The deployment of high-speed optical modulators is projected to grow from USD 43.2 billion in 2025. It is anticipated to grow at a rate of 5.4% to reach USD 73.09 billion by 2035. In 2024, the optical modulators market saw significant developments, driven by advancements in telecommunications, quantum computing, and high-speed data transmission technologies. Notably, several key players introduced enhanced lithium niobate modulators, which contributed to a surge in demand for optical components in 5G networks and fiber-optic communication systems.

The market also witnessed a rise in the adoption of electro-optic modulators, particularly in data centers where low-latency communication and high bandwidth are critical. By mid-2024, several strategic collaborations were formed between manufacturers and semiconductor companies, accelerating the integration of these modulators with next-generation photonic chips for AI-driven applications.

In terms of regional growth, North America and Asia-Pacific continued to dominate, with significant investments in photonic integrated circuits and optical interconnects. The integration of these modulators in quantum computing platforms and LiDAR systems further expanded their application scope.

Looking ahead to 2025 and beyond, the market is expected to maintain a steady growth trajectory, driven by increasing demand for high-speed data transmission in telecom and computing. The deployment of 5G and future 6G technologies will likely spur further adoption. Additionally, as quantum technologies mature, these modulators will become more integral to these platforms, fostering innovation and market expansion through 2035.

Market value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 43.2 billion |

| Industry Value (2035F) | USD 73.09 billion |

| CAGR (2025 to 2035) | 5.4% |

Explore FMI!

Book a free demo

This industry is poised for steady growth, driven by the increasing demand for high-speed data transmission and advancements in 5G, quantum computing, and photonics technologies. Companies investing in electro-optic modulator innovation and integration with AI-driven systems will benefit the most, while those unable to adapt to these rapid technological changes risk falling behind. The market will continue to evolve, with significant opportunities for players in telecommunications, data centers, and quantum computing sectors.

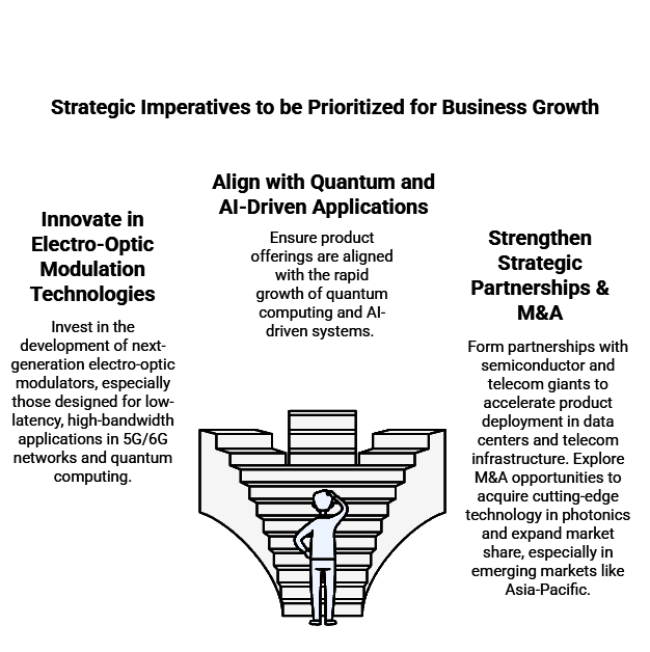

Innovate in Electro-Optic Modulation Technologies

Invest in the development of next-generation electro-optic modulators, especially those designed for low-latency, high-bandwidth applications in 5G/6G networks and quantum computing. Focus on enhancing performance, power efficiency, and miniaturization to stay ahead of emerging market demands.

Align with Quantum and AI-Driven Applications

Ensure product offerings are aligned with the rapid growth of quantum computing and AI-driven systems. Strengthen R&D efforts to integrate these modulators with photonic chips, enabling new applications in high-performance computing and next-gen communication networks.

Strengthen Strategic Partnerships & M&A

Form partnerships with semiconductor and telecom giants to accelerate product deployment in data centers and telecom infrastructure. Explore M&A opportunities to acquire cutting-edge technology in photonics and expand market share, especially in emerging markets like Asia-Pacific.

| Risk | Probability & Impact |

|---|---|

| Technological Obsolescence | High probability, High impact |

| Supply Chain Disruptions | Medium probability, High impact |

| Regulatory and Compliance Challenges | Medium probability, Medium impact |

| Priority | Immediate Action |

|---|---|

| Technology Advancement | Run feasibility on next-gen electro-optic modulator technologies |

| Industry Collaboration | Initiate partnerships with telecom giants for 5G/6G deployment |

| Research & Development | Launch R&D collaboration with quantum computing firms for integration |

To capitalize on the increasing demand for high-speed data transmission and quantum computing, the client needs to strategically target its next-generation electro-optic modulator technologies to 5G/6G network and quantum computing applications. This emerging market segment allows the client to lead in next-generation telecom and secure a strong position in advanced photonics solutions through R&D in miniaturized, high-efficiency modulators.

Looking forward, this intelligence should orient the roadmap towards category-redefining product innovation, and forward-looking M&A that improves technology differentiation and strengthens AI-driven systems for enhanced performance. This will keep the client-agency front and center in a high-growth environment.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, telecom operators, and research institutions in the USA, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Telecom Operators/Research Institutions):

Alignment:

Divergence:

High Consensus:

Key Variances:

Strategic Insight:

Tailoring products and solutions for regional markets- focusing on cost-efficiency in Asia, AI integration in the USA, and sustainability in Europe- will be key to capturing market share.

| Country | Impact of Policies & Regulations |

|---|---|

| United States | FCC regulations for 5G rollout drive demand for high-performance optical modulators. Certification: Compliance with FCC technical standards, including EMC and safety. |

| United Kingdom | UK’s telecom infrastructure plans, including 5G deployment, support the modulator growth. Certification: CE marking required for safety and environmental compliance. |

| France | France supports 5G and broadband expansion, boosting optical modulator adoption. Certification: CE marking required for telecom equipment safety and EMC standards. |

| Germany | Strong 5G development and emphasis on sustainability increase demand for optical modulators. Certification: CE marking and adherence to EU regulations required. |

| Italy | Italy’s focus on 5G and smart city projects drives the demand. Certification: CE marking required for compliance with EU safety and EMC standards. |

| South Korea | 5G and smart city initiatives foster demand for low-latency modulators. Certification: RRA regulations and EMC compliance mandatory for telecom equipment. |

| Japan | Japan’s 5G infrastructure development supports the use of these modulators. Certification: Telecommunications Business Law (TBL) certification and EMC compliance needed for telecom equipment. |

| China | China’s aggressive 5G rollout increases demand for optical modulators. Certification: CCC certification ensures compliance with national safety and technical standards. |

| Australia & NZ | 5G development and telecom infrastructure expansion promote modulator adoption. Certification: Compliance with ACMA and EMC standards required for telecom devices. |

Electro-optic modulators (EOMs) are the leading type in the market and play a critical role in telecommunications. Notably, the EOM market is expected to experience robust growth due to the increasing demand for 5G networks, which allow for quick, efficient data transfer over long distances with high precision and limited signal degradation.

However, acousto-optic modulators (AOMs) are the fastest-growing segment among optical modulators due to their versatility and accuracy. Because of their ability to modulate light in real-time, they are increasingly employed in applications like medical imaging, laser processing, and defense, where high accuracy is critical.

Optical modulators are the largest application in telecommunications, where there is a big need for high-speed communication for fiber-optic networks and an increasing demand for 5G infrastructure. As they enable higher data transfer and signal processing speeds, these modulators continue to be a core component of telecommunications development.

Healthcare, on the other hand, is the fastest-growing application, as optical modulators are important in medical imaging systems, primarily optical coherence tomography (OCT), and laser surgery equipment. Easy and fast diagnostic techniques are driving the adoption of advanced medical devices and tools. As manufacturers focus on non-invasive diagnostics, revenue in this segment is expected to grow over the forecast period.

The USA is expected to maintain strong growth in the optical modulator market due to its leadership in 5G, AI, and telecom infrastructure, with a CAGR of 5.5%. The USA remains a key driver in the global technology sector, with ongoing investments in 5G infrastructure, autonomous systems, and AI-driven applications. The Federal Communications Commission (FCC) is pushing for the widespread adoption of 5G, creating a growing demand for high-speed optical modulator technologies to ensure data transfer across new networks.

The market is also bolstered by a strong regulatory environment, including EMC standards and safety certifications, which are necessary for market access. Additionally, with a push towards sustainability and green technologies, the demand for energy-efficient, environmentally friendly optical modulators is expected to grow in line with governmental incentives and corporate sustainability goals.

The UK's steady investment in 5G and digital infrastructure will contribute to a stable growth trajectory, yielding a CAGR of 5.2%. The UK is witnessing rapid 5G and broadband expansion, aligning with the government’s “5G Strategy for the UK” initiative, which seeks to build a world-leading telecom network. As telecom providers aim for faster and more reliable data transfer, demand for advanced modulation technologies is on the rise.

Manufacturers must meet CE certification standards, ensuring compliance with European safety, health, and environmental regulations. Furthermore, the UK government’s focus on sustainability is pushing for eco-friendly designs, such as low-power, recyclable modulators. Following Brexit, the UK’s regulatory landscape has evolved but remains largely aligned with EU directives on telecom infrastructure.

The CAGR for France from 2025 to 2035 is 5.1%. France, like much of the EU, is heavily invested in 5G infrastructure, which directly boosts the demand for optical modulators. The French government’s commitment to the digital economy and smart city projects further fuels this growth, as telecom networks demand increased bandwidth and high data rates.

The regulatory environment in France requires products to meet CE marking standards, ensuring safety and compliance with EU-wide regulations. France also has a strong focus on sustainability, with eco-friendly and energy-efficient solutions becoming more attractive. The country’s telecommunications sector is shifting towards smart technologies and green solutions, creating opportunities for energy-efficient optical modulators.

Germany's CAGR from 2025 to 2035 is expected to be 5.3%. Germany, Europe’s largest economy, is a key player in the global telecom market, investing heavily in 5G networks and Industry 4.0 technologies. The growing demand for optical modulators aligns with the country's digital infrastructure expansion. Telecom equipment in Germany must be CE certified, a requirement stemming from EU regulations to prove compliance with safety, environmental, and technical standards.

Germany’s focus on energy-efficient technologies and sustainability further drives the development of low-power, high-performance modulators which satisfy the rapidly increasing digital requirements across urban and industrial applications including manufacturing and smart cities.

The estimated CAGR for the optical modulator market in Italy from 2025 to 2035 is 5.0%. The Italian telecom sector is being increasingly driven towards modernization, especially with respect to 5G deployment. The rise of the Fourth Industrial Revolution in Italy, along with its government's commitment to digital transformation and innovation, is driving demand for high-speed and low-latency technologies such as optical modulators.

CE certification still plays an important role for market access and compliance with EU standards required by default for any kind of telecom-related equipment. Moreover, Italy's emphasis on sustainability and carbon footprint reduction is creating opportunities for manufacturers to develop eco-friendly modulator solutions.

The CAGR for the optical modulator market in South Korea from 2025 to 2035 is estimated to be 5.6%. South Korea, a leader in 5G adoption, is heavily investing in its telecom infrastructure and smart city projects, fueling demand for high-speed data transfer technologies such as optical modulators. The country has a robust regulatory framework managed by the National Radio Research Agency (RRA), which ensures that telecom devices comply with strict technical and safety standards.

South Korea is also focused on sustainability, and with the rapid deployment of 5G networks, there is a significant push for energy-efficient and space-saving modulation technologies. Given the country’s strong emphasis on innovation and technology, optical modulators are expected to play a crucial role in future advancements.

The CAGR for the optical modulator market in Japan from 2025 to 2035 is estimated to be 4.5%. Japan continues to invest heavily in next-generation 5G networks, smart cities, and IoT systems, driving demand for advanced optical modulators. The country has a strong regulatory environment, requiring compliance with the Telecommunication Engineering Center (TEC) certification and electromagnetic compatibility (EMC) standards.

While the adoption of optical modulators is growing, cost efficiency remains a key concern in Japan, particularly for smaller telecom applications. Nevertheless, the push for sustainability and energy-efficient technologies is driving the development of compact and eco-friendly modulators. As Japan moves toward greater automation and digitalization, optical modulators will remain essential in facilitating high-speed communication systems.

China is anticipated to grow at a CAGR of 6.0%. China is one of the largest and fastest-growing markets for telecom infrastructure, with a massive push for 5G deployment and smart city projects. The government’s emphasis on technological self-reliance and innovation is spurring demand for optical modulators that can handle large volumes of data with low latency.

Regulatory standards in China require compliance with the China Compulsory Certification (CCC) for telecom equipment, ensuring product safety and quality. China’s focus on energy-efficient technologies, along with the growing trend towards sustainable manufacturing, is driving the development of high-performance modulators. With the country’s strategic focus on advanced technology, the optical modulator market will continue to thrive.

The CAGR for the optical modulator market in Australia and New Zealand from 2025 to 2035 is estimated to be 5.0%. Australia and New Zealand are making significant strides in the 5G rollout, with the Australian government particularly focused on expanding telecom networks to underserved areas, which is expected to drive demand for optical modulators.

Australia’s regulatory framework requires compliance with standards set by the Australian Communications and Media Authority (ACMA) and EMC requirements. New Zealand’s regulatory environment is similar, with an emphasis on ensuring safety and network reliability. Both countries are also focused on sustainability and are increasingly interested in energy-efficient technologies, making this an opportune time for manufacturers of eco-friendly and low-power modulators to enter the market.

Gooch & Housego expanded fiber-coupled acousto-optic modulators for quantum computing and enhanced manufacturing for high-power modulators. Intel advanced their silicon photonics portfolio with new integrated designs and co-packaged optics solutions. Fujitsu developed modulators for data center interconnects and improved their LiNbO3 technology.

Axsun Technologies released new solutions for medical imaging and expanded manufacturing capacity. Brimrose introduced acousto-optic designs for laser material processing. Inrad Optics launched improved electro-optic modulators with reduced insertion loss and expanded custom services.

APE released new pulse shapers for ultrafast laser applications. Conoptics developed new solutions for quantum technology applications and improved designs for higher-bandwidth applications.

Fujitsu Ltd

Estimated Share: ~25-30%

The dominant player in telecom-grade optical modulators, Fujitsu strengthened its position in 2024 through its acquisition of German photonics company LIONIX International (February 2024), enhancing its indium phosphide modulator technology for 800G/1.6T datacom applications. [Source: Fujitsu Press Release]

Intel Corporation

Estimated Share: ~20-25%

Intel maintained strong momentum in silicon photonics, launching its co-packaged optical (CPO) modulator platform for AI data centers in Q3 2024. The company secured major contracts with leading cloud providers for its integrated laser-modulator chipsets. [Source: Intel Investor Relations]

Gooch & Housego PLC

Estimated Share: ~15-20%

The UK-based specialist expanded its aerospace and quantum capabilities in 2024, opening a new £20 million manufacturing facility in Torquay (April 2024) dedicated to high-performance electro-optic modulators. [Source: G&H Annual Report]

Axsun Technologies, Inc

Estimated Share: ~10-15%

The LiDAR modulator leader formed a strategic partnership with Lumentum (June 2024) to develop next-generation MEMS-based optical modulators for autonomous vehicle applications. [Source: Photonics Media]

Brimrose Corporation of America

Estimated Share: ~5-10%

Brimrose secured a significant USA Department of Defense contract (April 2024) for its free-space optical communication modulators, strengthening its position in defense applications

Conoptics, Inc.

Estimated Share: ~4-7%

Specializing in high-speed analog modulators, Conoptics launched its new MOD-1000 series in Q2 2024, featuring improved linearity for aerospace testing applications. The company also expanded its production capacity by 30% to meet growing defense sector demand.

APE Angewandte Physik & Elektronik GmbH

Estimated Share: ~3-6%

The German manufacturer introduced its ultra-fast pico-second modulator series in March 2024, targeting advanced quantum computing research. APE GmbH secured a partnership with a leading European research institute to develop custom modulator solutions.

Inrad Optics, Inc.

Estimated Share: ~2-5%

Inrad Optics expanded its nonlinear crystal-based modulator offerings in 2024, with particular focus on medical imaging applications. The company received FDA clearance for its new medical-grade optical modulator in Q1 2024.

AA Opto Electronic

Estimated Share: ~2-4%

The French company launched its cost-optimized industrial modulator line in January 2024, specifically designed for factory automation sensors. AA Opto reported 40% year-over-year growth in Asian markets.

Felles Photonic Instruments Limited

Estimated Share: ~1-3%

This UK-based niche player developed a novel quantum optics modulator in collaboration with Oxford University (announced May 2024). The company secured £2 million in government funding for quantum technology development.

These modulators control light properties for applications like telecom, medical imaging, and lasers.

Optical modulators work by manipulating the properties of a light beam, such as its amplitude, phase, frequency, or polarization, using external signals or effects to encode information or control light transmission.

Telecom, healthcare, defense, and manufacturing use them for data transfer, diagnostics, and laser processing industries benefit from these modulators.

Electro-optic, acousto-optic, and liquid crystal modulators are commonly used for these modulators.

Faster modulation speeds, improved efficiency, and integration with 5G and advanced imaging are the recent advances in the technology.

The optical modulator market is divided into different types, including phase modulators, polarization modulators, analog modulators, and others.

The market is segmented based on applications, which include optical communication, fiber optic sensors, space and defense, and industrial systems.

The market is further categorized by region, covering North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.