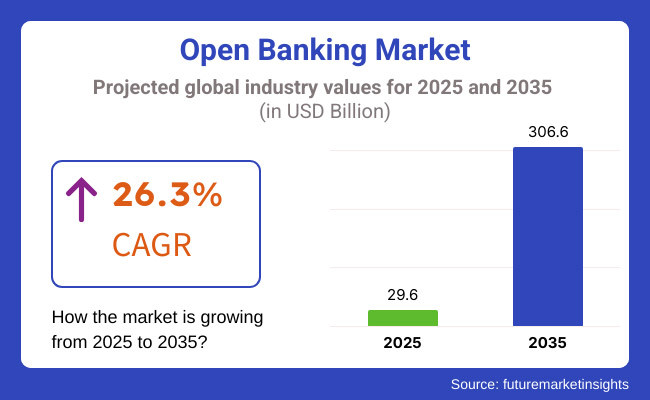

The open banking market is expected to be valued at USD 29.6 billion in 2025. The market is predicted to rise to USD 306.6 billion by 2035. Accordingly, the CAGR for sales throughout the period 2025 to 2035 is anticipated to go up by 26.3%.

The adoption of open banking is mainly propelled by regulatory actions like PSD2 in Europe, which are the same as those in other places across the world and thus are the drivers of interoperable and secure operations in the finance sector. The increase in the number of customers who want digital banking, the expansion of fintech, and the integration of APIs are the main reasons why Open Banking is the new driving force in the financial sector, fostering close proximity of banks with IT firms that lead to the ascendancy of the financial inclusivity and efficiency of service.

The global open banking market is growing with the push of regulatory mandates, API adoption, and digital services growth. Open banking helps secure data sharing between banking structures and third-party providers, which turns transparency, competition, and customer-centric solutions into reality. This growth is also due to more requests for digital solutions that provide smooth payments, individualized banking, and fintech creativity. Regulations like PSD2 (Europe), OBIE (UK), and CDR (Australia) are making a clean path for the secure financial data exchange ecosystem through their structured nature.

North America and Europe take the lead in this segment because they have relevant regulations in place and high adoption of fintech. On the other hand, Asia-Pacific is making the fastest but strongest move in investment in digital banking, which is seen in places like India, China, and Singapore. Major firms like Plaid, Tink, TrueLayer, and Finicity are pushing the development of API-based solutions. The financial institutions adopting Open Banking to get better customer retention are the driving factors for the market's good growth through 2035.

The Open Banking movement is heavily supported by the pervasive use of Application Programming Interfaces (APIs) in the money segment. APIs enable easy and safe data transfer among banks, fintech firms, and third-party providers, which makes it possible to deliver customized financial products, superior customer experience, and instant payment processing. As consumers are turning more towards digital transactions, the need for Open Banking APIs is now for contactless payments and peer-to-peer (P2P) transfers.

Explore FMI!

Book a free demo

FinTech firms drive disruption by covering customers more successfully and sustainably with the help of open banking frameworks. The integration of third-party suppliers (TPPs) is extremely relevant, as it allows digital payments, financial analytics, and credit scoring services to be accessed by the customers first, gaining higher levels of market adoption and innovation on behalf of suppliers. Individuals become the direct beneficiaries through the facility of personalized products, thereby enjoying increased financial transparency and better data management.

A further driver of the market is digital payments, which are now real-time, and finance that is embedded within other solutions. The enactment of regulative bodies such as PSD2 in Europe and similar setups globally is the leading factor that will breathe new life into the market and help it reach the level of open banking, which is now given to the users in the form of competitive financial products, and these products are much more accessible.

Open Banking Market Contract Analysis

| Company | Contract/Release Details |

|---|---|

| Santander UK | Announced a partnership with an open banking firm to enhance its payment solutions, aiming to provide faster and more secure payment options for customers. |

| European Payments Initiative (EPI) | Launched "Wero," a European electronic wallet operational in Germany and France, designed to rival global payment systems like Visa and Mastercard. Initial features include person-to-person payments, with plans to expand to e-commerce and in-store payments by 2026. |

| USA Consumer Financial Protection Bureau (CFPB) | Finalized new open banking rules to facilitate the transfer of consumer bank data between financial entities, aiming to foster competition and enhance consumer data rights. |

| New Zealand Government | Committed to implementing open banking by June 2026 as part of a broader initiative to increase competition in the consumer banking sector, following a report indicating inadequate competition among major banks. |

The rapid growth of the open banking market continued from the year 2020 until the year 2024, with some notable features being very strong public governance, rising fintech adoption rates, and changing consumer behavior toward seeking almost seamless financial services. Governments and other financial authorities across the globe pushed for the creation of a data-sharing framework that will allow third-party providers to offer personalized banking solutions. API-driven banking has brought in increased competition that features innovations in digital payments, lending, and financial management tools. Globalization and increases in cross-border standards and frameworks promoting open banking will further increase global financial connectivity; blockchain will enhance security and trust. Open finance will extend beyond banking to capture insurance, investments, and pensions and redefine the financial ecosystems of the future. Increased expectations will be following consumers with a more fine-tuned hyper-personalization and more frictionless financial experiences; mega partnerships among traditional banks, fintechs, and tech giants will propel the market into this next stage of growth.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments and regulators launched open banking regulations that compelled banks to securely share customers' data with APIs. | Policy makers fortify regulatory systems, imposing standardized usage of APIs, automated consent management, and data protection legislation for greater transparency and security. |

| Banks and fintech firms came together to design open APIs that facilitated seamless third-party integrations for digital payment, lending, and financial management. | API-driven ecosystems powered by AI reshape banking services, taking advantage of real-time data sharing, predictive analysis, and blockchain for secure and transparent transactions. |

| Consumers were presented with tailored banking experiences through fintech applications, including budgeting functions and AI-driven financial insights. | Hyper-personalized financial solutions emerge, utilizing AI and behavior analysis to create dynamic, real-time financial solutions in response to individual needs. |

| Banks added API security capabilities, such as multi-factor authentication (MFA) and strong customer authentication (SCA). | Fraud detection by AI and biometric authentication become the norms in the industry, preventing identity theft and cyber attacks in advance in real-time. |

| Companies adopted open banking platforms to provide embedded finance services, enhancing customer interactions and financial inclusivity. | BaaS transforms into decentralized financial platforms enabling non-banking companies to provide end-to-end financial products based on AI and blockchain. |

| Open banking adoption was different across regions, with Europe taking the lead through PSD2 compliance and North America and Asia following with incremental adoption. | Interoperability frameworks globally create frictionless cross-border open banking ecosystems, facilitating international financial transactions with increased efficiency and security. |

| Growing consumer demand for financial transparency, fintech innovation, and regulatory requirements drove market growth. | AI-based financial services, decentralized banking systems, and real-time cross-border payments drive industry growth. Governments and financial institutions invest in digital banking infrastructure to improve economic inclusion. |

Data security and privacy concerns are the key risk factors in the open banking market. The manager of third-party providers (TPPs) is at serious risk because any vulnerabilities in these APIs will expose sensitive consumer information to hackers who may also sell it for criminal purposes. The damages caused by malicious data handling and breaches of data protection regulations can be devastating to a firm. Strong encryption, authentication protocols, and compliance with frameworks like PSD2 in Europe and CCPA in the USA are essential to prevent this risk.

Compliance burdens made governmental and regional challenges for financial institutions. In contrast to some areas, banks' and fintechs' statutory obligations due to PSD2 and Open Banking UK open banking come less or more freely to the banks and fintech in question. Companies dealing globally need to read through different forms of regulations that might increase operating difficulty and budget.

Shopping customers and consumers still need help in tackling this issue. The major reason is that when it comes to data sharing, the customers believe that the data will be misused by third-party organizations. The build-up of trust comes with the progressive investment of financial institutions and fintech companies in customer education, transparency, and user-friendly consent management systems.

Market rivalry and standardization are yet another risk. The open banking ecosystem contains various traditional banks, fintech startups, payment service providers, and big tech companies, all rushing to grab a more significant portion of the market. The fragmentation of the global API standard and data-sharing protocols may lead to interoperability issues, which prevents the seamless integration of different financial services.

Cyber threats and frauds are risks of high concern since cybercriminals are targeting open banking APIs. Phishing scams and counterfeit third-party applications. Operational losses are mainly due to unprotected data breaches, identity theft, and unauthorized access to data other than the ones the user agreed to. However, operational losses can also occur due to fraud involving the software or a company not being compliant with the data protection laws. In the open banking environment, strong fraud detection mechanisms, real-time monitoring, and AI-driven anomaly detection are key to reducing financial crime risks.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 25.5% |

| Germany | 24.1% |

| UK | 25.6% |

| China | 27.2% |

| India | 27.4% |

Unlike in Europe, where Open Banking is regulated through mandates, private-sector cooperation propels the USA landscape. Plaid, Finicity (Mastercard), and MX Technologies are a few of the industry's top players building secure data-sharing networks so that banks and other financial institutions can leverage their digital banking expertise.Consumer demand for real-time payments, AI-based financial intelligence, and P2P lending is also propelling Open Banking. Further, the Consumer Financial Protection Bureau (CFPB) is also developing guidelines for Open Banking, providing a uniform method for secure sharing of financial information. FMI believes the USA market will achieve 25.5% CAGR in the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Fintech-Driven Innovation | Market leaders like Plaid and MX Technologies facilitate API-based financial data-sharing, which enhances Open Banking applications. |

| Regulatory Evolution | Consumer Financial Protection Bureau (CFPB) is working on Open Banking regulations to make financial data-sharing organized and secure. |

| Digital Payment Uptake | Increasing demand for real-time payments, AI-powered financial analysis, and embedded finance drives Open Banking services. |

Banks in Germany, such as Deutsche Bank, Commerzbank, and N26, are collaboratively working alongside fintech companies to simplify Open Banking products. With this coming together, products and services like personal finance management via artificial intelligence and peer-to-peer lending applications are hassle-free.Germany's robust data protection laws, such as the General Data Protection Regulation (GDPR), also increase customer trust in Open Banking through secure money transfers. Small and medium-sized businesses (SMEs) also enjoy API-based banking services with greater credit and business process accessibility.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| PSD2 Regulatory Compliance | PSD2 compliance by the German banks enables standardized and secure open banking information sharing. |

| Fintech Partnerships | Banks collaborate with fintech players to provide improved customer experience in online lending, artificial intelligence-driven financial planning, and API banking. |

| Robust Customer Trust in Online Finance | Germany's data protection regulations (GDPR) enable a robust generation of consumer trust in Open Banking platforms. |

China's open banking is developing at a quick pace with improved digital finance services, increasing mobile payments, and increasingly integrated AI banking applications. Large banks such as the Industrial and Commercial Bank of China (ICBC) and Alibaba's Ant Group are using Open Banking APIs to enhance access to finance.China's fintech industry is the sector's leading growth driver, fueled by AI-based risk analysis solutions and emerging credit scoring systems that enable financial inclusion. Government support for digital finance innovation also drives open banking adoption.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Robust Fintech Ecosystem | Some of the leaders in API-led financial services are Ant Group and Tencent, forcing the adoption of open banking. |

| Government-Supported Digital Finance | Regulatory bodies drive digital banking innovation, creating Open Banking infrastructure. |

| AI-Powered Financial Services | Artificial intelligence-based risk assessment and non-traditional credit scoring increase access to financial services. |

Reserve Bank of India (RBI) has an important role in Open Banking evolution through secure data sharing among banks, non-banking finance companies (NBFCs), and fintech players.The country's fintech industry continues to grow strongly, with Razorpay, Paytm, and PhonePe launching Open Banking APIs to enable embedded finance, digital lending, and auto-credit underwriting. Aadhaar-based eKYC and DigiLocker on a large scale also simplify financial transactions and security. FMI is of the view that the Indian market will grow at 27.4% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government-Supported Digital Infrastructure | Innovations like the Account Aggregator architecture and UPI augment Open Banking convenience. |

| Increased Fintech Adoption | Firms like Razorpay and Paytm use Open Banking APIs to drive embedded finance and other lending products. |

| Increased Smartphone Penetration | Over 1 billion smartphone users power digital banking adoption, which powers Open Banking convenience. |

The UK is among the world's most advanced Open Banking economies, with strong regulatory controls ensuring financial data security and competition. Banks are mandated by the Competition and Markets Authority (CMA) to provide Open Banking services, enabling consumers to enjoy customized financial products.British banks like Barclays, HSBC, and Lloyds have rolled out Open Banking APIs to make digital payments, credit reports, and AI-driven personal money management more seamless. The country's vibrant fintech landscape, embodied by names like Revolut and Starling Bank, further propels the Open Banking revolution.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Regulatory Leadership | The UK mandates banks' use of Open Banking, which compels transparency and competition. |

| Strong Fintech Landscape | Big fintech companies like Revolut incorporate Open Banking APIs into AI-powered financial services. |

| Consumer Adoption of Digital Payments | The UK's contactless payment infrastructure lends itself to the seamless embedding of Open Banking. |

The Open Banking Platforms segment is dominant in the market owing to the increasing adoption of API-based financial ecosystems, resulting in growing third-party integrations coupled with robust regulatory support. With two million tagged bank accounts, these platforms allow banks, fintech companies, and digital payment providers to integrate financial data, payments, and customer experience effortlessly. In this space, leading providers (e.g., Plaid, Tink (Visa), or TrueLayer) dominate with secure and scalable API-driven financial solutions. Open Banking platforms are also being driven by increased regulation - and compliance with standards such as PSD2 (Europe) and CDR (Australia) - as traditional banks look to improve data-sharing capabilities with firms that can access this data in a secure environment.

For those businesses, firms like Yapily and TrueLayer are leading the charge, providing powerful API scaffolding that allows even the smallest company to send secure and efficient payments. They enable use cases ranging from instant bank transfers to recurring payments for various industries. Regulations, such as PSD2 in Europe, require secure and standardized access to banking data and payment initiation services, encouraging traditional financial institutions to embrace Open Banking payment solutions.

This has, in turn, encouraged innovation and competition, allowing new players to bring value-added services to market and driving the transition towards more transparent and lower-cost means of making payments. With every passing day, the data shows consumers are increasingly demanding personalized banking experiences and real-time financial services; the Payments segment in Open Banking is set to continue to grow. Moreover, as it becomes progressively adopted, building secure, API-driven payment solutions will disrupt the financial landscape, providing better value propositions worldwide for businesses and consumers alike.

The fastest-growing segment of the open banking market is cloud-based open banking, which provides scalability, cost-effectiveness, and higher levels of security than cloud computing. Banks and fintech firms are moving to cloud-native open banking solutions to better manage large-scale finance datasets, provide better API performance, and comply with new regulations for data security.

Cloud-based Open Banking simplifies financial transactions, enabling services like real-time transfer of money and machine learning fraud detection while reducing complications of updating local data in close-knit operational environments. Thus, one increasingly sees big technology providers like AWS, Microsoft Azure, and Google Cloud teaming with banks to deliver more secure, more API-driven financial services. On-Premise Open Banking will still be an essential option for financial services organizations that prioritize control, customization, and compliance.

Banks and fintech firms can implement Open Banking solutions on their own infrastructure to cater to specific operational requirements while preserving direct oversight of sensitive financial data. Major technology providers such as Temenos, Finastra, and Oracle provide strong on-premise Open Banking platforms that enable institutions to integrate seamlessly with existing systems and data and regulatory security.

Such a solution is ideal for enabling secure data sharing and payment processing in a controlled environment, providing comprehensive API management to customers. While cloud-based solutions are increasingly popular, the on-premise model tends to be preferred by organizations that have strict data privacy requirements or are located in regions with strict regulatory environments. This deployment model provides improved data governance, decreased reliance on third parties, and the freedom to adapt features to meet institutional policies.

The Open Banking market is highly competitive and driven by innovations in APIs, regulatory frameworks, and collaborations between banks and fintechs. Given these considerations, businesses look for secure and scalable solutions that can optimize the sharing of financial data, payment processing, and digital banking services.

Market leaders such as Plaid, Tink, TrueLayer, and Finicity dominate the open banking APIs for account aggregation, payment initiation, and financial data enrichment. Plaid and Tink focus on providing smooth API integrations, while TrueLayer and Finicity use a partnership-based strategy to work with global financial institutions to ensure maximum data privacy and compliance. New fintechs such as Yapily, MX Technologies, and Token.io are gaining attention with their specific solutions in embedded finance, real-time payments, and lending powered by open banking. At the same time, the older banks are trying to implement Open Banking technologies to modernize digital services and enhance customer engagement.

The market is being shaped by the adoption of cloud-based infrastructure, AI-enabled fraud checks, and the opening up of various global markets through regulatory means. Major cloud vendors such as AWS, Microsoft Azure, and Google Cloud are the backbone upon which any Open Banking ecosystem is secured and scaled. In this rapidly expanding industry, organizations that keep working on innovation and compliance while looking toward cross-border financial integration will be well-positioned with respect to existing regulations and to accelerate adoption.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Plaid | 20-25% |

| Tink (Visa) | 15-20% |

| Finicity (Mastercard) | 12-16% |

| TrueLayer | 10-14% |

| Yapily | 8-12% |

| Other Companies (Combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Plaid | API-driven financial data aggregation, bank connectivity, and account verification solutions. |

| Tink (Visa) | Open Banking API infrastructure for payment initiation, data enrichment, and digital banking. |

| Finicity (Mastercard) | Consumer-permissioned data sharing, lending solutions, and AI-powered financial insights. |

| TrueLayer | Seamless API integration for financial services, payments, and digital identity verification. |

| Yapily | Enterprise-focused Open Banking infrastructure enabling real-time payments and financial analytics. |

Plaid (20-25%)

Plaid is a leading Open Banking provider, offering robust API connectivity for financial data aggregation, payments, and account verification across banks and fintech platforms.

Tink (Visa) (15-20%)

Acquired by Visa, Tink provides Open Banking APIs that enable seamless payment initiation, financial data access, and risk assessment solutions across Europe.

Finicity (Mastercard) (12-16%)

As a subsidiary of Mastercard, Finicity specializes in consumer-permissioned financial data sharing, lending decisioning, and AI-driven insights for banks and fintech firms.

TrueLayer (10-14%)

TrueLayer focuses on real-time financial data access and payments, allowing businesses to enhance digital onboarding, fraud prevention, and open finance capabilities.

Yapily (8-12%)

Yapily offers enterprise-grade Open Banking infrastructure, empowering businesses with real-time payments, account verification, and financial analytics solutions.

Other Key Players (30-40% Combined)

The market is projected to witness a CAGR of 26.3% between 2025 and 2035.

The market’s worth is at USD 29.6 billion in 2025.

The worth is anticipated to reach USD 306.6 billion by 2035 end.

East Asia is set to record the highest CAGR of 28.1% in the assessment period.

The key players operating in the industry include Finleap Connect, Finastra, FormFree Holdings Corporation, Jack Henry & Associates, Inc., MineralTree, Inc., NCR Corporation, Banco Bilbao Vizcaya Argentaria, S.A., DemystData, Ltd., Mambu, and Credit Agricole.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.