From 2025 to 2035, the optical encoder market will continuously grow as industrial automation systems seek motion control technologies with highly tuned accuracy. The industry size is expected to grow from USD 3.6 billion in 2025 to USD 8.7 billion in 2035.

Extensive use of robots, semiconductor fabrication equipment, NC machine tools, aerospace & defense products and health care equipment are driving the growth. As industries move to intelligent manufacturing, AI-driven automation, and contactless sensing technology, their demand for optical encoders will greatly increase. In a range of different industries, optical encoders are essential for precision motion control, speed control, and feedback mechanisms.

Optical encoders comply with light-based detection principles for both rotational and linear motion, enabling high precision, reduced mechanical wear, and longer life. Optical encoders have no mechanical contact and are, therefore, wear-free. In applications like friction-free ring gauges and touch probes where additional friction might cause wear and tear, optical encoders are more suitable.

In addition, the integration of Industry 4.0 technology and AI-based diagnostics further drives their use in future manufacturing systems. Several major factors influence the industry. The substantial uptake of robotics and automated technologies in manufacturing, automotive, and aerospace industries has led to a major increase in demand for accurate motion control systems.

Contactless sensing technologies, such as optical encoders, are also being used in conjunction with harsh industrial applications because conventional mechanical encoders will not work.

In addition, advances in machine learning and AI allow real-time diagnostics, predictive maintenance, and better operational efficiency, which is broadening the acceptability of optical encoders in applications that need extreme precision ultra-high speed positioning systems. Without a doubt, there is a robust growth potential. However, there are still some problems with optical encoders.

High initial costs for sophisticated optical encoder systems may inhibit their widespread use, especially by small and medium-sized companies (SMEs). Also, difficult integration with legacy industrial machinery and susceptibility to dust, dirt, and environmental noise can affect performance in some applications. The availability of competing encoder technologies, such as magnetic encoders, is also a source of competition, particularly in price-sensitive industries.

However, the growing industry has a few potential problems. Use of high-resolution, miniaturized encoders in semiconductor manufacturing medical imaging applications is now happening more often, sending the industry off into a new direction. The industry is facing changes because of fiber optic technology, AI-based calibration, and wireless communications into a facility offering greater precision and real-time monitoring functions and features.

It is also forecast that 5G networks and IoT-based industrial automation will generate new applications for optical encoders in smart factories, automatic vehicles, and future-generation robotics. As the industry keeps on entering this era of digital transformation and AI-driven motion control, the demand for optical encoders is destined to continue growing.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 3.6 billion |

| Industry Value (2035F) | USD 8.7 billion |

| CAGR (2025 to 2035) | 9.5% |

Explore FMI!

Book a free demo

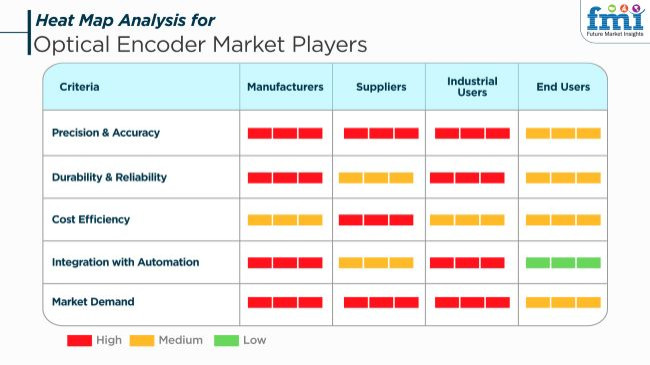

There have been huge surges of developments primarily due to an increased automation and robotics. Producers are prioritizing high-resolution encoders, toughness, and integration with the fourth industrial revolution (Industry 4.0) systems, thus, they provide real-time feedback and improved precision.

Suppliers are focusing on cost efficiency and supply chain optimization, ensuring that encoders are offered for various industries such as automotive, health care, and consumer electronics. Industrial customers are looking for the most accurate encoders for the use of motion control, CNC machinery, and robotics. They are worried about their performance and longevity in the most severe conditions.

Final customers, such as those in the consumer electronics and gaming sectors, usually turn their attention to compact, reliable, and economical solutions to applications like joysticks, trackballs, and digital cameras. The key decision factors are resolution, signal stability, cost-effectiveness, and compatibility with automation systems.

Contract & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Renishaw plc | Approximately USD 70 &ndash USD 80 |

| Heidenhain GmbH | Approximately USD 80 &ndash USD 90 |

| OMRON Corporation | Approximately USD 60 &ndash USD 70 |

| Rockwell Automation | Approximately USD 50 &ndash USD 60 |

During 2020 to 2024, the market for optical encoders grew, as a lot of automation took place in the consumer electronics and manufacturing sectors. Motion control applications requiring high precision led to the demand for high-precision optical encoders for use in industrial automation and medical devices. Robotics was used in the logistics and automotive industries.

This grew the demand for high-resolution encoders. Decreasing their size, the encoders could be integrated into small electronic devices. Technological developments improved precision, longevity, and resistance to the environment.

However, the production was costly, which made the product costly too. Hence, optical encoders were not used in large numbers, and the sales were not up to the mark. Between 2025 and 2035, the industry will see additional innovations, focusing on AI-based predictive maintenance, advanced signal processing, and connectivity with IoT systems. The emergence of smart factories and autonomous systems will drive demand for high-speed, ultra-accurate encoders.

Optical encoders with real-time monitoring of data and wireless connectivity will facilitate smooth automation in various industries. Sustainability issues will compel manufacturers to adopt energy-efficient designs and environmentally friendly materials. With deeper automation in various sectors, optical encoders will be an integral part of precision-based applications.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The growth of Industry 4.0 fueled the need for high-precision optical encoders for CNC machines, robotic arms, and automated assembly lines. | Optical encoders with AI support allow self-calibrating, real-time adaptive motion control for fully autonomous manufacturing systems, lowering mechanical errors and increasing efficiency. |

| Optical encoders developed higher resolutions in a smaller form factor to suit medical devices, semiconductor equipment, and aerospace applications. | Artificial intelligence-based nanoscale optical encoders improve accuracy in quantum computing, neurosurgical robotics, and space exploration, making next-generation motion sensing and control possible. |

| AI-powered optical encoders helped to predict future maintenance in mission-critical applications with reduced machine downtime. | Self-learning encoders that get feedback from AI detect motion system failures on their own, pre-emptively tweaking parameters to prevent failure in industrial, automotive, and defense use cases. |

| Use cases required ultra-high-speed encoders to achieve precision to a nanometer level in positioning. | AI-optimized and real-time error-corrected optical encoders achieve sub-nanometer positioning accuracy, facilitating innovation in biomedical imaging. |

| Miniature optical encoders were used in headsets, smartwatches, and gaming headsets to make the user experience better and also make tracking more precise. | Optical tracking encoders with AI assistance power future-haptic feedback solutions, providing highly accurate motion sensing for neurotechnology and extended reality (XR) interfaces. |

| Small-sized optical encoders played very important roles in navigation that used LiDAR and even in electric motor drives in EVs and Advanced Driver Assistance Systems (ADAS). | Artificial intelligence-based optical encoders help control vehicle motion in real time. Hence, autonomous driving becomes safer, the vehicle has better braking systems, and next-generation mobility solutions support accurate parking. |

| Legacy optical encoders enhanced performance by handling signals better, but mechanical degradation was a challenge. | Fiber optic and photonic-based encoders replace legacy optical disks with greater durability, environmental immunity, and ultra-high-speed data transfer for aerospace and deep space missions. |

| Optical encoders enhanced precision guidance systems in UAVs, missile guidance, and space exploration equipment. | Artificial intelligence-enabled radiation-hardened optical encoders provide ultimate reliability in deep-space exploration, high-speed military UAVs, and sophisticated missile guidance systems. |

| Industry players worked to create low-power optical encoders to enhance the efficiency of battery-powered devices. | AI-based energy-harvesting encoders do away with battery requirements by using motion-based technology to drive continuous operation in remote and off-grid industrial solutions. |

The global optical encoder circuit is at risk of supply chain issues, proprietary technologies, cyber threats, regulatory conformity, and competition.

Supply chain disruptions could be detrimental to the manufacturing process of encoders as they are heavily dependent on semiconductors, precision optics, and electronic components. Trade conflicts, material shortages, and global shipping constraints can cause losses and costs will rise to unexpected levels. Distribution of manufacturing hubs and supplier networks along with regional manufacturing could work this out.

Technological obsolescence is a serious issue as optical encoders face equivalents like magnetic and capacitive encoder devices. Encoder makers need to put up with the rapid progress in AI-driven motion control, Industry 4.0, and robotic automation by being involved in the R&D of high-resolution, ultra-precise, and ruggedized designs to keep pace with the industry.

Smart encoders that are used in IoT-connected automation systems are subject to cybersecurity threats. The unauthorized access of the encoder data could cause the system to malfunction, cause process inefficiencies, and lead to industrial sabotage. The use of secure firmware and encrypted communications with real-time monitoring can enhance security.

Regulatory compliance holds high priority for encoders that are used in industries like aerospace, automotive, and medical devices. The adoption of ISO, CE, and industry-specific safety certifications will increase acceptance in the market, but these will also be additional development costs. It is also formidable to follow RoHS and REACH regulations for the use of eco-friendly materials.

Competition is increasing with major brands like Renishaw, Rockwell Automation, and Heidenhain. Optical encoder manufacturers are obliged to customize for special solutions, ruggedly more durable for extreme environments, and for integration into the smart factory ecosystem, which is the only way to stand firm against competition.

The United States has a rapidly expanding market, driven by increasing demand for precision motion control, robotics, and automation in industries such as aerospace, healthcare, and manufacturing. The USA industrial sector is leveraging optical encoders for high-accuracy positioning, motor feedback systems, and automation in CNC machinery.

With ongoing investments in AI-integrated optical encoders, IoT-enabled motion control systems, and semiconductor manufacturing, the demand for optical encoders continues to grow. In 2024, the USA government and private sector invested over USD 10 billion in optical encoder technologies.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.1% |

China has a market that is growing due to rapid advancements in industrial automation, increasing demand for high-precision manufacturing, and government-backed initiatives promoting robotics and AI-driven production. As one of the world&rsquos largest producers of electronics and automotive components, China is witnessing a surge in demand for optical encoders in CNC machinery, robotics, and LiDAR-based applications.

The government&rsquos focus on smart factories and high-tech manufacturing has further fueled the growth. In 2024, China invested USD 14 billion in optical encoder development and automation solutions.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.6% |

Germany shows a notable growth due to its strong engineering base, increasing adoption of automation in manufacturing, and advancements in high-precision control systems.

As one of Europe&rsquos leading technology hubs, Germany is investing in optical encoders for machine tool automation, factory robotics, and electric vehicle development. The country&rsquos focus on sustainability and energy-efficient production processes has also driven the adoption of high-resolution optical encoders.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 8.8% |

Japan is expanding due to innovations in precision motion control, increased adoption of encoders in consumer electronics, and advancements in semiconductor and robotics applications.

The country&rsquos industrial sector is leveraging the encoders for factory automation, robotics, and aerospace navigation systems. Japan&rsquos leadership in miniaturized, energy-efficient encoders has accelerated the adoption of high-performance rotary and linear optical encoders.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.9% |

India's Optical Encoder market is witnessing rapid growth, fueled by increasing investments in industrial automation, the rise of smart manufacturing, and government-led initiatives promoting robotics and AI integration.

With programs such as &lsquoMake in India&rsquo and an expanding industrial base, India is experiencing high demand for encoders in motor control, CNC machinery, and smart motion tracking systems. The rise of AI-driven motion feedback and smart robotics is further driving the expansion.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.7% |

Australia&rsquos market is steadily growing due to increasing investments in mining automation, renewable energy, and defense industries. Australian industries, including robotics, aerospace, and energy management, are adopting the encoders for process automation, motion tracking, and navigation applications. The country&rsquos commitment to fostering technological advancements in photonics and high-precision motion control is driving demand for advanced solutions.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 8.6% |

Absolute Encoders Becoming Popular

Absolute optical encoders are becoming the industry's choice. They have high precision and accuracy and, hence, are suitable for aerospace, manufacturing, and robotic applications.

The only variation from incremental encoders is that they don't require a homing sequence or reset to understand their position. This saves time and decreases downtime. Every position has a unique code, so they will always know where they are even in a power failure.

Other encoders also capture multiple turns, which is best suited for extended movement applications. Such encoders are used in many industries, such as automotive and medical devices.Their accuracy and flexibility continue to fuel growth.

Growing Need for Digital Optical Encoders

Digital encoders are sweeping the market. They offer digital output signals compatible with contemporary control systems, microcontrollers, and digital processors. They offer digital output signals compatible with contemporary control systems, microcontrollers, and digital processors. They are more accurate and have a higher resolution than analog encoders. This renders them suitable for use in CNC machining, robotics, and automation.

Their high-precision position and motion data optimize performance in these areas. Digital encoders are readily compatible with factory networks like Ethernet and Fieldbus, which are easy to install in systems. They are also resistant to electromagnetic interference, making them safe to transmit under poor conditions. Their reliability and accuracy consistently generate demand for them across different industries.

The optical encoder industry is very competitive, with both established industry automation players and new entrants vying for leadership. Companies compete on the basis of innovation in high-resolution encoders, AI-based motion control, and IoT integration to address the increasing demand for precision motion control.

Dominant players like Renishaw plc, Heidenhain GmbH, and Rockwell Automation lead in the production of advanced encoders. Their offerings last longer, are very accurate, and they can also easily integrate into smart factory and automation environments.

Expansion is driven by growing industrial automation, miniaturization, and the accelerating need for high-precision motion feedback in automobile, medical, and aerospace uses. Firms are working on putting their resources into research and development of sophisticated encoder technology as the industry standards are also taken care of.

Strategic competition drivers are partnerships with automation companies, investments in AI and IoT-based motion control solutions, and expansion in emerging markets. Pricing strategies, product customization, and technological innovations play a big role for any player to stay on the top.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Renishaw plc | 20-25% |

| Heidenhain GmbH | 15-20% |

| Rockwell Automation | 10-15% |

| Dynapar Corporation | 8-12% |

| Sensata Technologies | 5-10% |

| Baumer Group | 4-8% |

| Other Players | 30-38% |

| Company Name | Key Products/Services |

|---|---|

| Renishaw plc | High-performance solutions for precision motion control and measurement. |

| Heidenhain GmbH | High-grade absolute and incremental encoders for industrial automation and CNC machines. |

| Rockwell Automation | Integrated optical encoding solutions for robotics, production, and smart factories. |

| Dynapar Corporation | Custom-programmable incremental encoders for industrial equipment and motor feedback. |

| Sensata Technologies | Robust solutions for automotive and aerospace applications. |

| Baumer Group | Miniaturized and high-speed encoders for IoT-based automation applications. |

Key Company Insights

Other Key Players (30-38% Combined)

The industry is projected to reach USD 3.6 billion in 2025.

The industry is anticipated to grow to USD 8.7 billion by 2035.

India is projected to grow at a CAGR of 9.7% from 2025 to 2035.

Leading companies in the market include Honeywell International, Rockwell International, Renishaw PLC, Allied Motion Technologies, Sensata Technologies, USA Digital, Bourns Inc., Dynapar (Danaher Corporation), GrayHill, and CodeChamp.

Incremental and absolute encoders are among the most widely used encoders.

The market is segmented by configuration into shafted, hollow-shaft, absolute, multi-turn, and incremental.

The market is segmented by output signal format into analog and digital.

The market is segmented by application into healthcare equipment, consumer electronics and semiconductor manufacturing equipment, robotics equipment, test & measurement equipment, and others.

The market is segmented by region into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.