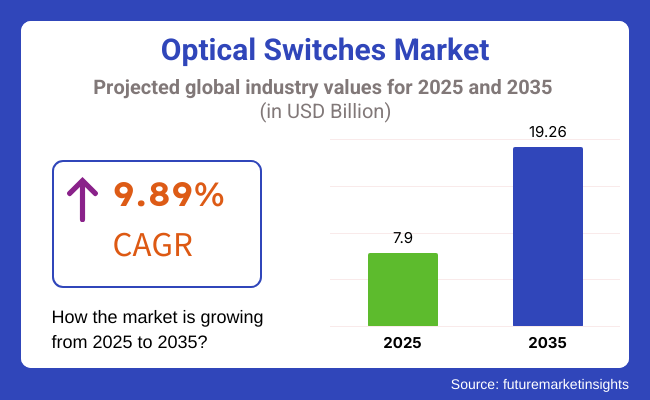

The optical switches market is expected to grow at a CAGR of 9.89% between 2025 and 2035, reaching USD 7.9 billion in 2025 and USD 19.26 billion by 2035. The growth is due to an increasing need for high-bandwidth, energy-efficient switching products and advances in photonic integrated circuits (PICs) and wavelength-selective switching technology. The industry is being propelled by the accelerating uptake of the industry within telecommunications, originally via Enterprise Networking and later on by high-performance computing.

Optical switch technology is now in development and provides much greater performance than conventional electronic switches, achieving faster data transmission, improved scalability, and superior power efficiency. By enabling seamless data transfer and reducing latency, the industry plays a crucial role in revolutionizing network infrastructures.

They are being adopted in SDN and DCI solutions to provide flexibility and automation and are becoming essential components in next-generation communications networks. With the development of network capabilities continuously by organizations and service providers, demand for high-speed, low-latency is predicted to grow by an orders of magnitude.

Several major factors drive the visitation of the industry. Fiber-optic networks and 5G infrastructure deployment are driving demand for high-performance switching technology. Data centers are also investing heavily in optical switch technologies to accommodate the immense amounts of traffic generated by cloud computing, AI applications and IoT implementations.

Moreover, developments in photonic technologies like micro-electromechanical systems (MEMS) and silicon photonics are enhancing the efficiency and reliability of the industry. Expansion in smart city initiatives and policies by governments to promote high-speed broadband connectivity is also contributing to the industry growth.

Despite having a positive future ahead, the industry is challenged by some barriers. The relatively high initial deployment costs, in addition to the challenges of integrating the industry with existing network infrastructures, may also be deterrents. In addition, the need for standardized protocols and interoperability among the multiple optical switch technologies presents a challenge for network operators.

Also, security problems regarding optical communications networks and susceptibility of data transmission through fiber-optic systems should be taken into account, and sufficient encryption and cybersecurity solutions need to be engaged to eliminate risks.

Continuous technological developments and convergence among the industry stakeholders will shape the future of the industry. Artificial intelligence-powered network optimization, edge computing and the adoption of quantum communications technology also are expected to lead to expanded functionality in optical switch products, he said.

Additionally, the increasing need for power-efficient and green networking devices is also driving manufacturers to produce low-power options. Optical networks gaining momentum in the sectors further drives the demand for the industry with long-term opportunities in cloud networking, smart infrastructure, telecom of the future etc.

Explore FMI!

Book a free demo

The industry experiences great growth due to the need for more data transmission, expansion of the 5G network, and the development of fiber optics. In telecommunications, the use of these options is very important in increasing the bandwidth capacity and minimizing latency problems.

Hence, they are a priority for investment. Data centers that are operating large-scale cloud computing and storage systems want to have faster and energy-efficient sources. The industrial automation sector uses these options in machine vision systems, robotic control, and smart manufacturing.

The industry in healthcare allows very accurate medical imaging and diagnosis, but the adoption rate is not high because of the integration problems. The defence and aerospace industry uses tough and high-reliability options in secure communications and advanced surveillance systems.

Across the technological canvas, as the demand for faster, more efficient data transmission grows, they are introduced as new-age components in every industry, increasing the network performance and trimming the operational costs.

From 2020 to 2024, the industry grew rapidly due to heightened demand for high-speed data transmission, cloud computing, and fiber-optic networks. AI deployment, 5G deployment, and data center expansion drove demand for low-latency, cost-effective optical switching. Wavelength-selective switches (WSS), 3D MEMS-based options, and acousto-optic tunable filters (AOTFs) enabled network speed and scalability.

Governments have invested in photonics innovation and the deployment of 5G networks, which encouraged subsea cable industry adoption and low-latency financial networks. Industry challenges were high cost, scalability, and supply chain disruptions. However, network management through AI, SDN, and self-healing fiber optic networks became more efficient and automated.

Industry expansion from 2025 to 2035 will be accelerated by quantum photonics, AI-optimized optical switching, and terabit-scale networks. Silicon photonics, plasmonic switches, and artificial intelligence traffic control will maximize bandwidth allocation and network responsiveness.

Quantum networking and optical processing will support real-time AI, autonomous system, and high-frequency trading processing. Edge computing will require small, power-efficient options, and photonic blockchain and quantum-safe encryption will provide superior data protection.

Sustainability will become the focus, with energy-efficient switches, reusable components, and AI-optimized wavelength enhancement enhancing network resilience and environmentally friendly footprint reduction.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments funded optical networking research, broadband expansion, and 5G infrastructure deployment. | AI-driven optical network automation, quantum-secure communication policies, and sustainability-focused regulations will define governance. |

| Adoption of MEMS-based options, silicon photonics, and wavelength-selective switching (WSS) solutions. | AI-optimized optical switching, quantum photonics, and terabit-scale optical network architectures will revolutionize data transmission. |

| They were used in data centers, 5G backhaul networks, and high-speed financial trading platforms. | AI-powered optical computing, autonomous traffic management, and secure quantum networking will expand industry applications. |

| Businesses deployed software-defined optical networks and reconfigurable optical add-drop multiplexers (ROADMs). | Artificial intelligence (AI)-driven real-time wavelength tuning, self-optimizing photonic circuits, and adaptive optical mesh networking will power future optical infrastructure. |

| High cost of deployment and power-hungry optical switches proved to be issues for widespread deployment. | Energy-efficient optical switching, recyclable photonic components, and AI-driven power optimization will improve sustainability and cost efficiency. |

| AI-driven optical network monitoring, fault detection, and automated bandwidth allocation enhanced efficiency. | Quantum-enhanced predictive analytics, self-healing optical circuits, and AI-assisted optical traffic rerouting will redefine network reliability. |

| Shortages of photonic components and expense constrained scalability of the industry. | Decentralized photonic production, AI-optimized supply chain operations, and computer-automated optical component fabrication will make markets more accessible. |

| Expansion was fueled by expanding data traffic, growth in cloud computing, and 5G network deployments. | AI-driven autonomous networking, ultra-high-speed quantum-secure data transport, and terabit-scale optical computation will drive future growth. |

The industry is showing a booming growth on the back of the demand for super speedy connections in telecom and data centers. Nevertheless, with the fact that companies face the financial difficulties on account of the high initial investments in development, research, and infrastructure, they must way out of the situation. Building long-lasting capacity for the industry would require companies to mainly work on the reduction of costs on production, the introduction of innovations, and entering into strategic partnerships.

The supply chain issues, especially the semiconductors' shortages and the need for rare earth materials, have both direct and indirect effects on production while at the same time, they increase costs. The geopolitical disputes and the restrictive measures on trade not only in part create the problems, but also add to the troubles.

To cope with these unpredictability the companies should, on the one hand, bring in more suppliers, on the other hand, they should check the use of different materials as well as they can support the economy by investing in local manufacturing facilities.

Conversely, the progress in optical switching means that the older product versions are at risk of obsolescence. The use of AI for real-time monitoring of Letflow-over connections with respect to network security issues and framework coupling between free choice networks and telecommunication networks would be the most effective operations.

Electro-Optical Switches segment is expected to dominate the industry over the forecast period accounting for around 58% of the industry share by 2025 owing to its high-speed switching capabilities along with integration with electronic circuits and their extensive use in data centers and telecom networks. These switches are based on the use of electrical signals to control the passage of light and thus can be used for applications that require sharp signal modulation and low power consumption.

Major players such as Cisco, Huawei, and Fujitsu are making its advancement a priority to optimize network efficiency and scalability. As 5G infrastructure and high-performance computing continue to grow, so will demand for electro-optical switches in cloud computing, military, and enterprise networks.

The all-optical Switches segment will cover 42% of the industry share in 2025, with markets migrating to ultra-fast latency optical networking. These switches simply rely on light signals to process the information, thereby surmounting any potential electronic conversion bottlenecks for processing data and saving energy.

Companies such as Ciena, Infinera, and Nokia are leading advancements in all-optical switching to support next-generation fibre-optic networks and quantum computing applications. As telecom operators and cloud providers scale up their fiber-optic infrastructure, all are becoming increasingly crucial for high-bandwidth and low-latency applications.

Whether with electro-optical switches or all-optical switches, they will occupy an important position paving the way for high-speed communication networks, as data traffic continues to grow and more applications are requiring the advent of 5G and the growing popularity of cloud computing.

Fiber restoration is expected to account for 57% of the industry share in 2025 due to rising demand for rapid fault recovery in fibre-optical networks. As 5G, high-speed internet, and cloud computing continue to expand, downtime is expensive-powering the growth of automated fibre restoration solutions for telecom providers, data centres, and more.

We are seeing the adoption of intelligent optical switching by major players like Ciena, Huawei, and Nokia to support self-healing networks that can automatically sense and route traffic around fiber cuts or failures. With worldwide fiber builds accelerating (both in North America, Europe, and Asia-Pacific), the industry for fiber restoration solutions will rapidly continue to expand.

In 2025, the Optic Component Testing segment of the market will make up 43% of the overall offering. It will continue to be driven by the increasing demand for quality assurance of fiber-optic networks and next-generation optical components. They are involved in testing transceivers, photonic integrated circuits (PICs), and wavelength division multiplexing (WDM) systems.

Major companies, including Keysight Technologies, Viavi Solutions, and EXFO, are devising sophisticated optical testing solutions for 5G infrastructure, data center interconnects, and quantum computing applications. The optic component testing industry is forecasted to keep growing steadily due to the increasing complexity of optical communication networks across R&D labs, semiconductor fabs, and telecom infrastructure providers.

As fiber-optic technology and the reliability standards of networks keep changing, applications such as fiber restoration and testing of optic components will continue to drive demand for these products in the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

| UK | 7.1% |

| France | 7% |

| Germany | 7.3% |

| Italy | 6.8% |

| South Korea | 7.5% |

| Japan | 7.2% |

| China | 7.6% |

| Australia | 6.9% |

| New Zealand | 6.7% |

The industry is expanding aggressively due to increasing demand for high-speed data communication, cloud computing, and mass rollouts of 5G networks. Hyperscale cloud operators and data centers are the key growth drivers, and leaders, including Cisco, Ciena, and Juniper Networks, are investing in photonic integrated circuits and SDN-based switches. Government initiatives towards broadband deployments and data security also drive industry growth.

Telecom operators and business networks are employing these options to enhance scalability and efficiency. The USA leads in R&D spending with firms developing AI-driven optical networking technologies. The increasing need for ultra-low latency networks in gaming, financial services, and AI applications ensures future industry expansion. The need for these options in autonomous vehicles, medical imaging, and space communications is also increasing, making the USA a global leader in photonics technologies.

The industry in the UK is expanding steadily with increasing investment in digital infrastructure, cloud, and national initiatives towards full-fiber broadband installation and 5G rollouts. Industry giants like BT Group and Vodafone are using optical switching technology to enhance data transmission speed and network efficiency and reduce latency.

Network management and SDN solutions based on AI optimize the utilization of these options, and overall connectivity is enhanced. The focus of the UK on cybersecurity and data protection laws spurs investments in advanced optical networking solutions.

The growing need for high-speed optical networks in enterprise IT, data centers, and telecom markets drives industry growth. Additionally, the increasing adoption of smart home devices and edge computing applications further accelerates demand in homes and offices.

France's industry is advancing with government-initiated digital transformation initiatives and increased fiber-optic network investments. The country is a leader in high-speed connectivity, and telecommunication behemoths like Orange and Alcatel-Lucent are the prime drivers for adopting optical networking solutions.

France also takes the lead in green networking with an emphasis on energy-saving products to drive sustainable development goals. Increased growth of high-speed networks in fintech, healthcare, and smart cities drives adoption.

Photonic computing and edge networking are also driving innovation in the industry. France's strong research and academic institutions also drive next-generation photonic chips and quantum communication technology, keeping France at the top in optical technology innovation.

The industry is driven by growth in applications of Industry 4.0, autonomous cars, and cloud computing, which use high amounts of data. In the Digital Strategy 2025, the government supports fiber deployment and network upgrades by AI-based networks. Flagship players like Deutsche Telekom, Siemens, and Nokia are leading technology innovations for optical switching.

Pressure towards ultra-reliable low-latency communication (URLLC) across industrial manufacturing and automotive sectors powers demand at an accelerated rate. Additionally, enhanced deployment of IoT-based and smart manufacturing further intensifies industry development. Quantum communication and research for photonic integrated circuits at the forefront by Germany is guaranteed to transform the standard of optical networking in the country.

The industry in Italy is developing in the wake of the government plan for nationwide fiber-optic infrastructure and smart city projects. The telecommunication sector, led by TIM (Telecom Italia) and Fastweb, is investing in high-speed infrastructure optical networking solutions to meet growing data demands

Italy's key priority in digitalizing sectors like healthcare, education, and finance is the promotion of the adoption of the industry. Automation through artificial intelligence and increasing reliance on cloud-based services are further propelling industry growth. Italy's increasing startup activity in photonic technology and hardware in optical networking is also contributing significantly to shaping the competitive industry landscape.

South Korea's industry is flourishing due to aggressive 5G infrastructure spending, AI networking, and semiconductor advancements. Telecom giants like SK Telecom, KT, and LG Uplus utilize these products to assure network stability and diminish latency.

Its emphasis on smart factories, IoT, and interconnected ecosystems is fueling adoption at a blistering rate. South Korea's semiconductor ecosystem plays a pivotal role in pushing next-generation optical switch components to drive innovation at every point in time. The government's vision for a hyper-connected society and innovation in AI-enabled optical networking is turning South Korea into a global leader in optics technology.

The Japanese industry is led by strong government support for high-speed networks and photonics R&D. Fujitsu, NEC, and NTT invest in software-definable and AI-adept optical solutions and networking. Japan's focus on 6G research, edge computing, and green data centers spurs industry expansion.

The application of these products in the automotive, robotics, and industrial automation industries expands the industry further. Japan's quantum optics and next-generation photonic circuit technologies are aimed at revolutionizing high-speed optical communication networks with high security.

The New Zealand industry is gradually growing with increasing fiber-optic broadband, cloud adoption, and deployment of 5G in New Zealand. Chorus and Spark New Zealand are investing in high-speed optical networking to enhance connectivity in urban and rural areas of New Zealand.

Growth is being fueled by growth requirements for low-latency, high-reliability networks within finance, healthcare, and intelligent farming verticals. Government initiatives driving digitalization and green networking in New Zealand are also driving industry growth. Expansion in the country's data center industry and requirements for satellite-based optical communication provide new opportunities for the deployment of these products.

The industry is highly competitive, characterized by the widespread adoption of high-speed data transmission, the rapid growth of data centers, and the progress of fiber-optic communication. The transition toward photonic-based network solutions, low-latency switching, and the widespread adoption of 5G and cloud computing applications drive industry expansion. Demand is also driven by the demand for energy-efficient network infrastructure, automation of telecom networks, and increased adoption in AI data centers.

The players that lead the industry are Cisco Systems, Huawei Technologies, Ciena Corporation, and Fujitsu, which invest heavily in r&d and have a strong supply chain and strategic partnerships. New players and startups are also innovating in space through MEMS-based optical switching, wavelength selective switching, SDN integration, etc.

Other major trends impacting the evolution of this industry are developments in hybrid optical-electrical switching, the emergence of highly scalable and programmable switching solutions, and increasing investments in all-optical networks.

So, companies are moving forward with M&A and partnerships to increase their industry share and technological capabilities. Cost pressures, regulatory compliance, and the increasing demand for ultra-fast and reliable connectivity solutions are also impacting competitive dynamics.

With the increasing demand for high-bandwidth, low-latency applications, industry players need to differentiate themselves with better performance, energy efficiency, and integration with next-generation networking technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cisco Systems, Inc. | 25-30% |

| Ciena Corporation | 15-20% |

| Huawei Technologies Co., Ltd. | 10-15% |

| Nokia Corporation | 5-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cisco Systems, Inc. | Provider of Fast Optical Switch Solution for Enterprise and Data Center Networks , which Enables Automation/SDN Integration. |

| Ciena Corporation | Focuses on wavelength-selective switches and optical transport network solutions for telecom and cloud service providers. |

| Huawei Technologies Co., Ltd. | Offering cost-effective optical switching solutions, enabling global telecom and 5G infrastructure for customers. |

| Nokia Corporation | Develops formally proven systems for photonic switching and optical networking technologies to increase data transport efficiency. |

Key Company Insights

Cisco Systems, Inc. (25-30%)

Cisco is a leader in the industry, integrating software-defined networking (SDN) and automation into data center and enterprise high-capacity optical switching platforms.

Ciena Corporation (15-20%)

Ciena builds optical networking gear, such as wavelength-selective switches and reconfigurable optical add-drop multiplexers (ROADMs), to refine high-speed data transport.

Huawei Technologies Co., Ltd. (10-15%)

Huawei offers cloud-based optical switching solutions designed to deliver telecom and cloud-level scalability and robustness to support 5G deployments and high-capacity optical networks.

Nokia Corporation (5-10%)

Nokia focuses on photonic switching technologies and optical transport, providing high-capacity and low-latency connections between data centers and networks.

Other Key Players (25-35% Combined)

The industry is expected to generate USD 7.9 billion in revenue by 2025.

The industry is projected to reach USD 19.26 billion by 2035, growing at a CAGR of 9.89%.

Key players include Cisco Systems, Inc., Ciena Corporation, Huawei Technologies Co., Ltd., Nokia Corporation, Fujitsu Limited, Infinera Corporation, ADVA Optical Networking, Juniper Networks, Inc., and ZTE Corporation.

Asia-Pacific and North America, driven by rising investments in fiber-optic communication, data centers, and next-generation telecom networks.

All-optical switches dominate due to their high-speed performance, low power consumption, and increasing adoption in data centers and telecommunications infrastructure.

By type, the industry covers electro-optical switches and all-optical switches.

By application, the industry includes fiber restoration, optic component testing, and optical switching.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA).

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.