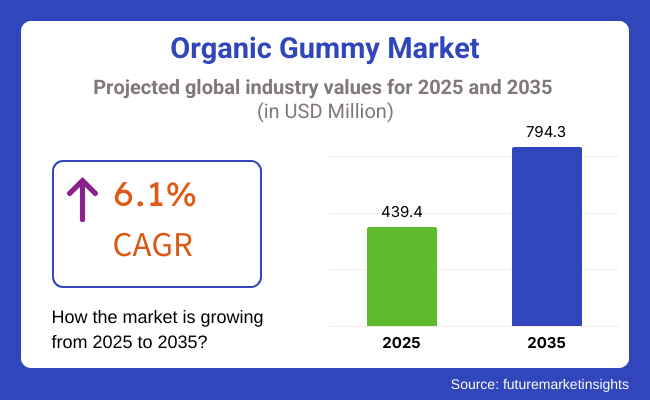

The organic gummy worms market is projected to expand at a steady pace, backed by an estimated worth of USD 439.4 million in 2025. The entire industry is anticipated to demonstrate a CAGR of 6.1% over the assumed period between 2025 and 2035. The total industry value is expected to climb up to USD 794.3 million by 2035.

The organic gummy worms are gaining momentum due to the shift towards healthier options embraced by the consumers from traditional gummy candies. These candies are made of organic materials, natural sweeteners, and they are also devoid of colorings or flavors that are not considered to be.

The target audiences of these gummies include health nutritionists, parents, and those who stick to clean-label and plant-based diets. The increasing preference for non-GMO gluten-free and allergen-free confectionery products also adds to the industry growth.

The surge in the industry is mainly because of the rising demand for organic and natural confectionery products. The public has become more conscientious about the health issues that are associated with artificial additives, which has led to the growing popularity of products with a short and understandable ingredient list.

Producers, seeking to boost with the recent trends, are working on plant-based and pectin-based gummy formulas to appeal to the rising vegan and vegetarian population. Along with the growth of retail distribution, including supermarkets and online platforms, organic gummy worms have turned out to be more available to the general public.

The extension of e-commerce, as well as the rise of direct-to-consumer brands, has been a further factor in the industry expansion, with companies focusing on sustainable packaging and eco-friendly sourcing to attract customers who are environmentally friendly.

On the other hand, the industry is confronted with the challenges of high production costs related to the use of organic goods as well as the limited shelf life in comparison to traditional gummy candies. Tariffs that are set by the manufacturers for organic product brands may also have an impact on the markets in question.

Regardless of the obstacles, the industry possesses vast potential for extension. The growing demand for functional gummies that come with vitamins, probiotics, or other elements beneficial for health is likely to stimulate even higher demand. The fact that clients always look for bite snacks that are luxurious yet nutritious makes the industry undoubtedly a sustainable one for the period to come.

Explore FMI!

Book a free demo

The industry is growing as consumers are increasingly opting for natural, non-GMO, and additive-free confectionery items. Health-conscious consumers look for gummies produced using organic fruit extracts, natural sweeteners such as agave or monk fruit, and plant-based colorants from ingredients such as turmeric and beetroot.

Food and beverage is in the lead, with companies promoting gluten-free and vegan products in order to have a wider audience. Organic gummy worms get vitamins, minerals, and functional ingredients in the dietary supplement to act as simple substitutes for common pills.

Retail & e-commerce sites are seeing growth in sales with digital marketing and subscription-based health snacking culture. Specialty retailers highlight premium organic options, which are preferred by eco-friendly shoppers.

With clean-label trends driving innovation, the focus is on manufacturers exploring sustainable packaging, sugar reduction, and allergen-free formulation, indicating strong industry expansion over the next several years.

The industry saw significant growth between 2020 and 2024 as consumers' tastes turned toward healthier and natural snack foods. Health-conscious consumers increasingly demanded products that contained no artificial additives, prompting manufacturers to innovate with organic ingredients and natural flavors.

Increasing demand for clean-labeling drove product diversification as firms launched gummy worms derived from plants and naturally sweetened. This trend notwithstanding, increased production costs and supply chain volatilities challenged the capacity of manufacturers to ramp up operations and satisfy increasing demand

For the future years 2025 to 2035, the industry will register greater growth as product development and sustainability are key. Shoppers will seek greater transparency in the manufacturing and sourcing of their gummies, and companies will meet that demand with green manufacturing and sustainably sourced ingredients.

Product development will reach into functional gummies packed with vitamins, minerals, and probiotics that will appeal to health-aware consumers. Advancements in production technology will reduce costs, improve uniformity, and expand flavor profiles. Additionally, the evolution of e-commerce and direct-to-consumer platforms will enable brands to target more population and build closer customer interactions. The health, sustainability, and transparency turn in the industry is likely to characterize the ten-year growth ahead.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for natural and organic ingredients | More emphasis on sustainability, transparency, and functional value |

| Growth with higher acceptance of organic gummy worms | Faster growth through innovation and expanded product ranges |

| Addition of natural colors, natural flavors, and organic versions | Development of sugar-free, vegan, and functional variations |

| Expansion of physical store presence with developing online sales | Increased focus on e-commerce and direct-to-consumer channels |

| Adherence to organic labeling requirements and clean-label regulations | More stringent requirements for sustainable production and ingredient sourcing |

| Increased application of natural and organic ingredients | Increased focus on green production and responsible sourcing |

The industry is expanding because of increased customer interest in healthier confectionery options. However, the compliance safety is the issue which is strict regulatory requirements for the organic certification, ingredient sourcing, and labeling. Manufacturers are required to meet the global food safety standards, get the necessary approvals, and ensure the transparency of the supply chain to create trust among the customers and to gain the credibility in the industry.

Adding complexity to product formulation, consumer demand for sugar-free and functional ingredients is becoming more common. The issue of balancing taste, texture, shelf-life stability, and non-use of artificial additives still exists. Invest in R&D to come up with new formulations that trend conscious consumers would love and at the same time, they would look the same as traditional gummy products is the necessity of the companies.

Competitor pressure from traditional and other organic candy is driving down the prices and creating a differentiation problem. Businesses, to be on the competitive edge, should tangled upfront with unique selling points like clean-label formulations, eco-packaging, and advertising campaigns that stress sustainability and health.

Economic downturns and variations in diet architecture lead to decreased demand for organic gummy worms. To remain profitable in the long run, firms should reduce the cost, diversify their sales network, and make the best of the online selling opportunities to reach more people while at the same time adapt to the changes in the industry environment and in the rules and regulations.

Based on flavor, the industry for organic gummy worms is divided into cherry and grapefruit , among others. The growth of this industry segment is being driven also by consumer preferences for natural, fruit-based flavors and clean-label products.

While cherry-flavored organic gummy worms are the omnipresent standard, making up a projected 60% of the industry share by 2025. The combination of sugar and sourness has a universal consumer appeal, particularly in North America and Europe, where berries and fruit flavors dominate the organic candy sector.

Companies like YumEarth and Black Forest sell their own organic cherry gummy worms, a product category that, due to consumer demand, must be non-GMO, gluten-free, and free from artificial colors. Tarty grapefruit-flavored organic gummy worms are picking up momentum, expected to clinch approximately 40% of the industry share by 2025.

Its demand is driven by the increasing number of consumers leaning toward citrus-infused, tangy, and refreshing flavors, especially health-focused consumers who seek alternative flavors with less sugar than conventional sweet flavors.

Such companies as Surf Sweets and Wholesome Sweeteners have come up with grapefruit gummy worms - using natural fruit extracts and organic sweeteners - in response to a shift in diets. As the world gradually moves to healthier, plant-based confectioneries, demand for cherry and grapefruit flavors is likely to increase steadily in the industry.

The industry is divided into online retailing and store-based retailing, with both distribution channels playing a vital part in making products available to customers. In 2025, online retailing is expected to hold about 55% of the industry share as a result of consumer convenience and direct-to-consumer sales.

Organic gummy worm brands are abundant on e-commerce websites like Amazon, Thrive Market, or Vitacost, where deals and subscriptions can be found. Moreover, in the organic sector, brands like YumEarth and Black Forest use their own websites to reach diet-conscious shoppers with transparency around source and sustainability.

The increase in consumers buying organic and specialty food at higher prices from digital channels also helps increase online sales. Despite the growth in online sales, 45% of the industry share of retailing will still be store-based in 2025, with supermarkets, specialty organic stores, and convenience stores continuing as the main points of purchase.

Chains such as Whole Foods, Sprouts Farmers Market, and Trader Joe's have dedicated sections in their candy aisles to organic gummy worms, appealing to shoppers looking for a more natural take on the type of candy they would have eaten in childhood. And many consumers still want to shop in stores especially if they're making impulse purchases or need to physically examine a product before they buy.

Rising demand for clean-label and allergen-free candies continues bolstering sales growth of organic gummy worms across retailing channels, wherein online retailing is expected to record comparatively stronger growth than store-based retailing.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

| UK | 5.8% |

| France | 5.5% |

| Germany | 6% |

| Italy | 5.3% |

| South Korea | 6.5% |

| Japan | 5.9% |

| China | 7.2% |

| Australia | 6.1% |

| New Zealand | 5.7% |

The industry is anticipated to grow at a CAGR of 6.2% from 2025 to 2035. Increasing consumer demand for organic and clean-label confectionery is one of the major drivers for industry growth. Sugar-free and plant-based gummies are growing in popularity, and companies are launching more products. Online stores and specialty organic retailers also aid growth by making them widely available.

Large brands are investing in new flavors and functional ingredients, such as vitamins and probiotics, to differentiate themselves. Additionally, stringent FDA regulations ensure transparency, which generates consumer trust in organic candy. With growing health-consciousness, the USA industry is expected to maintain its strength throughout the forecast period.

The UK industry will expand at a rate of 5.8% CAGR from 2025 to 2035. Rising demand for gelatin-free and plant-based gummies following the growth in the population of vegans and vegetarians has propelled the expansion. Two leading brands, Candy Kittens and Biona, have seen increased demand following the offering of sweets that are organic and ethically produced. With growing fears about artificial additives, manufacturers have been compelled to utilize fruit extracts and natural coloring.

Tesco and Sainsbury's, among other retailers, are increasing shelf space for organic confectionery in response to high consumer demand. Additionally, government campaigns for less sugar intake have accelerated the shift towards healthier gummies. The UK industry will continue to grow steadily because of these conditions.

France's industry is projected to grow at a 5.5% CAGR from 2025 to 2035. The industry is assisted by the country's long history of preference for natural and organic food. French people prefer high-quality ingredients, and firms such as Pâtes de Fruits and Naturgie have capitalized on this. Such firms emphasize fruit-based ingredients and avoid artificial additives.

Moreover, increasing organic confectionery availability in retail outlets like Carrefour and Monoprix has propelled industry growth. Due to rigorous organic food standards and a strong emphasis on sustainability, the French industry is anticipated to experience consistent growth.

The demand for German organic gummy worms is likely to grow at a CAGR of 6% during 2025 to 2035. Germany is home to one of the largest markets for organic food in Europe, and customers are keen on buying certified organic products. Katjes and Riegel are brands that have gained the trust of customers by offering gelatin-free and sugar-free gummy items. The nation's extensive network of organic food stores and chains supports growth within this segment.

Additionally, German consumers are highly conscious of sustainable packaging, and therefore brands use biodegradable and recyclable materials. With both strict regulatory demands and a health-conscious population, the German industry is expected to grow steadily.

Italy's industry is projected to grow at a CAGR of 5.3% between 2025 and 2035. The country's deep-forged culinary culture has influenced consumer appetite for natural and premium ingredients. Italian firms like Fida and Leone have introduced organic confectionery lines that respond to this need. Increasing health awareness about sugar is encouraging increasing numbers of consumers to move to organic and low-sugar versions of gummies.

Retailers like Coop Italia and Esselunga have expanded their organic department, and the products are increasingly available to consumers. Premium organic confectionery demand is on the rise in the Italian industry, and it will increase steadily.

The industry for South Korea will expand during the period of 2025 to 2035 at a CAGR of 6.5%. There has been growing demand for beauty- and functionality-enhancing gummies, such as collagen- and vitamin-based gummies. Players like Orion and Lotte have started using organic ingredients in their gummies to meet customers' demands.

The convenience of direct-to-consumer and e-commerce businesses has made organic gummies more accessible. Moreover, the effect of K-pop culture on lifestyle is also behind increasing demand for trendy and healthy confectionery items.

The industry in Japan will expand during 2025 to 2035 at a CAGR of 5.9%. Japanese customers value innovative and functional foods, and Meiji and UHA Mikakuto are investing in organic and naturally flavored gummies to cater to evolving preferences. As the demographics are aging, there is a heightened demand for vitamin-fortified organic gummy products.

Convenience stores and health food stores have increased their lines of organic products, thereby making the products even more accessible. Since Japan focuses on high quality and unique tastes, the industry will be able to experience steady growth.

China's industry is expected to grow at 7.2% CAGR from 2025 to 2035, being one of the fastest-growing markets globally. Higher disposable income and growing health consciousness of organic food advantages are some of the key drivers. Global players such as Haribo and domestic players such as Want Want are expanding their organic product lines to attract consumers who are health-conscious.

Internet retailing websites such as Alibaba and JD.com also play a crucial role in broadening markets. Furthermore, increasing concerns about food safety and the use of natural ingredients fuel the demand for organic gummy products in China.

Australia's industry is anticipated to grow at a 6.1% CAGR between 2025 and 2035. Australia's established organic food culture and regulations supporting clean-label products drive the industry. The Natural Confectionery Co. has been able to provide organic products to meet demand.

The heightened popularity of diets based on vegetables and sugar-free desserts further invites industry expansion. With big brands like Woolworths and Coles giving greater shelf space to organic sweets, the industry is poised to perpetuate its growth trend.

New Zealand's industry is expected to grow at a 5.7% CAGR through the years 2025 to 2035. Natural and organic food has received immense significance in the country, leading to increased demand for organic confectionery. HealthPost and Tom & Luke give significance to organic and sustainable ingredients to appeal to the consumer who has a health-focused mind.

Government assistance to organic farming and clean-label food further speeds up industry prospects. As sweet treats that are ethical and environmentally friendly gain popularity, the industry in New Zealand is expected to increase steadily.

The industry is rapidly evolving as consumers are increasingly turning towards clean-label, plant-based, and reduced sugar varieties. The growth of organic gummy products is being supported by health-conscious consumers and parents looking for natural substitutes that are allergy-free.

Players in the segment include YumEarth, SmartSweets, The Organic Candy Factory, Black Forest Organics, and Wholesome Sweeteners. Several start-ups and niche brands are also penetrating the industry with unique formulations, including vegan, sugar-free, as well as functional ingredient-promoted gummy worms.

Organic gummy worms are being made using natural fruit flavors, organic cane sugar, and plant-based gelling agents like pectin to satisfy a vegan- and gluten-free-conscious customer base. There is a growing trend for gummies that are fortified with vitamins, fiber as well as probiotic ingredients, which is much in line with the wellness trend.

Innovations in natural colorants, enhancing textures, and sugar alternatives are changing product innovation. Due to the arena of e-commerce expansion, the private labeling spree, and an increasing presence in supermarkets, this segment is also witnessing a lot of transformation.

Beyond maintaining their competitive edge through sustainable sourcing of ingredients, eco-friendly packaging, and transparency with their labeling, companies have gone ahead to form strategic partnerships with health-oriented brands, retailers, and online subscription services to fortify their competitive advantage.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| YumEarth | 18-22% |

| SmartSweets | 14-18% |

| The Organic Candy Factory | 10-14% |

| Black Forest Organic (Ferrara) | 8-12% |

| Wholesome Sweeteners | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| YumEarth | Offers organic, allergen-free gummy worms with non-GMO, gluten-free, and artificial dye-free formulations. |

| SmartSweets | It specializes in low-sugar, high-fiber gummy worms and uses natural sweeteners like allulose and monk fruit to target health-conscious consumers. |

| The Organic Candy Factory | It focuses on premium organic, gelatin-free gummy worms and uses fruit-based pectin for a vegan-friendly texture. |

| Black Forest Organic (Ferrara) | Offers certified organic, real fruit juice-based gummy worms, emphasizing natural flavors and sustainability. |

| Wholesome Sweeteners | Provides Fair Trade-certified organic gummy worms, catering to eco-conscious and ethically driven consumers. |

Key Company Insights

YumEarth (18-22%)

As the leader in organic candy, YumEarth has built itself a favorable reputation with its allergen-friendly gummies and is now expanding through key retailers as well as e-commerce channels.

SmartSweets (14-18%)

SmartSweets comes across as a manufacturer of low-sugar, high-fiber gummy innovations and is popular among keto-friendly and fitness-focused consumers.

The Organic Candy Factory (10-14%)

Highly vegan, the premium organic gummies make it a pioneer brand appealing to health-conscious and plant-based consumers alike.

Black Forest Organic (8-12%)

It is a strong contender in the organic mass-market candies and is buoyed by formulation using real fruit juice and vast distribution networks.

Wholesome Sweeteners (6-10%)

The source of their well-being does not only cover Fair Trade but also organic-certified gummies. They are different in the way they are sourced and produced ethically.

The industry is expected to generate USD 439.4 million in revenue by 2025.

The industry is projected to reach USD 794.3 million by 2035, growing at a CAGR of 6.1%.

Key players include YumEarth, SmartSweets, The Organic Candy Factory, Black Forest Organic (Ferrara), Wholesome Sweeteners, Surf Sweets, Annie’s Homegrown, Torie & Howard, Project 7, and Lovely Candy Company.

North America and Europe, driven by growing consumer preference for organic and clean-label candies, along with increasing regulatory support for natural ingredients.

Fruit-flavored organic gummy worms dominate due to their widespread appeal, natural fruit juice content, and availability in various flavors with reduced sugar formulations.

By flavors, the industry is classified as cherry, grapefruit, watermelon, strawberry, orange, raspberry, lemon, green apple, mango, and others (pineapple, grape, etc.).

By distribution channel, the industry is classified as online retailing, store-based retailing, hypermarkets/supermarkets, convenience stores, specialty retail stores, wholesale stores, and mass grocery retailers.

By region, the industry is divided as North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.