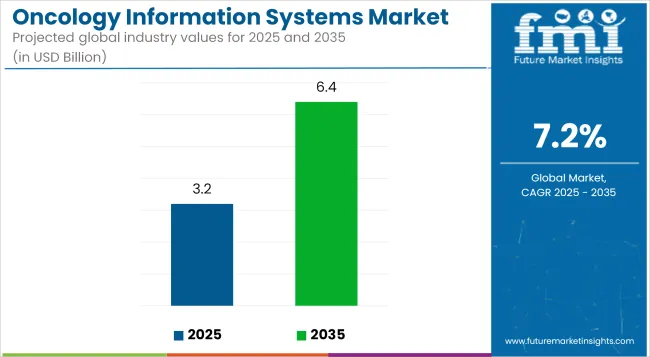

The global spending on oncology information systems market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate of 7.2% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3.2 billion |

| Projected Market Size in 2035 | USD 6.4 billion |

| CAGR (2025 to 2035) | 7.2% |

The oncology information systems market is evolving rapidly due to rising cancer cases and the need for integrated, data-driven care. Hospitals and Cancer Research Institutes are adopting oncology information systems platforms to streamline workflows, enhance patient data accuracy and support personalized treatment planning.

Technological advancements like AI integration and cloud-based deployment are accelerating adoption, especially in resource-constrained settings. Healthcare policies promoting digital transformation and value-based care are further propelling demand. Additionally, the need for interoperability with existing EHRs is shaping vendor strategies and innovation.

As healthcare providers focus on efficiency, precision medicine, and outcome-based care, oncology information systems is positioned as a critical enabler of future-ready oncology infrastructure. Growth opportunities lie in cloud adoption, real-time analytics, and cross-platform integration.

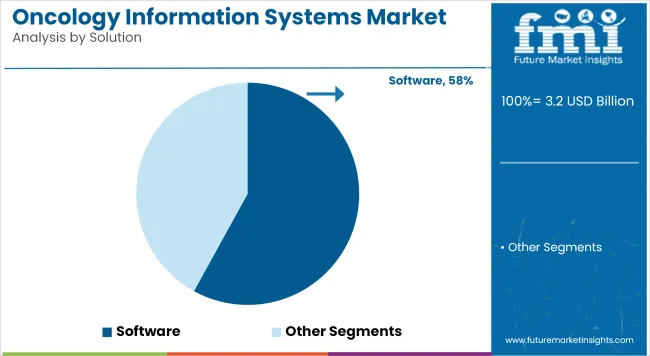

The software segment has been observed to dominate the oncology information systems market, accounting for approximately 58% of revenue share in 2025. This growth has been primarily driven by the increasing integration of digital tools across oncology practices.

Comprehensive patient data management, electronic health records (EHR), and clinical decision support systems have been widely adopted to enhance treatment accuracy and workflow efficiency. The need to consolidate patient information, streamline treatment planning, and comply with regulatory standards has further accelerated software adoption.

Cloud-based platforms and AI-powered analytics have also been embedded to improve predictive modeling and patient monitoring. Moreover, the flexibility to interface with other hospital systems has been cited as a major enabler of this segment's success.

Vendor investments in modular, interoperable solutions have been prioritized by healthcare institutions to support precision oncology approaches. As oncology practices become more digitally mature, the preference for software-centric oncology information systems platforms is expected to remain high across developed and emerging markets.

In 2025, fully integrated platforms is estimated to account a revenue share of 65.3%. This dominance has been linked to growing clinical emphasis on centralized systems that reduce duplication of work and unify diagnostic, therapeutic, and administrative workflows. Fully integrated systems have been widely preferred by healthcare providers to achieve seamless coordination between radiology, oncology, pathology, and patient records.

These systems have also enabled synchronized scheduling, billing, and outcome tracking, thereby improving operational efficiency. Their adoption has been reinforced by the pressing need to reduce medical errors and improve compliance with institutional protocols. Hospitals and cancer research institutes have increasingly opted for these platforms to reduce dependency on disparate systems and optimize staff productivity.

The integration of clinical intelligence tools within these oncology information systems platforms has also enhanced treatment planning capabilities, particularly in multi-specialty environments. As treatment complexity increases, integrated systems are expected to remain the preferred deployment model across oncology networks.

With a 72.1% revenue share, the clinical diagnostics & treatment segment has emerged as the most dominant application in the oncology information systems market in 2025. This prominence has been supported by the increasing prioritization of early-stage cancer detection and data-driven treatment planning across oncology departments.

The integration of imaging data, pathology results, and genetic insights into a unified system has been enabled by oncology information systems platforms, streamlining clinical decisions and enhancing outcome predictability.

Greater focus on real-time monitoring, radiotherapy planning, and biomarker-driven protocols has also fueled the usage of oncology information systems in this application area. Furthermore, the shift toward value-based healthcare delivery has placed strong emphasis on patient-centric diagnostics and precision therapy, making this application a critical focus for both public and private cancer centers.

Integration with Existing Healthcare Systems

There are enormous challenges for the Oncology Information Systems (OIS) market as new technologies are integrated into an existing medical environment and infrastructure. However, many healthcare facilities still use old systems unable to connect with modern oncology information systems. The result is data silos and inefficiencies.

Regulatory Compliance and Data Security

OIS providers face another obstacle in the form of strong regulatory requirements concerning patient data privacy (such as HIPAA in the USA or GDPR in Europe). How to be in compliance yet retain seamless interoperability and secure storage of patient data is an area for concern still being hammered out by all players in this market.

Advancements in AI and Big Data Analytics

Artificial intelligence (AI) and vast data analyses have taken hold in oncology. This is a huge opportunity for the OIS market. AI-fuelled analyses will help oncologists with finer diagnoses and treatment recommendations by examining through large amounts of patient data, and imaging and genetic information.

Rising Incidence of Cancer and Demand for Personalized Medicine

A growing cancer burden means the demand for advanced oncology information systems is on the increase around the world. Also, the transition from standardized therapy to targeted medicine-drugs and radiation modified depending upon a patient's genetic profile or combination of molecular markersmakes it all the more crucial to have a solid OIS platform than can effectively handle complex patient data.

A growing market for oncology information systems in the United States comes as a result of an increasing incidence of cancer and a concerted upgrading in healthcare infrastructure. Also important are the installing of electronic health records (EHRs) on behalf of healthcare professionals and the move from paper charts to various cloud-based solutions for patient management.

Further business incentives are provided through government initiatives toward the digital transformation and precision of medical services. For major health care agencies and educational institutions, the introduction of AI-driven solutions that assist in diagnosing and treating cancer is a concrete step towards making the conduct of their business more science-based.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.0% |

The United Kingdom's OIS market is shifting toward mainstream as more cases of cancer arrive and improved digital healthcare systems are established. By integrating AI and big data analytics into oncology systems, the quality of care available to cancer patients is raised.

Initiatives to expand cancer research and make the health service digital by the British government offer OIS supplier’s ample opportunities. As well the energy and creativity which technology firms bring to oncology software solutions as they join forces with medical research establishments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.3% |

In the European Union, the market for Oncology Information Systems has turned into a big business; more and more people under treatment for cancer means both better analytic quality depending on big data and tighter healthcare controls leading towards digitalization In AI-driven patient management platforms and cloud-based oncology systems Europe is a major user region, with leaders such as Germany turning to these new technology advances.

Even more important is the European emphasis on early cancer detection and precision medicine, both of which serve to reinforce demand for OIS solutions. European nations are beginning to invest heavily in digital healthcare infrastructure as they facilitate interoperability among themselves.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

South Korea’s advanced healthcare system and emphasis on AI-driven medical innovations is driving the OIS market. The emphasis on precision medicine alongside introduction of big data analytics into oncology services is raising demand for these systems.

Incorporating government policies supporting innovation in healthcare IT and cancer research are fuelling market expansion. Collaborations between major hospitals or research institutions and software companies are creating AI integrated oncology information systems to cater for personalized treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

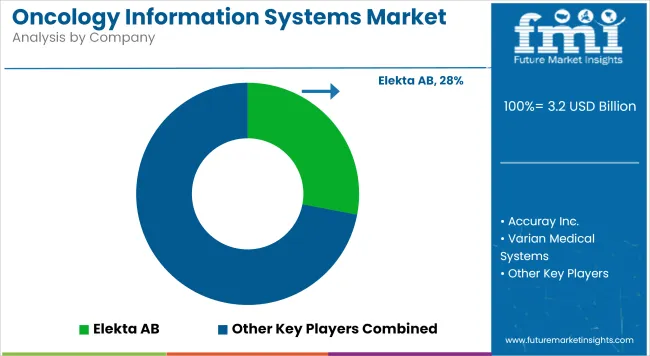

The oncology information systems market is experiencing dynamic competition, fueled by innovation in AI-based decision support, cloud deployment, and modular system design. Vendors are prioritizing solutions that integrate seamlessly with EHRs and support real-time monitoring and personalized oncology care. Strategic collaborations with hospitals and research institutions are being used to boost adoption and global reach.

Emphasis on cybersecurity and data privacy compliance is also shaping vendor positioning. Additionally, market players are aggressively expanding into emerging economies, where digital health infrastructure is rapidly evolving. This shift is intensifying competition and driving product differentiation based on interoperability, regulatory alignment, and clinical efficiency.

Key Development

The overall market size for oncology information systems market was USD 3.2 billion in 2025.

The oncology information systems market is expected to reach USD 6.4 billion in 2035.

The demand for oncology information systems will be driven by rising cancer cases, advancements in treatment planning, increasing adoption of digital healthcare solutions, and growing demand for integrated patient management and professional services.

The top 5 countries which drives the development of oncology information systems market are USA, European Union, Japan, South Korea and UK.

Solutions Segment demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oncology Based Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Oncology Blood Testing Market Size and Share Forecast Outlook 2025 to 2035

Oncology-Based In-vivo CRO Market - Growth & Emerging Trends 2025 to 2035

Oncology Nutrition Market Insights - Trends & Growth Forecast 2025 to 2035

Oncology Apoptosis Modulators Market Insights – Forecast 2025 to 2035

The Oncology Adjuvants Market is segmented by Application, Indication and End User from 2025 to 2035

Oncology Imaging Software Market – Growth, Demand & Forecast 2025 to 2035

Immuno Oncology Assay Market Size and Share Forecast Outlook 2025 to 2035

Generic Oncology Drugs Market Growth – Industry Forecast 2025 to 2035

Sterile Oncology Injectable Market

Clinical Oncology Next-generation Sequencing Market Analysis - Size, Share, and Forecast 2025 to 2035

Paediatric Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Immunology-oncology ELISA Kits Market Analysis - Size, Share & Forecast 2025 to 2035

Orthopedic Oncology Market Growth - Trends & Forecast 2025 to 2035

Musculoskeletal Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Information Security Consulting Market

Weather Information Technology Market Analysis - Growth & Forecast through 2034

Product Information Management Market Growth – Trends & Forecast 2024-2034

Airport Information Display System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA