The text indicates that the online rental market for clothing is experiencing an upward trend, with consumers accepting affordability, sustainability, and access to premium fashion without ownership. Innovations within the industry are fueled by eco-conscious fashion, special event rentals, and wardrobe subscription services.

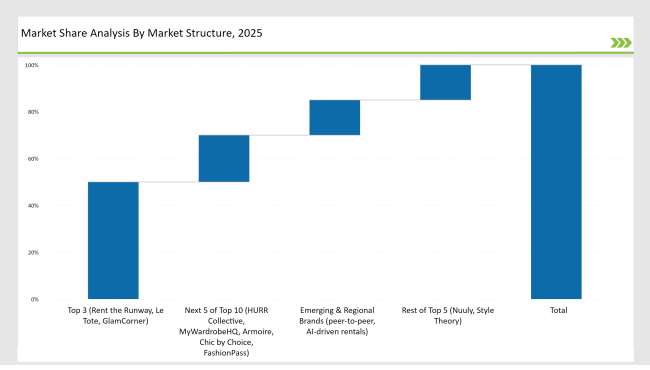

Presently, companies are leading the market that focus on flexible rental models, AI-driven personalization, and high-quality fashion collections. These companies include the most popular ones such as Rent the Runway, Le Tote, and GlamCorner which share the market at 50% because of the best designer collaborations, AI-based styling advice, and hassle-free logistics.

Independent and regional rental sites account for 30%, where niche fashion selections, local designer collaborations, and eco-friendly clothing options are on offer. Lastly, the emerging startups that focus on peer-to-peer rentals, AI-driven sizing solutions, and circular fashion initiatives account for 20% of the market.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Rent the Runway, Le Tote, GlamCorner) | 50% |

| Rest of Top 5 (Nuuly, Style Theory) | 15% |

| Next 5 of Top 10 (HURR Collective, MyWardrobeHQ, Armoire, Chic by Choice, FashionPass) | 20% |

| Emerging & Regional Brands (peer-to-peer, AI-driven rentals) | 15% |

E-commerce & Direct-to-Consumer Platforms lead the way with 60%, as digital-first rental services satisfy on-demand fashion aspirations. Luxury & Designer Fashion Rental Services take 20%, because high end customers demand high-end brands. Peer-to-Peer & Community-Based Rentals fill 15%, as sustainable fashion sharing is being encouraged. Retail & Brick-and-Mortar Clothing Rental Boutiques compose 5%, where in-person shoppers go to look for try-before-you-rent experiences.

Occasion & Formal Wear Rentals dominate at 40%, with weddings, galas, and other special events. Casual & Everyday Wear Rentals account for 30%, with rotating wardrobes for work and lifestyle needs. Designer & Luxury Fashion Rentals take up 20%, providing access to exclusive, high-end apparel. Sustainable & Eco-Friendly Fashion Rentals make up 10%, focusing on secondhand and upcycled fashion trends.

As the tastes of the customer changed, so did the strategic decisions by the market leaders and new entrants in the online clothing rental market.

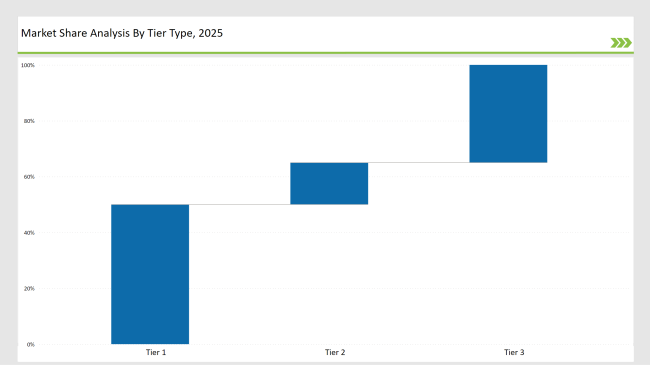

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Rent the Runway, Le Tote, GlamCorner |

| Market Share (%) | 50% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Nuuly, Style Theory |

| Market Share (%) | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | HURR Collective, MyWardrobeHQ, Armoire, Chic by Choice, FashionPass |

| Market Share (%) | 35% |

| Brand | Key Focus Areas |

|---|---|

| Rent the Runway | AI-powered styling & premium membership services |

| Le Tote | Personalized fashion curation & flexible rentals |

| GlamCorner | Circular fashion & resale integration |

| Nuuly | Sustainable rental fashion & eco-conscious collections |

| Emerging Brands | Peer-to-peer rental platforms & AI-enhanced fit solutions |

The online clothing rental market is becoming sustainable, leveraging technology for personalization and providing flexible wardrobe options. Instead of sticking to fast fashion, consumers are looking away from the same, and thus, AI-powered outfit recommendations, circular fashion initiatives, and even luxury collaborations are going to dominate the industry.

Subscription-based rental services and eco-fashion rental platforms will gain more pace. Increasing demand for clothing rotation models will see more consumers putting access above ownership. In other words, sustainability and personalization will set success in the coming years for high-quality garment care, AI-based size prediction, and on-demand styling.

Sustainability and personalization will drive tech-driven, eco-conscious clothing rental market made for modern consumers who focus more on experiences rather than owning and possessing in the future of the online clothing rental market.

Leading players such as Rent the Runway, Le Tote, and GlamCorner collectively hold around 50% of the market.

Online sales represent approximately 60% of the market, driven by AI-powered recommendations and flexible rental models.

Eco-friendly rental services account for about 15% of the market, with growing consumer demand.

High-end fashion rentals hold around 20% of the market, with increasing brand partnerships.

High for companies controlling 50%+, medium for 30-50%, and low for those under 30%.

Leather Goods Market Outlook - Size, Share, and Growth 2025 to 2035

Asia Pacific Hats Market Analysis – Size, Share & Trends 2025 to 2035

Tactical Boots Market Analysis - Growth & Industry Forecast to 2025 to 2035

Porcelain Tableware Market Trends - Growth & Demand Forecast 2025 to 2035

Toothpaste Market Trends - Growth, Sales & Forecast 2025 to 2035

Snus Market Growth - Demand, Sales & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.