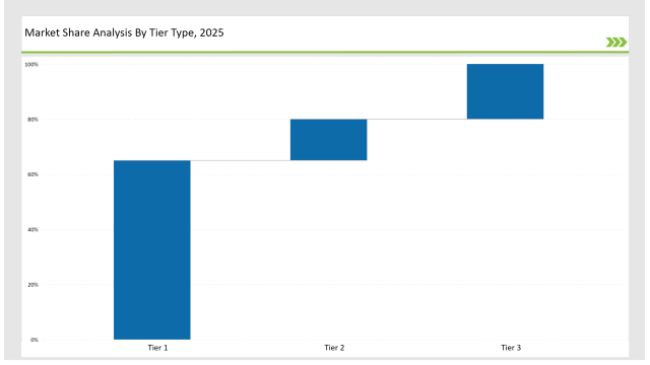

Tier-Wise Brand Classification, 2025

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Dr. Scholl’s, PowerStep, Vionic |

| Market share% | 65% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Spenco, Protalus |

| Market share% | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, emerging startups |

| Market share% | 20% |

| Brand | Key Focus Areas |

|---|---|

| Dr. Scholl’s | 3D foot scanning for custom-fit insoles |

| Vionic | Carbon fiber reinforcement for durability |

| PowerStep | Medical-grade orthotics and healthcare partnerships |

| Spenco | Hybrid memory foam and gel technology |

| Protalus | Posture-correcting, pain-relief insoles |

| Emerging Brands | AI-driven custom insoles and sustainable materials |

Steady growth is seen ahead for the orthopedic insole market because of medical technology innovations, customization, and sustainability. Direct-to-consumer models and integrations with healthcare providers are expected to expand among the brands. Future adoption would rely on the level of consumer education about foot health benefits. More e-commerce sales and the trend toward personalized fitting will define the orthopedic insole future market.

Major brands such as Dr. Scholl’s, PowerStep, and Vionic collectively hold around 65% of the market.

Regional manufacturers, including medical-grade and podiatrist-recommended brands, contribute approximately 20% of the market.

Startups leveraging digital foot scanning and 3D-printing hold about 10% of the market.

Private labels from pharmacy chains and orthopedic clinics hold approximately 5% of the market.

High for companies controlling 65%+, medium for 40-65%, and low for those under 30%.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.