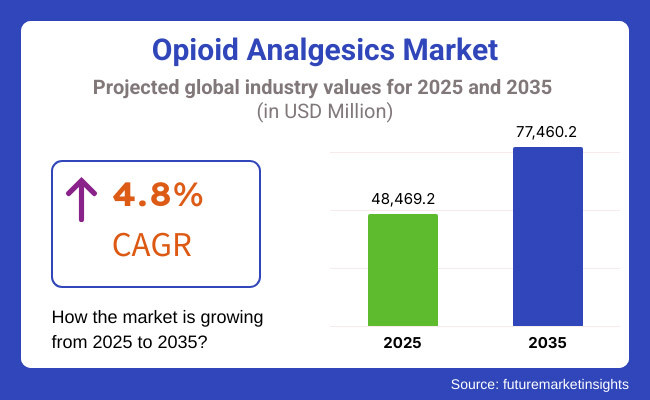

The global Opioid Analgesics market is expected to be reach USD 48,469.2 million in 2025 and is likely to expand up to approximately USD 77,460.2 million by the end of 2035. The sales are believed to rise with a CAGR of 4.8% during the period of 2025 to 2035.

The market for opioid analgesics is set to expand steadily with the rising prevalence of chronic neuropathic pain, post-surgical pain and cancer pain. With geriatric population on rise and at risk for arthritis and neuropathic pain and this will propel the demand for opioid analgesics over the forecast years.

Drug manufacturers continue to innovate abuse-deterrent formulations or ADF and extended-release opioids to increase safety and efficacy, obtaining regulatory clearances. Stringent government regulations, prescription limits and continuous litigation against opioid companies might hamper market growth.

The rising applications of synthetic opioids such as fentanyl are transforming the scene, particularly in palliative care. Simultaneously, new pain relief alternatives including non-opioid analgesics, medical marijuana and neuromodulation treatments are picking up pace and building competition.

Over the years, the market will rely on industry participants building on how well they manage accessibility and safety. Ongoing innovation in opioid pain relief technologies and changing regulatory environments will define the future of the market, with ensured use of opioids while looking into the increasing need for pain management.

Explore FMI!

Book a free demo

North America is the largest market for opioid analgesics, propelled by a high prevalence of chronic pain disorders, postoperative pain management and also cancer pain which contributes a significant share in the overall market.

The United States holds maximum revenue share based on its prescription rates and consumption for opioid analgesics towards chronic pain management and continued R&D in abuse-deterrent technology. The implementation of strict regulatory guidelines and increased concern over opioid dependence have resulted in reduced rates of opioid prescribing.

Government policies supporting opioid stewardship programs and alternative pain therapies are driving market trends. Implementation of prescription drug monitoring programs or PDMPs and analytics for tracking opioids are new trends in the region. Telemedicine and digital therapeutics are also being incorporated into pain management regimens to enhance patient compliance and lower opioid dependency.

Europe is an established market for opioid analgesics with the role of Germany, France, and Switzerland prominent in pain management medicine development. Strictly regulated prescription of opioids and government-sponsored opioid reduction initiatives are defining the market. The rising focus on other pain solutions, including non-opioid analgesics and medical cannabis, is driving the demand for opioids.

There is still an urgent need for effective palliative care and surgical pain relief despite rising concern in proper opioid prescribing procedures. This demand continues to drive opioid use in speciality clinics as well as hospitals.

Expansion in opioid de-prescription initiatives and investment in research on safer opioid medications are trends picking up pace in the European market. Furthermore, public-private collaborations between healthcare organizations and pharmaceutical companies are promoting the identification of new pain management techniques with lower risks of addiction.

The Asia-Pacific market for opioid analgesics is growing fast as a result of the rising prevalence of chronic disease coupled with rising elderly population and their shift towards pain management treatment. China and India have higher opioid usage for treating post-surgical and cancer pain.

With over 45.7 million and 182 million people living with chronic pain in these countries respectively. Regulatory limitations and strict prescription adherence are restraining mass acceptance. The increasing need for multimodal pain treatment strategies, such as acupuncture, nerve blocks as well as non-opioid options is transforming the market over the forecast years.

The initiation of government-initiated pain management awareness campaigns is aiding market growth in the region. Rising investments in setting up palliative care facilities and the launch of new transdermal patches and buccal tablets will push to market growth.

Rising Scrutiny and Declining Opioid Prescriptions Reshaping Opioid Sales

The opioid analgesics market is under increased pressure due to the ongoing opioid epidemic, increasing regulatory pressures and trending shift towards non-opioid alternative pain management options. Issues with opioid dependency and addiction have led to stringent prescribing regulations in various countries with governments applying strict monitoring systems to monitor opioid abuse.

Various cases were filed against North American pharmaceutical manufacturers and have raised the scrutiny of opioid dispensation, discouraging excessive prescription and leading to declining sales.

The growing shift towards non-opioid alternatives like NSAIDs, biologics, and cannabinoid therapy is an expression of the broader industry trend toward safer therapies. In addition, stigma related to opioid use as well as fears like respiratory depression and addiction limits their long-term application.

Physicians and regulatory agencies must collaborate with pharmaceutical manufacturers in order to weigh effective pain relief against regulatory control. Going forward, drug manufacturers shall have to innovate with abuse-deterrent technology and safer products in order to grow amid such regulatory and social challenge.

Future Growth Lies in Controlled-Release and Tamper-Resistant Opioids

Pharmaceutical firms can actually accelerate growth in the opioid analgesics industry by developing safer products, entering new markets, and partnering with other companies. With so many individuals requiring treatment for chronic pain, there is an open opportunity to bring to market products that are safer and with lesser cost.

There is a tremendous growth prospects in palliative care and surgical pain management as opioids are still quite significant to those procedures. Companies should absolutely explore new markets in regions such as Asia-Pacific and Latin America, where regulatory frameworks for opioids are a bit more lenient and healthcare quality is improving.

Educating doctors and increasing patients' awareness, industry leaders can promote responsible prescribing and enhance opioid safety. Collaboration with regulatory agencies also provides such companies the opportunity to influence policy to balance accessibility while attempting to reduce abuse.

In order to remain proactive, companies should try to provide safer opioid alternatives, investigate controlled-release technology, and possess a range of pain management options in this evolving regulatory landscape.

Between 2020 and 2024, the world market for opioid analgesics experienced a consistent growth. This largely resulted from the swelling prevalence of chronic pain, requiring efficient postoperative pain control, and expanding demands for trustful pain relief.

Manufacturers are developing improved formulas with releasing long-acting and abuse-deterrent opioids that facilitate the ability of patients to continue their therapies in safety. But with governments began to clamping down with tighter regulation to fight against opioid abuse and dependency, and people became more aware of alternative treatments that sort of put the kibosh on market expansion.

Looking forward to 2025 to 2035, we can anticipate the manufacturers to focus on creating abuse-resistant products that maintain opioid safety under control while remaining effective.

Researchers are going to explore personalized medicine and pharmacogenomics to develop pain management plans tailored to individuals with fewer side effects and improved outcomes. The sector is set to grow particularly as developing markets enhance their healthcare and access to pain relief drugs improves.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emphasis on monitoring opioid prescriptions and risk reduction initiatives |

| Technological Advancements | Formulation of extended-release and transdermal patch products |

| Consumer Demand | High dependence on opioids for chronic and postoperative pain relief |

| Market Growth Drivers | Increased growth in palliative care and pain management in cancer |

| Sustainability | Early uptake of green chemistry and sustainable drug packaging. |

| Supply Chain Dynamics | Hospitals and retail-based traditional distribution. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent regulations encouraging abuse-deterrent opioids and pain management alternatives |

| Technological Advancements | AI-based adherence monitoring devices for opioids and pain management in real-time |

| Consumer Demand | Increasing trend towards multimodal pain relief and customized therapies.. |

| Market Growth Drivers | Increased usage of non-opioid analgesics and online pain management platforms. |

| Sustainability | Mass-scale execution of environmentally friendly manufacturing and waste management tactics |

| Supply Chain Dynamics | Blockchain supply chain traceability to impede opioid counterfeiting distribution. |

The market for opioid analgesics is poised for further development, with regulatory policies, technological advancements, and sustainability initiatives driving its expansion. Manufacturers need to invest in safer formulations, digital health solutions, and alternative pain management options to stay ahead in this changing environment.

Market Outlook

The opioid analgesics market in United States is in transformation due to increasing regulatory oversight, legal actions and changing paradigms for treatment that influence business dynamics. As much as tighter prescribing mandates and opioid settlement litigations have restricted legacy opioid use, growing demand exists for safer forms of pain control.

Pharmaceutical organizations are moving to abuse-deterrent formulations and long-acting opioids to walk a fine balance between efficacy and safety. Pain management clinics and hospitals are incorporating multimodal pain therapies, decreasing the use of opioids as a standalone option.

The increase adoption across elderly population and increasing post-operative and cancer pain cases will continue to drive opioid demand, especially in palliative care. In the future, developments in opioid formulations and increased emphasis on non-addictive options will shape market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

The opioid analgesics market in Germany is confronted with a multifaceted environment defined by stringent regulation, increasing cases of chronic pain, and changing prescribing habits. The German Federal Institute for Drugs and Medical Devices implements strict opioid prescribing regulations, curtailing abuse while maintaining availability for patients suffering from severe pain. In spite of regulatory restrictions, aging populations and growing cancer-related pain cases drive demand, especially in palliative and post-operative care.

Germany's public health care system focuses on multimodal pain management, seeking a balance of opioids and non-opioid options such as NSAIDs and physiotherapy. Pharmaceutical industries are investing in abuse-deterrent formulations in order to conform to safety mandates. In the future, opioid availability will rely on regulatory conformance, prescriber education, and breakthroughs in pain relief therapies for responsible prescribing purposes while filling unmet pain management needs.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.6% |

The opioid analgesics market in China is increasing with the expanding elderly population, increased surgical operations, and the growing number of cancer cases. The government has also strengthened regulations on opioids to avoid abuse, but demand in palliative treatment and post-surgical pain control is still robust.

China also boasts low per capita opioid use, mainly because prescription controls are stringent and traditional medicine is preferred. But with the growing awareness of pain management, hospitals and health care facilities are more and more incorporating opioid therapy alongside non-opioid therapies. The drug industry is putting money into safer drugs and long-acting opioids in compliance with regulatory requirements.

In the future, industry participants must address regulatory problems, enhance physicians' education, and develop properly balanced pain management solutions in an effort to support growth while staying away from abusive use of opioids.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.1% |

The market for opioid analgesics in India is expected to grow steadily with increasing cases of cancer, postoperative pain management and growing palliative care awareness. Even with the rising demand for pain management, strict guidelines were implemented under the Narcotic Drugs and Psychotropic Substances Act to hinder opioid availability, preventing abuse, but also limiting availability for legitimate medical purposes.

The low per capita rate of opioid consumption is a reflection of regulatory hurdles as well as physicians reluctance to write opioid prescriptions. Government policies are only enhancing access to opioids for cancer care and end-of-life care. Domestic manufacturer is designing safer, controlled-release formulations that comply with requirements. Future growth in the market will be subject to regulatory reform, physician education, and increases in pain management programs to make opioid use responsible but accessible.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

The opioid analgesics market in Brazil is shifting with growing demand for pain management fuelled by old aged population, increasing number of surgical procedures, and increasing cancer patient’s cases. Though the demand for opioids exists, rigid government controls and prescription monitoring curtail extensive use to avoid abuse.

Brazil's opioid use remains below North America and Europe's, mainly due to physician reluctance, cultural affinity for non-opioid analgesics, and regulatory limits. Nonetheless, increased availability of palliative care services and better physician education are driving greater opioid acceptance.

Local drugmakers are emphasizing affordable and abuse-resistant formulations to keep pace with safety guidelines. Going forward, weighing regulatory control against patient access, combined with spending on pain management programs, will drive market expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.5% |

Oxycodone Leading the Market with widespread Use in Post-Surgical and Cancer Pain Relief

Oxycodone to hold maximum revenue share over the forecast years as physician prescribe oxycodone extensively for severe and moderate pain management, especially for post-surgical rehabilitation and the treatment of cancer. Immediate-release and extended-release drugs are preferred by pain specialists and hospitals for chronic long-term pain management to allow controlled dosing.

Growing numbers of chronic pain diseases and cases of post-operative pain are keeping the market on an upswing. North America has the most oxycodone prescriptions, but regulatory actions to curb opioid abuse are instigating controlled dispensing initiatives. Demand in Europe and Asia-Pacific is high in palliative pain and postoperative pain, respectively.

Drug companies are also coming up with newer formulations of oxycodone with lower chances of addiction, while combination drugs with non-opioid analgesics are picking up popularity.

As the regulations get tighter, policymakers and healthcare providers are introducing stricter monitoring systems to guarantee prudent prescribing. In the future, regulatory adjustment and innovation in pain management solutions will dictate oxycodone's market path

Morphine continues to hold a significant share in the opioid analgesics market due to its widely usage in severe pain treatment, post-operative recovery as well as palliative care treatment. Healthcare professionals recommend morphine to treat cancer pain, terminal illness care and trauma-related pain and thus creating a steady demand.

Market expansion in coming years will be fuelled by growing hospice care and palliative care services. Increase in surgical volume and growing incidence of cancer. Stringent opioid regulations, addiction concerns and pressure for alternative pain treatment can affect growth, though.

Drug companies are placing emphasis on controlled-release products and safer delivery systems to preserve morphine's place in pain treatment. Future market trends will focus on increased opioid stewardship, creative pain relief approaches, and enhanced regulatory compliance, supporting sustainable growth while meeting safety needs.

Surgical pain dominates opioid analgesics market in terms of revenue share and remains the most predominant reason for the use of opioid analgesic with physicians relying on opioids to achieve effective management of pain following surgery and in trauma cases. Morphine, oxycodone, and fentanyl are typically prescribed by physicians as a component of both inpatient and outpatient pain regimens.

With the increasing volume of surgeries, there is more utilization of multimodal pain control with opioids drive additional requirements. North America and Europe to continue to lead surgical opioid prescriptions in all major countries and Asia-Pacific sees growing demand with growing access to surgical services.

The oral route dominates revenue in the opioid analgesics market due to its convenience and ease of administration. Doctors prescribe extended-release and immediate-release oral opioids, including oxycodone, morphine, and hydrocodone, for chronic pain and postoperative recovery.

The high bioavailability and consistent absorption of oral formulations make them the preferred choice for outpatient and long-term pain management. While regulatory bodies implement safer use of opioids, drug makers create tamper-resistant oral forms in an effort to curb abuse.

While intravenous (IV) and transdermal opioids are still used by hospitals, health professionals prefer oral opioids due to their affordability and patient compliance, making them the market leaders for the foreseeable future.

The market for opioid analgesics is very competitive, fueled by the rising incidence of chronic pain disorders, postoperative pain management requirements, and the dynamic regulatory environment regarding opioid prescriptions.

Firms are investing in abuse-deterrent products, long-acting opioids, and non-opioid pain management therapies to stay ahead of the competition. The industry is influenced by established pharmaceutical companies, specialty pharmaceutical companies, and research programs prompted by regulation, each playing their part in shaping the dynamic picture of opioid analgesic treatments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pfizer Inc. | 10-12% |

| Abbott Laboratories | 7-10% |

| Johnson & Johnson | 5-7% |

| Novartis AG | 3-5% |

| Bayer AG | 3-5% |

| GlaxoSmithKline plc | 3-4% |

| Other Companies (combined) | 61-57% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pfizer Inc. | Market leader offering oxycodone-based opioid analgesics, including abuse-deterrent formulations. |

| Johnson & Johnson | Develops pain management solutions, including fentanyl-based products and extended-release opioids. |

| Novartis AG | Specializes in generic opioid formulations and branded pain relief medications. |

| Abbott Laboratories | Provides a range of opioid analgesics for acute and chronic pain management, focusing on regulatory compliance. |

| GlaxoSmithKline plc | Offers opioid-based pain relief solutions, including hydrocodone and morphine formulations. |

Key Company Insights

Pfizer Inc. (10-12%)

A leading company in pain management, Pfizer produces branded and generic opioid analgesics, with an emphasis on extended-release products and safer opioid delivery systems to meet changing regulations.

Abbott Laboratories (7-10%)

One of the main suppliers of opioid-based pain relief products, Abbott deals with hospital-quality and post-surgical opioid preparations, emphasizing patient safety and compliance.

Johnson & Johnson (5-7%)

A pioneer in pharmaceutical research, Johnson & Johnson produces a series of opioid and non-opioid pain relief products, with a growing focus on opioid-sparing treatment.

Novartis AG (3-5%)

Famous for its pain management portfolio with varied offerings, Novartis creates opioid formulations with controlled-release technology and spends on non-addictive pain relief alternatives.

GlaxoSmithKline plc (3-4%)

An active player in the opioid and non-opioid pain relief market, GSK combines opioid formulation with multimodal pain management strategies, prioritizing global accessibility and regulatory alignment.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and regulatory-driven innovations. These include:

These companies focus on expanding the reach of opioid analgesic treatments, offering competitive pricing and developing safer, abuse-deterrent opioid formulations to meet diverse medical needs.

The global Opioid Analgesics industry is projected to witness CAGR of 4.8% between 2025 and 2035.

The global Opioid Analgesics industry stood at USD 45,864.8 million in 2024.

The global Opioid Analgesics industry is anticipated to reach USD 77,460.2 million by 2035 end.

China is expected to show a CAGR of 8.5% in the assessment period.

The key players operating in the global Opioid Analgesics industry are Pfizer Inc., Abbott Laboratories, Johnson & Johnson, Novartis AG, Bayer AG, GlaxoSmithKline plc., Boehringer Ingelheim International GmbH, Bausch Health Companies Inc., Sanofi S.A., Teva Pharmaceuticals, AbbVie Inc. , Purdue Pharmaceuticals L.P. and others

Cold Relief Roll-On Market Analysis by Application, Distribution Channel, and Region through 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Burn Matrix Devices Market Insights - Size, Share & Industry Growth 2025 to 2035

Chlorhexidine Gluconate Dressing Market Outlook - Size, Share & Innovations 2025 to 2035

Chloridometer Market Report Trends- Growth, Demand & Forecast 2025 to 2035

Coagulation Markers Market Trends - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.