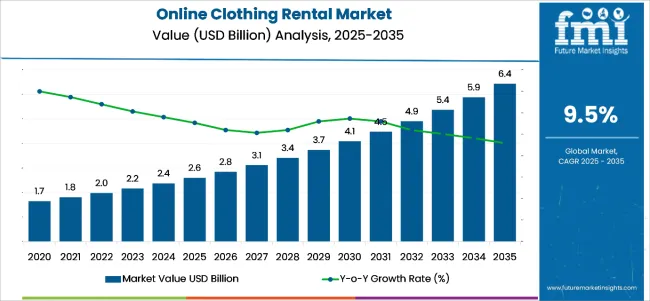

The global online clothing rental market is projected to grow significantly from an estimated USD 2.60 billion in 2025 to around USD 6.4 billion by 2035, expanding at a CAGR of 9.5% over the forecast period.

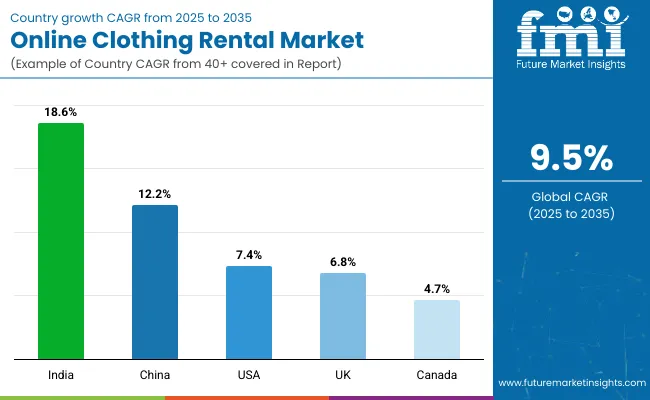

The increasing consumer shift toward fashion flexibility, sustainability, and convenience is fostering demand. Countries such as the United States, India, and China are emerging as key contributors, with India expected to record the fastest CAGR of 18.6%.

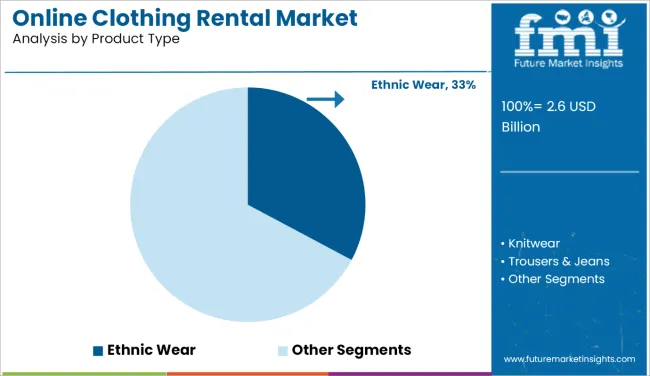

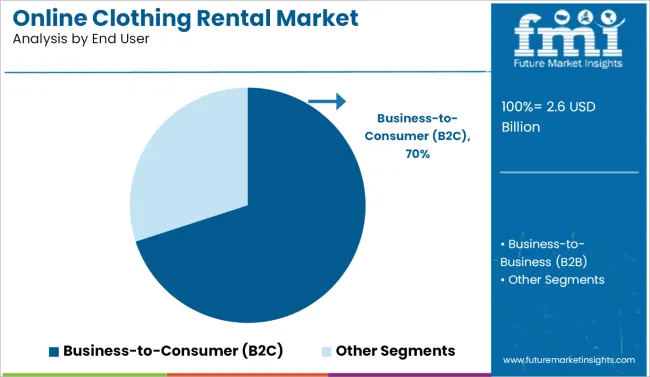

Among the apparel segments, ethnic wear holds a dominant share in terms of value due to event-centric demand. Meanwhile, B2C is the leading end-user model, benefiting from deep digital penetration and social media influence.

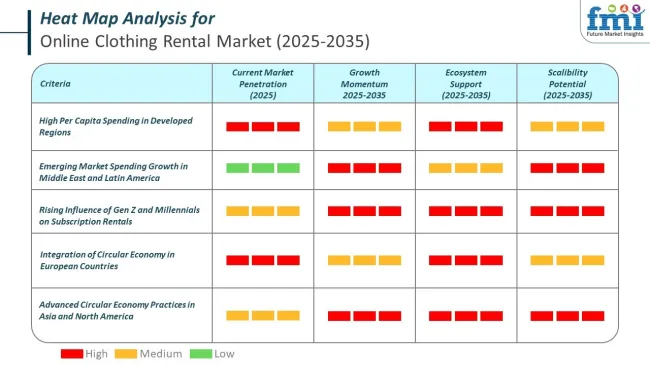

Growing environmental concerns, especially among millennials and Gen Z, have significantly influenced wardrobe choices. The market is experiencing rapid adoption due to the rising inclination toward circular fashion models, where clothes are reused or rented rather than owned.

Online platforms provide easy access to premium and designer apparel at a fraction of the price, eliminating the burden of long-term ownership. These services are especially popular among urban consumers seeking short-term fashionable solutions for weddings, parties, or corporate events.

Major drivers of market expansion include the rise of subscription-based services, on-demand rentals, and AI-powered personalization. The ability to receive handpicked garments regularly through subscriptions enhances user loyalty while maintaining a dynamic wardrobe experience. Additionally, tech-driven solutions like virtual try-ons and blockchain-enabled garment tracking elevate the digital customer journey, making online clothing rental more accessible and reliable.

However, market adoption still faces challenges such as size-fit issues, hygiene concerns, and limited reach in semi-urban and rural zones. Still, innovation in eco-friendly dry cleaning, easy return logistics, and improved user interfaces is helping overcome these obstacles. The increasing availability of luxury ethnic and western wear for rent is enabling wider access to fashion previously restricted by high cost.

Looking ahead, future growth will be shaped by enhanced digital ecosystems, greater sustainability regulations, and the growing popularity of fashion-as-a-service models. Market leaders are investing in strategic partnerships with fashion designers and eco-conscious labels to expand their premium offerings. With customer behavior rapidly aligning with minimalist and sustainable values, the online clothing rental ecosystem is set to become a core pillar in the modern apparel value chain.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 2.60 billion |

| Projected Market Size (2035) | USD 6.4 billion |

| CAGR (2025 to 2035) | 9.5% |

Per capita spending on online clothing rental is steadily increasing as rental culture moves from occasional event-based use to routine wardrobe choices. High urban internet penetration, fashion-forward youth demographics, and awareness of sustainable consumption are fueling this shift. Spending patterns vary based on geography, age group, and frequency of subscription use.

Circular economy practices are becoming central to national sustainability strategies as countries move away from the linear take-make-dispose model. Governments and industries are embedding reuse, recycling, product life extension, and regenerative design into core policy frameworks, especially across manufacturing, packaging, textiles, and e-waste.

The below table presents the expected CAGR for the on line clothing rental industry over semi-annual periods spanning from 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.5% |

| H2 (2024 to 2034) | 9.9% |

| H1 (2025 to 2035) | 10.5% |

| H2 (2025 to 2035) | 8.4% |

The CAGR exhibits a fluctuating trend, initially increasing by 85 BPS from H1 (2024 to 2034) to H2 (2024 to 2034), indicating stronger growth momentum in the latter half. However, a slight increase of 105 BPS in H1 (2025 to 2035) suggests temporary market stabilization or external constraints.

Growth rebounds in H2 (2025 to 2035) with an 84 BPS decrease, reflecting renewed demand or industry expansion. This pattern suggests cyclical variations, with stronger growth in the second half of each period, possibly driven by evolving market conditions and strategic investments.

The online clothing rental market is segmented based on two primary investment areas: product type and end user. By product type, the market includes knitwear, trousers & jeans, jumpsuits, coats & jackets, ethnic wear, performance wear, active wear, and lounge wear. By end user, key segments encompass business-to-business (B2B) and business-to-consumer (B2C) models.

Ethnic wear is anticipated to account for a substantial 33% share of the online clothing rental market by 2025. This category sees consistent demand for traditional garments used during weddings, festivals, and cultural events. Since these outfits are often worn only once or twice, renting presents a practical and cost-efficient solution.

Consumers benefit from access to designer ethnic collections without the commitment of ownership. Social media platforms play a role in encouraging outfit variation for events, supporting the demand for temporary wardrobe options.

Additionally, growing disposable income in emerging markets and increased digital access to curated ethnic wear have contributed to the segment’s expansion. Rental services now include a wide selection of items such as sherwanis, lehengas, sarees, and anarkalis, appealing to users seeking flexibility and affordability.

| Product Type | Market Share (2025) |

|---|---|

| Ethnic Wear | 33% |

The business-to-consumer (B2C) model is expected to grow with a CAGR of 10.6% during 2025 to 2035. This growth is primarily fueled by millennials and Gen Z consumers, who prioritize fashion flexibility, affordability, and sustainability. B2C platforms offer curated wardrobes, personalized recommendations, and subscription plans that align with rapidly shifting fashion trends.

These platforms simplify access to high-end fashion while minimizing storage and ownership burdens. The ease of mobile apps, free returns, and home delivery has further accelerated the adoption of B2C rentals. Additionally, the rising frequency of special occasions like parties, holidays, and corporate events contributes significantly to demand in this segment.

| End User | CAGR (2025 to 2035) |

|---|---|

| Business-to-Consumer (B2C) | 10.6% |

Online clothing rental services are gaining popularity as more consumers seek convenient and eco-friendly alternatives to traditional fashion. These services provide users with the opportunity to rent high-quality, fashionable clothing for numerous occasions without murky ownership obligations. Sustainability-minded millennials and Gen Z consumers heavily favor eco-friendly products due to their strong environmental awareness and frugal tendencies.

Rental platforms evolve rapidly with advanced features like subscription models and virtual fitting rooms. Growing awareness of textile waste prompts consumers to consider clothing rental as a sustainable option, and companies now offer highly flexible plans. Rapid growth emerges swiftly due to changing consumer habits fueling market expansion.

Subscription-based models alongside on-demand rentals are gaining massive popularity rapidly, driving market expansion at a rapid pace. These models provide consumers with a ridiculously flexible rental experience, allowing them access to an ever-changing wardrobe sans costly clothing investments. Rental services offer sheer convenience via home delivery, easy returns, and vastly varied clothing categories, including premium designer items.

Innovative features like personalized recommendations powered by AI enhance user experience significantly every day. Technological advancements contribute significantly to online clothing rental services, gaining popularity rapidly among individuals and businesses seeking sustainable fashion solutions.

Sustainable fashion trends drive demand for clothing rental services, which will likely surge extremely fast in future markets. Renting clothes drastically cuts down textile waste, promoting a fairly circular business model. Fast fashion's environmental impact motivates consumers deeply nowadays, so they seek greener alternatives through clothing rentals.

Consumer services demand for fast fashion surges upward rapidly now; clothing rental services evolve rapidly, providing high-quality options.Special events like weddings and parties spark high demand for fancy clothes on short notice, somehow becoming extremely popular suddenly.

| Countries | Population (millions) |

|---|---|

| United States | 345.4 |

| United Kingdom | 67.7 |

| China | 1,419.3 |

| France | 64.6 |

| Australia | 27.0 |

| Countries | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 3.25 |

| United Kingdom | 2.80 |

| China | 2.50 |

| France | 2.60 |

| Australia | 2.45 |

The USA online clothing rental market, valued at USD 813.8 million, thrives owing to extremely fashion-conscious consumer spending amidst widespread adoption of rental-based fashion models. Sustainable fashion solutions are gaining traction rapidly due to a robust e-commerce infrastructure, boosting market penetration significantly. Rent the Runway dominates market share alongside similar platforms, slowly but surely forcing e-commerce giants like Amazon and Nordstrom to support rental services.

The UK’s USD 134.1 million online clothing rental market is expanding as consumers shift toward circular fashion models. Sustainability awareness and demand for designer wear at lower costs contribute to growing adoption. The rise of peer-to-peer clothing rental platforms and partnerships with luxury fashion brands accelerates market traction, particularly in metropolitan areas like London.

China’s online clothing rental market, valued at USD 140.3 million, benefits from digital-first consumer behavior and a strong luxury market. Younger demographics and urban professionals prefer short-term fashion access over ownership, fueling demand for rental services. E-commerce giants like Alibaba and JD.com support online clothing rental through integrated platforms. Increasing sustainability initiatives also promote rental fashion models.

France's online clothing rental market, totaling USD 62.8 million, gets fueled by extremely fashion-forward consumers alongside luxury-minded folks. Paris bears witness largely due to its status as a global fashion hub to the high demand for luxury fashion rentals in formal events. Startups specialize in high-fashion pieces for a growing consumer base seeking affordability beneath fancy designer labels.

Australia’s USD 63.4 million online clothing rental market is growing due to rising sustainability concerns and strong demand for event-based rentals. Wedding attire, designer evening wear, and maternity fashion rentals are particularly popular. E-commerce platforms like GlamCorner and peer-to-peer marketplaces contribute to market expansion, making rental fashion more accessible nationwide.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

| Canada | 4.7% |

| UK | 6.8% |

| China | 12.2% |

| India | 18.6% |

The USA online clothing rental market is set to grow at a CAGR of 7.4% from 2025, driven by consumer demand for sustainable fashion alternatives. Rising awareness of environmental impact prompts consumers to shift towards rental models, reducing fashion waste and saving costs on luxury garments.

Rapid adoption occurs swiftly among urban professionals seeking variety in fashion without the burden of ownership due to flexible wardrobe options. Premium brands on rental platforms accelerate market growth rapidly nowadays as customers prefer designer outfits for special occasions or everyday wear. Social media's influence, alongside digital wardrobes, boosting engagement, makes rental services a fairly popular alternative now.

The UK online clothing rental market is expected to expand at a robust CAGR of 6.81% over the next decade. Sustainable fashion preferences rising rapidly fuel demand for rental services due to pricey designer wear options being highly sought after nearby. Young urbanites frequently choose clothing rentals as a pretty affordable way staying on trend by leasing fashionable garments periodically.

The market benefits from growing digitalization and seamless app-based rental experiences, making it easier for consumers to access curated wardrobes. The expansion of subscription-based clothing rental services enhances consumer retention, while partnerships with leading fashion brands strengthen service offerings. The shift toward short-term wardrobe solutions for events, workwear, and casual outfits further drives widespread adoption.

India’s online clothing rental market is poised for rapid growth at an anticipated CAGR of 18.6% from 2025 to 2035. The rise of digital commerce and the rapid pace of urbanization profoundly impact consumer preferences, favoring rental apparel as an affordable fast fashion alternative nowadays. Young professionals and college students drive demand for stylish clothing that's pretty affordable without requiring long-term financial obligations.

E-commerce platforms, alongside app-based fashion rentals, significantly increase access for vast arrays of consumers seeking high-end fashion daily. Luxury brands rapidly gain popularity online due to affordability factors and consumers seeking high-end products. Rising eco-consciousness alongside government efforts boosts sustainable fashion trends, thereby fostering consumer preference for rental models over buying fashion.

The Online Clothing Rental Market is competitive, with brands like Rent the Runway, HURR Collective, and Le Tote leading the way. Rent the Runway offers a wide range of clothing for both everyday and special occasions with an easy subscription model.

HURR Collective focuses on sustainable fashion, offering eco-friendly rental options, while Le Tote is known for its flexible rental plans, catering to both casual and formal wear needs. These established brands dominate the market by providing consumers with convenient, affordable, and stylish clothing options.

Emerging brands like MyWardrobeHQ and GlamCorner are making their mark by focusing on luxury and high-end designer pieces, meeting the growing demand for premium attire rental.

The increasing popularity of sustainability and affordability among consumers is driving growth in this market. The trend toward renting instead of buying to reduce waste and refresh wardrobes regularly is gaining momentum, with the flexibility of online rental services further fueling market expansion.

Rent the Runway announced a partnership with multiple sustainable fashion brands, offering customers eco-friendly options for clothing rentals, aligning with&growing demand for sustainability in fashion.

H&M expanded its business model by launching an online clothing rental service, allowing customers to rent trendy outfits for special occasions, thus increasing access to high-quality fashion at affordable prices.

MyWardrobeHQ upgraded its online platform with AI-based recommendations, improving the personalization of clothing rentals and customer experience, while&also offering a wider selection of designer pieces for rent.

| Report Attributes | Details |

|---|---|

|

Report Attributes |

Details |

|

Current Total Market Size (2025) |

USD 2.60 billion |

|

Projected Market Size (2035) |

USD 6.4 billion |

|

CAGR (2025 to 2035) |

9.5% |

|

Base Year for Estimation |

2024 |

|

Historical Period |

2020 to 2024 |

|

Projections Period |

2025 to 2035 |

|

Market Analysis Parameters |

Revenue in USD billion |

|

By Product Type |

Knitwear, Trousers & Jeans, Jumpsuits, Coats & Jackets, Ethnic Wear, Performance Wear, Active Wear, and Lounge Wear |

|

By End User |

Business-to-Business (B2B), and Business-to-Consumer (B2C) |

|

Regions Covered |

North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania |

|

Countries Covered |

United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

|

Key Players |

Rent the Runway, H&M (H&M Rental), MyWardrobeHQ, Le Tote, GlamCorner, For Rent (forrent.com), ThredUp, Fashion Pass, Borrowing Magnolia, FlexiRent, Others (As Per Request). |

|

Additional Attributes |

Dollar sales by value, market share analysis by region, country-wise analysis |

|

Customization and Pricing |

Available upon request |

In terms of product type, the industry is divided into knitwear, trousers & jeans, jumpsuits, coats & jackets, ethnic wear, performance wear, active wear, and lounge wear.

The industry is further divided by end users that are Business-to-Business (B2B), and Business-to-Consumer (B2C).

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The online clothing rental market is expected to be valued at USD 2.60 billion in 2025, driven by increasing demand for sustainable and affordable fashion solutions.

The online clothing rental market is projected to grow at a CAGR of 9.5% from 2025 to 2035, reaching a total value of USD 6.4 billion by the end of the forecast period.

As of 2025, ethnic wear accounts for approximately 33% of the online clothing rental market, supported by demand for occasion-based apparel such as wedding and festive garments.

The business-to-consumer (B2C) segment is the leading end-user in the online clothing rental market, showing strong adoption among millennials and Gen Z due to cost-efficiency and style variety.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Business Model, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by End User , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Business Model, 2023 to 2033

Figure 23: Global Market Attractiveness by End User , 2023 to 2033

Figure 24: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by End User , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Business Model, 2023 to 2033

Figure 48: North America Market Attractiveness by End User , 2023 to 2033

Figure 49: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by End User , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Business Model, 2023 to 2033

Figure 73: Latin America Market Attractiveness by End User , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by End User , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 96: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 97: Europe Market Attractiveness by Business Model, 2023 to 2033

Figure 98: Europe Market Attractiveness by End User , 2023 to 2033

Figure 99: Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Business Model, 2023 to 2033

Figure 123: South Asia Market Attractiveness by End User , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by End User , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Business Model, 2023 to 2033

Figure 148: East Asia Market Attractiveness by End User , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by End User , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Business Model, 2023 to 2033

Figure 173: Oceania Market Attractiveness by End User , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Age Group, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Business Model, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by End User , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Business Model, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Business Model, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Business Model, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by End User , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by End User , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by End User , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 196: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 197: MEA Market Attractiveness by Business Model, 2023 to 2033

Figure 198: MEA Market Attractiveness by End User , 2023 to 2033

Figure 199: MEA Market Attractiveness by Age Group, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Online Clothing Rental Market Share & Industry Insights

Online Airline Booking Platform Market Size and Share Forecast Outlook 2025 to 2035

Online To Offline Commerce Market Size and Share Forecast Outlook 2025 to 2035

Online Travel Market Size and Share Forecast Outlook 2025 to 2035

Online Fitness Market Size and Share Forecast Outlook 2025 to 2035

Online Gambling Market Size and Share Forecast Outlook 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

Online Catering Marketplace Size and Share Forecast Outlook 2025 to 2035

Online Powersports Market Size and Share Forecast Outlook 2025 to 2035

Online Paint Editor App Market Size and Share Forecast Outlook 2025 to 2035

Online Grocery Market – Trends, Growth & Forecast 2025 to 2035

Online Travel Agencies Market Trends-Growth & Forecast 2025 to 2035

Online Food Delivery Services Market Outlook - Growth, Demand & Forecast 2025 to 2035

Online Advocacy Platform Market

Online Executive Education Program Market Trends – Growth & Forecast 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

Online Leadership Development Program Market Insights – Trends 2024-2034

Online Food Delivery Market Analysis – Trends & Forecast 2024-2034

Online Home Rental Market Analysis – Trends, Growth & Forecast 2025 to 2035

India Online Grocery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA