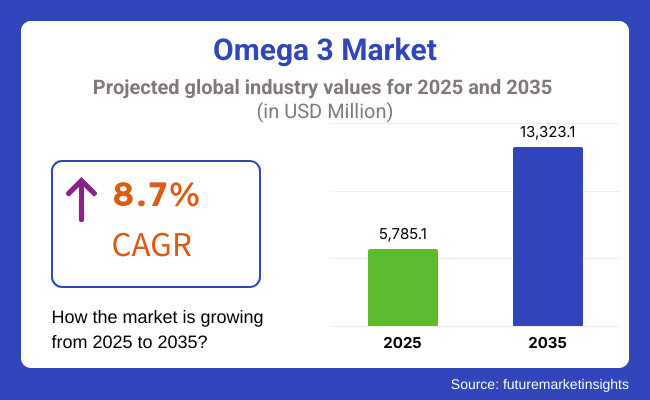

The Global Omega-3 Market is projected to grow from USD 5,785.1 million in 2025 to USD 13,323.1 million by 2035, exhibiting a CAGR of 8.7% during the forecast period.

The market is witnessing an upward trend as more and more people are becoming aware of Omega-3's health benefits, especially in cardiovascular, cognitive, and infant nutrition applications. The sale of high-purity, concentrated Omega-3 formulations is raising the bar on the clinical benefits available for people suffering from hypertriglyceridemia, brain function, and inflammation-related disorders.

The companies are getting more EPA and DHA that are of pharmaceutical quality, which are approved by the authorities, and also they are increasing their production capacities and refining the processes for coming to the prescription-based Omega-3 market, which is growing in demand, especially in North America, Europe, and Japan.

The food and drinks market's growth is fuelled mainly by the increase of plant-based Omega-3 particularly algal DHA-focus on sustainability, heavy metals in fish oil, and consumers’ dietary preferences. Firms such as DSM and Corbion are rapidly increasing microalgae production, while fish oil suppliers are optimizing purification technologies to meet stricter EU and FDA purity standards.

Furthermore, traceability and sustainability certifications have become the focus of manufacturers who are investing in block-chain based supply chain transparency, thus assuring consumers coming from completely honest sources.

The primary growth areas are ready-to-drink (RTD) formulations, sports nutrition products, and individualized dietary supplements that are now incorporating Omega-3 into their products. EPA:DHA ratios through customization, the focus is now on joint health, cognitive support, and heart health, these are the most sought-after issues, hence the growth in the range of premium, high-concentration Omega-3 products.

In China and India, growth in the infant formula fortification and general wellness supplementation is experiencing a rapid increase, which, in turn, is positively impacting the adoption of Omega-3. The government through policies requiring DHA fortification in baby formula is reaching a bigger market, meanwhile, sales channels DTC and platforms e-commerce do marketing on Tmall and Amazon that facilitate the distribution process.

However, disruptions in the supply chain due to the availability of raw materials, as a result of fishing quotas, and climate factors in Peru and Chile have posed problems for the industry. To reduce the risk of supply interruptions, companies are laying their bets on a variety of sources like krill oil and genetically modified oilseed crops-aiming to stabilize production and maintain fair pricing.

The competition in the market is thickening as the main companies are cantering on M&A, R&D in bioavailability enhancement, and formulation innovations in order to maintain market leadership. The Omega-3 market is set to witness a gradual but continuous growth with clinical research development, modern technologies, and regulatory interest being the driving forces, thus providing a diverse range of applications for profitable growth.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 8.3% (2024 to 2034) |

| H2 2024 | 8.9% (2024 to 2034) |

| H1 2025 | 8.5% (2025 to 2035) |

| H2 2025 | 9% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 8.3% in the first half (H1) of 2024 and then slightly faster at 8.9% in the second half (H2) of the same year.

The CAGR is anticipated to decrease somewhat to 8.5% in the first half of 2025 and continues to grow at 9% in the second half. The industry saw a decline of 30 basis points in the first half (H1 2025) and an increase of 42 basis points in the second half (H2 2025).

The dominance of algal sources in infant nutrition with regard to Omega-3

The shift in the infant nutrition sector toward algal-sourced Omega-3 and especially DHA is attributed to the sustainability of the product, as it has high purity, it is plant-based, and it does not contain contaminants (e.g., heavy metals). The approval of algal DHA for baby formula by regulatory bodies such as the FDA and EFSA has helped in the rapid adoption of the technology.

Consumers are increasingly relating marine-derived Omega-3 with sustainability issues thereby driving the manufacturers to the use of algal instead. Firms like DSM and Corbion are enlarging their microalgae cultivation capacities to meet demand.

The major concentration areas consist of bioavailability formulations, stability, and cost reduction to fish oil-based DHA articles. Notably, infant formulae brands are creating their unique selling attributes by the addition of DHA as the critical factor of cognitive and visual development, which has a further positive impact on the demand for high-purity algal DHA oils and powders.

Omega-3 Enrichment in Sports Hydration & RTD Beverages

The trend is shifting in the direction of Omega-3 fortification of ready-to-drink (RTD) beverages, which athletes are increasingly demanding to tackle inflammation with the additional endurance boost they can get from the drinks. Research has shown that Omega-3s are the most effective way to recover from exercise, help the joints, and improve cognitive development and so it was included in sports drinks, protein shakes, and even some electrolyte waters.

But stability and flavor changes are two of the main problems that need to be dealt with. Companies like Golden Omega and Croda International are working on the development of microencapsulation and emulsification technologies that would help to improve the solubility, shelf life, and taste neutrality of Omega-3 products.

The main focus areas are nano-emulsified Omega-3 for faster absorption, water-dispersible forms, and the addition of amino acids or electrolytes in a synergistic blend with Omega-3. Some brands in the functional beverage niche are promoting Omega-3 as a method of product differentiation by associating it with brain health, endurance, and muscle repair.

Supply Unpredictability Because of Changing Fishery Quotas and Climate Anomalies

The supply of marine Omega-3 on a global level is notably unreliable, owing to the policies governing the fishing industry, geopolitical issues, and the climate crisis. Peru and Chile, as the leading providers of fish oil, set fishing quotas to curb overfishing thus adversely affecting Omega-3 oil production.

El Niño climate conditions also have a negative effect on anchovy stocks which leads to supply shortages and price fluctuations. In response, businesses such as Epax, BASF, and Omega Protein are using multi-origin procurement (North Atlantic, South Pacific) and aquaculture-based fish oil production as their diversification strategies.

Another alternative is through increasing their investment in refining and yield optimization to get more Omega-3 out of new raw material. Emphasis is placed on the areas like maintaining a flexible supply chain, resource-efficient processing methods, and looking for marine alternatives (e.g., krill, menhaden, and sardine oil).

Pharmaceutical-Grade Omega-3 Making Inroads in Cardiovascular Health

The provision of Omega-3 medications through prescription is extending its wings as more clinical studies support its use for cardiovascular disease (CVD) management. The FDA's green light for Vascepa (icosapent ethyl) and other Omega-3 drugs has turned high-purity EPA and DHA supplements into major players in the fight against elevated triglycerides as well as cardiovascular disease.

The rise of the elderly population, coupled with the increase in knowledge related to hypertriglyceridemia has made pharmaceutical companies like KD Pharma and Novonesis invest in the ultra-refined, high bioavailability of Omega-3 API. The main focal points include elevating the purity to >90% EPA/DHA, the respective of new/soft delivery systems (e.g., liquid suspensions), and directing some more clinical trials to widen indications.

With the support of health providers, who regard Omega-3 as a cost-effective cardiovascular measure, the demand for pharma-grade Omega-3 is expected to increase in a stable manner, resulting in a change of industry direction to include prescription formulations.

Concentrated & Customizable Omega-3 to Personalize Nutrition

The program of DNA-based nutrition, customized supplements, and precision health has partly driven the demand for ultra-concentrated and personalized Omega-3 formulations. There has been a noticeable trend as consumers are asking for omega-3 products that are designed according to their genetic profiles, dietary needs, and health goals (e.g., high EPA for inflammation, high DHA for cognitive support).

Companies like Cargill and Croda are integrating the design of custom Omega-3 blends with specific EPA:DHA ratios, targeted delivery mechanisms (softgels, gummies, powders), and complementary ingredients (e.g., CoQ10, astaxanthin). In addition, they are utilizing AI along with consumer data analytics, offering a subscription-based approach to personalized Omega-3 regimes.

The key areas of the focus include a higher Omega-3 concentration (>80%), customer education on dosing, and collaboration with nutrigenomics companies. This trend is driving manufacturers towards the production of more flexible and high-purity Omega-3 formulations with specific health claims.

Heavy Metal & Toxin Regulations Stringently Imposed Thus Amplifying Compliance Costs

Legislative bodies, which include the European Food Safety Authority (EFSA) and the USA FDA, are tightening heavy metal and toxic limits in marine-derived Omega-3 products due-to contamination risks (mercury, PCBs, dioxins). This has led to a jump in the cost of purification and new investments in advanced refining technologies.

Companies such as BASF and DSM are now incorporating molecular distillation, supercritical CO₂ extraction and cold filtration methods to both remove contaminants and protect Omega-3 bioactivity. The industry focus is now on third-party testing certifications, the ultra-purified Omega-3 types, and transparency in the sourcing process.

Besides, the regulatory framework is pushing the manufacturers towards algae and krill alternatives which due to their natural growth, have less contamination. The regulatory landscape is stimulating the manufacturers to be purity, sustainability, and traceable to the point of both supply chain, and R&D investments.

For the period between 2020 and 2024, the Omega-3 business was progressive and the main factors of growth were spreading health consciousness, the rise of dietary supplements bought and approved medical applications of pharmaceutical-grade formulations. There was a peak in the functional foods, infant nutrition, and cardiovascular health applications; that is why the manufacturers started to expand high-purity EPA and DHA production.

The COVID-19 pandemic was the main reason for the increase in the demand for Omega-3 since it has immune-boosting properties and it is anti-inflammatory, which forms a basis for the development of new products. Nevertheless, raw materials faced supply chain disruptions and fishery quota restrictions that consequently made it difficult to get.

Between 2025 and 2035, organic demand is likely to be directed toward high concentrations, individualized and plant-based Omega-3. Algal DHA and pharmaceutical-grade EPA will be the main sectors to expand the market, followed by the promotion of bioavailability and technologies of microencapsulation.

Regulatory restrictions pertaining to heavy metal content and the issue of sustainability will spur innovation in traceability, purification, and alternative sourcing by manufacturers in a bid to keep their market edge.

The Global Omega-3 Market is relatively competitive, with Tier 1, Tier 2, and Tier 3 players contributing to the industry’s competitive dynamics. The Tier 1 players, such as DSM, BASF, Cargill, Epax, and Golden Omega, corner the market by producing high-purity, pharmaceutical-grade Omega-3, having strong supply chains, and doing cutting-edge R&D on sustainable sourcing.

These companies are the ones who mainly establish pricing benchmarks, regulatory standards, and the direction of tech innovation, especially in concentrated Omega-3 formulations, prescription-grade products, and functional nutrition applications.

On the other hand, Tier 2 players like KD Pharma, Corbion, GC Rieber Oils, and Nordic Naturals are engaged in more sophisticated Omega-3 brand offerings, individualized nutrition, and also expand to niche markets.

They challenge their competitors through innovation, namely, the introduction of targeted mixtures (for instance, high-EPA for cardiovascular health and high-DHA for cognitive support), algae-based alternatives, and delivery forms like emulsions and phospholipid-bound Omega-3 having even higher bioavailability.

Tier 3 and unorganized players, such as localized fish oil suppliers, small-scaled supplement brands, and private label manufacturers, typically offer the main fish oil-based Omega-3 standard formulation with price cuts.

Poor quality and lack of advanced refining technologies are the reasons behind comparatively less standard applications in high-purity or pharmaceutical formulation production. Additionally, thanks to their role, these companies are the ones who should create new markets through expanding the radius of Sunlight Omega-3.

The most relevant focus points for the entire industry are environmental sustainability (through alternative sourcing), personalization (driven by custom-made nutrition), and technological advancement (microencapsulation, molecular distillation).

As Tier 1 and Tier 2 players go ahead with the market share consolidation via acquisition deals and partnerships, the companies and individuals who are operating at lower levels are going to have to innovate or find their unique areas of specialization to compete.

The following table shows the estimated growth rates of the top three countries. USA, China and Japan are set to exhibit high consumption, and CAGRs of 4.2%, 5.1% and 2.5% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 4.2% |

| China | 5.1% |

| Japan | 2.5% |

In the USA, the Omega-3 pharmaceutical market is going through a transition from dietary supplements to pharma-grade formulations, the latter being the predominant entity. KD Pharma, DSM, and BASF are the forefront companies in the area of high purity EPA and DHA, and they are extending their products to meet the ever-increasing Cardiovascular prescriptions.

The FDA-EU Vascepa (icosapent ethyl) formulation is the high standard with which other manufacturers strive to comply; thus creating a need for the development of ultrarefined, high-dose Omega-3 concentrates for the treatment of triglycerides.

Additionally, clinical research activates are directing new therapeutic claims beyond the heart health area, including, neurological conditions, and anti-inflammatory treatments. The main focus is now on patent-protected, and high-bioavailability Omega-3 variants, and that is why manufacturers are investing in softgel, liquid, and encapsulated forms of delivery.

Regulatory compliance and insurance reimbursement mechanisms are also of high priority, therefore ensuring pharmaceutical Omega-3 remains a thriving segment in the USA market, which is highly valued.

In China, Omega-3 demand is rapidly increasing because of the premiumization trend of infant formula, which is made possible by regulatory approvals and consumer trust in fortified nutrition. The major companies like Cargill, Novonesis, and Corbion are boosting their investments in high-quality algal DHA, which will take the lead in the replacement of traditional fish oil.

The stricter National Food Safety Standards (GB regulations) of China provide obligate Be specific regarding the levels of DHA and ARA (arachidonic acid) in the formula and therefore manufacturers are urged to orreasonable high-purity, bioavailable DHA solutions.

Moreover, the new policies of the government promoting birth rate along with the better-off middle class have been the main reasons why the DHA-enhanced formula marketed for brain and visual development has gained popularity.

Brands use science-related evidence and clinical trials to position their products, while platforms for international e-commerce, such as JD.com and Tmall, unleash the sale of direct-to-consumer DHA supplements, thus solidifying penetration into the market.

In Japan, the major application area of Omega-3 is cognitive health, which mainly targets the growing elderly population in the country. Prominent producers like Nippon Suisan Kaisha (Nissui), Mitsubishi Corporation Life Sciences, and Takeda Pharmaceuticals have introduced specific formulations with DHA and EPA focusing on brain health.

The increase in dementia and neurodegenerative diseases as pressing public health concerns has seen Omega-3 being largely marketed for issues related to retention of memory, cognitive function, and neuroprotection. High-DHA supplements, emulsified Omega-3 drinks, and fortified dairy products have become popular among older people.

The functional food regulatory platform of Japan (FOSHU & Foods with Functional Claims - FFC) is in favor of Omega-3 claims and thus, brands get the motivation to launch scientifically substantiated products.

The trend in the market is shifting towards Omega-3 emulsions that have high bioavailability and phospholipid-bound formulations, these two factors are the key to achieve efficient delivery to the brain and consequently improved cognitive performance among the aging demographic.

| Segment | Value Share (2025) |

|---|---|

| Docosahexaenoic acid (DHA) (Product Type) | 45% |

DHA has a lion's share in the Omega-3 market as it is crucial for brain development, cognitive function, and visual health. It is the primary ingredient in infant formula, prenatal supplements, and cognitive support products, thus, it is a very high-demand category.

Top companies such as DSM, Corbion, and BASF are engaged in producing both marine and algal high-purity DHA extracts, which, in turn, will be free of the contaminants and deliver high-bioavailability. The ever-increasing number of elderly people and the corresponding growing need for brain health supplements are unfolding the wings of DHA for better market position.

The perks from the rules, like the imposable DHA fortification in infant formula in many countries, also add to the positive influence. Nanoparticle encapsulation of DHA and phospholipid-bound DHA are the innovations that brands have embraced for the intention of improving absorption, whereas personalized DHA mixtures for memory, visual well-being agency, and prenatal care are emerging on a functional food and dietary supplement basis.

| Segment | Value Share (2025) |

|---|---|

| Fish Oil (Source) | 51% |

Fish oil, with more than 60% of the global EPA & DHA demand being satisfied by its contribution, remains the most significant Omega-3 source in the world. It is a widely utilized ingredient in dietary supplements, pharmaceutical formulations, and fortified foods, being an inevitable part of the segment.

Companies like Omega Protein Corporation, Epax, and Golden Omega are employing molecular distillation and supercritical CO₂ extraction to get rid of heavy metals and contaminants, thus, making purity and concentration levels better. The low cost, high absorption, and already proven benefits in heart, and anti-inflammatory diseases are factors that contributed to the fish oil being dominant in the market.

Peru and Chile, which are the top-ranking countries for fish oil production globally, are revising their stock strategies for the sake of keeping the fisheries stable. The next generation of the market will be characterized by sustainable growth due to the development of ultra-purified, high-potency fish oil concentrates as well as the transition into krill and menhaden oil.

The Global Omega-3 Market is characterized by stiff competition, where DSM, BASF, Cargill, KD Pharma, and Epax are in the lead with their high-purity formulations, pharma-grade Omega-3, and eco-friendly practices.

In order to grow their market share, these companies are working on the launch of algal DHA production, investing in the development of high-concentration Omega-3 for prescription drugs, and upgrading the purification technologies. Moreover, there is a rising demand for plant-based alternatives and thus Novonesis and Corbion will scale fermentation-derived Omega-3.

Besides, manufacturers are launching tailor-made Omega-3 blends for personalized nutrition, right now Nordic Naturals’ high-DHA cognitive support supplements are available. The Golden Omega company enlisted ultra-pure fish oil concentrates for the cardiovascular health market.

Strategic buyouts, collaboration with supplement brands, and beyond consumer marketing (e.g., Omega-3-functional foods) are proven growth strategies that they strictly adhere to. Additionally, companies will pay more attention to certifications (GOED, IFOS) and trackability for the sake of boosting consumer trust and premium positioning.

The market is expanding due to rising consumer awareness of cardiovascular, cognitive, and infant nutrition benefits, alongside increasing demand for pharmaceutical-grade and plant-based Omega-3 formulations.

Docosahexaenoic Acid (DHA) leads the market due to its essential role in brain development, cognitive function, and infant nutrition, with strong demand in functional foods, dietary supplements, and pharmaceuticals.

Fishing quotas, climate-related disruptions, and regulatory restrictions on contaminants in marine-derived sources impact supply, leading manufacturers to explore alternative sources like algal DHA, krill oil, and genetically modified oilseeds.

Docosahexaenoic Acid (DHA), Eicosapentaenoic Acid (EPA), Alpha-Linolenic Acid (ALA)

Fish Oil, Krill Oil, Algal Oil, Flaxseed, Chia Seeds

Soft Gels/Capsules, Oil, Powder, Gummies

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.