The oral care market is growing at a very rapid pace. It is because of increasing awareness about dental hygiene, growing adoption of technologically advanced oral care products, and the shift towards sustainable and eco-friendly solutions. With increasing awareness and the understanding role of oral hygiene in overall general well-being among consumers, a rising rate with unprecedented speed was observed for demand and innovative formulations or smart oral devices. The leading companies holding market shares included Colgate-Palmolive, Procter & Gamble, and Unilever, who have a hold of a premium product presently utilizing advanced research, accounting to 70% share of the present market. 23% is taken by regional players and niche players that are offering products on the back of affordability and locality. There is a 7% in emerging brands concentrating on ingredients, biodegradable packaging, and zero waste oral care. The consumer is finally raising his voice through these ever-increasing demands for ethically and ecologically friendly solutions.

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Colgate-Palmolive, Procter & Gamble, Unilever) | 70% |

| Rest of Top 5 (Johnson & Johnson, GlaxoSmithKline) | 3% |

| Next 5 of Top 10 (Church & Dwight, Dentsply Sirona, Henkel, Lion Corporation, Sunstar) | 7% |

| Emerging & Regional Brands (natural and sustainable oral care startups) | 20% |

The oral care market in 2025 is highly concentrated, with top players like Colgate-Palmolive, Procter & Gamble, and Unilever controlling a significant portion of the market. While smaller brands and natural oral care products are gaining traction, established companies continue to dominate through strong branding and widespread distribution networks.

It still distributed mostly through supermarkets and retail stores, 50% since e-commerce already takes up 30% with oral care brands going exclusive online or using subscription models. Pharmacies and healthcare providers have 15% as their products are those medically prescribed while the remaining 5% went to DTC brands and niche marketplaces that talk much of solutions that are very personal and about sustainability.

The market can be categorized into four groups: toothpaste, mouthwash, toothbrushes, and floss. Toothpaste holds the lead with 45% market share due to demand for whitening, cavity protection, and gum health. Mouthwash accounts for 25% market share since there is a growing demand for alcohol-free and fluoride-based products. Toothbrushes account for 20% with electric toothbrushes fast moving. Dental floss and interdental cleaners account for 10%. That share is rising due to a growing awareness of comprehensive oral care. Who Defined the Year

2024 has been an innovative year for the oral care market, in terms of sustainability, technology, and holistic wellness trends. That's led by the following figures:

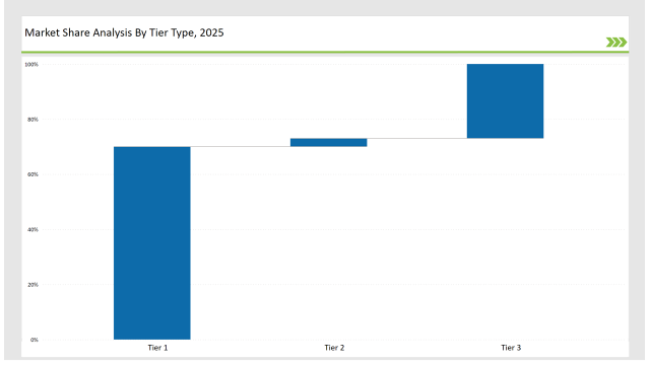

Tier-Wise Brand Classification, 2025

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Colgate-Palmolive, Procter & Gamble, Unilever |

| Market share% | 70% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Johnson & Johnson, GlaxoSmithKline |

| Market share% | 3% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, sustainable startups |

| Market share% | 27% |

Key Brand Initiatives

| Brand | Key Focus Areas |

|---|---|

|

Colgate-Palmolive |

Sustainable and plant-based oral care products |

|

Procter & Gamble |

AI-powered toothbrushes and smart oral hygiene |

|

Unilever |

Fluoride-free and herbal toothpaste offerings |

|

Johnson & Johnson |

Alcohol-free and clinically backed mouthwashes |

|

Dentsply Sirona |

High-tech electric toothbrushes and dental solutions |

|

Emerging Brands |

Zero-waste, sustainable packaging, and custom oral care |

The oral care market will be on a growth path, sustainable with innovations in sustainability, AI-driven technology, and consumer demand for holistic wellness solutions. Hybrid business models focused on e-commerce and in-store experiences will continue to be crucial for brands. Sustainability and personalization will become the key differentiators in the oral care market. The market will continue growing with an upswing in direct-to-consumer brands and AI-powered oral care solutions.

Global brands such as Colgate-Palmolive, Procter & Gamble, and Unilever hold around 70% of the market.

Regional brands focusing on herbal and natural oral care hold about 20% of the market.

Startups specializing in eco-friendly and fluoride-free products hold around 7% of the market.

Private labels from pharmacies and retail chains hold approximately 3% of the market.

High for companies with 70%+, medium for 50-70%, and low for those under 30%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oral Dosing Cup Market Forecast AND Outlook 2025 to 2035

Oral Irrigator Market Size and Share Forecast Outlook 2025 to 2035

Oral Antiseptics Market Size and Share Forecast Outlook 2025 to 2035

Oral Food Challenge Testing Market Analysis Size and Share Forecast Outlook 2025 to 2035

Oral Dosage Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutrition Desserts Market Analysis - Size, Growth, and Forecast 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Oral Immunostimulant Market – Demand, Growth & Forecast 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Oral Controlled Release Drug Delivery Technology Market Trends – Growth & Forecast 2025-2035

Oral Clinical Nutrition Supplement Market Trends - Growth & Forecast 2025

Oral Syringe Market

Oral Solid Dosage Pharmaceutical Formulation Market Analysis – Size, Share & Forecast 2024-2034

Oral Rinse Market

Oral Anticoagulants Market

Oral Screening Systems Market

Competitive Breakdown of Oral Clinical Nutrition Supplements

Key Companies & Market Share in the Oral Dosage Powder Packaging Machines Sector

Oral Care Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oral Care Market Growth – Demand, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA