The global oral clinical nutrition supplement market is moderately consolidated, dominated by multinational companies and contains a strong presence of regional players and niche brands. MNCs that dominated the market include Abbott, Nestlé Health Science, Fresenius Kabi, and Danone Nutricia, which account for approximately 55% of the market share.

It provides them with extraordinarily strong and deep distribution network facilities, huge and diversified portfolio products, and sound R&D and innovation support which enables it to innovate the offering to consumers accordingly.

Local or regional companies, which operate, hold around 30% market share; those who are serving locally prevailing preferences along with economic conditions are attracted mostly by the low-priced and region-specific offer in the case of Ajinomoto, as well as in Aspen Nutritionals.

Startups and niche brands currently take 15% of the market share, carving a niche for themselves with innovation, plant-based nutrition, personalized formulation, and sustainable packaging. Two of the better-known brands here are Entira and Medifast, which built market presence on the back of direct-to-consumer models and partnerships with healthcare providers.

Explore FMI!

Book a free demo

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top Multinationals (Abbott, Nestlé, Fresenius Kabi, Danone Nutricia, B. Braun) | 50% |

| Regional Leaders (Ajinomoto, Aspen Nutritionals, Cipla, Victus) | 30% |

| Startups and Niche Brands (Entira, Medifast, Victus) | 20% |

The market is moderately concentrated with high concentration of MNCs and relatively low concentration by smaller regional and niche players.

Standard supplements, accounting for 35% of the market share, are topped by products such as Ensure and Boost, which cater to general nutrition as well as the needs of the aging population. The remaining 65% market share is accounted for by Specialized Formulas.

The market for disease-specific supplements is witnessing rapid growth driven by the increasing incidence of chronic diseases such as diabetes and renal disorders. Glucerna and Nepro are some of the top-selling brands.

High-protein and high-calorie combinations comprise an important share, mainly marketed towards surgery and disease recovery patients. In both the developed and emerging markets, pediatric supplements, including Pediasure, are popular. Manufacturers of specialized formulations, such as immune-boosting ingredients, are driving growth in these categories.

Prescription-based is the leading sales channel in the global oral clinical nutrition supplement market, accounting for a high 70% of total sales. This is because patients with specific medical conditions or nutritional deficiencies require healthcare professionals to prescribe specialized oral supplements to meet their unique dietary needs.

The prescription-based supplement formulas are designed in accurate composition with nutrient elements for various conditions of health like malnutrition, dysphagia, chronic diseases, and postoperative recovery. It involves higher degrees of regulation, clinical evidence, and health provider interaction with safety and efficacy ensured within these special products.

The global oral clinical nutrition supplement market saw much progress in 2024. Innovation, focused product launches, and strategic expansions were the cornerstones of improvement. Key players adopted region-specific strategies, releasing new products specifically tailored to regional preferences, for example, flavors in Asia and plant-based formulations in North America.

Sustainability also became a priority among multinational corporations: eco-friendly packaging and ethical sourcing. Partnerships with healthcare providers and fitness brands further enhanced market penetration.

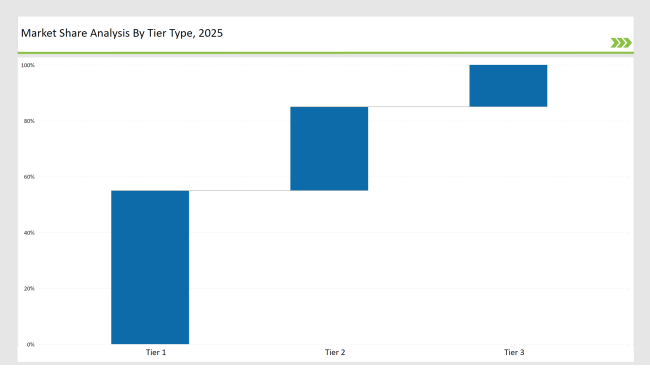

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | Abbott, Nestlé, Fresenius Kabi |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Ajinomoto, Aspen Nutritionals, Danone Nutricia |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Example of Key Players | Victus, Entira, Medifast |

| Brand | Key Focus |

|---|---|

| Abbott | Developed localized nutrition packs for low-income markets, targeting rural distribution in Asia. |

| Nestlé Health Science | Acquired regional startups in Africa to strengthen presence in emerging markets. |

| Fresenius Kabi | Partnered with tech companies to create smart nutritional tracking solutions. |

| Danone Nutricia | Launched a zero-sugar supplement for diabetics in North America. |

| Ajinomoto | Focused on fortifying supplements with amino acids for faster recovery in elderly populations. |

| Victus | Introduced cost-effective, travel-sized supplements for middle-income consumers. |

| Cipla | Expanded partnerships with hospitals to promote oncology-specific nutritional products. |

| Medifast | Invested in AI-driven platforms for personalized nutrition recommendations. |

| Aspen Nutritionals | Increased investments in sustainable sourcing and packaging innovations. |

| B. Braun | Enhanced R&D efforts for organ-specific clinical nutrition solutions. |

Products that are designed to fulfill specific nutritional needs for oncology, diabetes, and geriatric populations will dominate the market in the coming years. The growth in these disease-specific segments will be fueled by the increasing prevalence of chronic health conditions and the aging of global populations. Manufacturers can capitalize on this trend by developing high-protein, immune-boosting, and condition-tailored formulations to cater to the unique dietary requirements of these patient groups.

Demand for oral clinical nutrition supplements that are vegan and plant-based is expected to grow at a robust CAGR in the coming years. Danone, for example, can ride on this trend with the launch of plant-based versions of popular products catering to the increasing preference of consumers for nutritional solutions that are sustainable and ethically sourced.

Advances in delivery systems, including nanoemulsion technologies, will improve nutrient absorption and bioavailability. Manufacturers that invest in these innovative formulation technologies will be able to gain a competitive edge in the premium market segment, as consumers increasingly seek out high-performance, science-backed nutritional supplements.

Abbott, Nestlé, Fresenius Kabi, Danone Nutricia, and B. Braun collectively account for 50% of the market, showcasing significant dominance.

Trends include plant-based formulations, personalized nutrition through AI, and advanced bioavailability technologies for better nutrient absorption.

Regional players account for 30%, focusing on localized preferences and cost-effective products tailored to specific demographics.

The pediatric segment, with a 20% market share, is expanding rapidly due to innovations in immunity-boosting and age-specific formulations.

Stringent guidelines and approval processes for medical nutrition products, varying regulations across different regions and countries, and the need for extensive clinical trials and safety data to support product claims are some of the challenges faced by firms operating in this market.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.