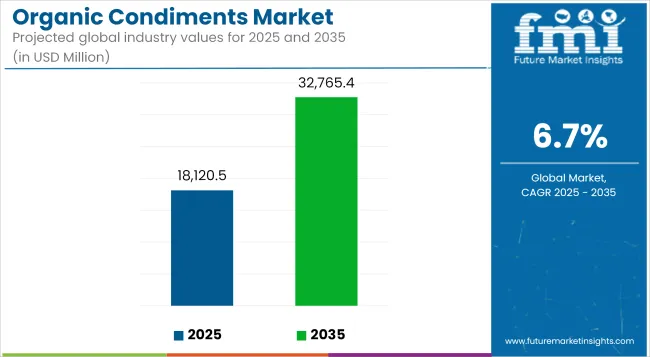

In 2025, the global organic condiments market size is assessed at USD 18,120.5 million and is forecasted to witness robust growth, reaching USD 32,765.4 million by 2035, reflecting a CAGR of 6.7%. Mounting consumer preference for chemical-free and minimally processed food items has accelerated demand for organic condiments globally. Organic ketchup, sauces, and dressings have gained strong traction due to their alignment with clean-label diets and sustainable food sourcing principles.

| Attributes | Description |

|---|---|

| Estimated Size (2025E) | USD 18,120.5 million |

| Projected Value (2035F) | USD 32,765.4 million |

| CAGR (2025 to 2035) | 6.7% |

The market has been steered by growing health awareness and demand for transparency in ingredient sourcing. Consumers are actively shifting toward organic labels, perceiving them as safer and environmentally sound. Innovations in fermentation-based condiments, increasing use of exotic flavor pairings, and growth in premium organic spreads have contributed to category expansion.

However, the segment continues to face pricing constraints and shelf-life limitations, which have restricted penetration in price-sensitive economies. Despite these challenges, organic certification remains a strong differentiator, especially in North America and Europe, where organic private labels have expanded shelf share. Product manufacturers have been expanding distribution via omnichannel strategies, while investing in packaging sustainability and taste innovation to appeal to eco-conscious buyers.

Over the coming decade, rising vegan adoption and plant-forward meal habits are expected to influence innovation in condiment formulations. The market will likely see a transition toward functionally enhanced condiments with added probiotics, vitamins, and adaptogens.

By 2035, retail and online sales channels are projected to consolidate their dominance, backed by expanded organic food portfolios and subscription-based offerings. Premiumization of everyday condiments will likely shape the next wave of organic condiment innovation, especially in developed markets where health-centric food consumption continues to mature.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Organic Condiments market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.3% |

| H2 (2024 to 2034) | 6.7% |

| H1 (2025 to 2035) | 6.8% |

| H2 (2025 to 2035) | 7.1% |

The second half, H2, includes the months from July to December. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 6.3%, followed by a slightly higher growth rate of 6.7% in the second half (H2) of the same year.

Moving into 2025, the CAGR is projected to increase slightly to 6.8% in the first half and remain relatively moderate at 7.1% in the second half. In the first half (H1 2025), the market witnessed a decrease of 16 BPS, while in the second half (H2 2025), the market experienced an increase of 34 BPS.

Organic functional condiments are projected to hold approximately 9.6% of the global organic condiments market in 2025. This niche, while still emerging, is expected to grow at a faster pace than the broader category, fueled by innovation in value-added health benefits. Functional condiments fortified with ingredients such as prebiotics, turmeric, ashwagandha, and apple cider vinegar are gaining attention among health-conscious and ingredient-aware consumers.

These offerings align with a growing preference for food products that contribute to immune health, digestion, and metabolic support. Companies such as Cleveland Kitchen have gained traction in North America by introducing raw, fermented organic dressings with live probiotics, catering to clean-label and gut-health-seeking consumers.

The segment is also benefitting from evolving organic regulatory definitions, particularly in the EU where the European Commission’s Regulation (EU) 2018/848 supports organic certification for health-positioned condiments that meet strict ingredient and process criteria.

Despite formulation challenges such as maintaining taste, stability, and shelf life while incorporating bioactives, the premium pricing opportunity offsets development risks. Continued demand from specialty natural retailers and e-commerce wellness platforms will bolster product visibility. As functional snacking and clean-label crossover expand, this segment is poised to outperform traditional organic condiments by 2035.

Private label organic condiments are projected to account for 18.9% of total organic condiment sales in 2025. This segment has rapidly scaled, particularly in Western Europe and North America, due to intensified private label strategies by major retailers such as Whole Foods Market (365 Everyday Value), ALDI (Simply Nature), and Carrefour Bio.

These store-brand condiments offer competitive pricing while aligning with retailer-led transparency initiatives. Retailers are capitalizing on increasing consumer trust in private labels and investing in vertically integrated supply chains to control quality and cost.

The segment has seen significant growth in categories like organic mayonnaise, mustards, and dips where price sensitivity often impedes premium brand adoption. European organic retailer Edeka has expanded its Bio brand range to include global flavors such as organic curry ketchup and tahini sauces. Regulatory enforcement under USDA Organic and EU Organic ensures standardization, facilitating cross-border acceptance and export potential.

With inflationary pressures intensifying price-consciousness in households, private labels are set to dominate volume growth, particularly in mainstream grocery and discount formats. Their expansion into online-exclusive SKUs and value-pack condiments will further consolidate share in the mid-priced tier.

Growing Preference for Chemical-Free Seasonings

The trend of shifting towards natural seasonings is very prominent on the part of consumers as they are becoming more and more aware of artificial additives in processed foods. Regular sauces and dressings often have artificial preservatives, colorants, emulsifiers, which have been associated with possible health issues such as allergies and metabolic disorders.

The desire for organic sauces and dressings comes from the fact that they are natural and minimally processed, thus being more nutritional without pulling down the taste. Trust consumers in certified organic products as the USDA and the EU Organic regulatory bodies enforce hard-and-fast rules.

A build-in feature of many brands to show transparency in sourcing the ingredients has led clean-label organic condiments to become common in both retail and foodservice sectors. The cooking phenomena in the homes and the acceptance of the international cuisine also complement the rising demand for organic spices as people strive for real flavors and food safety.

Expansion of Plant-Based and Vegan Diet Trends

The staggering increase in the demand for organic condiment products has been significantly attributed to the diet shift towards plant-based and vegan eating. The increasing number of people turning to new eating habits, such as flexitarian, vegetarian, and vegan, has inevitably led to a higher demand for choices like condiments without animal ingredients and dairy and non-GMO options.

Generally, the traditional condiments have these additional ingredients such as the dairy, eggs, or synthetic stabilizers that make them not suitable for individuals who are on a plant-based diet. The manufacturers of organic condiments have curbed this problem by coming up with different, such as cashew-based spreads, dairy-free dressings, and plant-based mayonnaise. In addition to that, there are many large and small companies that are participating in this expansion of the market with the introduction of organic, plant-based products.

Also, not only the products but the foodservice restaurants and chains that go for organic products are benefiting from the trend among diners who are health-conscious. Moreover, there is an increase in the e-commerce sector, which in turn has brought about the direct-to-consumer sales, thus providing a wider range of organic plant-based condiments global.

Rising Demand for Ethically Sourced and Sustainable Products

The organic condiments market is being propelled by the consumer trend towards the purchase of ethical and exclusively natural food products. As more consumers become aware of environmental issues such as deforestation, soil erosion, and greenhouse gas emissions associated with traditional farming, they buy brands that champion sustainability.

Condiments produced with organic ingredients are typically made with plants grown through regenerative agriculture, based on the idea of regenerative agriculture, therefore, they produce less ecological damage and - at the same time - assure long-term fertility of the soil.

Moreover, fair-trade certifications, innovative environmentally-friendly packaging, and a clear supply chain are the most important distinguishing factor in consumer purchasing choices. Brands that are involved in sustainable sourcing agreements with the help of organic farmers and also limit carbon emissions have an upper hand in the market.

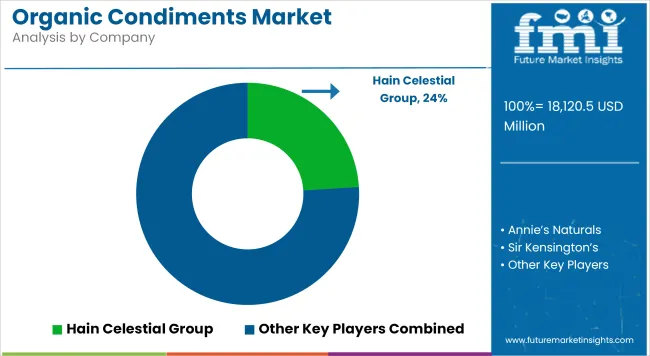

Tier 1 companies in the organic condiments market consist of industry giants with annual revenues exceeding USD 8700 million, commanding approximately 40% to 50% of the market. These companies boast large-scale production capabilities, extensive global distribution networks, and strong brand recognition.

Their ability to innovate, market aggressively, and leverage economies of scale allows them to maintain a competitive edge. Prominent companies in this tier include Nestlé S.A., Unilever PLC, The Kraft Heinz Company, and Conagra Brands Inc.

These players invest heavily in R&D, introducing organic condiment variants enriched with functional health benefits such as probiotics and antioxidants. Their strong retail partnerships across supermarkets, hypermarkets, and e-commerce platforms ensure maximum product visibility and consumer accessibility, solidifying their leadership position.

Tier 2 companies comprise mid-sized players generating annual revenues between USD 4200 million and USD 5000 million, holding a market share of approximately 25% to 35%. These companies focus on strong regional markets and have a well-established presence in specific geographies.

They often specialize in organic and premium celery juice products tailored to niche consumer preferences, such as sugar-free, preservative-free, and locally sourced offerings. While they may not have the extensive global reach of Tier 1 companies, they leverage strategic partnerships with health food stores, juice bars, and online retail platforms to expand their customer base.

Notable Tier 2 players include Blueprint Organic, Tio Gazpacho, Lakewood Organic, and Sol-ti. These companies differentiate themselves through product innovation, eco-friendly packaging, and direct engagement with health-conscious consumers, allowing them to compete effectively in the growing celery juice market.

Tier 3 comprises small-scale producers with annual revenues below USD 1200 million, operating at local or artisanal levels, making up 10% to 20% of the market. These businesses focus on craft organic condiments, direct-to-consumer sales, and farmers’ market distribution. Their key strength lies in their strong regional consumer base, authenticity, and commitment to organic integrity.

Examples include local organic hot sauce brands, specialty spice manufacturers, and homemade condiment startups. While these companies offer high-quality organic products, they face challenges in scaling operations, securing retail shelf space, and competing with mass-market organic brands. However, the rising popularity of e-commerce platforms and subscription-based food services provides new growth opportunities for small organic condiment producers to expand their reach.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 1,120.4 million |

| Germany | USD 760.8 million |

| China | USD 620.5 million |

| India | USD 410.2 million |

| Japan | USD 175.9 million |

In the organic condiments sector, The United States is considered to be a leader, mainly due to the consumer's inclination towards clean-label, minimally processed, and organic-certified food products. Health-conscious individuals across the country are on a mission to find condiments that have no artificial preservatives, high-fructose corn syrup, and synthetic additives.

The move is backed up by the strict FDA regulations and the USDA Organic certification, which helps consumers to trust even more the brands that are organic. Also, big food chains have made an effort to widen their organic products such as Whole Foods Market, Trader Joe's, and Walmart which is consequently making organic condiments available for a larger consumer culture.

Along the line, new e-commerce platforms like Amazon Fresh and Thrive Market have confronted real sales through the need for customer-friends' home delivery of organic pantry staples. Being part of a healthy growing foodservice, restaurants, and cafés have begun noticing the trend of consumers preferring organic sauces, dressings, and seasonings in their meals so that they can promote healthy eating among they customers.

The popularity of gluten-free plant-based and allergen-friendly condiments is also certainly going up, and it is a time when the producers started to make innovations in the premium organic category.

Germany is at the forefront of the European organic condiments market. This is because of its eco-friendly consumers and the precise food quality standards. The German society is predominantly green, care about ethical companies, and prefer ecological food packaging, which shifts the horse's preference breed to the organic condiments.

Various government programs, for example, the ones that support the organic farmers and the EU’s Farm to Fork Strategy, have already added the extra power to the market. The main stores, like Edeka, REWE, and Alnatura have added organic products in their range in response to the steadily increasing demand for them.

The German public has developed a penchant for condiments that are made in small batches, by hand, from organic, pesticide-free crops that are typically grown in the locale, with an emphasis on fair trade. Brands that utilize glass containers/bottles, which are recyclable, and which have biodegradable packaging have emerged with a unique product.

The influence of the vegan and flexitarian lifestyle trend has also been observed in the increase in the demand for dairy-free and plant-based organic condiments, which in turn, led the manufacturers to invent new products, such as dressings made of cashew nuts and fermented organic sauces.

China is becoming a major market for organic condiments, primarily due to its fast-growing urbanization, increased disposable incomes, and greater public health consciousness. Food safety and quality have become central issues for Chinese consumers, and as a result, they are increasingly looking to buy certified organic condiments that are accepted by international authorities and standards.

Government's support for organic farming and the proliferation of the specialized organic food chain have caught attention in this regard. High-end foreign brands are now stepping into China's territory, exploiting online platforms such as Alibaba's Tmall and JD.com to attract health-oriented customers.

The trend toward Western cuisine and international culinary styles has also brought about the need for organic ketchup, mustard, and salad dressings. In fact, the Chinese consumers are also being drawn to fermented organic products like sauces made with miso, and organic soy sauce, which follow traditional food culture and provide better health.

The Organic Condiments Market is characterized by strong competition among established global players and emerging regional brands. Leading companies focus on expanding product portfolios, emphasizing clean-label ingredients, and investing in sustainable packaging to appeal to health-conscious consumers.

Mergers, acquisitions, and strategic partnerships play a crucial role in consolidating market share. Brands are leveraging e-commerce channels and enhancing retail presence to increase accessibility. Additionally, advancements in organic farming and regulatory compliance shape the market landscape. Companies that innovate with unique flavor profiles and functional ingredients gain a competitive edge in this evolving industry.

For instance

The global Organic Condiments industry is estimated to be worth USD 18,120.5 million in 2025 and is projected to reach USD 32,765.4 million by 2035, expanding at a CAGR of 6.7% over the assessment period of 2025 to 2035.

Sales of Organic Condiments increased at 6.9% CAGR between 2020 and 2024.

Some of the leading players in this industry include Heinz, Annie’s Homegrown, Sir Kensington’s, Primal Kitchen, Spectrum Naturals, Organicville, Simply Organic, Woodstock Foods, Tessemae’s, and Follow Your Heart.

The Asia-Pacific region is projected to hold a revenue share of 34% over the forecast period.

North America holds 36% share of the global demand space for Organic Condiments in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Organic Lamb Market Size and Share Forecast Outlook 2025 to 2035

Organic Snack Food Market Size and Share Forecast Outlook 2025 to 2035

Organic Rice Protein Market Size and Share Forecast Outlook 2025 to 2035

Organic Hydrosols Market Size and Share Forecast Outlook 2025 to 2035

Organic Trace Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Food and Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Organic Starch Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA