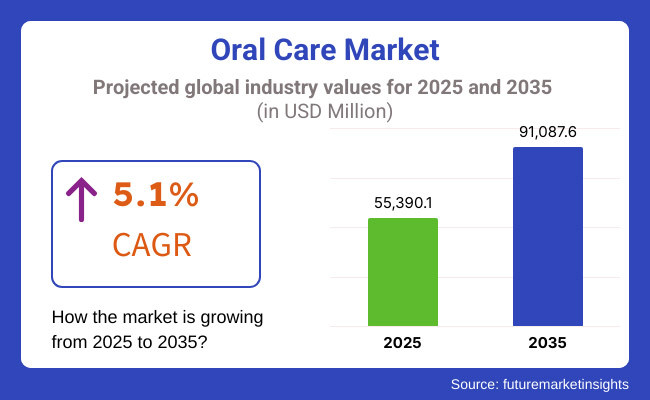

The global oral care market is projected to grow significantly, from USD 55,390.1 million in 2025 to USD 91,087.6 million by 2035. The market is expected to exhibit a CAGR of 5.1% from 2025 to 2035.

Modern technologies have brought major industrial transformations through the release of innovative oral hygiene products like electric toothbrushes, herbal toothpaste, and smart dental solutions. Market growth speeds up due to an increasing number of people understanding oral hygiene and the rising use of sustainable fluoride-free products.

The number of people who value their dental wellness has grown significantly as they notice increasing dental problems like tooth decay and periodontal diseases together with stained teeth issues. The increasing market demand for premium oral care products has grown significantly because customers now purchase high-end whitening solutions combined with probiotic toothpaste and sophisticated mouthwash systems. E-commerce marketplace reforms have made markets more accessible to consumers by providing simplified shopping procedures combined with customer-specific recommendation systems.

People consider oral care essential to personal hygiene practices because they want protective measures combined with aesthetic treatments. The market expands due to government programs which raise dental budgets and spread oral health knowledge among the population. Periodontal diseases and tooth decay continue to escalate in frequency thus maintaining market demand across all geographical areas.

The worldwide oral care market shows slow yet consistent expansion because people are paying more attention to dental hygiene through advancements in technology while their buying behaviours adapt. Market expansion in the industry especially benefits from rising incomes and urban trends as well as improved dental healthcare accessibility. More and more customers choose premium oral care products like advanced herbal toothpaste together with electric toothbrush systems and high-end mouthwash formulations with improved ingredients.

The sustainability trend has led to the market introduction of biodegradable toothbrushes and chemical-free toothpaste combined with eco-friendly packaging. The emergence of e-commerce as a booming market enabled global consumers to access oral care products more easily. Online marketplaces in combination with DTC brands provide competitive prices along with simplified shopping methods which result in consumers migrating from conventional retail shops.

Explore FMI!

Book a free demo

The table below presents the expected CAGR for the oral care market over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.9% |

| H2 (2024 to 2034) | 4.5% |

| H1 (2025 to 2035) | 6.2% |

| H2 (2025 to 2035) | 4.0% |

The CAGR exhibits a fluctuating trend, initially increasing by 59 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. Further, a slight increase of 62 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external growth. Growth declines in H2 (2025 to 2035) with a 40 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

People Today Strongly Prefer Toothcare Items Made from Natural Ingredients Together with Organic Components

People view natural and organic oral care options as vital since they want products without artificial chemicals and additives. Businesses now launch environmentally conscious along with plant-based products because of rising consumer interest. To accommodate this rising demand Colgate-Palmolive released biodegradable toothbrushes accompanied by toothpaste made from plant ingredients.

Unilever continues to develop fluoride-free and herbal toothpaste solutions that serve health-focused customers. Natural products now lead the market evolution by forcing companies to use sustainable and clean ingredients in their formulations.

Technological Innovations Drive Market Expansion

The oral care market has advanced considerably because of technological developments. AI-enabled smart toothbrushes enable users to track their brushing method in real time and receive instant feedback for performance enhancement. Through its Oral-B brand Procter & Gamble introduced AI-controlled toothbrushes that give users exact feedback about their oral hygiene practices.

The oral care market continues to grow through the adoption of toothpaste tablets together with advanced electric toothbrushes which provide popular convenient and effective oral care solutions to consumers. Technology advances provide better user experiences which simultaneously draws tech-advanced consumers to the market.

Online shopping through e-commerce has transformed how shoppers purchase products while changing their purchasing procedures

Online shopping for oral care products has completely altered consumer buying patterns throughout the digital era. People are switching to online shopping because e-retail platforms present extensive product choices with competitive pricing along with delivery-to-home services. The online retail industry of oral care products demonstrated the highest Compound Annual Growth Rate (CAGR) during the year 2024.

Amazon with Flipkart leads e-commerce providing deep discounts and wide product selections to draw in more consumers. The digital transformation caused companies to improve their online presence through direct-to-consumer models which altered the market competition by extending access to more consumers.

The worldwide oral care industry maintained sustainable development throughout 2020 to 2024 because customers became more conscious about dental care alongside manufacturers releasing better products. In 2024 the market demonstrated a value of approximately USD 52,403.1 million.

The oral care market expanded because consumers increasingly sought natural and organic choices and technology-delivered AI toothbrushes and growing online platforms gave customers access to diverse oral care items. The oral care market will keep growing between 2025 and 2035. According to analysts it will reach USD 91,087.6 million in 2035 and maintain a CAGR of 5.1%.

Tier 1: Market Leaders (55-65% Market Share)

The global oral care market is controlled mainly by three dominant entities: Colgate-Palmolive, Procter & Gamble, and Unilever because they possess robust brands together with extensive distribution capabilities alongside consistent product development initiatives. The companies make significant R&D investments to develop AI toothbrushes and sustainable packages as they advance technology through research.

Their worldwide distribution network and marketing operations deliver access to consumers worldwide. The companies offer premium versions alongside diverse products for both basic and upscale markets while keeping their competitive position alive through acquisition deals and alliance formation.

Tier 2: Established Competitors (25-35% Market Share)

Johnson & Johnson and GlaxoSmithKline represent the second tier of the market with limited but impactful shares through their clinically researched innovations in oral healthcare. Through their pharmaceutical experience, these companies create medical products including therapeutic toothpaste and medicated mouthwashes.

These manufacturers preserve solid positions in various regions together with chosen market segments by providing advanced professional oral care solutions to consumers. As a result of their partnerships with dental experts, these companies gain increased professional validation.

Tier 3: Niche and Emerging Players (5-15% Market Share)

The third tier consists of developing brands that serve different niche markets by offering organic and eco-friendly products in addition to herbal offerings. The natural oral care market appeals to health-focused customers through the products of Tom’s of Maine together with Himalaya and Hello. The brands access their customers directly by selling through e-commerce channels. The smaller market presence of these companies combined with their flexible operations makes them able to shift rapidly towards consumer patterns as well as market trends.

| Countries | Population (millions) |

|---|---|

| United States | 345.4 |

| United Kingdom | 68.3 |

| Germany | 84.1 |

| Japan | 123.2 |

| Australia | 26.3 |

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 5.2 |

| United Kingdom | 4.1 |

| Germany | 4.5 |

| Japan | 3.8 |

| Australia | 4.7 |

The oral care market of the United States stands at the forefront worldwide since Americans spend USD 5.20 each per person. The market demands are fueled by strong dentist recommendations and high dental hygiene education as well as consumer preference for premium oral care products. Electric toothbrushes together with medicated mouthwashes and whitening products displays high appeal to consumers. The progress of major brands together with smart dental device innovation and sustainable product development enhances total expenditure in the market.

The UK oral care market stands at USD 4.10 per capita budget because increasing consumer adoption of preventive dental practices. Strategic public health communications combined with NHS oral hygiene practices create rising consumer interest in fluoride toothpaste and interdental tools and sustainable oral care products. The dental care market expands through online sales because electronic commerce platforms give customers the option to subscribe during purchases.

German dental consumers focus on researching scientific solutions when they spend USD 4.50 per capita on oral health products. The dental care market depends on customers who want advanced toothpaste products as well as electric brushes and novel dental equipment technologies. Germans look for accuracy in engineering design when they buy products and therefore choose oral care products which have both advanced technologies and clinical testing. The market expansion drives from increasing interest in sustainable products in oral hygiene.

Japanese citizens spend USD 3.80 per person each month on oral care products that prioritize advanced technologies in their high-quality formulations. The demand for novel toothpaste products and ultrasonic toothbrushes and teeth-whitening solutions increases because dental aesthetics and hygiene receive substantial cultural prominence within this market. The increasing concern about gum health among consumers supports the market growth as manufacturers adding functional toothpastes that prevent periodontal diseases to their product lines.

Australia's market for oral care stands at USD 4.70 per person where customer understanding leads to increased dental services recommendations as well as market demand for high-end oral health products. Australians favor electric toothbrushes, herbal and fluoride-free toothpaste, and high-performance mouthwashes. The public interest in sustainability drives up the demand for biodegradable toothbrushes along with sustainable oral care products. Preventive healthcare initiatives have created further market development opportunities for the country.

| Segment (Product Type) | CAGR (2025 to 2035) |

|---|---|

| Toothbrush | 4.5% |

| Others | 4.9% |

The toothbrush segment continues to grow because consumers seek electric and smart toothbrushes. The 'Others' category including toothpaste interdental tools and mouthwash products is set for major expansion through innovations and better-quality premium product development.

People widely use toothpaste for maintaining good oral health because it has a substantial market demand. The product exists in diverse formulations and benefits with multiple flavours to suit individual consumer needs. The oral care market has increased its profitability to companies through continuous product innovation and marketing of toothpaste.

| Segment (Distribution Channel) | CAGR (2025 to 2035) |

|---|---|

| Convenience Stores | 4.2% |

| Others | 5.1% |

Convenience stores led the oral care market during 2024 by obtaining 37.5% market control. The oral care market finds readiness stores offer economic opportunities due to their service of fast portable shopping needs.

The accessibility of daily necessity oral care products in convenience stores increases their purchase likelihood by providing easier access to customers. Convenience stores provide affordable pricing and promotional deals that stimulate sales performance and boost recognition of oral care items among consumers.

Global competitors in the oral care market are investing heavily in R&D every day to broaden their product lines and achieve sustainability. They are expanding their production facilities through mergers and acquisitions to get ahead.

Recent Industry Developments

The market is expected to grow at a CAGR of 5.1% between 2025 and 2035.

The industry was valued at USD 55,390.1 million in 2025.

The market is projected to reach USD 91,087.6 million by 2035.

Leading companies include Colgate-Palmolive, Procter & Gamble, Unilever, GlaxoSmithKline, and Johnson & Johnson among others.

Toothbrush and Others are the key segments driving market growth.

The end-use segment is segregated into Convenience Stores and Others.

The market spans across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.