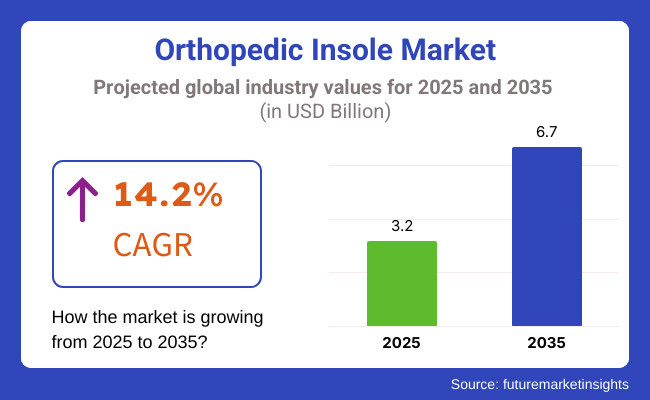

The orthopaedic insole market is set to experience significant growth between 2025 and 2035, driven by increasing awareness of foot health, rising incidences of orthopedic disorders, and advancements in material technology. The market is projected to grow from USD 3.2 billion in 2025 to USD 6.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 14.2% over the forecast period.

The demand for orthopedic insoles is fueled by the growing population, increased frequency of conditions like plantar fasciitis, arthritis, and diabetes-related nethermost issues, and the growing handover of customized insoles. Inventions in 3D printing and smart sensor-enabled insoles are enhancing product effectiveness and consumer appeal. Also, the shift toward sustainability has led to the development of eco-friendly insoles made from recycled and biodegradable paraphernalia.

Explore FMI!

Book a free demo

North America will continue to lead the orthopedic insole request due to high healthcare spending, increased consumer mindfulness, and the strong presence of crucial assiduity players. The demand for customized and tradition-grounded insoles will rise, supported by advancements in orthopedic care. E-commerce platforms will play a pivotal part in request expansion, offering a variety of products with digital bottom scanning services for substantiated fitting.

Europe is anticipated to witness steady growth, driven by a growing population and a high prevalence of orthopedic diseases. The region's focus on preventative healthcare is fueling demand for orthopedic insoles among athletes, senior individuals, and those with habitual bottom conditions. Government enterprises promoting bottom health mindfulness and payment programs for orthopedic products will further support request expansion.

Asia-Pacific is anticipated to be the swift-growing request due to adding disposable income, urbanization, and rising cases of bottom affection. Countries like China, India, and Japan are seeing a swell in demand for orthopedic insoles as mindfulness about bottom health grows.

The expansion of retail and online distribution channels is making these products more accessible. Also, collaborations between orthopedic specialists and manufacturers are leading to the development of region-specific results.

Challenges

One of the primary challenges in the orthopedic insole request is the high cost of customized and technologically advanced insoles, which may limit affordability, especially in developing husbandry. Also, a lack of mindfulness regarding the benefits of orthopedic insoles and indecorous operation can hamper request growth. Numerous consumer services still conclude for general insoles that do not give acceptable support, leading to patient bottom-related issues.

Opportunities

Growing demand for specialized orthopedic insoles presents the greatest development opportunity. Development in 3D scanning and printing technology makes it possible for manufacturers to design insoles for a person's foot size, which is comfortable and more efficient.

Furthermore, intelligent insoles with sensing features to monitor pressure on the feet, posture, and gait monitoring are in demand among sports athletes and patients with mobility disabilities. Another key opportunity is the increasing need for sustainable, biodegradable products as consumers look for greener alternatives in the health and wellness category.

| Country | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| Germany | 84.1 |

| United Kingdom | 68.3 |

| Japan | 125.1 |

| Country | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 14.50 |

| China | 7.20 |

| Germany | 12.40 |

| United Kingdom | 11.80 |

| Japan | 10.00 |

The USA's request for orthopedic insoles continues to thrive due to the increasing frequency of bottom diseases, diabetes, and sports-related injuries. Medical professionals, including podiatrists and orthopedic specialists, laboriously recommend custom and untoward insoles to cases, further driving demand.

Also, e-commerce platforms and direct- to- consumer brands expand availability, allowing consumers to fluently buy orthopedic insoles acclimatized to their requirements. The country’s high per capita spending of USD 14.50 reflects strong consumer amenability to invest in bottom health and decoration insole products.

China’s orthopedic insole request benefits from a fleetly growing senior population and increased mindfulness of orthopedic care. As further individualities seek preventative bottom care results, demand for insoles rises across colourful demographics.

Original and transnational brands contend to give affordable yet high-quality insoles, feeding to both civic and pastoral consumers. With per capita spending at USD 7.20, the request shows implicit unborn growth as disposable inflows rise and healthcare mindfulness improves.

Germany has high relinquishment rates for orthopedic insoles, particularly customized options specified by medical professionals. Specialty conventions and footwear retailers play a pivotal part in distribution, icing high-quality, medically approved results that reach consumers. The country’s strong healthcare structure and emphasis on bottom health contribute to its USD 12.40 per capita spending, situating Germany as a crucial player in the European orthopedic insole request.

The UK request grows as consumers decreasingly seek results for plantar fasciitis, flat bases, and arch support. Online deals and digital retail platforms significantly enhance availability, allowing guests to explore custom-fit and medical-grade insoles with ease. With USD 11.80 per capita spending, the UK request demonstrates steady expansion, driven by increased mindfulness of orthopedic issues and visionary bottom care measures.

Japan’s orthopedic insole request leverages biomechanical inventions and a growing population to drive demand. The country’s focus on technologically advanced and ergonomic insole designs ensures harmonious request growth.

Medical professionals and sports suckers likewise fete the benefits of orthopedic insoles for injury forestalment and posture correction. With USD 10.00 per capita spending, Japan remains a strong request, emphasizing customization, advanced accoutrements, and exploration-driven orthopedic results.

The market for orthopedic insoles is growing continuously with growing awareness of foot care, the growing incidence of orthopedic conditions, and demand for personalized comfort solutions. A poll of 250 people consisting of individuals with foot ailments, healthcare workers, and general consumers offers a glimpse of major market trends and consumption behavior.

Pain relief and posture correction are the main drivers of purchase, with 69% of them looking for insoles to ease conditions such as plantar fasciitis, flat feet, and arch pain. Amongst those aged 40+, 52% prioritize orthopedic insoles for long-term support of the foot and protection against pain. Custom-fitted insoles are becoming increasingly popular, especially for individuals with persistent foot problems.

Support quality and material technology determine the categories of consumer buys, with 60% opting for memory foam or gel insoles for comfort and 40% opting for semi-rigid or rigid orthotic insoles to support the arch. Podiatrist-prescribed insoles made from medical-grade technology are in-demand products, with 47% of consumers wanting podiatrist-stamped products over the same over-the-counter counterparts.

Brand name and price are the most influential factors in buying behavior. Whereas 44% of the survey respondents who took part in the survey stick to established brands such as Dr. Scholl's, Power Step, and Spence, 42% of the respondents would try new, specialized solutions-providing new brands. 63% of the respondents like insoles below the price level of USD 75, and 37% would pay more for premium, custom-fit orthopedic solutions.

Web-based shopping websites and specialist orthopedic clinics are the favoured modes of purchase, with 55% relying on online shops for convenience and product variety. 45% of customers still favour face-to-face buying in medical supply shops, podiatrist clinics, and specialist shoe shops to receive personalized fit and advice. Increased distribution through subscription orthopedic insoles is also making them attractive as options to buy by customers who need constant replacements.

As demand for comfort from foot aches, posture rectification, and comfort-oriented orthopedic insoles increases, the market for orthopedic insoles will certainly expand even more. Companies can take advantage of this by offering more personalization options, utilizing cutting-edge materials, and increasing online shop visibility to accommodate changing consumer demand.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced memory foam, gel-based, and shock-absorbing insoles to enhance foot support. AI-driven gait analysis tools improved custom insole fitting. |

| Sustainability & Circular Economy | Companies adopted biodegradable, recycled, and plant-based materials. Subscription-based insole recycling programs gained traction. |

| Connectivity & Smart Features | IoT-enabled insoles tracked foot pressure, walking patterns, and arch support needs. Smart insoles connected with health-monitoring apps to provide personalized recommendations. |

| Market Expansion & Consumer Adoption | Increasing cases of plantar fasciitis, diabetes-related foot issues, and aging populations fueled demand for orthopedic insoles. E-commerce and direct-to-consumer (DTC) models expanded access. |

| Regulatory & Compliance Standards | Stricter FDA and CE regulations on medical insoles led to increased transparency in product claims. Certifications for orthopedic safety and biomechanical efficacy gained importance. |

| Customization & Personalization | Brands introduced AI-assisted foot scanning and 3D printing for custom insoles. Personalized arch support options and pressure relief designs gained traction. |

| Influencer & Social Media Marketing | Podiatrists, orthopedic specialists, and lifestyle influencers promoted foot health awareness. YouTube and Instagram fueled trends in comfort, wellness, and mobility-enhancing footwear. |

| Consumer Trends & Behavior | Consumers prioritized pain relief, posture correction, and long-lasting comfort. Demand surged for moisture-wicking, antibacterial, and anti-fatigue insoles. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered orthopedic insoles adjust support levels in real time based on user movement. Self-adapting materials optimize pressure distribution to prevent foot strain and injuries. |

| Sustainability & Circular Economy | Zero-waste, 3D-printed insoles become standard. AI-driven material selection ensures durable and sustainable orthopedic insoles with minimal environmental impact. |

| Connectivity & Smart Features | AI-integrated insoles sync with medical wearables to track foot health and detect posture imbalances. Blockchain ensures transparency in the ethical sourcing of materials and production. |

| Market Expansion & Consumer Adoption | Emerging markets see rapid growth in cost-effective, AI-integrated orthopedic insole solutions. AI-driven analytics refine product recommendations based on gait, posture, and orthopedic conditions. |

| Regulatory & Compliance Standards | Governments mandate carbon-neutral, medically certified insoles. Blockchain enhances compliance tracking and ensures product quality for orthopedic applications. |

| Customization & Personalization | AI-powered orthopedic insoles dynamically adjust to user movement and body weight distribution. 3D-printed on-demand insoles offer hyper-personalized foot care solutions. |

| Influencer & Social Media Marketing | Virtual health influencers and metaverse-based orthopedic consultations redefine digital marketing. AR-powered foot scanning lets consumers visualize orthopedic benefits before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired insoles integrate muscle activation and circulation-boosting properties. Consumers embrace AI-driven orthopedic solutions for superior mobility, foot health, and overall well-being. |

The USA orthopedic insole request is witnessing steady growth, driven by a growing population, rising cases of bottom-related diseases, and adding demand for custom orthotic results. Major players include Dr. Scholl’s, Super Feet, and Power Step.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The UK orthopedic insole market is expanding due to increasing awareness of foot health, rising adoption of preventive orthopedic care, and a growing elderly population. Leading brands include Vionic, Sorbothane, and FootActive.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

Germany’s orthopedic insole request is growing, with a strong preference for medically approved, high-performance bottom support results. Crucial players include Bauerfeind, Birkenstock, and Sidas.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s orthopedic insole request is witnessing rapid-fire growth, fuelled by adding mindfulness of diabetic bottom care, rising sports participation, and demand for cost-effective orthopedic results. Major brands include Bacca Bucci, Dr. Foot, and Neman’s.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

China’s orthopedic insole request is expanding significantly, driven by adding disposable inflows, growing health knowledge, and rapid-fire advancements in smart insole technology. Crucial players include Li- Ning, Scholl China, and Xtep.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.0% |

Consumers suffering from bottom affections similar as plantar fasciitis, arthritis, flat bases, and diabetic bottom ulcers are decreasingly seeking medical-grade orthopedic insoles for bettered bottom support and pain relief.

Custom-molded orthotic insoles, frequently specified by podiatrists, are gaining fashion ability due to their capability to provide customized support. Also, the growing population and rising frequency of rotundity-related bottom conditions are further fueling demand for technical orthopedic insoles.

As sustainability becomes a crucial purchasing factor, orthopedic insole manufacturers are instituting biodegradable lathers, natural cork, factory-grounded gels, and recycled rubber accouterments. Eco-conscious consumers are looking for insole products that give comfort and continuity while reducing environmental impact.

Brands are also fastening their efforts to reduce carbon emissions by using immorally sourced raw accounts and espousing greener manufacturing processes. The addition of mindfulness to sustainable fashion and footwear is driving the relinquishment of eco-friendly orthopedic insoles.

The rise of online retail platforms and direct-to-consumer ( DTC) brands has significantly increased the availability of orthopedic insoles to a broader client base. Virtual bottom surveying technology, AI-driven product recommendations, and substantiated sizing tools are enhancing the online shopping experience for guests.

Numerous brands are now using subscription-grounded deals models and offering trial ages to encourage client relinquishment. Also, online commerce and specialty health retailers are making it easier for consumers to explore and compare different orthopedic insole brands before making a purchase.

The integration of advanced technologies in orthopedic insoles is revolutionizing the request. Smart insoles equipped with pressure detectors, real-time gait analysis, and Bluetooth connectivity are gaining traction among athletes and individuals with mobility impairments.

These smart insoles give precious biomechanical perceptivity, helping druggies ameliorate posture, help injuries, and enhance overall bottom health. Also, inventions in memory froth and gel-grounded insoles perfect shock immersion and long-term comfort, feeding to individuals who bear enhanced support for prolonged standing or high-impact conditioning.

The orthopedic insole request is passing steady growth, driven by adding mindfulness of bottom health, the rising frequency of orthopedic diseases, and the growing relinquishment of customized and remedial insoles. Consumers seek results for conditions similar to plantar fasciitis, flat bases, and overpronation, leading to high demand for podiatrist-recommended and medically approved insoles.

crucial players concentrate on technological inventions, including 3D- published orthotics, pressure-relief designs, and humidity-wicking accouterments. E-commerce and direct-to-consumer channels continue to expand request reach, as companies emphasize customization and digital bottom- surveying results.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Dr. Scholl’s | 18-22% |

| Superfeet | 15-19% |

| Powerstep | 10-14% |

| Spenco | 8-12% |

| Aetrex | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dr. Scholl’s | Mass-market orthopedic insoles designed for pain relief, arch support, and diabetic foot care. Expands into digital foot-scanning technology for a customized fit. |

| Superfeet | Premium insoles with biomechanical arch support and carbon-fiber reinforcement. Focuses on podiatrist-endorsed designs for sports and everyday wear. |

| Powerstep | Orthotic-grade insoles offering deep heel cups and cushioning for plantar fasciitis and overpronation relief. Expand clinical partnerships with podiatrists. |

| Spenco | Shock-absorbing, anti-microbial insoles designed for high-impact activities and medical foot conditions. Leverages research in pressure-point relief. |

| Aetrex | Specializes in pressure-mapped orthotics and 3D-scanned custom-fit insoles. Focuses on diabetic foot care and AI-driven customization. |

Strategic Outlook of Key Companies

Dr. Scholl’s (18-22%)

Scholl leads the orthopedic insole request with affordable, untoward results for common bottom affections. The company expands its customization capabilities with in-store bottom- surveying alcoves and AI-driven recommendations. Strong retail hook-ups with apothecaries and supermarkets continue to drive deals.

Super feet (15-19%)

Super Feet offers ultra-expensive insoles with high-performance bow support, feeding both orthopedic cases and athletes. The brand invests in sustainability, using factory-grounded accouterments and recyclable packaging. Super Feet strengthens its e-commerce presence and digital customization tools to enhance the stoner experience.

Powerstep (10-14%)

Power Step is honored for its podiatrist-approved insoles designed for plantar fasciitis and bottom alignment correction. The company mates with orthopedic conventions and sports drug professionals to expand its client base. Power step focuses on invention in medical- grade bumper and custom orthotics.

Spence (8-12%)

Spence specializes in shock-absorbing insoles that relieve pressure points and reduce impact-related pain. The company enhances its orthopedic product range with anti-microbial and temperature-regulating accouterments. Spence targets active individualities and diabetic cases with technical comfort insoles.

Aertex (6-10%)

Aertex differentiates itself with slice- edge 3D- published custom insoles and AI-driven bottom- surveying technology. The brand expands its reach to diabetic bottom care members, offering pressure-counterplotted orthotics for enhanced support. Aertex focuses on inventions in orthopedic footwear and digital results.

Other Key Players (30-40% Combined)

Several emerging and niche players contribute to the market’s expansion by offering specialized orthopedic solutions. Notable brands include:

The Orthopedic Insole industry is projected to witness a CAGR of 14.2% between 2025 and 2035.

The Orthopedic Insole industry stood at USD 2.4 billion in 2024.

The Orthopedic Insole industry is anticipated to reach USD 6.7 billion by 2035 end.

North America is set to record the highest CAGR of 6.8% in the assessment period.

The key players operating in the Orthopedic Insole industry include Superfeet, Aetrex Worldwide, Bauerfeind, Dr. Scholl’s, Powerstep, and Spenco.

Custom Orthotic Insoles, Prefabricated Insoles, Gel Insoles, Foam Insoles, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Pharmacies/Drug Stores, and Others.

Men, Women, Kids, and Geriatric Population.

Plantar Fasciitis, Flat Feet, Diabetes, Arthritis, Sports Injuries, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.