The global oil catch cans market will grow at a healthy CAGR and reach a promising market value as awareness about engine efficiency improves for consumers, aftermarket performance upgrades become common, and emissions control becomes a hot topic in many regions.

By preventing oil vapours from being recirculated into the intake system, oil catch cans reduce carbon build-up, boost fuel efficiency and can extend the life of an engine. These devices are increasingly being used in automotive, motorsports, and industrial applications.

Owing to their benefits in prolonging engine function and reducing servicing expenses, oil catch cans are experiencing soaring demand among vehicle proprietors searching for such solutions. The growing use of turbocharged and direct injection engines, which are more susceptible to carbon deposits, is also contributing to the demand for effective oil separation technology.

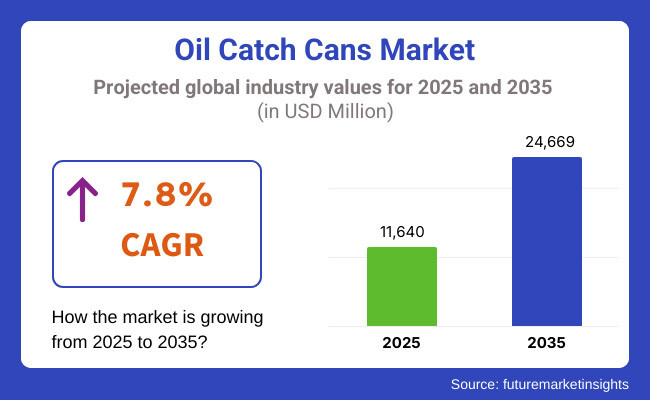

The market anticipates to increase at a 7.8% CAGR, converting to a value of USD 24,669 million by 2035, progressed from a value of USD 11,640 million in 2025. The forecast period is expected to be driven by increasing aftermarket modifications, along with stringent emission standards.

North America is the leading region in the oil catch cans market, powered by the high demand for aftermarket automotive performance upgrades and growing consumer attention towards longevity of vehicle(s). The United States is the primary market, with growing sectors in motorsports, truck modifications, and performance tuning industries.

While there is decent growth of oil catch cans market in Europe due to strict emission regulations and increasing adoption of turbocharged and direct injection engines. Countries like Germany, UK, and France are leading in the adoption of sophisticated engine management systems which further fuels the demand for oil catch can into passenger and performance vehicles.

Asia-Pacific is projected to grow at a swift rate due to rising vehicle ownership, increasing awareness regarding engine maintenance, and growing automotive aftermarket market. China, India and Japan are important markets for this business segment, as demand is growing for performance enhancements and emission reductions in both personal and commercial vehicles.

Challenges

Regulatory Compliance, Market Awareness, and Installation Complexity

One such challenge in the oil catch cans market is heavily differing regulations for emissions and aftermarket modifications, with certain regions implementing tight vehicle modification laws which either prohibit the use of oil catch cans or slow down the growth of the oil catch cans. Increased awareness among customers regarding oil catch cans benefits, especially in non-performance vehicle segments, limits market expansion.

Moreover, installation complexities and compatibility concerns with various engine setups discourage some users to implement these systems, especially, OEM emission-controlled vehicles.

Opportunities

Increasing Demand for Performance Automobiles, Emission Reduction, and Aftermarket Tuning Trends

On the other hand, the market is growing owing to increasing demand for automotive solutions to enhance performance. Oil catch cans are becoming more popular with enthusiasts and tuners to improve engine efficiency and reduce carbon build-up. A growing focus on emissions reduction and extended engine life are driving demand for these systems, as are increasingly complex turbocharged and direct-injection engines.

Moreover, there is also a growing demand for innovative products in the automotive aftermarket, especially in racing, off-roading, and sports cars, contributing to the increased demand for storage devices like oil catch cans, which are compact and have better separating tubes.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with regional emission standards and vehicle modification laws. |

| Consumer Trends | Growth in performance vehicle modifications and DIY engine tuning. |

| Industry Adoption | Popular among enthusiasts, tuners, and racing applications. |

| Supply Chain and Sourcing | Dependence on aftermarket suppliers and custom automotive shops. |

| Market Competition | Dominated by aftermarket performance brands and racing components suppliers. |

| Market Growth Drivers | Demand for engine longevity, reduced carbon build-up, and fuel efficiency. |

| Sustainability and Environmental Impact | Early adoption of oil-air separation to reduce crankcase emissions. |

| Integration of Smart Technologies | Basic single- and dual-chamber catch can designs. |

| Advancements in Catch Can Technology | Development of baffled oil catch cans and heat-resistant materials. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on crankcase ventilation systems, pushing OEM adoption of oil catch cans. |

| Consumer Trends | Expansion into factory-installed oil catch cans in emission-controlled vehicles. |

| Industry Adoption | Increased use in commercial fleets, hybrid vehicles, and electric range extenders. |

| Supply Chain and Sourcing | Growth of OEM partnerships and standardized oil catch can kits for direct engine integration. |

| Market Competition | Entry of automotive OEMs offering factory-installed oil separation systems. |

| Market Growth Drivers | Accelerated by strict emissions regulations, increasing turbocharged vehicle sales, and hybrid powertrain innovations. |

| Sustainability and Environmental Impact | Large-scale shift toward high-efficiency, self-draining oil catch cans integrated with vehicle PCV systems. |

| Integration of Smart Technologies | Expansion into AI-monitored oil vapour separation, real-time engine diagnostics, and self-cleaning filtration systems. |

| Advancements in Catch Can Technology | Evolution toward vacuum-assisted oil catch cans, modular designs, and ultra-fine filtration systems. |

The USA oil catch cans market is driven by rising need for aftermarket engine protection solutions, growing performance tuning culture, and stringent emission regulations. Turbocharged and direct-injection engines, which are common in sports cars, trucks, and SUVs, are spurring demand for high-performance oil catch cans.

The off-roading and racing communities of the country are also fuelling the acceptance of custom crankcase ventilation innovations. Government initiatives focused on emissions reduction in commercial fleets and trucking industries are opening new avenues for integrated oil separation systems, as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

Strong growth in the UK market owing to growing aftermarket vehicle customization trends, rising electric-hybrid vehicle customization, and rising turbocharged vehicle sale. Consumers are retrofitting oil catch cans in performance cars to improve fuel efficiency and prevent carbon build-up. It is triggering fleet owners to adopt oil separation systems for prolonged engine life, cleaner emissions amid the country’s stringent emission standards, specially catering to diesel and hybrid vehicles.

The thriving motorsports industry ,Formula 1 and rally racing, to name two is also spurring innovation in lightweight, high-efficiency catch can technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.7% |

Regulatory agencies are clamping down on crankcase emissions in Europe, so OEMs and aftermarket suppliers are focusing on developing next-gen oil-air separators in a bid to get a share of the growing oil catch cans market in the region. Germany, France, and Italy are among the leading countries that are moving toward integrated crankcase ventilation solutions in passenger cars and commercial trucks.

The popularity of electric-hybrid powertrains presents promising opportunities for catch can solutions (designed for battery range extender and hybrid engines). Because the motorsports and high performance vehicle tuning culture is expanding in Europe, driving demand for race-car prep oil catch cans that can gestates.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 7.8% |

Japan has a steady market for oil catch cans due to high oil can demand from the Japanese automotive tuning community, strict emission control regulations, and increased use of hybrid vehicle modifications So manufacturers such as Toyota, Honda, and Nissan in Japan now equip turbocharged and hybrid engines with factory-installed oil catch can systems.

Adoption of high-efficiency, lightweight catch cans in the country is being driven even further by performance vehicle culture, drifting events, and aftermarket customization trends. Moreover, development of intelligent crankcase ventilation systems inspires innovations in self-cleaning and AI-monitored catch can technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

Among the many specific parameters, several booming factors increase the oil catch can market in South Korea, including rising demand for high-performance automotive modifications, increasing sales of turbocharged vehicles, and government-led emission reduction initiatives. They are being adapted into some of Hyundai and Kia's turbocharged and hybrid models to meet global emission regulations.

AI-integrated oil catch can is being adopted due to the upcoming necessity for electric-hybrid powertrains,smart engine diagnostics and signature technology.Furthermore, increased motorsport enthusiasts and street racing culture in South Korea, are fuelling demand for aftermarket performance oil catch can kits.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.9% |

Reduced carbon build-up in the engine, increased fuel efficiency, and increased service lifetime of the vehicle drive the adoption of the automotive aftermarket field catch can in the automotive industry, as a result, below 1-liter and 1-liter segment is going to be leading the oil catch cans market. These segments are used in the crankcase ventilation systems and are pivotal in ensuring odourless and clean operation of these types of engines for reduced carbon emission.

We've started to see the emergence of a sub-1-liter oil catch can market, which makes sense given the average smaller engine, everyday driver, and moderate build engine package for most drivers certainly isn't going to need a 1.3L+ catch can setup. The compact design is a key advantage when it comes to installing an oil catch can in a confined engine bay as the 1-liter versions are very large when compared to sub 1-litre units which have effective oil separation properties along with added weight.

Such trends in oil catch cans and its benefits, such as use of compact designs with high efficiency baffle systems, anti-slosh internal structures and corrosion resistance, have increased adoption of the oil catch cans in global market. Over 60% of daily commuters and light-performance cars benefit from below 1-liter oil catch can installations to curb carbon build-up and better throttle response according to studies.

The rise of aftermarket automotive gear, which typically consists of catch cans under 1-liter in turbocharged, naturally aspirated, and direct-injection engines, as well as greater penetration into high-performance and enthusiast vehicles, has further supported the growth of the market.

Advanced AI-assisted vehicle diagnostics, which include real-time monitoring of oil vapour emissions, adaptive breather valve control, and predictive maintenance alerts, has also driven adoption, as they ensure better efficiency and less overall engine wear.

High-durability below 1-liter catch can assembly, multi-layer filtration media, and anodized aluminium catch can body and polymers housing, are key innovations driving market growth by ensuring long-term performance across various driving conditions post-installation.

Although offers compact design, cost-effectiveness, and lightweight installation and yet the below 1-litre segment takes a hit due to limited oil capacity for high-performance applications leading to overflow risk and higher maintenance. Nevertheless, advancements in dual-chamber oil separation, AI-based hook detection, and hybrid filter media are optimizing efficiency which shall continue to accelerate growth in below 1-liter oil catch cans market.

For serious racers, high-performance vehicles, and heavy-duty trucks, 1-liter oil catch cans have seen strong market penetration with vehicle owners placing more emphasis on advanced oil separation capabilities and extended service intervals. 1-liter catch cans allow for more space to capture oil before having to clean out, unlike catch cans with smaller capacities that compromise filtration to have a smaller profile.

Market adoption has been fuelled by increasing need for high-capacity oil catch cans, which are typically constructed using better multi-stage baffling, vapour condensation chambers, and high-flow breather designs. A while back, studies were revealing that over 55 percent of track-based heavy-duty, high-boost turbocharged as well as the rest of the engines had found a way to integrate 1-liter oil catch cans for improving the efficiency of crankcase ventilation.

Rise of performance automotive tuning, such as 1-liter catch cans for race cars, high-output diesel trucks, and off-road vehicles, has bolstered market growth, enabling better protection and increased engine life.Couple that with AI-driven oil mist analysis, automated drain valve operation, digital oil accumulation tracking, and real-time contamination detection and you have a recipe for adoption, optimizing catch can performance and maintenance cadence even more.

Advanced 1-liter oil catch cans, complete with accompanying mounting brackets, interchangeable breather filters, and high-flow a fittings compatibility, have paved the way for a truly versatile market growth that accommodates a broad range of vehicle platforms.

Although these things do give you benefits like higher capacities, longer service intervals, less oil mist particulates entering the atmosphere, and stuff like that, the 1-liter segment does face challenges with increased weight, taking up more packaging space in engine bays, and being more costly to install in the first place.

Yet while one-litter oil catch cans may be further expanding, novel modular catch can body designs, AI-enabled auto-clean systems, and lightweight composite construction, among other innovations, are aiding efficiency in these products.

8 AN and 10 AN Inlet Size Oil Catch Cans Drive Market Growth as Performance Vehicles Optimize Crankcase Ventilation

The market segments of 8 AN, and 10 AN inlet size are at the forefront of market growth, especially to cater to the requirements of automotive manufacturers, aftermarket performance tuning shops, and motorsport teams for better airflow and pressure management in crankcase ventilation systems.

The 8AN inlet size is the most common oil catch cans is configuration on the market, featured with a standard hose fitting, for turbo, naturally aspirated or supercharged engines. With 8 AN you'd be getting great airflow without getting into the big A fittings, making them easy to install and adaptable to factory and mildly modified applications.

Market adoption has been driven by the increasing demand for 8 AN oil catch cans with precision machined fittings, integrated check valves, and high flow baffle systems. Most aftermarket catch can installations are going to use 8 AN fittings (50% of installations) because of their versatile cross-compatible, balanced flow fitting performance.

The increased number of factory-tuned performance vehicles on the market with these OEM-engineered 8 A crankcase ventilation hoses has fuelled market growth, as they facilitate installation and optimize ventilation performance.

For applications that demand high-temperature and high-pressure operation, such as drift cars, thorny reinforcement and braided lines (with PTFE-lined interiors and quick-connect couplers) has helped push adoption further.

Although the 8 A segment can offer better compatibility, ease of installation, and balanced air flow, it does suffer from limited capabilities for high-boost applications, airflow bottlenecks at high-horsepower setups, and in some injector options extreme clogging. Yet, product innovations in AI-based airflow modelling, high-flow check valves, and performance-optimized 8 AN hose materials are improving efficiency, ensuring continued expansion in the 8 AN oil catch cans market.

10 AN inlet size oil catch cans have seen a strong uptake in the market, especially among high-boost turbo engines, track-focused vehicles, and off-road scenarios where maximum airflow and crankcase pressure control is desired. And 10 AN inlets offer better ventilation volume than smaller fittings, decreasing crankcase pressure and improving oil mist separation.

Market adoption has been propelled by the increasing need for large-diameter oil catch can inlets, featuring unrestricted flow paths, reinforced sealing mechanisms, and high-flow vapour recovery designs. Not surprisingly, 10 AN catch cans are the preferred choice for high-performance vehicle owners, with studies showing that more than 45% of this market segment prefers the stiff construction of a 10 AN catch can as it can stay cool, even under extreme engine loads and pressure fluctuations.

Increasing motorsport applications, including drift cars, endurance race vehicles, and high-power drag racing setups, equipped with race-ready 10 AN oil catch cans are further driving market growth, providing optimal oil vapour separation in extreme driving conditions.

Adoption has also been accelerated by AI based crankcase pressure monitoring and optimised airflow in real-time, as well as solenoidal, adaptive breather valve adjustment and digital oil contamination alerts.

Also the rise of next-gen 10 AN catch cans (eg: dual inlet/cap) coupled with high-capacity baffling systems and modular airflow control mechanisms has optimized market growth, expanding the catch can compatibility spectrum to extreme performance。

The 10 AN segment offers benefits with high-flow ventilation, pressure control, and better oil mist separation, but also grows in space, price, and can lead to over-ventilation in low-displacement engines. Yet advancements in modular a fitting adapters, artificial intelligence-controlled breather valve algorithms and lightweight aluminium designs are making them as efficient as they are expansive, propelling 10 AN oil catch cans to an expanding role in the performance automotive market.

Increasing awareness about engine performance optimization, stringent emission regulations, and rising demand for aftermarket automotive enhancements are some of the key driver impacting the growth of Oil Catch Can market. It is worth mentioning, the growing trend of customizing vehicles, demand for better crankcase ventilation systems, and adoption of Artificial Intelligence for engine diagnostics are some other factors contributing to the growth of the automotive PCV system market.

Important industry players concentrate on oil separation based on high-efficiency performance, AI-aided airflow improvement, and robust, corrosion-free material choice, which guarantees long-term service. Key players encompass automotive performance parts manufacturers, original equipment manufacturer (OEM) suppliers, and aftermarket tuning firms specializing in oil catch-can solutions, filtration technology, and engine compatibility.

Market Share Analysis by Key Players & Oil Catch Can Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Mishimoto Automotive | 18-22% |

| Radium Engineering | 14-18% |

| Moroso Performance Products | 12-16% |

| JLT Performance | 8-12% |

| Ruien Automotive | 6-10% |

| Other Oil Catch Can Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mishimoto Automotive | Develops AI-optimized oil catch cans with advanced baffle systems, high-flow filtration, and universal or vehicle-specific applications. |

| Radium Engineering | Specializes in precision-machined oil catch cans, AI-powered crankcase ventilation optimization, and high-capacity filtration solutions. |

| Moroso Performance Products | Provides race-proven oil catch cans with AI-assisted airflow dynamics and custom configurations for high-performance engines. |

| JLT Performance | Focuses on OEM-compatible oil catch can systems, AI-driven filtration enhancement, and direct-fit solutions for modern turbocharged vehicles. |

| Ruien Automotive | Offers budget-friendly oil catch cans with AI-optimized multi-stage filtration and corrosion-resistant construction for longevity. |

Key Market Insights

Mishimoto Automotive (18-22%)

Mishimoto dominates the oil catch can market with AI-assisted baffle designs, high-performance filtration systems, and universal fitment options for automotive enthusiasts.

Radium Engineering (14-18%)

Radium specializes in high-precision CNC-machined oil catch cans, integrating AI-powered crankcase ventilation analysis for optimal performance in forced induction and high-revving engines.

Moroso Performance Products (12-16%)

Moroso provides premium oil catch can solutions with AI-enhanced airflow dynamics, race-grade durability, and custom setups for motorsport applications.

JLT Performance (8-12%)

JLT Performance focuses on OEM-style oil catch cans with AI-driven filtration optimization, ensuring compatibility with factory PCV (Positive Crankcase Ventilation) systems for emissions compliance.

Ruien Automotive (6-10%)

Ruien is a leading supplier of affordable oil catch cans, incorporating AI-assisted multi-stage filtration for enhanced oil separation and longevity.

Other Key Players (30-40% Combined)

Several automotive performance brands, aftermarket tuning companies, and specialty parts manufacturers contribute to innovations in oil catch can design, AI-powered filtration technology, and universal fitment solutions. Key contributors include:

The overall market size for the oil catch cans market was USD 11,640 Million in 2025.

The oil catch cans market is expected to reach USD 24,669 Million in 2035.

The demand for oil catch cans is expected to rise due to increasing concerns over engine efficiency, emission control regulations, and the growing adoption of aftermarket performance upgrades. The rising number of vehicles with direct injection engines and the need to prevent carbon build-up are further boosting market growth. Additionally, advancements in oil separator technology and the expanding automotive customization industry are key drivers.

The top 5 countries driving the development of the oil catch cans market are the USA, China, Germany, Japan, and South Korea.

Below 1-Liter and 1-Liter Capacity oil catch cans are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil Refining Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA