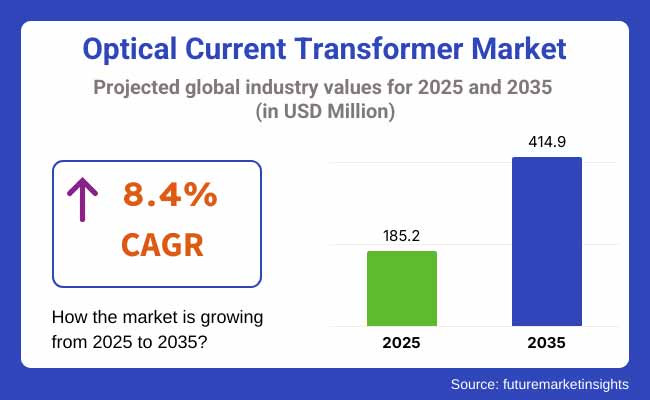

The optical current transformer (OCT) market is set for significant growth between 2025 and 2035, driven by the increasing demand for smart grid infrastructure, advancements in digital substations, and the growing adoption of fiber-optic sensor technologies. The market is projected to expand from USD 185.2 million in 2025 to USD 414.9 million by 2035, reflecting a CAGR of 8.4% during the forecast period.

Optical current transformers not only do they achieve higher accuracy and increased reliability, but they are also safer than conventional electromagnetic current transformers. Employing this technology, electric current is measured with the help of fiber-optic technology using less interference, lower energy losses, and better protection from external electromagnetic fields.

The digitalization trend in substations and the switch to smart grids cause the need for current measurement solutions which increase the speed of modernization of power transmission networks. Thus, OCTs have become the main component of new electric grid networks.

The focus on establishing intelligent energy systems along with the rise of energy consumption and the deployment of advanced metering infrastructure (AMI) is the major factor for the market expansion. The growth rate of the fiber optic sensor market is partly affected by the replacement of outdated power infrastructure and partly by the increased implementation of optical sensors in high-voltage applications.

Explore FMI!

Book a free demo

The market for optical current transformers is being driven by the digitalization and renewable energy integration of the power grid, adoption of smart substation concepts, as well as the program for grid modernization. The United States and Canada are focusing on standard emission procedures, new overhead conductors, digital grids, and substitution of traditional to optical technologies.

Digital substations and HVDC transmission systems are initiated and supported by the USA Department of Energy (DOE) and Federal Energy Regulatory Commission (FERC), thus they also promote OCT. The drivers are the increased EV and DER installation that cause the grid modifications, and technical innovations in the field.

Europe’s optical current transformer market has been rallying due to the strict energy efficiency regulations, a rise in the construction of renewable energy facilities, and the development of smart grid infrastructure. The carbon footprint of countries like Germany, the United Kingdom, and France is being reduced and electricity transmission is being improved.

The EU's Green Deal and the implementation of Energy Transition Policies are enabling utilities to switch to high-precision, non-intrusive current measurement technologies. This makes optical current transformers the most suitable choice for this application. The ongoing establishment of wind and solar projects along with the grid interconnection projects will add further fiber-optic solutions for current sensing.

The OCT sector in Asia-Pacific is the fastest growing as this area is experiencing rapid urbanization, increased electricity demand, and large scale grid expansion. Countries such as China, India, Japan, and South Korea are investing heavily in smart grid networks, high-voltage power lines, and energy efficient substations.

Next generation current monitoring solutions are being adopted by China’s State Grid Corporation (SGCC) and India’s Power Grid Corporation allowing for better efficiency in the transmission and reduction of grid losses. The deployment of HVDC and UHV networks in Asia-Pacific augments the demand for optical current transformers which are characterized by superior operational features under high voltages.

Latin America, Middle East, and Africa are the emerging markets for optical current transformers with significant investments in energy infrastructure and electrification projects.

Brazil and Mexico are two countries in Latin America that are modernizing their transmission network and adding solar and wind energy, thereby, the requirement of highly accurate current measurement technologies will shift to these companies.

The Middle East region which has a huge energy sector is making a move towards digital substation and smart grid framework or, in other words, a better power distribution. Taking the example of Saudi Arabia and UAE, the two are both, respectively, incorporating OCTs into their grid as well as the deployment of HVDC lines.

In Africa, the expansion of electrification schemes and investments towards renewable technologies create the demand for cheap and high-quality sensing.

High Initial Costs & Infrastructure Challenges

The initial investment challenge comes from the fact that an optical current transformer is not only more expensive than traditional CTs but also has long-term added-value benefits. Utilities and grid operators in such regions that are cost sensitive may not implement this technology due to financial constraints and their lack of knowledge about the optical sensors.

Integrating the optical current transformers into the existing networks may actually be a huge issue as it would necessitate the upgrade to the digital substations and advanced communication networks, which is problematic in regions where the power systems are old.

Lack of Standardization & Technical Barriers

The absence of a common design and performance standards applicable to these devices on a global scale brings about compatibility and interoperability issues in a multi-vendor environment. The differences in optical sensor technology, calibration requirements, and fiber optic materials have been the reasons why widespread adoption has been slow.

Expansion of Smart Grid & Digital Substations

The increasing trend of smart grid digital substations has created numerous opportunities for optical current transformers. Governments and utilities are spending heavily to implement intelligent energy management systems, resulting in the demand for current monitoring solutions with the highest accuracy possible in real-time.

The IoT integration, AI-operated analytics, and remote data visualization which engineer technology to further advanced sensors are the real stuff that provides dependable solutions for grid operation which mean remote access, predictive maintenance, and risk mitigation.

Rising Adoption of Renewable Energy

The transition to wind and solar power is a major growth driver of recent technology and optical current transformers. As wind continues to increase in the renewables mix, this will result in the need for faster and more accurate current measuring techniques for the power transmission lines in order to handle the load variations, and improve the grid stability.

The development of the offshore wind farms and utility-scale projects with solar energy contributes to the demand for fiber-optic current sensors which are characterized by long-distance signal transmission, better electromagnetic immunity, and less environmental impact.

Advancements in Fiber-Optic Sensing Technologies

The continual evolution of fiber-optic materials, the rise of new photonic sensors and digital signal processing technologies is the driving force behind the enhancement of performance and cost-effectiveness for optical current transformers. New technologies, like polarimetry optical sensing, interferometric techniques, and AI-assisted data interpretation, are also further benefiting the reliability and the accuracy of measurements.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Usage of fiber-optic sensors and digital output systems has been fully adopted. |

| Technological Advancements | IEC and IEEE standards required transformer accuracy and performance were adhered to. |

| Industry-Specific Demand | High voltage substations and the industrial sector have been on the rise. |

| Sustainability & Circular Economy | Need for more precise, safe, and light transformer solutions is a driving force. |

| Production & Supply Chain | Increase in the presence of fiber-optic materials and elements and sensors. |

| Market Shift | Growth Factors |

|---|---|

| Regulatory Landscape | AI-based analytics and real-time monitoring solutions are finding more advantages in the Internet of Things. |

| Technological Advancements | Grid stability, cybersecurity, and environmental safety were the newly prescribed regulations. |

| Industry-Specific Demand | Smart grids, renewable energy networks, and the deployment of EV charging infrastructure have been the additional benefits. |

| Sustainability & Circular Economy | Increased allocation in the energy-efficient power management and digital substantiation is also a push. |

| Production & Supply Chain | Due to the need for the global market, the local producers are augmenting their activities. |

The Optical Current Transformer (OCT) market in the United States is flourishing due to the fast-paced transformation of power grids, the green energy housing market, and significantly increased investments in digital substations. Across the USA, the power sector is undergoing a major redesign through the installation of high-voltage direct current (HVDC) transmission lines and smart grid technologies, where OCTs are used to ensure exact current measuring and to enhance system efficiency.

Federal policies such as the Inflation Reduction Act (IRA) and the Grid Resilience and Innovation Partnership (GRIP) Program provide the foundation for the devastatingly large infrastructure rehabs that will push the demand for accurate, free-of-interference, current-measuring solutions to the roof. They also added the new project of offshore wind energy and the new plan for the large battery energy storage system which has increased the need for fiber-optic current transformers in modern networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.6% |

As the United Kingdom is making the switch to energy sources that are more sustainable, it is also updating the electric transmission lines, which, together with the solid government endorsements for the technologies that are environmental-friendly, are driving the optical current transformer market to the next level. National Grid and election to refurbish substations and transmission networks has caused the rise of demand for optical current sensors in particular places, such as offshore wind farms, and high-voltage transmission networks. The British government seeking to achieve the Net Zero target is resulting in the higher installation of smart grids and digital substations with guaranteed accurate current measurement. The installation of interconnectors that bring the UK and the European Union closer to carbon-neutral power generation has backed the OCT market even further.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.2% |

The European Union’s Optical Current Transformer Market is advancing due to the expansion of cross-border electricity networks, energy efficiency initiatives, and increased adoption of smart grid technology. The EU Green Deal and the Fit for 55 policies are the major factors leading to increased investments in renewable energy infrastructure, and the modern transmission systems with the new OCTs be the most logical option.

The countries that have been setting the trend in terms of the adoption of optical current transformers in smart substations and high-voltage power transmission projects include Germany, France, and the Netherlands which are improving grid efficiency significantly. The HVDC interconnectors and the all-European transmission network concept also played a role in the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.3% |

The growth of the Optical Current Transformer Market in Japan is backed by the country's agenda for smart grid deployment, high-voltage infrastructure renewal, and the expansion of renewable energy. The foreign body's assurance to achieving carbon neutrality by 2050 has resulted in the establishment of the digital power transmission technology, of which the OCTs are being the very basis of the real-time and precise monitoring.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.0% |

The market for Optical Current Transformers in South Korea is on its way to rapid growth underpinned by development in smart grids, adoption of renewable energy, and modernization of digital substations. Through the Green New Deal, the State has catalyzed the investment into high-efficient power transmission systems thereby creating a ripple effect on the demand for optical current sensors in HVDC transmission lines along with the offshore wind projects.

The Korea Electric Power Corporation (KEPCO) is a notable player involved in the national energetic infrastructure modification which translates into the widespread utilization of optical current transformers for the improvement of monitoring systems and the optimization of energy operational mechanisms. South Korea's accentuation on nuclear energy, and the storage of this kind of energy, has played the determining factor in raising the demand for current measuring technology of a higher level.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

Magnetic Optical Current Transformers Lead Due to High Precision and Stability

Magnetic Optical Current Transformers are the devices which are measure of electric currents based on the Faraday Effect. They are one of the indispensable devices for high-voltage substations and industrial applications. These transformers display remarkable linearity, high bandwidth, and practically no phase error, thus, they are the best choice when compared to conventional current transformers.

The increased focus on grid modernization and digital substations has been the propellant for the magnetic OCTs surge in demand. Their low weight and compact design have made the installation and maintenance easier. As utilities and industrial operators try to solve the problem of unsafe current measurement with the help of reliability, the number of magnetic optical current transformers is estimated to go up.

Fiber Optical Current Transformers Gain Traction for Smart Grid Applications

Fiber Optical Current Transformers (FOCT) are becoming the trend of the time, thanks to their non-reactivity to electromagnetic interference and the efficiency with which they work in extreme environmental conditions. These transformers are used extensively in HVDC transmission systems, substations, and offshore wind farms.

The demand for FOCTs, on the other hand, is skyrocketing due to the growing trend for renewable energy and the issue of increasing load. Smart grids can do the job of integrating these technologies into systems that work better, and FOCTs are a perfect match due to their digital integration features.

Electrical High Voltage Substations Drive Market Growth

High-voltage substations need accurate current measurement to ensure stable and efficient power transmission. On the other hand, optical current transformers provide significant advantages over standard transformers including higher precision, less insulation, and better safety. As EHV and UHV substations are being more widely deployed, the usage of OCTs is seeing a steep growth.

Besides that, urban, energy, and traffic safety which are corner issues for the grid as mandated in the various regulations are the triggers for the utilities to invest in the use of the advanced, high-tech, OCT system.

Network Applications See Rising Adoption in Smart Grids and Power Distribution

Optical current transformers are assisting the power grid modernization efforts by taking part in the network-wide applications which include power distribution monitoring and load balancing. These transformers stand out as they are able to give real-time data for power flow analysis, fault detection, predictive maintenance, and thus are invaluable for utilities that want to harden readiness of the grid besides that, with the distributed energy resources such as solar arrays and wind farms, there is a rise in the need for proper management of bidirectional power through the use of the OCTs to control that better.

Digitalization is being the thing throughout the energy sector and network applications will be a great engine for the OCT industry.

The Optical Current Transformer (OCT) is that class of products which is experiencing steady growth rate, because of the need for modern power monitoring systems in high voltage substations, renewable energy systems and industrial electricity distribution networks. The advantages of optical current transformers are such as high accuracy, wide bandwidth, compact design and immunity to electromagnetic interference when compared to conventional electromagnetic transformers. The ongoing push for the modernization of the grid infrastructure, smarter technology integration and a bigger role for renewable energy are all factors that will lead to the increase in demand for the OCT market.

Competing businesses in the market are emphasizing research and development (R&D) to increase measurement accuracy, increase lifespans and decrease costs. The statutory mandates for the network's reliability and its efficiency improvement are also compelling the utilities to switch to the use of new technologies through the implementation of the OCTs. Progress in the sector is driven by technological innovation, strategic alliances, and territorial expansion through action plans set by the major actors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 20-25% |

| Siemens AG | 15-20% |

| GE Grid Solutions | 12-16% |

| Arteche Group | 8-12% |

| NR Electric Co., Ltd. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | Develops high-accuracy OCTs with fiber-optic sensing technology for smart grid applications and HV substations. |

| Siemens AG | Offers compact and efficient OCTs with digital integration for energy monitoring and grid automation. |

| GE Grid Solutions | Provides advanced optical sensing solutions for precision current measurement in high-voltage transmission. |

| Arteche Group | Specializes in innovative OCT solutions with enhanced signal processing for reliable and stable power systems. |

| NR Electric Co., Ltd. | Focuses on cost-effective OCT designs for utility-scale renewable energy and power distribution networks. |

Key Company Insights

ABB Ltd.

ABB Ltd. is an international electrical and automation leader and is also the supplier of advanced optical current transformer solutions for high-voltage substations and smart grid applications. ABB's optical current transformers employ fiber-optic sensing technology, which improves the precision of measurements and removes the need for heavy and space-consuming conventional transformers.

The company's commitment to digital transformation has resulted in the integration of cloud-based monitoring systems into the OCTs, which provide real-time diagnostics and predictive maintenance. ABB, by investing and cooperating with other companies, along with seeking out innovative research and development opportunities, continues to broaden its product range and penetrate emerging markets.

Siemens AG

Siemens AG is a key market player and is recognized for its production of first-class products that make the power grid more efficient. Its optical current transformers not only provide accurate readings but are also small in size and compatible with digital substations. Together with the integration of renewable energy, Siemens aims to meet the demands of the future by developing connected and automated solutions.

Its large network and ambition for developing sustainable energy solutions have made the company a driving force for the growth of the OCT market.

GE Grid Solutions

GE Grid Solutions manufactures cutting-edge optical sensing devices designed to operate in high-voltage power transmission and distribution networks. The OCTs from GE are engineered for high accuracy and durability, with fiber-optic technology featuring real-time monitoring and fault detection capabilities.

The company is pioneering in the field of digital substation transformation through the implementation of IoT-based analytics and artificial intelligence to stabilize the grid. With an extensive portfolio in electrical infrastructure, GE Grid Solutions is in a good position to adapt to the changing demands of modern power grids.

Arteche Group

Arteche Group is a dedicated manufacturer of current measurement solutions with an emphasis on innovation and technology. The optical current transformers manufactured by Arteche are well-known for their special signal processing technologies which improve the reliability and stability of the current systems in the power sector.

The company is heavily investing in research and development with the aim to design affordable and precise OCTs for utilities and industrial applications. The expansion of Arteche continues through its collaboration and partnership with global energy companies.

NR Electric Co., Ltd.

NR Electric Co., Ltd. is a well-known OCT supplier, especially in Asia, where it is the answer to the increasing demand for affordable and effective power monitoring solutions. The company concentrates on creating optical current transformers for large-scale renewable energy ventures as well as power distribution networks.

The NR Electric's OCTs are compatible with digital control systems thus empowering effective power management and fault detection. Its strategy of competitive pricing, along with the promotion of technological innovations, are the main reasons behind the stable growth of the company in the market.

The global optical current transformer market is projected to reach USD 185.2 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.4% over the forecast period.

By 2035, the optical current transformer market is expected to reach USD 414.9 million.

The market is segmented into Fiber Optic Current Transformer (FOCT) and Hybrid Optical Current Transformer.

The industry is divided into GIS (Gas Insulated Switchgear), AIS (Air Insulated Switchgear), and Transformer Installations.

The market is classified into Low Voltage (Up to 1kV), Medium Voltage (1kV–69kV), High Voltage (69kV–230kV), and Extra High Voltage (Above 230kV).

The market caters to Power Grid, Industrial Applications, and Renewable Energy Integration.

The report covers key sectors, including Utilities, Industrial, Renewable Energy, and Commercial Infrastructure.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.