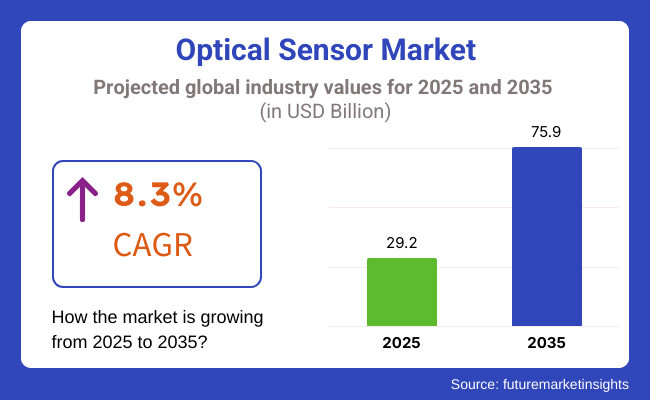

The optical sensor market will register a healthy CAGR of 8.3% from 2025 to 2035, with an estimated size of USD 29.2 billion in 2025 and USD 75.9 billion in 2035. The increasing use of smart sensors and adoption of automation in industrial operations is a key factor propelling the growth of the industry.

These sensors have been increasingly utilized for real-time sensing, precise measurement, and object recognition in various fields. They are widely used in these fields including the automotive industry, where they are used for advanced driver assistance systems (ADAS) and autonomous vehicle navigation, and the healthcare industry, where they are being integrated into wearable devices that monitor health continuously and aid in medical diagnostics.

The industry is for state-of-the-art sensing technologies which sense light, measure environmental factors and provide real-time data processing in a wide range of applications. They are particularly relevant to automotive, healthcare, consumer electronics and aerospace industries because they enable automation, increase safety and add smart device features. They are increasingly used in IoT-based applications, medical diagnostics, and high-speed optical communications; hence the industry is expected to exhibit good growth in the coming years.

Technological advancements have revolutionized the industry, leading to innovations such as advanced fiber optic sensors, infrared sensors, and laser-based detection systems, all of which contribute to improved performance and efficiency.

High-speed optical communication is another significant stimulant, the high demand for faster information transmission which subsequently is implementing optical sensing technologies in telecoms and data centers. They are already widely used in consumer electronics (e.g., facial recognition, ambient light sensing, and gesture recognition), thus representing key elements in smartphones, smart home devices, and augmented reality.

North America leads in technological sophistication due to extensive research and development in optical sensing technologies. The European industry is focusing on regulatory and automotive safety standards, which are driving the adoption of optical sensors in intelligent traffic systems. The Asia-Pacific region is rapidly industrializing and digitizing, which manifests itself as a greater deployment of these sensors in smart manufacturing, industrial automation, and consumer electronics.

The industry is poised for sustainable growth due to active developments in AI-centered data processing, miniaturization of sensor components and energy efficiency. Increasing interest in smart cities, industrial Internet of Things and next-generation healthcare solutions may continue to drive adoption. Considering the industries continue to focus on automation, connectivity, and real-time monitoring, these sensors will be at the forefront of the evolution of sensing technology, driving innovation and efficiency across industries.

Explore FMI!

Book a free demo

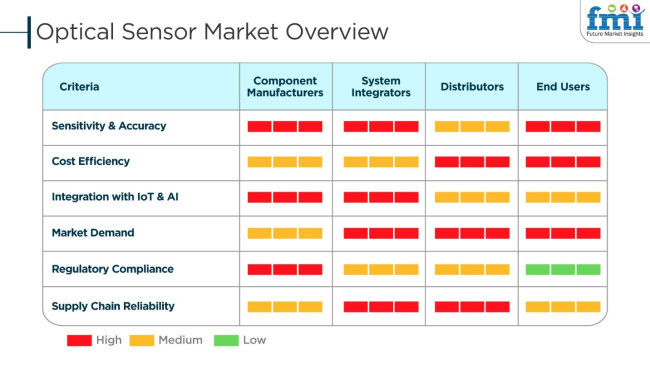

The Industry is seeing a fast increase due to the rising need in the applications of automotive, industrial automation, healthcare, and consumer electronics. Manufacturers of components pay attention to increasing the sensitivity, miniaturization, and power efficiency in order to satisfy the requirements of these high-performance applications. Integrators of the systems accentuate IoT and AI as a paramount and integral component for the improved automation, real-time monitoring, and predictive analytics.

Distributors put the cost efficiency and supply chain reliability first to make sure the industry is stocked with their product permanently. End users, which include sectors like robotics, security systems, and biomedical devices, are the ones who demand sensors that would have the combination of high precision, reliability, and reasonable price.

The main factors influencing the choice involve wavelength range, response time, environmental adaptability, and integration capabilities. The advent of LiDAR, fiber optic sensors, and photodetectors that are being utilized by industries in their quest for smart manufacturing, autonomous vehicles, and advanced medical diagnostics is indeed a major factor driving further industry development.

| Company | OSI Systems |

|---|---|

| Contract/Development Details | OSI Systems secured a USD 3 million order to supply advanced sensors for missile systems. This contract with a leading defense original equipment manufacturer (OEM) highlights OSI Systems' commitment to enhancing defense technologies. The sensors will play a key role in modernizing missile systems for improved accuracy and performance. |

| Date | March 2024 |

| Contract Value (USD Million) | USD 3 |

| Estimated Renewal Period | 6 Years |

| Company | ABB Ltd. |

|---|---|

| Contract/Development Details | ABB acquired Canadian company Real Tech, enhancing its water management portfolio with advanced optical sensor technology. Real Tech’s real-time water quality monitoring solutions and AI-driven analytics will bolster ABB's capabilities in sustainable water management. This acquisition supports ABB’s strategy to expand in the environmental technology sector. |

| Date | January 2024 |

| Estimated Renewal Period | 5 Years |

| Company | Digantara |

|---|---|

| Contract/Development Details | Indian space tech firm Digantara signed contracts with multiple USA Department of Defense agencies, including the USA Air Force and Space Force, to provide advanced electro-optical sensors capable of tracking space objects as small as 5 cm in diameter. This collaboration aims to enhance space surveillance and safety. |

| Date | February 2025 |

| Estimated Renewal Period | 3 Years |

In 2024 and early 2025, the industry experienced significant growth, driven by strategic contracts and technological advancements across various sectors. OSI Systems' USD 3 million contract to supply advanced optical sensors for missile systems underscores the defense industry's reliance on precise sensing technologies to enhance the accuracy and performance of modern weaponry.

ABB Ltd.'s acquisition of Real Tech reflects the increasing importance of this industry in environmental monitoring, particularly in real-time water quality assessments. Additionally, Digantara's collaboration with USA defense agencies highlights the critical role of advanced electro-optical sensors in space surveillance, aiming to address the challenges posed by increasing space traffic and debris. These developments indicate a broader trend towards the integration of sophisticated optical sensor technologies to improve performance, safety, and sustainability across diverse industries.

The industry grew strongly between 2020 and 2024, fuelled by innovation in consumer electronics, automotive safety systems, and industrial automation. The products were used extensively due to their precision, dependability, and non-intrusive measurement characteristics.

The use of these sensors in smartphones, wearable technology, and autonomous cars improved user experiences, safety, and operational effectiveness. Industry growth was driven by technological innovations such as miniaturization, spectral sensing, and 3D imaging.

Between 2025 and 2035, the industry will move towards intelligent, adaptive optical sensing systems based on AI-driven analytics, quantum photonics, and neuromorphic computing. They will facilitate hyper-spectral imaging, real-time environmental monitoring, and autonomous decision-making.

The emphasis will be on energy-efficient, self-powered sensors, flexible and stretchable optical devices, and AI-integrated sensing ecosystems. Quantum sensing and 6G connectivity will transform optical sensing capabilities, creating new opportunities in healthcare, smart cities, and space exploration.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Products offered multi-spectral and 3D imaging for facial recognition, gesture control, and industrial inspection. | Hyper-spectral imaging and quantum photonics will enable ultra-high resolution, real-time environmental monitoring, and non-invasive medical diagnostics. |

| AI-powered image processing enhanced object detection, facial recognition, and biometric authentication. | Cognitive AI models will provide predictive analytics, autonomous decision-making, and real-time anomaly detection for intelligent sensing systems. |

| Miniaturized products integrated with wearable devices, smartphones, and AR/VR applications. | Flexible, stretchable sensors with self-healing materials will enable seamless integration with smart textiles, bio-wearables, and electronic skin. |

| Quantum photonics improved the accuracy, speed, and sensitivity of sensing for high-precision measurements. | Entangled-photon quantum sensing will provide unparalleled precision, facilitating space exploration, quantum cryptography, and fundamental physics. |

| Low-power sensors improved the battery life in consumer electronics and IoT devices. | Energy harvesting sensors with zero-power standby capabilities will enable sustainable sensing solutions. |

| These sensors connected with 5G networks for low-latency data communication. | Optical sensing systems based on 6G with AI-enabled edge computing will offer real-time analytics, holographic communication, and decentralized decision-making. |

| These sensors enabled non-invasive health monitoring, biometric authentication, and optical coherence tomography (OCT). | Quantum-enhanced biosensors, photonic neural interfaces, and AI-driven medical diagnostics will revolutionize personalized healthcare and digital therapeutics. |

| These sensors enhanced object detection, navigation, and safety in autonomous vehicles and smart cities. | Intelligent sensing ecosystems with cognitive AI and digital twins will optimize autonomous systems, traffic management, and urban planning in smart cities. |

| These sensors monitored air quality, water quality, and environmental parameters for smart agriculture and pollution control. | Hyper-spectral environmental sensors with AI-driven analytics will enable real-time ecosystem monitoring, climate change prediction, and sustainable resource management. |

The industry for these sensors has to deal with various notable risks, such as supply chain disruptions, technological obsolescence, compliance with regulations, cybersecurity vulnerabilities, and industry competition. A major risk is the supply chain instability since optic sensors heavily depend on semiconductors, rare earth elements, and precision optical components.

Ineffectiveness of technology is yet another significant major threat, particularly due to the rapid advances in technologies such as LiDAR, fiber-optic, and infrared sensing. Businesses that fail to invest in the requisite R&D and keep up with the new needs in areas such as autonomous driving, medicine, and consumer devices are looking for the loss of industry implications.

Regulatory compliance represents also one more crucial factor that has been worried a lot about, especially in sectors like automotive (ISO 26262), healthcare (FDA, CE marking), and aerospace (FAA, EASA). The failure to achieve safety and quality requirements can incur legal penalties, recalls, and damages to the reputation of the company.

The last threat is deep industry competition as a result of low-cost manufacturers, counterfeit products, and sensor alternatives having a direct effect on the profits and the brand being put on the industry. Companies are bound to concentrate on the differentiation, innovation, and collaborations as major factors for achieving the needed competitive edge.

Low transmission loss, immunity from electromagnetic interference, high sensitivity, and energy efficiency are the main advantages owing to the demand for fiber optic sensors, which is likely to see a surge in demand in 2025. These benefits render them essential for remote sensing applications across sectors such as oil & gas, aerospace, structural health monitoring, and medical diagnostics. Oil and Gas Companies like Schlumberger and Halliburton have implemented fiber optic sensors into downhole pressure monitoring in oil drilling to improve operational safety and efficiency.

The prominence of big data analytics and IoT-driven automation further boosts demands from end users, as fiber optic sensors provide real-time data analysis, critical for predictive maintenance and operational optimization. For example, these sensors are integrated into systems like Pearson and Siemens and into intelligent manufacturing in industrial environments to control processes more efficiently.

These sensors industry is expected to grow in 2025 owing to their high reliability and excellent real-time motion tracking features. Such sensors are critical elements in many robotics, automotive, aerospace, and industrial automation applications where precise position detection directly influences the performance and safety of the system.

The automotive is one of the biggest adopters with applications in ADAS (Advanced Driver Assistance Systems), EPS (electric power steering), throttle control, and braking that uses position sensors. Bosch and Continental are examples of companies that build this type of sensor to improve vehicle stability and fuel efficiency in addition to autonomous driving functions.

Optical sensor technologies are poised to be the most widely used technological area due to the growing consumption from the automotive industry, which is expected to capture a revenue share of 10.2% in 2025. The industry is rapidly advancing technologically, with the integration of autonomous driving features and Advanced Driver Assistance Systems (ADAS), resulting in such a large share.

They form a vital part of such systems, providing reliable environmental perception and vehicle safety. With the automotive industry constantly evolving, the demand for optical sensor technologies is likely to augment as automation levels in a vehicle rise.

The industry is expected to grow significantly from 2025 to 2035, mainly due to technological advancements, the rising complexity of manufacturing processes, and the need for industries to utilize optimal, data-driven solutions to remain competitive.

Among the key verticals driving demand for these sensors is consumer electronics, in which vertical these sensors find deployments in smartphones, wearable devices, AR/VR headsets, and smart home products. Leading production houses like Apple, Samsung, and Sony use these sensors to enable facial recognition, provide a better augmented reality experience, and adjust feedback to ambient light and proximity.

Apple Face ID employs complex infrared and 3D depth-sensing tech, while Samsung Galaxy screens use optical proximity sensors to make the display on and off as a convenience for a touchless environment. Enjoy the convenience of Continuous Optical Heart Rate Sensors Wearable devices such as Apple Watch and Fitbit are used as 24 hours × 7 days, week health monitors using optical heart rate sensors.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.3% |

| China | 9.8% |

| Germany | 8.7% |

| Japan | 8.9% |

| India | 10.1% |

| Australia | 8.5% |

The USA industry is expanding steadily as industries adopt these sensors in industrial automation, smart consumer goods, and medical diagnostics. Increasing demand for AI-driven optical sensing technologies in environmental monitoring, autonomous driving, and imaging precision drives industry expansion.

In 2024, the USA government and private sector invested over USD 12 billion in optical sensing technologies, further driving innovation in IoT, AI-based sensors, and emerging healthcare technologies. FMI projects the USA industry to expand at 9.3% CAGR over the forecast period.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| IoT and Automation Smart Sensor Growth | These sensors are enriched by smart home, industrial automation, and smart city applications. |

| Rise of AI-Driven Optical Sensing | AI-supported products bring more accuracy to medical diagnosis, imaging, and machine vision. |

| Growing Healthcare, Automotive, and Security Applications | These sensors enable high-accuracy imaging and real-time processing of information. |

China's industry is increasing swiftly with the adoption of 5G infrastructure, industrial automation, and semiconductor-based AI technologies. China, the world leader in consumer electronics and automobile manufacturing, is witnessing an increased optical sensor application in facial recognition, LiDAR, and environment sensing.

Government focus from China on high-tech manufacturing and smart automation also boosts demand for the industry. In 2024, China invested USD 15 billion in R&D in optical sensing and semiconductors. FMI opines that the Chinese industry is expected to grow at 9.8% CAGR during the study period.

Growth Drivers in China

| Key Drivers | Detail |

|---|---|

| Government Initiative towards High-Tech Production | Government push on smart manufacturing and semiconductor technology. |

| Development of AI and IoT in Optical Sensing | Rising application of these sensors in facial recognition, machine vision, and LiDAR applications. |

| Growing Demand in Consumer Electronics and Automotive | These sensors contribute to road safety in autonomous vehicles and facilitate image precision in mobile phones. |

Germany's industry is expanding due to its strong industrial base, rising adoption of automation, and photonics innovation. With high-precision engineering as a thrust area, Germany is investing in products to transition into intelligent factories, safety systems of the automotive industries, and medical imaging in healthcare.

Clean technologies, especially in environmental protection and energy conservation, have been areas of focus for Germany in expanding the adoption of these sensors.

Growth Drivers in Germany

| Key Drivers | Detail |

|---|---|

| Strong Automotive and Industrial Take-Up | They are widely used in automotive security systems and factory automation. |

| Environmental- and Energy-Efficiency Requirements | They reduce energy consumption and track environmental changes. |

| Photonic and Laser-Based Sensing Innovation | Enhanced investment in high-performance photonic sensing technologies. |

Japan's industry is growing consistently due to precise image technology, increasing use in consumer products, and developments in medical diagnostics.

Japan's industrialization uses these sensors to manufacture semiconductors, robots, and AI-based automation. With its leadership role in energy-saving miniaturized sensor technology, Japan dominates the globe in terms of next-generation optical sensing technologies. FMI forecasts Japan's industry to register 8.9% CAGR during the forecast period.

Growth Drivers in Japan

| Key Drivers | Detail |

|---|---|

| Optical Sensors in Consumer Electronics | Japan is leading the integration of sensors in smartphone cameras, gaming, and wearables. |

| Growth in Robotics and Automated Manufacturing | Higher demand for these sensors in AI-driven automation and smart factories. |

| Advances in Healthcare and Medical Imaging | Growing application of these sensors for non-invasive diagnosis and biomedical applications. |

India's industry is expanding rapidly since IoT adoption, smart city projects, and artificial intelligence-based security applications are becoming increasingly fast-paced. Government-initiated programs such as 'Make in India,' and higher levels of consumer electronic production have led to the adoption of these sensors for security monitoring, industrial control, and fingerprint recognition. Small and medium-sized businesses and business firms are deploying effective, high-performance optical sense solutions.

Growth Drivers in India

| Key Drivers | Detail |

|---|---|

| Government Schemes for Smarter Infrastructure | Smart IoT and surveillance policies spark sensor adoption. |

| Industrial and Consumer Electronic Growth | Increased use of these sensors across consumer electronics, security devices, and smart appliances. |

| Increased Need for AI-Based Products | SME and organization adoption of new detection solutions. |

Australia's industry is increasing steadily with renewable energy, environmental monitoring, and healthcare technology. The major industries, such as mining, agriculture, and defense, are embracing these sensors for precise tracking, automation, and safety requirements. Government initiatives towards technological development in photonics are also driving the industry.

Growth Drivers in Australia

| Key Drivers | Detail |

|---|---|

| Government Investment in Renewable Energy & Environmental Monitoring | These sensors offer real-time energy efficiency and environmental fluctuation measurements. |

| The Rise of AI and IoT-Based Optical Sensors | Companies use smart sensors for security and automation needs. |

| Growing Demand for Precise Medical and Scientific Imaging | These sensors are a key component of research labs and medical diagnostics. |

The industry is experiencing rapid growth, driven by rising demands in consumer electronics, automotive, healthcare, and industrial automation. Optical sensors are used in various applications, including biometric recognition, environmental monitoring, and fiber-optic communication, imposing constant demand for innovations concerning sensitivity miniaturization and AI-based sensing.

Through constant capital infusion, companies such as ams-OSRAM, Hamamatsu Photonics, STMicroelectronics, ON Semiconductor, and ROHM Semiconductor are focused on innovative solutions that increase sensor performance and power efficiency while guaranteeing real-time processing of data. The integration of These sensors with the IoT ecosystem, high-speed communication networks, and AI-driven analytics further strengthens these players' competitive position.

Contributions from start-ups and niche providers are also providing industry evolution toward specialized solutions, guiding the development of hyperspectral imaging, quantum dot-based sensors, and next-gen LiDAR systems. The strategic partnerships with semiconductor manufacturers and automotive OEMs are further widening applications into autonomous vehicles, smart wearables, and industrial safety monitoring.

As regulatory requirements come down in full force in the domains of environmental sensing, medical diagnostics, and cybersecurity, the companies with early investments in superior precision detection, energy-efficient designs, and robust security frameworks stand to have a competitive advantage. The nature of competition will be towards those with investments in mass production and a diversified application portfolio.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ams-OSRAM AG | 20-25% |

| Hamamatsu Photonics | 15-20% |

| ON Semiconductor | 10-15% |

| STMicroelectronics | 8-12% |

| ROHM Semiconductor | 5-10% |

| Vishay Intertechnology | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| ams-OSRAM AG | High-performance optical sensors for industrial, automotive, and consumer applications. |

| Hamamatsu Photonics | Advanced photodetectors, imaging sensors, and fiber optic components. |

| ON Semiconductor | Optical sensing solutions for smart lighting, industrial automation, and biometric applications. |

| STMicroelectronics | Miniaturized optical sensors for mobile devices, healthcare, and IoT applications. |

| ROHM Semiconductor | Infrared and ambient light sensors for consumer electronics and automotive safety systems. |

| Vishay Intertechnology | Optical sensors for industrial automation, proximity detection, and wearables. |

Key Company Insights

ams-OSRAM AG (20-25%)

ams-OSRAM is the winner in the optical sensor industry by providing high-performance sensing solutions for all its applications, including industrial automation, safety in automobiles, and smart devices. Future emerging sensor technologies are concentrated mainly in the areas of AI-based and energy-efficient sensors, which can strengthen competitive positioning.

Hamamatsu Photonics (15-20%)

Hamamatsu develops photodetectors and fiber optic components primarily for the medical, industrial, and scientific domains. Its continuous development investment in high-sensitivity, high-precision sensors has been increasing its status in the industry.

ON Semiconductor (10-15%)

ON Semiconductor is a provider of optical sensing solutions that are specifically optimized for biometric recognition, industrial automation, and smart lighting. The company is expanding its portfolio to include high-efficiency and AI-powered sensors.

STMicroelectronics (8-12%)

STMicroelectronics is focusing on miniaturized optical sensors for mobile, health care, and IoT applications. His advancements in low-power, high-accuracy sensors add to a growing presence in the industry.

ROHM Semiconductor (5-10%)

Infrared and ambient light sensors are manufactured by ROHM for both consumer electronics and automotive applications. The company's focus on energy efficiency with compact design features provides a sound foundation for industry dominance.

Vishay Intertechnology (4-8%)

In parallel with the above, Vishay Optics has an array of these sensors adopted for industrial automation, wearables, and proximity detection; indeed, the company innovates in optical sensing in diversified industrial applications.

Other Key Players (30-38% Combined)

The industry is projected to witness USD 29.2 billion in 2025.

The industry is anticipated to reach USD 75.9 billion by 2035.

India, set to record 10.1% CAGR during the assessment period, is poised for fastest growth.

The key companies in the industry include Analog Devices Inc., ABB Ltd., Hamamatsu Photonics, STMicroelectronics, AlphaSense, Texas Instruments, NXP Semiconductor, ams AG, Honeywell International Inc., and ROHM Semiconductor.

Fiber optics are widely used.

By type, the industry is segmented into fiber optics, position sensors, image sensors, ambient light sensors, proximity sensors, infrared sensors, and others.

By application, the industry is segmented into consumer electronics, automotive, industrial process control, military & defense, energy & utility, transportation & navigation, and others.

Region-wise, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.