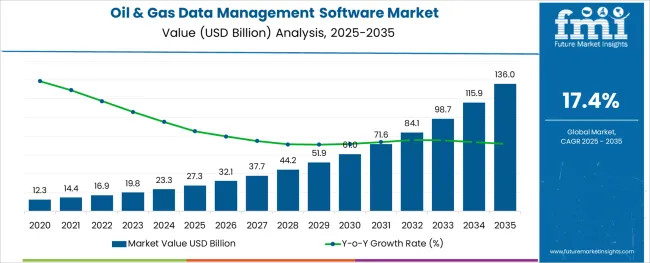

The Oil & Gas Data Management Software Market is estimated to be valued at USD 27.3 billion in 2025 and is projected to reach USD 136.0 billion by 2035, registering a compound annual growth rate (CAGR) of 17.4% over the forecast period.

The oil & gas data management software market is experiencing sustained growth, driven by the rising volume of operational, exploration, and production data generated across upstream, midstream, and downstream activities. Digitalization efforts within the energy sector, particularly among large integrated oil companies and national oil enterprises, have intensified to enhance operational efficiency, regulatory compliance, and asset performance management.

As the industry navigates volatile commodity prices and complex geopolitical landscapes, robust data management frameworks are being prioritized to enable real-time analytics, optimize resource allocation, and support predictive maintenance. Market expansion is further reinforced by the increasing adoption of cloud-based platforms and advanced analytics tools designed to handle unstructured and geospatial data.

Over the forecast period, continued investments in automation, artificial intelligence, and enterprise-wide data governance frameworks are expected to drive software upgrades and new deployments. The ability of these solutions to reduce operational risks, improve reservoir management, and streamline decision-making processes positions the market for steady, long-term expansion.

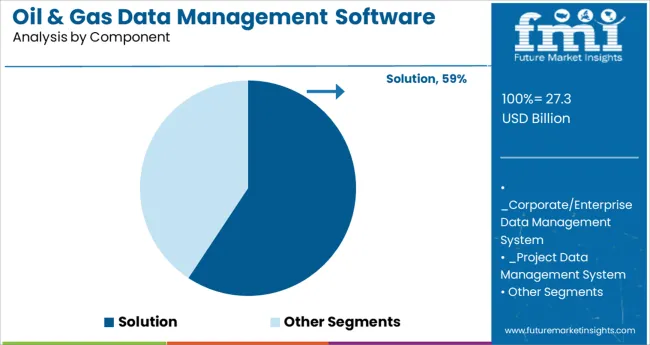

The market is segmented by Component and region. By Component, the market is divided into Solution and Services. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solution segment accounted for approximately 59.3% of the total oil & gas data management software market share, establishing itself as the most dominant component within the competitive landscape. The widespread adoption of integrated data management platforms is being propelled by the sector’s increasing reliance on real-time data integration, well log interpretation, production optimization, and asset performance analytics.

Oil and gas companies are progressively transitioning from legacy systems to advanced, scalable software solutions capable of managing vast, multi-format datasets generated across seismic, drilling, and production operations. The growing complexity of data sources, combined with heightened regulatory requirements for data security and environmental reporting, has further intensified demand for specialized software platforms.

Additionally, integrated solutions offering functionalities such as data quality monitoring, business intelligence, and geospatial analysis are witnessing higher uptake due to their ability to improve operational decision-making and reduce downtime. As market participants expand digital infrastructure and pursue data-driven operational strategies, the solution segment is anticipated to retain its leadership, supported by continuous innovations in cloud integration, AI-based analytics, and predictive modeling capabilities.

Optimizing resources while tracking the project progress and analyzing the data, the oil & gas data management software offers everything at one stop, improving the overall structure of plants. Improved efficiency drives the growth of the oil & gas data management software market.

Oil & gas data management software market demand analysis explains the driving factors for the market, such as the digitization of multiple industries, including the oil and gas industry, and the growing need for managing and protecting the data along with tracking progress and analyzing the data.

Any data management software makes sure that the data is protected, well-managed, and segmented. These include resource management, operational management, inventory management, and capital management, making sure the workflow remains active. It provides solutions related to data planning, segmenting data, and filtering it. These prospects of the platform attract the end users respective to the industry and help in expanding the oil & gas data management software market size.

Rising data breaches and the advent of cloud storage are pushing the demand for the oil & gas data management software market. Lately, technologically advanced malicious hackers breach data and steal it for various wrong purposes. Oil & gas data management software helps the company’s information in integrating with the cloud spaces that are protected by advanced security layers like closed-chain technology.

Oil & gas data management software integrated with cloud computing helps in speeding up data transfer and processing tasks. This saves time and increases productivity, and saves time for the core competency tasks.

As the industry grows, the use of new innovative technologies like artificial intelligence, machine learning, and predictive learning along with data management software tools. The integration of these platforms makes the platform futuristic and makes it more technically weaponed. AI integration helps in easing out the verification processes while ML and predictive decision tools help in finding conclusions and solutions for any error occurrence, expanding the oil & gas data management software market size.

Covid-19 and the incompatible workforce make things tricky for the oil & gas data management software market, leading to a decline in the growth of its supply chains. An incompatible workforce that needs a significant amount of capital to get trained is a next-to-impossible thing for small and medium-sized enterprises (SMEs). The companies now relook at their budget management as covid-19 has affected the revenue of the oil & gas management software market.

The oil & gas data management software market is categorized by components. This category is further divided into small segments that expand their channels in multiple market spaces. These segments perform differently in multiple markets as they have a stronghold in multiple regions.

The component category is segmented into solutions that are further divided into corporate/enterprise data management systems, project data management systems, and national data repositories (Standalone, Integrated), while the service segment is segmented into sub-segments of consulting & planning, Integration & implementation and, operation & maintenance.

By component, data management software market analysis finds that the solution segment is the biggest segment and is expected to hold the major chunk of the market in the forecast period, thriving at a CAGR of 15.5%. Solutions include corporate/enterprise data management, project data management system, and national data repository.

The factors behind the sales of this segment are its high consumption incorporating oil offices, increased flexibility of the platform and government initiatives that promote a more secure and easy way to protect and manage the data, expanding the oil & gas data management software market size.

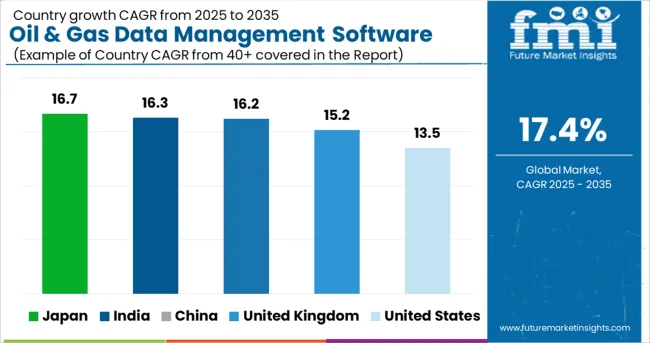

The oil & gas data management software market report explains that the market is divided into regions; North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe. The biggest market is the USA, which is growing at a CAGR of 13.5% between 2025 to 2035.

The region is expected to hold a market revenue of USD 136 Billion by the end of 2035. The factors behind the high sales of oil & gas data management software are rapid digitization and rising cyber-attacks. Apart from this, China is the second highest growing market for oil & gas data management software market, thriving at a CAGR of 16.2% and is projected to hold the second-highest value of USD 7.8 Billion by 2035, while the Japan region is the highest growth potential with a CAGR for 16.7% between 2025 to 2035, generating a revenue of USD 2.0 Billion. The UK also grows along with Japan the forecasted value of USD 2.01 Billion (2035) at a CAGR of 15.2% between 2025 to 2035.

| Regions | CAGR (2025 to 2035) |

|---|---|

| United States | 13.5% |

| United Kingdom | 15.2% |

| China | 16.2% |

| Japan | 16.7% |

| India | 16.3% |

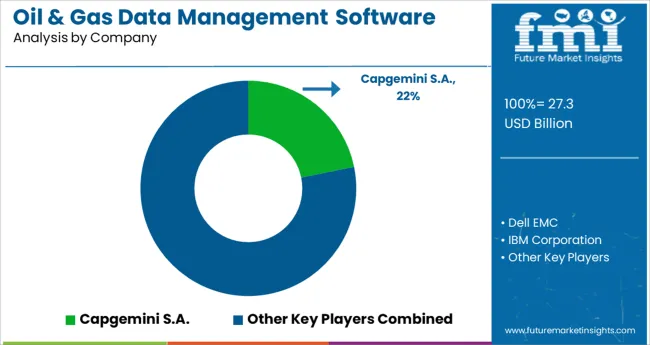

The competitive landscape of the oil & gas data management software market is new, dynamic, and highly capital driven. Companies also collaborate and merge with other companies, which strengthens their roots and expands their distributional channels.

Recent Developments in the Oil & Gas Data Management Software Market

The global oil & gas data management software market is estimated to be valued at USD 27.3 billion in 2025.

It is projected to reach USD 136.0 billion by 2035.

The market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types are solution, _corporate/enterprise data management system, _project data management system, _national data repository, services, _consulting & planning, _integration & implementation and _operation & maintenance.

segment is expected to dominate with a 0.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oil and Gas Pipeline Management Software Market

Oil and Gas Data Monetization Market

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Structured Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Oil And Gas Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Fittings Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Valve Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA