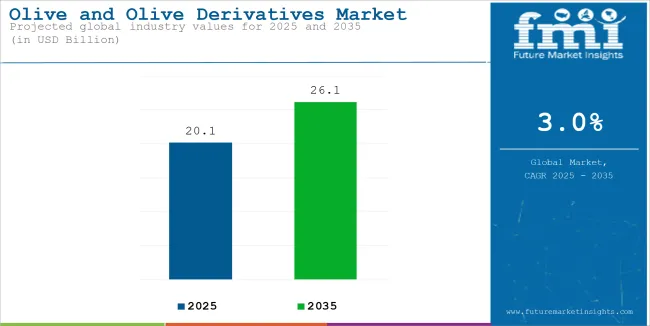

The global olive and olive derivatives market is estimated to account for USD 20.1 billion in 2025. It is anticipated to grow at a CAGR of 3.0% during the assessment period and reach a value of USD 26.1 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Olive and Olive Derivatives Market Size (2025E) | USD 20.1 Billion |

| Projected Global Olive and Olive Derivatives Market Value (2035F) | USD 26.1 Billion |

| Value-based CAGR (2025 to 2035) | 3.0% |

The olive and olive derivatives industry involves producing, processing, and distributing goods made from olives in Mediterranean regions. Along with table olives and other by-products like olive paste and cosmetics, Virgin olive oil is a noteworthy product for refined oil in several forms. Since olive oil is a common ingredient in worldwide kitchens, it is significant in the food industry.

As olive trees are drought-tolerant and are immune to pests, olive farming has become highly sustainable. Additionally, by-products such as olive pits and leaves are recycled into fertilizer, animal feed, and electricity, enhancing the industry’s eco-conscious image. The global surge of interest in olives and their by-products is triggering industrial breakthroughs and advancement.

The health benefits attached to the use of olive oil, particularly extra virgin olive oil, have turned the product into a trendy option for fitness lovers. This food has the highest antioxidant content and healthy fat ratio and is thought to be one of the essential foods for the heart and overall health.

The advancement of this industry has, for the most part, resulted from the growing number of customers leaning toward the consumption of natural and health-oriented foods.

| Product Type | Average Price Range (USD) |

|---|---|

| Extra Virgin Olive Oil | USD 5 - USD 15 per liter |

| Olive Oil (Refined) | USD 3 - USD 10 per liter |

| Olive Paste | USD 2 - USD 6 per kg |

| Olive Extracts | USD 10 - USD 50 per liter |

| Olive Pomace Oil | USD 2 - USD 5 per liter |

| Olive Leaves (for tea or extracts) | USD 5 - USD 20 per kg |

Production methods, quality, and origin influence olive and olive derivative prices. Extra virgin olive oil is celebrated for its superior quality and low level of processing, usually priced between USD 5 and USD 15 per liter based on its source and certification.

In contrast, the cost of the most ordinarily used refined olive oil, which is subject to further processing, can mostly be the cheapest oil in the market, and this oil typically costs between USD 3 and USD 10 per liter. Furthermore, the disparity in the pricing of olive paste and oil extracts can be attributed to their quality and concentration, mainly if they come with extra health benefits like antioxidants.

Olive pomace oil, made from residual pulp after the initial oil extraction, is generally more affordable, priced between USD 2 and USD 5 per liter. Olive leaves are increasingly used for their health benefits in products such as teas and extracts but tend to be more expensive, with prices ranging from USD 5 to USD 20 per kilogram, depending on their use in specialized products.

The olive trends in price reveal that olives and their products have many uses, including producing gourmet oils and extracts, which are mainly for health benefits. At the same time, the costs vary depending on the demand and the processing.

Spain emerged as the world's top exporter of virgin olive oil and its derivatives in 2019, exporting around 852 million kg, worth about USD 2.64 billion annually. Significant contributions were also made by Italy and the European Union. The exports stood at 253 million and 484 million kilos, respectively in 2019.

With nearly 808 million kg shipments, or roughly USD 3.04 billion, Spain continued to hold its top export spot by 2021. Greece (148 million kilograms), Portugal (189 million kilograms), Italy (293 million kilograms), and the European Union (561 million kilos) were among the other top exporters. The sources that are currently accessible do not provide the import data for 2021.

Growing Popularity of Mediterranean Diet

Due to its correlation with lower risks of chronic illnesses, including obesity, diabetes, and heart disease, the Mediterranean diet-which strongly emphasizes using olive oil as a key fat source-continues to gain favor throughout the world. As a result, there is now more global demand for premium olive oil and goods made from olives, particularly in health-conscious culinary items.

Sustainability and Eco-Friendly Practices

The olive oil industry has a strong appeal due to its relatively low environmental impact compared to other vegetable oils. Since olive oil is a more sustainable crop with less processing needs, the movement towards sustainability and eco-conscious customer behavior drives the industry's growth. Olive production also utilizes less water than other oilseed crops, further increasing its appeal in markets focused on environmental responsibility.

Price volatility becomes a challenge for the olive industry

Fluctuating prices are major obstacles in the olive and olive products market. The environmental conditions, for instance, unexpected temperature and precipitation variations in addition to the greenhouse effects trigger low output. Also, olive trees are influenced by most droughts, heat, and deep freeze during particular times of the year, thus affecting the overall yield.

In European countries, the price variation as a result of the political landscape is found in Greece, Italy, and Spain. Consequently, this makes it hard for the producers and consumers to make precise forecasts on the expenses of the products, resulting in the slow growth of the industry and affecting the decisions for the long term.

Expansion into Health and Wellness Segments

Businesses can add fortified or functional olive-based goods to their product portfolios as consumer awareness of the health advantages of olives and their derivatives, such as their high antioxidant content and heart-healthy qualities, grows. These might include health supplements using olive oil, enhanced oils, or novel nutraceutical compositions.

Development of Premium and Gourmet Products

Due to the growing demand for artisanal and gourmet food items, there is a chance to launch luxury products like cold-pressed, single-origin olive oils, infused oils, or specialty olive tapenades. These goods provide customers with exceptional and distinctive gastronomic experiences.

Diversification into Non-Food Segments

The use of olive derivatives in cosmetics, personal care, and pharmaceuticals is growing. Companies can develop skincare products, such as moisturizers, anti-aging creams, or medicinal items leveraging olive oil and extracts' anti-inflammatory and antimicrobial properties.

A significant trend in the olive and olive derivatives market is the rising demand for products that are both health-conscious and sustainably. People focus more on their well-being, and extra virgin olive oil and other minimally processed olive products are becoming favorites for their heart-healthy fats, anti-inflammatory properties, and rich antioxidants.

At the same time, consumers are increasingly drawn to brands that prioritize sustainable farming, reduce waste, and use eco-friendly packaging.

| Attributes | Details |

|---|---|

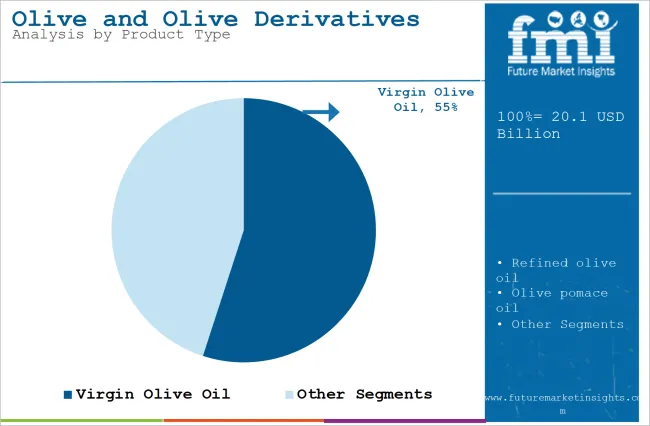

| Top Product Type | Virgin Olive Oil |

| Market Share in 2025 | 55% |

By type, the industry is dominated by virgin olive oil and is expected to account for 55% market share in 2025. Virgin olive oil is becoming more well-known due to its many culinary uses, natural production methods, and health advantages.

Rich in antioxidants, monounsaturated fats, and anti-inflammatory qualities, it is associated with better well-being, heart health, and general well-being. Virgin olive oil is becoming more popular among health-conscious people, as opposed to oils that include more additives or saturated fats.

Its chemical-free, clean-label production method satisfies the growing desire for minimally processed whole foods. As a result of olive oil's versatility in using raw and cooked foods, it has become a staple among Mediterranean people, preferring the use of organic ingredients in food preparation.

| Attributes | Details |

|---|---|

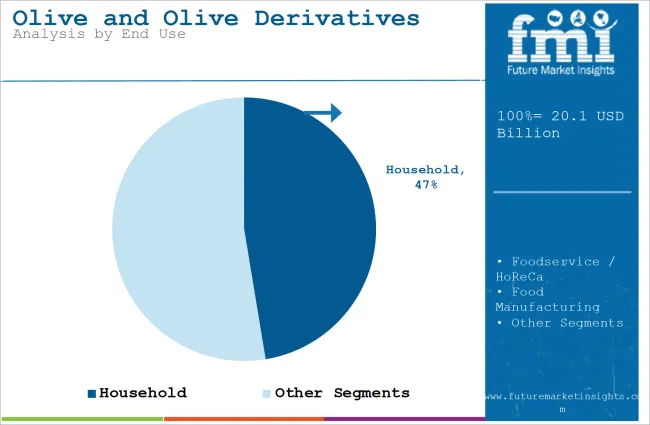

| Leading End Use | Household |

| Market Share in 2025 | 47.4% |

Olive and its derivatives are becoming more popular in households due to their health benefits, versatility, and alignment with clean-label food trends. Extra virgin olive oil, rich in heart-healthy monounsaturated fats, antioxidants, and anti-inflammatory compounds, is a top choice for health-conscious consumers seeking to support heart health, improve cholesterol, and reduce the risk of chronic diseases.

The versatility of olive products in the kitchen also contributes to their growing popularity. Olive oil is used in various culinary applications, from sautéing to salad dressings, while other olive-based products like olives, olive paste, and olive leaf extract are gaining attention for their unique flavors and health benefits.

With increasing demand for natural, minimally processed ingredients, olive oil and its derivatives fit perfectly into the trend for high-quality, sustainable food choices.

| Attributes | Details |

|---|---|

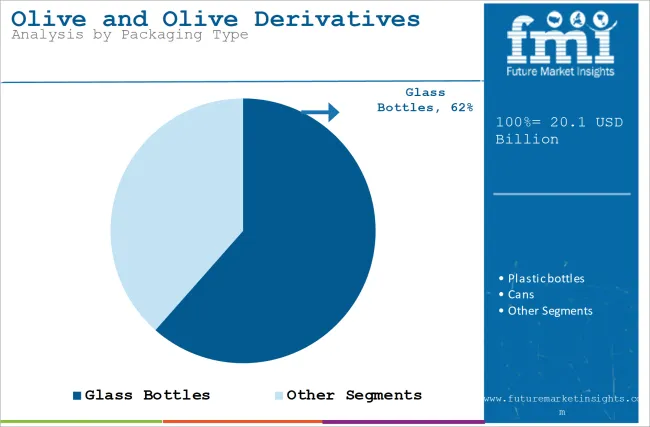

| Leading Packaging Type | Glass Bottles |

| Market Share in 2025 | 61.5% |

By Packaging type, glass bottles are expected to account for 61.5% of the market share in 2025. Glass bottles are commonly used as premium packaging for olive oil, particularly extra virgin olive oil, as they help preserve the oil’s quality by protecting it from light and air.

Glass is an inert material and does not react with the oil, keeping the flavor and nutritional profile intact. It is also favored for its premium appearance, making it ideal for retail packaging in higher-end markets. Additionally, Glass is recyclable, making it an eco-friendly packaging choice.

| Attributes | Details |

|---|---|

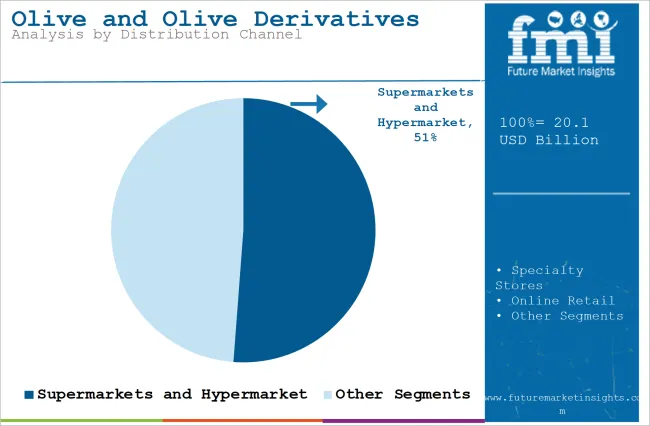

| Leading Distribution Channel | Supermarkets and Hypermarket |

| Market Share in 2025 | 51.2% |

By Distribution Channel, supermarkets and hypermarkets are expected to account for 51.2% market share in 2025. The most popular and extensive distribution channels for olive oil and its derivatives are supermarkets and hypermarkets. They serve a broad range of customers with many olive oil products in various sizes, brands, and pricing points.

Due to their significant foot traffic, these retail locations are substantial points of sale for both high-end and mainstream olive oil goods. Olive oil is a simple choice for routine household purchases because it is readily available to consumers alongside other cooking oils.

| Countries | CAGR (%) |

|---|---|

| India | 18.2% |

| USA | 11.6% |

| Spain | 12.6% |

India

The market for olives and olive derivatives in India is growing due to increasing health awareness, changing dietary preferences, and global food trends. As health-conscious consumers seek benefits like heart health and antioxidants, olive oil-especially extra virgin-has become a popular alternative to traditional cooking oils.

The adoption of international and Mediterranean diets prioritizing olive oil also drives demand. Greater availability in supermarkets, specialty stores, and online platforms has made these products more accessible.

The expanding middle class and rising disposable incomes increase demand for premium imported foods, including high-quality olive oil. This trend aligns with a growing preference for clean-label and organic products, making olive derivatives a top choice for health-conscious consumers.

USA

The Mediterranean diet is known for using olive oil as a primary fat source, has become more popular in the USA due to its connection with a lower risk of chronic diseases like heart disease and diabetes.

This shift towards healthier eating and the rising demand for plant-based and clean-label foods have fueled the growing popularity of olive oil and its derivatives in the USA.

Additionally, olive oil has expanded beyond just cooking, with people incorporating it into beauty products, supplements, and snacks, further boosting its appeal across multiple industries.

Spain

The olive and olive derivatives market in Spain is expanding due to the country being one of the largest producers and exporters of olive oil in the world and additional demand for high-quality and health-focused products.

The Mediterranean diet of Spain, which uses olive oil as a basic ingredient, affects both home and world consumption, especially for extra virgin olive oil that is enriched with good fats and antioxidants.

Spain is a leader in olive cultivation and is known for novelties in the processing, which in turn have led to a variety of olives derivatives. While the consumers are focusing on consuming natural, organic, and sustainable products, Spain's commitment to green farming and its clean-label products are the prime reasons for market development.

United Kingdom (UK)

The UK market for olive and olive derivatives is increasing steadily as a result of the increasing trend of Mediterranean diet and healthy lifestyle. Olives, olive oil, and derivative products such as spreads and tapenades feature prominently in the retail and foodservice markets.

Imports dominate, with Spain, Italy, and Greece being among the leading suppliers. Supermarkets and specialty retailers are the principal sales channels; e-commerce continues to expand into this space.

Consumers like extra virgin and organic olive oil, which marks a trend toward premium products. Government initiatives that promote healthy diet and sustainability add to the demand, making the UK a leading market for olive products.

France

The country enjoys a long-standing culinary tradition with local production in Provence for olive and its derivatives. Olive oil, table olives, and specialty derivatives such as tapenades form an integral part of French cuisine.

Domestic production caters to part of the demand, but imports from Spain and Italy supplement supply, especially for premium varieties. Artisanal and organic olive products are gaining traction in retail.

Local markets, gourmet stores, and supermarkets dominate sales, with increasing adoption of online platforms. Sustainability and quality certifications like AOP and AOC influence purchasing decisions. Rising awareness of the health benefits of olives supports consistent market growth in France.

Germany

Germany’s olive and olive derivatives market relies heavily on imports due to limited local production. Consumers prioritize high-quality products such as extra virgin olive oil and marinated olives, often sourced from Spain, Italy, and Greece. Supermarkets, health food stores, and online platforms serve as key distribution channels.

German consumers increasingly prefer organic and sustainably produced olive products, reflecting a growing focus on health and environmental responsibility. Olive oil consumption remains a part of the Mediterranean diet that is gaining popularity.

Marketing efforts that promote a diet of nutritional value, as well as other environmental certifications, keep boosting demand that identifies Germany as a major importer of olive products.

Brazil

Brazilian market of olive and its derivatives is growing fast due to urbanization and rising consumer interest in Mediterranean diets. Domestic olive production is centered in Minas Gerais and Rio Grande do Sul, increasing, but is supplemented by imports from Spain, Portugal, and Argentina.

The bulk of domestic olive oil produced is extra virgin, followed by table olives, specialty products like flavored oils, etc. Premium and organic lines are gaining momentum at supermarkets, gourmet stores, and online sales platforms.

Government incentives to regional olive production in addition to informative campaigns regarding potential health benefits push market growth forward toward Brazil becoming Latin America's principal player.

Argentina

Argentina was a major producing nation and a relevant consumer for this olive and derivates of oil market, also with its local production mainly occurring across Mendoza, La Rioja, table-olive-type production as well as the prominent extra virgin-type oil.

Local brands are quite popular, and there are significant imports from Spain and Italy into premium market segments. Supermarkets, traditional markets, and specialty stores dominate the retail sector. North America and Europe are its principal export markets.

Argentina is an area of strong commitment to sustainability and innovation; thus, there has been development into organic and flavored olive oil. Health awareness increases the demand for olive products.

The olive and olive derivatives market is very competitive, with key companies aiming to innovate products sustainably and expand their global network. Deoleo, being at the top of the game with brands such as Bertolli and Carapelli, stresses the importance of premium quality olive oil and organic products, besides implementing the most advanced sustainable farming practices.

Cargill significantly improves traceability and quality through partnerships with olive farmers and modern production facilities. Gaea stands out for its premium extra virgin olive oil and focuses on sourcing from certified organic farms.

At the same time, Sovena, owner of Oliveiras and Oliviers & Co., aims to expand internationally and introduce health-focused products with added polyphenol content.

Furthermore, emerging players such as OliveOilMania focus on the niche market by providing boutiques and small-batch olive oils and stressing artisanal production methods.

The sector as a whole is moving in a different direction with the rise in companies producing eco-friendly products, diversifying their portfolios, and using modern technology to secure a leading position in the ever-growing olive oil market.

Several startups are gaining momentum in the olive and olive derivatives market with innovative products and best practices. Oliveology is one such Greek startup focused on artisanal extra virgin olive oil, organic farming, and small-batch production, appealing to eco-conscious consumers around the world. Soleado, a Spanish brand offers cold-pressed olive oils and skin care products, highlighting authenticity in Mediterranean farming traditions.

The USA Olive Tree Company is a company that is all about olive oil and olive leaf-based wellness products, and it also has the perfect chance to be on the trend in the natural area.

Vincotto, a young and brilliant Italian company, has a unique approach of mixing old balsamic vinegar with olive oil and selling it as a premium product in a small batch, distinguishing it from competitors. With their product offerings, these companies are cracking the market on trends of organic agriculture, sustainability, and being health-conscious.

Focus on Premium and Health-Conscious Products

As people turn health-conscious, there’s a growing interest in high-quality, nutritious products. Olive oil brands can stand out by offering extra virgin and organic options and expanding into wellness products such as supplements and skincare.

Emphasizing the health benefits of olive oil, known for its heart-healthy fats and antioxidants, can attract consumers who want natural, good-for-you food choices.

Embrace Sustainability and Eco-Friendly Practices

Due to the environmental impact of purchases, consumers are becoming more conscious of what to buy. Olive oil brands can gain trust and loyalty by adopting sustainable practices, like organic farming and eco-friendly packaging.

Being transparent about how products are sourced and made helps build a connection with eco-conscious shoppers who care about the planet as much as the product itself.

Novel Product Offering

The popularity of olive oil has gone beyond cooking. Brands can now tap into new markets by introducing olive-based snacks, beauty products, and beverages. By using out-of-the-box and creative product ideas, companies can reach a broader audience.

In terms of product type, the olive and olive derivatives market is segmented into virgin olive oil, refined olive oil and olive pomace oil.

In terms of end use, the olive and olive derivatives market is segmented into households, foodservice /HoReCa, food manufacturing.

In terms of packaging, the olive and olive derivatives market is segmented into glass bottles, plastic bottles, cans, bulk containers, and others.

In terms of distribution channel, the olive and olive derivatives market is segmented into supermarkets /hypermarkets, specialty stores, online retail, and others.

In terms of Region, the market is segmented as North America, Europe, Middle-East and Africa, and Asia Pacific.

The global olive and olive derivatives market is estimated to account for USD 20.1 billion in 2025.

The market is expected to grow at a CAGR of 3.0% during the assessment period from 2025 to 2035.

Virgin olive oil holds the largest market share at 55% in 2025.

The rising popularity of the Mediterranean diet, health benefits of olive oil, and the shift towards sustainably products are key drivers.

India and the USA are experiencing the fastest market growth and poised to reach high CAGRs respectively.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Olive Market Size and Share Forecast Outlook 2025 to 2035

Olive Oil Market Size and Share Forecast Outlook 2025 to 2035

Olive Leaf Extract Market

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA