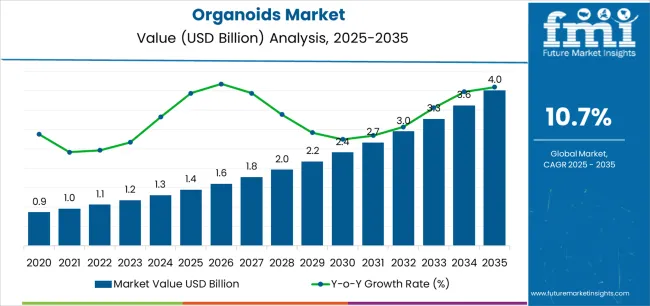

The Organoids Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period.

The Organoids market is witnessing substantial growth driven by advancements in stem cell research, 3D culture systems, and regenerative medicine. The market expansion is primarily attributed to the increasing use of organoids in disease modeling, personalized medicine, and drug discovery. Growing investments in biotechnology and pharmaceutical research have accelerated the adoption of organoid-based systems as an alternative to conventional animal testing.

The future outlook for this market is strengthened by continuous innovations in bioengineering, microfluidics, and genome editing technologies that enhance organoid functionality and scalability. Rising prevalence of chronic diseases, coupled with the growing need for effective therapeutic testing platforms, is further promoting market demand.

Academic and research institutions are increasingly focusing on developing organoids that mimic human physiology for better understanding of organ development and pathology As a result, the Organoids market is expected to experience sustained growth in the coming years, supported by advancements in cellular reprogramming and the rising application of patient-derived models in precision medicine.

| Metric | Value |

|---|---|

| Organoids Market Estimated Value in (2025 E) | USD 1.4 billion |

| Organoids Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

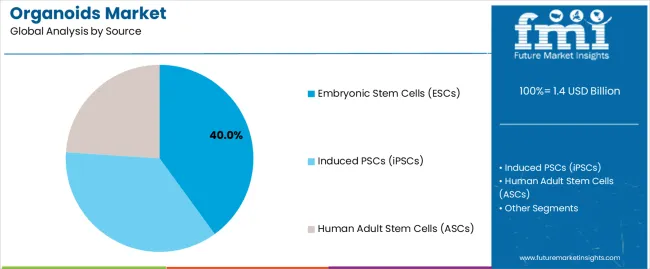

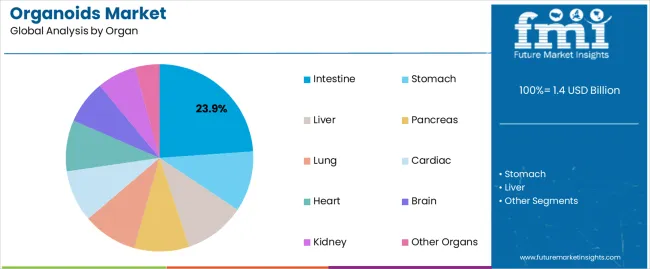

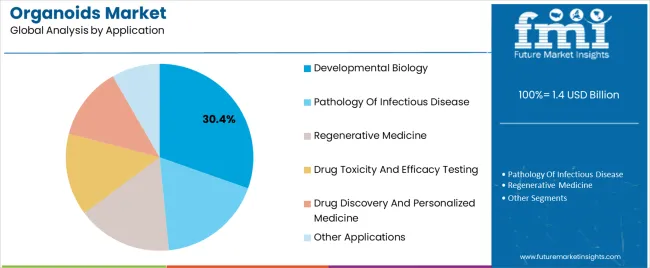

The market is segmented by Source, Organ, Application, and End User and region. By Source, the market is divided into Embryonic Stem Cells (ESCs), Induced PSCs (iPSCs), and Human Adult Stem Cells (ASCs). In terms of Organ, the market is classified into Intestine, Stomach, Liver, Pancreas, Lung, Cardiac, Heart, Brain, Kidney, and Other Organs. Based on Application, the market is segmented into Developmental Biology, Pathology Of Infectious Disease, Regenerative Medicine, Drug Toxicity And Efficacy Testing, Drug Discovery And Personalized Medicine, and Other Applications. By End User, the market is divided into Biopharmaceutical Companies, Contract Research Organizations, and Academics And Research Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Embryonic Stem Cells (ESCs) segment is projected to hold 40.00% of the Organoids market revenue share in 2025, making it the leading source segment. This dominance has been driven by the pluripotent nature of ESCs, which allows for the generation of diverse organ-specific organoids with high physiological relevance.

The ability of ESCs to differentiate into various tissue types has positioned them as an essential foundation for modeling developmental processes and studying genetic disorders. The segment’s growth has been further supported by advancements in gene-editing tools and culture media optimization, which have improved efficiency and stability of ESC-derived organoids.

Increasing demand for early-stage disease modeling and regenerative therapies has also reinforced the use of ESCs in organoid production Furthermore, ongoing academic and clinical collaborations focusing on organogenesis and tissue regeneration continue to expand the utilization of ESCs, solidifying their leadership within the Organoids market.

The Intestine organ segment is anticipated to account for 23.90% of the Organoids market revenue share in 2025, establishing it as one of the leading organ types. This segment’s prominence has been influenced by the growing demand for gastrointestinal disease modeling and drug absorption studies.

Intestinal organoids are being increasingly utilized to replicate the complex structure and function of the human gut, offering enhanced accuracy in assessing disease mechanisms and therapeutic responses. Their ability to mimic intestinal epithelial interactions provides valuable insights into conditions such as inflammatory bowel disease and colorectal cancer.

Additionally, technological advancements in organoid culture systems and bioreactors have improved the scalability and reproducibility of intestinal models The focus on gut microbiome research and nutrient absorption studies has also fueled adoption of intestine organoids across research and pharmaceutical applications, ensuring steady segment growth within the overall market.

The developmental biology application segment is expected to account for 30.40% of the Organoids market revenue share in 2025, positioning it as a leading application area. This segment’s growth has been driven by the growing need to study organogenesis, tissue differentiation, and genetic regulation using physiologically relevant models. Organoids derived from stem cells provide a dynamic system for visualizing cellular behavior during development, which has revolutionized the understanding of human biology and disease mechanisms.

Researchers are increasingly leveraging organoid systems to examine how specific genes influence tissue formation and morphogenesis. The ability to replicate complex developmental processes in vitro has reduced dependency on animal models and enhanced translational research accuracy.

Furthermore, the integration of CRISPR-based gene editing and high-content imaging has expanded the utility of organoids in developmental biology research As scientific focus on human developmental processes intensifies, this segment is expected to remain a cornerstone of organoid-based research and innovation.

The table below offers a comparative analysis of the Compound Annual Growth Rate (CAGR) fluctuations for the global organoids market between the base year (2025) and the current year (2025) over six months.

This examination uncovers significant changes in market performance and highlights trends in revenue generation, giving stakeholders valuable insights into the market’s growth trajectory throughout the year. The first half (H1) encompasses January through June, while the second half (H2) covers July through December.

In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 12.0%, followed by a slightly lower growth rate of 11.7% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 12.0% (2025 to 2035) |

| H2 | 11.7% (2025 to 2035) |

| H1 | 11.3% (2025 to 2035) |

| H2 | 10.8% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 11.3% in the first half and remain relatively moderate at 10.8% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS

Rising focus on developing alternatives to animal testing models to drive Organoids Market

Organoids present a promising alternative to traditional animal testing methods by providing disease models more human-relevant. Unlike animal studies, which most often do not successfully predict human responses because of species differences, organoids are directly derived from human tissues and preserve the genetic and physiological characteristics from their parental tissues.

Combining these human-specific properties has positioned organoids as better simulators of human diseases and human responses to drugs, thus increasing the accuracy and relevance of preclinical studies.

Government initiatives and funding programs spur the adoption of organoids further by supporting research into new methods and technologies that can replace animal testing. For instance, programmes such as the NIH Common Fund's initiatives focus on offering accelerated development and validation of human-based New Approach Methodologies-including organoids-for regulatory purposes.

Organoids will not only increase the efficiency and effectiveness of drug development and toxicity testing but also represent a large step toward a more humane and scientifically robust approach in biomedical research.

Expanding application of organoids are Creating New Opportunities

The organoids reconstituted from lung, liver, kidney, and brain tissues helped in a large way to clearly figure out the viral pathogenesis and assess potential therapeutics. Some of the key advantages derived from organoids would be their predisposition to mimic human organ physiology and cell interactions which make them very useful in preclinical drug evaluation. Drug efficacy and safety can be achieved with more precision than when traditional methods of testing are used.

Second, improvements to bioengineering techniques, which include others such as microfluidics and synthetic biomaterials, have increased the fidelity and functionality of organoids.

These technologies help in the development of controlled cellular microenvironments inside organoids and make possible studies that were otherwise quite difficult or impossible to conduct using other models.

For instance, embedded bioelectronics allow for the real-time monitoring of activities from organoids-such as neural electrophysiology in brain organoids required for investigations into brain function and mechanisms of disease. Organoids can be used for individual treatments based on patient-specific organoids, thereby offering a-like accelerated development of individual therapies.

Growing Adoption of Organ-on-a-chip Technology Is a Key Trend in Organoids Market

Organ-on-a-chip systems combine self-organized 3D tissue structures, organoids, which are derived from human pluripotent stem cells or patient-specific cells, and microfluidic devices. Such integration provides a higher degree of physiological relevance to in vitro models by mimicking the complex microenvironment and interactions happening in human organs.

The complexity in the human structure and functioning of organs is mostly difficult to replicate using traditional 2D cell cultures and typically those standalone organoid models. This is because organ-on-a-chip platforms allow the integration of vascular networks and immune cells, as well as other non-parenchymal cell types, to examine holistically the physiology happening at the organ level and mechanisms of diseases.

This capacity is important if developing an understanding regarding the interaction of drugs with tissues and for the advancement of more accurate assessment of their efficacy and safety profiles.

Another advantage of the organ-on-chip systems is the possibility of high-throughput screening of drugs. The self-contained systems modeling a real response of human organs to the drug will help researchers minimize the use of animal models in this sphere and raise the speed of development for new drugs.

Moreover, the prospect of coupling several organ-on-a-chip models into "body-on-a-chip" configurations allows for pioneering opportunities for the analysis of systemic drug effects and personalized medicine approaches. Another reason for the growth in the organoids market is the increasing synergistic integration with microfluidics as the organoid technology evolves further.

Lack of Standardization Impede Organoids Use

Variability in tissue sampling methods introduces inconsistency in organoid cultures. Organoids can, therefore, poorly represent the heterogeneity of tumors, particularly if they are derived from single-point biopsies or surgical resections, making the modeling of drug responses less accurate.

Furthermore, the methods used for processing primary tissues into organoids are quite different. Enzymatic dissociation has off-target effects that apparently disturb cellular interactions driving organoid formation. On the other hand, mechanical methods like tissue chopping preserve the architecture of tissue but produce variable fragments of tissue that impact on outcome reproducibility and reliability in culture.

Moreover, it is not the organoid culture environment itself but its components, such as culturing medium and extracellular matrix (ECM) that are standardized. Hence, differences in growth factor supplementation (e.g., Wnt, R-spondin) and ECM composition (Matrigel, collagen, synthetic matrices) create variability, further supporting incompatibility between studies and leading to failure in the reproducibility of experimental results.

Batch-to-batch variability in conditioned medium and animal-derived serums further makes standardization difficult and likely affects organoid phenotype and drug response. These three most critical aspects are devoid of standardization and are, therefore, a barrier to large-scale organoid adoption in the clinic.

The organoids industry recorded a CAGR of 7.4% between 2020 and 2025. According to the industry, organoids generated USD 1,178.3 million in 2025, up from USD 0.9 million in 2020.

Organoid development as of current date have been majorly focused on developing model that can mimic human physiological function. Organoid have huge potential that is yet to be exploited.

In December 2025, FDA passed the Modernization Act 2.0 which allows for alternatives to animal testing be used in the drug approval process. As of now many standardization challenges need to be addressed. With the growing adoption of organoids new regulation are expected to enter the market which will eventually address this challenge.

Coupled with the rapidly evolving fields of bioengineering and genetic engineering, organoid technology certainly holds a very bright future. Bioprinting techniques are likely to improve reproducibility and scalability of organoid cultures, while spatial arrangement of cells and biomaterials becomes very accurate.

Biofabrication methods, among which is laser ablation, have already created complicated tissue structures similar to intestines, such as intestinal villi, thus significantly improving the physiological relevance of organoid models.

Organoids in microfluidic "organ-on-a-chip" platforms combine the use of advanced genome editing via CRISPR-Cas9 in the modeling of tissue-specific functions and dynamics of a disease process. More so, these resultant organoids will be helpful in the elucidation of responses to drug interventions, and these disease mechanisms could be explained.

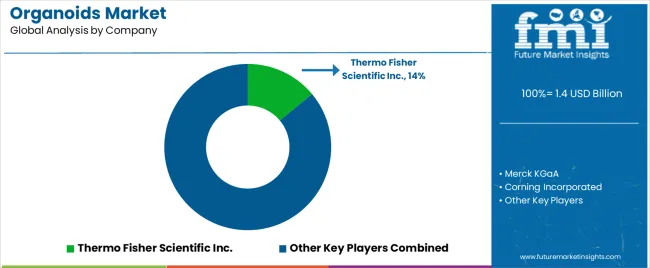

Companies in the Tier 1 sector account for 60.9% of the global market, ranking them as the dominant players in the industry. Tier 1 players offer a wide range of products related to organoid culture, have an established industry presence, offer continuous innovation, and have a significant influence in the field.

Having financial resources enables them to enhance their research and development efforts and expand into new markets. A strong brand recognition and a loyal customer base provide them with a competitive advantage. Prominent companies within Tier 1 include Thermo Fisher Scientific Inc., Merck KGaA, and Corning Incorporated.

Tier 2 players dominate the industry with a 28.9% market share. Tier 2 firms have a strong focus on a specific technology and a substantial presence on the industry, but they have less influence than Tier 1 firms.

The players are more competitive when it comes to pricing and target niche markets. New products and services will also be introduced into the industry by Tier 2 companies. Tier 2 companies include Charles River Laboratories, STEMCELL Technologies Inc., UPM Biomedicals, Emulate Bio, and MIMETAS among others.

Compared to Tiers 1 and 2, Tier 3 companies have smaller revenue spouts and less influence. Those in Tier 3 has smaller work force and limited presence across the globe. Prominent players in the tier 3 category are Cellesce Ltd., Lena Biosciences, DefiniGEN, and Visikol, Inc.

The section below covers the industry analysis for the organoids market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia, Western Europe, Eastern Europe, and Middle East and Africa (MEA), is provided.

The United States is anticipated to remain at the forefront in North America, with a value share of 87.8% through 2035. In Asia Pacific, South Korea is projected to witness a CAGR of 17.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| Canada | 7.9% |

| Germany | 9.2% |

| France | 8.8% |

| Italy | 8.4% |

| China | 17.5% |

| South Korea | 17.1% |

The USA organoids industry is expected to grow at 7.5% CAGR from 2025 to 2035. The United States has high per capita spending on healthcare, which indicated is an indication of a strong environment in terms of investing in state-of-the-art medical technologies like organoids.

The current government policies of the country are very supportive to drive innovation in healthcare and increase the pace since this provided an easier path for market access and developed an easy adoption rate in clinics and research laboratories.

The large size of the biopharmaceutical sector in the USA lends support to substantial demand for organoids in drug discovery and development. Organoids can provide far more accurate and human-relevant models for the testing of new drugs to bring about efficiency and reduce costs compared to traditional methods.

The active research funding by huge institution such as the NIH supports active research programs that will further precipitate the development of organoid applications and continue to solidify the United States' position at the top of translating organoid technology into the clinic.

A CAGR of 17.5% is predicted for china in the forecast period. China has experienced a huge expansion in the biotechnology sector, in which various advanced technologies, such as organoids, are in huge demand. Collaborations by Chinese researchers with international researchers have been vital to the research and commercialization of organoids.

Bilateral cooperation allows sharing of knowledge, and innovation in technology. Government support also fuels the adoption of organoids. Policies and initiatives toward life sciences sectors facilitate key funding, infrastructure, and regulatory frameworks necessary to support market growth.

Besides, the large and diversified patient pool of China, associated with a high prevalence of various diseases, underlines the requirement for personalized medical solutions which organoid technologies provide.

This creates demand for the same, thereby fueling research and development activities that have placed China at the forefront of the global organoids industry, at the threshold of massive growth and new innovations.

Japan is a leader in basic and translational research on SCs, upon which organoid technologies are premised. Such expertise has provided technical know-how for continuous models with advanced features that better mimic the structure and functions of human organs; in other words, enabling conditions for doing research and effecting therapy.

Japanese companies are collaborating with international players for supporting market growth. Such collaborations facilitate technological development, and market expansion. This in turn boosts Japan's position in the organoids industry. Between 2025 and 2035, Japan is expected to expand at a CAGR of 15.8%.

Japan's aging population and healthcare-related problems raise additional demand for the realization of innovative medical solutions. Organoid technologies can realize promising avenues of personalized therapies, disease modeling, and drug discovery that meet explicit healthcare needs.

Converging factors make Japan a prime mover in the advancement of organoid technology and set the scene for further sustainable growth with very significant contributions to global biomedical research and healthcare innovation.

A description of the leading segments in the industry is provided in this section. The intestine segment held 23.9% of the value share in 2025. Based on the application, developmental biology held 30.4% of the market in 2025.

| Organs | Intestine |

|---|---|

| Value Share (2025) | 23.9% |

Intestinal organoids are most widely employed tools in biomedical research. They retain the capacity to mimic the complex structure and functions of the intestinal epithelium, hence become an invaluable tool in disease modeling and drug discovery. Their derivation from easily accessible sources, such as intestinal biopsies, allows for applications in personalized medicine that is quite a challenge to meet with many other organs.

Intestinal organoids are versatile tools to investigate a wide array of diseases from inflammatory bowel diseases to colorectal cancer which can be designed to encompass important components, including the microbiome and immune cells.

This relevance thus extends to studies on drug absorption and metabolism, answering the critical clinical need for more predictive in vitro models. They offer ethical advantages with regard to the use of animal models and are cost-effective. The confluence of above factor result in dominance of intestinal organoids

| Application | Developmental Biology |

|---|---|

| Value Share (2025) | 30.4% |

Organoids provide an almost accurate model for in vitro study of human organ development and function, way beyond the limitations from traditional 2D cultures and animal models. This enables researchers to acquire insights into the intricacies of processes and mechanisms lining organogenesis, mainly during early human development, in a way that is very difficult to study otherwise.

Organoids provides modeling at the genomic level of genetic diseases and working out an approach of personalized medicine regarding individual genetic profiles. Further technological improvements of organoid maturation and complexity represent an increasingly truthful way of depicting developmental processes.

The versatility of organoids for mechanistic studies-by means of genetics and advanced imaging technologies-permits detailed investigation of cellular interactions and signal transmission pathways involved in this process of organ development. These three attributes collectively position organoids as key tools that facilitate new discovery and drive translational research in developmental biology.

Industry players operating in the organoids sector collaborate with other companies to take advantage of their research capability and achieve breakthrough discovery. This provide competitive advantage to both company. These collaboration is also focused on synergistically utilizing the existing technology of Partner Company and improve their market reach.

Many research firm operating in the market aim to achieve certification and other forms of recognition to establish their brand value within the industry. Introducing novel product in the market and expanding the service portfolio is common tactic adopted by the companies. Below mentioned are few example of recent development that took place in the organoid industry.

Recent Industry Developments in the Organoids Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.3 billion |

| Projected Market Size (2035) | USD 3.8 billion |

| CAGR (2025 to 2035) | 11.3% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion / volume in million units by organ type, source, and application |

| Source Analyzed | Embryonic stem cells (ESCs), Induced PSCs (iPSCs), Human adult stem cells (ASCs) |

| Organs Analyzed | Stomach, Intestine, Liver, Pancreas, Lung, Cardiac, Heart, Brain, Kidney, Other Organs |

| Applications Analyzed | Developmental biology, Pathology of infectious disease, Regenerative medicine, Drug toxicity and efficacy testing, Drug discovery and personalized medicine, Other Applications |

| End Users Analyzed | Biopharmaceutical Companies, Contract Research Organizations, Academics and Research Institutes |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Spain, China, India, Japan, South Korea, Australia, Brazil |

| Key Players | Thermo Fisher Scientific Inc., Merck KGaA, Corning Incorporated, Charles River Laboratories, STEMCELL Technologies Inc., UPM Biomedicals, Emulate, Inc., MIMETAS, InSphero, Promega Corporation, Crown Biosciences, Nortis Bio, HUB Organoids, Cellesce Ltd., Lena Biosciences, Inc., DefiniGEN Limited, Visikol, Inc., Nuvisan GmbH, Alveolix AG, AxoSim, Inc., CELLphenomics GmbH, Synthecon, Inc., 3Dnamics Inc., Reprocell, Inc., PromoCell GmbH, 3D Biotek LLC, Nanofiber Solutions |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis. |

| Customization and Pricing | Available upon request |

In terms of source, the industry is segregated into embryonic stem cells (ESCs), induced PSCs (iPSCs), and human adult stem cells (ASCs).

In terms of organs, the industry is segmented into stomach, intestine, liver, pancreas, lung, cardiac, heart, brain, kidney, and other organs.

In terms of application, the industry is bifurcated into developmental biology, pathology of infectious disease, regenerative medicine, drug toxicity and efficacy testing, drug discovery and personalized medicine, and others applications.

In terms of end user, the industry is segmented into biopharmaceutical companies, contract research organizations, and academics and research institutes.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, Middle East, and Africa have been covered in the report.

The global organoids market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the organoids market is projected to reach USD 4.0 billion by 2035.

The organoids market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in organoids market are embryonic stem cells (escs), induced pscs (ipscs) and human adult stem cells (ascs).

In terms of organ, intestine segment to command 23.9% share in the organoids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organoids LNP Market Size and Share Forecast Outlook 2025 to 2035

Organoids Kits Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA