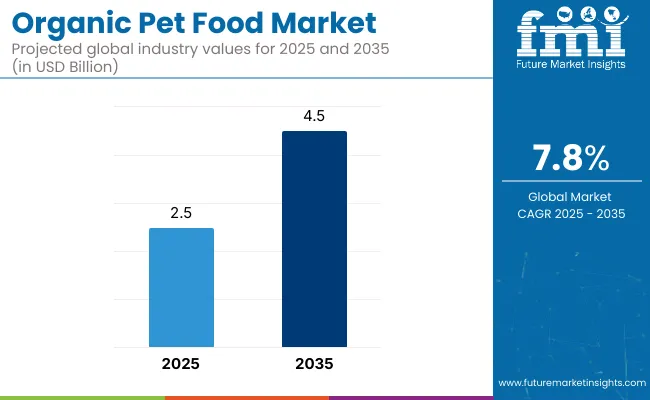

The demand for global Organic Pet Food market is expected to be valued at USD 2.50 Billion in 2025, forecasted at a CAGR of 7.8% to have an estimated value of USD 4.50 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 6.3% was registered for the market.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 2.50 Billion |

| Projected Global Industry Value (2035F) | USD 4.50 Billion |

| Value-based CAGR (2025 to 2035) | 7.8% |

The importance of providing the best possible nutrition for pets is growing as more pet owners become aware of the medical needs of their animals and turn to natural and organic products and health supplements. They would rather see their pet food served in a more organic manner and want it to be fresh and healthy.

Due to population growth urbanization and rising incomes in developing countries there is a greater demand for organic pet food worldwide. As the number of pets has grown so too has the humanization of pets. Customers are therefore choosing high-quality pet food products in an effort to lessen health risks.

It also gives manufacturers profitable opportunities to produce nutritious and healing foods for pet’s health which enables them to grow their market share in the organic pet food sector.

Currently organic pet foods only account for a small percentage of the pet food industry. Due to the absence of a specific regulation for pet foods many pet food manufacturers are also compelled to adhere to organic labels for human food in the current industry scenario which limits market demand.

Rise in Pet Owners is Driving the Market Growth

Global pet ownership rates are expected to rise especially in developing nations which will propel market expansion. Pet owners are being encouraged to buy wholesome high-quality food for their animals by the growing development and humanization of pets which is driving the markets expansion. The market for organic pet food is expanding due to the growing popularity of organic food.

Awareness in Pet Health Drives the Market Growth

Consumers spending on pet care and pet food has grown particularly in the last few decades as pets have become more humanized. Customers increasing per capita income is motivating them to spend money on organic and healthful pet food products for their pets’ benefit.

Additionally, a positive growth factor for the global market is the easy accessibility of products with varying price ranges. The main market participants are concentrating on introducing a range of pet food items to meet the demand for different kinds of animals across different age groups. This is expected to propel the market expansion for organic pet food.

During the period 2020 to 2024, the sales grew at a CAGR of 6.3%, and it is predicted to continue to grow at a CAGR of 7.8% during the forecast period of 2025 to 2035.

Globally organic pet food is becoming more and more well-known. People’s awareness of their health is growing. Sales of organic pet food are also boosted by increased information sharing on social media platforms about the potential dangers of synthetic chemicals and other hazardous materials.

Food security as a top priority and the growing benefits of natural and healthful food could drive pet food sales at faster growth rates.

Because of the nutritional advantages of organic food pet approval is the most widespread trend in the world. Health and wellness are becoming more and more important to consumers and they also want the same for their pets.

Tier 1 companies comprises industry leaders acquiring a 50% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

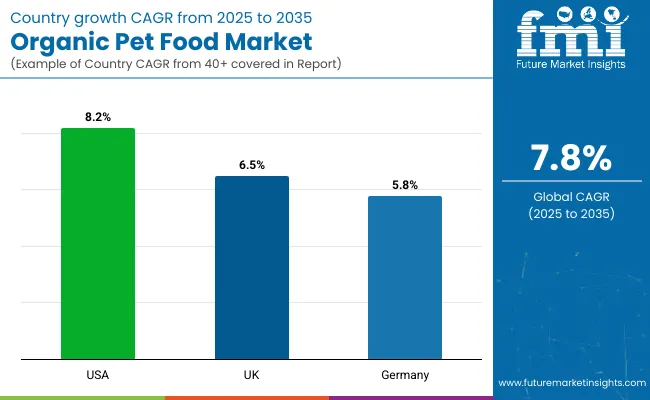

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and Germany come under the exhibit of high consumption, recording CAGRs of 8.2%, 6.5% and 5.8%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 8.2% |

| UK | 6.5% |

| Germany | 5.8% |

The United States accounts for a substantial 43% of the market revenue for organic pet food products. The growing demand for organic food may be the cause of the rise in pet ownership and consumer awareness of pet health. One of the main factors contributing to the USA dominance is the high level of acceptance of pets in American homes.

The market expansion for pet food products is being aided by the favorable sentiment of American consumers toward humanization and its broad acceptance.

German organic pet food manufacturers like Herrmanns Manufaktur provide premium gently processed pet foods made from organic ingredients without additives which are highly sought after in the nation. The company creates species-appropriate recipes using only one animal protein source in each of its Selection and Classic lines which include a variety of products with a high meat content and no cereals.

In the UK market organic chicken and vegetable dry food products for pets are becoming more and more popular. These products dont contain grains and are hypoallergenic. Companies like Lilys Kitchen offer consumers organic chicken recipes and delectable vegetable dry food that has been enhanced with prebiotics to support pet’s healthy digestion. Along with organic vegetables and botanical herbs that help strengthen pets’ immune systems the products give pets all the nutrients they need.

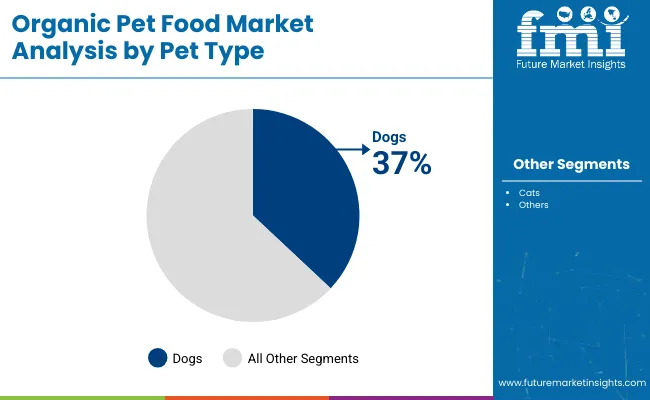

| Segment | Value Share (2025) |

|---|---|

| Dogs (Pet Type) | 37% |

The dog cat and other pet food segments make up the global organic pet food market. In 2025 the dog segment held the largest market revenue share at 37%. This is because nuclear families are becoming more and more popular and consumers are choosing dogs as companions and sources of security.

For their health dogs also require a range of nutrients. As a result, dog owners have been concentrating on providing their animals with higher-quality food that contains vital nutrients to maintain their health. Organic dog food is also becoming more and more popular due to the high costs associated with maintaining and caring for dogs.

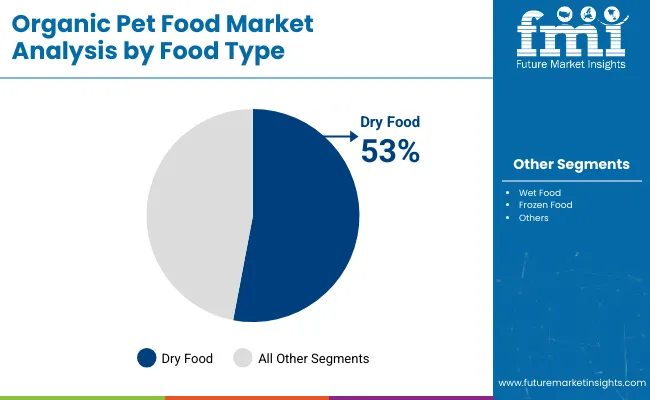

| Segment | Value Share (2025) |

|---|---|

| Dry Food (Food Type) | 53% |

With a 53% market revenue share in 2025 the dry food segment had the largest share. Dry pet food has grown significantly as a result of various factors including the growing significance of dry premiumization among pet food manufacturers.

Additionally, the growing inclination of consumers to think about dogs as well as an increase in investments in premium pet food products and innovative product developments present a substantial market opportunity for the top competitors in the dry food segment. Since it is inexpensive and accessible to many dog owner’s dry food is the most popular choice for dogs. Throughout the forecast period the wet food segment is expected to grow at the fastest rate.

The major players in the market concentrate on launching new products in order to gain a significant portion. The majority of global market share is held by Mars Incorporated along with a number of other regional markets. For the purpose of expanding their customer base and dominating the global market the major players are implementing a number of strategies including partnerships mergers and acquisitions creative product launches and online product distribution.

By Food Type, methods industry has been categorized into Dry Food, Wet Food and Frozen Food

By pet type industry has been categorized into dogs and cats

Industry analysis has been carried out in key countries of North America, Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

The market is expected to grow at a CAGR of 7.8% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 4.50 Billion.

Rise in pet ownership is increasing demand for Organic Pet Food.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Merrick Pet Care, Inc., Castor & Pollux, WellPet LLC and more.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Foods Market Analysis by Category, Product Type, Distribution Channel, and Region Through 2035

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA