Recent research gives a 10-year forecast for the odometer market from 2025 to 2035, which is expected to grow on a global scale, driven by the need for accurate tracking of vehicle mileage, the rise of digital and GPS-integrated odometers, and advancements in automotive sensor technologies.

Odometers, which measure how far vehicles have traveled, are important for fleet management, vehicle diagnostics and insurance monitoring. The increasing focus on connected vehicles as well as advances in real-time mileage monitoring and tamper-proof odometer systems are contributing to market growth. The ongoing evolution of the industry is also furthered by the expansion of electric vehicles (EVs), increased investment in automotive telematics and growing attention from regulators addressing odometer fraud prevention.

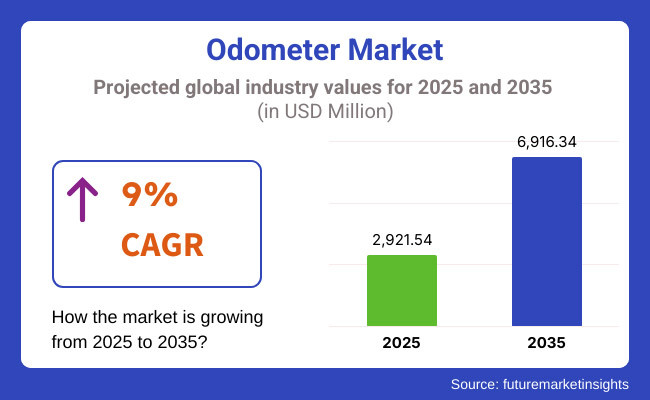

In 2025, the odometer market was valued at approximately USD 2,921.54 million. By 2035, it is projected to reach USD 6,916.34 million, reflecting a compound annual growth rate (CAGR) of 9%. The growth of this market is attributed to increasing adoption of digital and GPS-enabled odometers, rising consumer preference for real-time vehicle diagnostics, and expanding investments in advanced vehicle tracking solutions.

The integration of AI-driven mileage analytics, enhanced accuracy in distance measurement, and cost-effective manufacturing techniques is further supporting market expansion. Additionally, the development of smart, wireless, and cloud-connected odometer systems is playing a crucial role in market penetration and industry adoption.

The North America odometers market is driven by high adoption of connected vehicle technologies, growing regulations against odometer fraud, and large investments in automotive telematics. Currently, the USA and Canada are at the forefront of driving next-gen odometers in the form of GPS-enabled and AI-integrated mileage tracking solutions to market.

The vehicle market is expanding owing to the rising demand for real-time insights, improving fleet management efficiency, and growing acceptance of blockchain-based odometer verification systems. The growth of electric vehicles and autonomous vehicles has smart mileage monitoring capabilities which is also fueling the product innovation and adoption.

The European market is driven by rising demand for high-precision odometers, favorable government policies toward digital mileage tracking, and technological advancements in automotive sensors. The focus of several countries including Germany, France, and the UK is on creating tamper-proof odometers for high-performance purposes in connected and fleet car ecosystems, and digital insurance monitoring.

Rising natural gas control vehicle transparency emphasis, increased applications such as rental car mileage tracking and studies on blockchain-backed odometer readings are anticipated to augment market adoption. Moreover, growing applications in shared mobility service, commercial vehicle tracking and regulatory compliance for mileage-based taxation is unlocking an array of opportunities for manufacturers and suppliers.

Odometer Market in Asia-Pacific is reacting the fastest, owing to expanding vehicle manufacturing, increasing necessities for digital odometers, and uplifting investments in smart transportation solutions. China, India and Japan are making huge investments in R&D in low-cost high-precision odometers for two-wheeler, passenger vehicle and commercial fleet. The regional market is responding rapidly through the high demand for vehicle tracking solutions, an increase in ride hailing services, changing regulations, and government moves towards connected vehicle infrastructure.

In addition, rising compatibility of mileage fraud prevention systems with Internet of Things (IoT) based odometer solutions further fuels market penetration. Additionally, the presence of domestic automotive components manufacturers along with partnerships with global automotive brands is further supporting the market expansion.

As GPS-integrated odometer solutions become increasingly sophisticated, AI-based mileage tracking is adopted widely, real-time vehicle diagnostics take center stage, the odometer market will continue to witness steady growth in the coming years. In the scope, companies are working on blockchain-protected odometer readings, tear-proof digital displays, and smart connectivity features that enhance functionalities, increase marketability, and add to long-term usability.

Furthermore, rising consumer interest in accurate mileage monitoring, integration of digital technology in vehicle tracking platforms, and evolving regulatory standards are some other factors driving the market growth. AI-powered fraud detection, next-generation IoT-based odometer, and cloud-connected mileage analytics are all working together to enhance the efficiency and precision of vehicle data while delivering high-performance odometer solutions across the globe.

Challenge

Rising Cases of Odometer Fraud and Data Manipulation

The global Odometer electronics market is driven by increase in cases of Odometer tampering and Mileage fraud which negatively affect vehicle valuation and consumer trust. As a result it has been show to undervalue the vehicle condition, and thus, mislead buyers and cost them money. Even governments around the world are starting to clamp down with laws demanding advanced anti-tampering tech and blockchain-linked mileage recording. To combat this, companies need secure digital odometer systems, AI-powered fraud detection systems and real-time data verification of mileage.

Transition from Mechanical to Digital Odometers and Compatibility Issues

This segment is transitioning from mechanical odometers to digital, sensor-based systems connected with vehicle telematics. But moving to digital odometers can cause compatibility issues in older vehicles. Ensuring accuracy and cybersecurity are a few other things to worry about as well when it comes to connected vehicle ecosystems. These open source solutions need to make user adoption and reliability easy, so companies need to start focusing on seamless integration solutions, cybersecurity, and standardizing the communication protocol, if they are to work.

Opportunity

Growing Demand for Smart and Connected Vehicles

Increasing the adoption of connected and autonomous vehicles is also expected to fuel demand for advanced odometer systems equipped with real-time tracking and cloud-based data storage. Fleet management firms, ride-sharing companies, and insurance firms are using digital odometers more and more to base their mileage billing, predictive maintenance, and asset tracking upon. The growing smart mobility market will benefit companies developing IoT implementation odometer systems, GPS integrated mileage tracking, and blockchain enabled data verification.

Advancements in AI-Powered Predictive Analytics and Telematics Integration

AI and telematics advancing odometers technology to get the job done. Predictive analytics powered by artificial intelligence allow for accurate assessment of wear and tear on a vehicle, and integration with telematics gives real-time monitoring of mileage. Blockchain is attempted behind the secure mileage record, empowering them to minimize any kind of fraud in them. The companies that create AI-enhanced odometer solutions, alongside cloud-based vehicle tracking and encrypted digital odometer logs, will find competitive advantage in the shifting automotive terrain.

Odometer historical market analysis from 2020 to 2024 and expected future trend analysis from 2025 to 2035 Odometer market has shown tremendous growth from 2020 to 2024, driven by the growing adoption of digital odometers, stringent regulations against odometer fraud, and integration with vehicle telematics. But barriers including cyber security threats, data manipulation and compatibility with legacy vehicle systems hindered adoption across the board. In the wake of these revelations, companies eagerly sought better cybersecurity measures, tamper-resistant measuring devices, and blockchain-based systems for validating mileage.

During the period 2025 to 2035, the market will have integrated AI powered mileage prediction, real time blockchain authentication & 6G enabled vehicle connectivity. With the advent of autonomous transportation and shared mobility services, coupled with the deployment of smart road infrastructure, the need for reliable and secure odometer systems will grow even further. Moreover, the evolution of digital twin technologies, OTA odometer patches and self-calibrating mileage trackers would set new benchmarks for the industry. Digital security, connected vehicles, and AI-based analytics will make up the next chapter of the Odometer market, with emerging players taking the stages.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter anti-fraud policies and digital odometer regulations |

| Technological Advancements | Growth in digital odometers and GPS-based tracking |

| Industry Adoption | Increased use in fleet management, insurance, and ride-sharing services |

| Supply Chain and Sourcing | Dependence on conventional vehicle electronics manufacturers |

| Market Competition | Dominance of traditional automotive instrumentation providers |

| Market Growth Drivers | Demand for accurate mileage tracking and fraud prevention |

| Sustainability and Energy Efficiency | Initial focus on low-power digital displays and tamper-resistant systems |

| Integration of Smart Monitoring | Limited real-time odometer tracking and fraud detection |

| Advancements in Odometer Innovation | Development of GPS-integrated and cloud-based odometers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance tracking, blockchain-based mileage authentication, and global standardization initiatives |

| Technological Advancements | Expansion of AI-powered predictive analytics, digital twin vehicle integration, and 6G-enabled odometer connectivity |

| Industry Adoption | Widespread adoption in autonomous vehicles, smart city infrastructure, and decentralized vehicle tracking systems |

| Supply Chain and Sourcing | Shift toward AI-driven IoT sensor integration, software-defined odometer solutions, and tamper-proof digital interfaces |

| Market Competition | Rise of blockchain-based vehicle data startups, AI-driven odometer analytics firms, and connected car innovators |

| Market Growth Drivers | Growth in self-verifying odometers, decentralized mileage tracking, and AI-driven vehicle lifecycle management |

| Sustainability and Energy Efficiency | Large-scale adoption of self-powered odometers, energy-efficient e-paper displays, and OTA software-based mileage adjustments |

| Integration of Smart Monitoring | AI-powered odometer diagnostics, predictive mileage analytics, and real-time odometer health monitoring |

| Advancements in Odometer Innovation | Introduction of self-calibrating, smart contract-enabled, and autonomous vehicle-compatible odometer solutions |

The United States consists of the largest odometer market owing to upsurge in the vehicle production along with escalating adoption of digital as well as GPS based odometers along with prominent regulations toward vehicle mileage tracking. The increasing need for precise and non-tamperable odometer readouts presents significant opportunities for the market to grow further.

Escalating investment in smart vehicle technology with real-time mileage tracking and blockchain-based odometer validation mechanisms would also contribute to the industry expansion. Also, AI diagnostics, cloud-based connectivity, and sophisticated telematics are adding new functionalities to odometer. In line with the growth of ownership-based digital odometers, companies are now working on high-precision, anti-tampering models as regulations change. In addition, integrated fleet management systems, rental vehicle tracking, and insurance-based mileage monitoring integrated with odometers are also fuelling demand in the United States market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.2% |

On the basis of region, the global odometer market has been classified as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. The United Kingdom is expected to be a key market due to increasing concerns over odometer fraud, rising demand for vehicle history transparency, and growing adoption of smart mobility solutions. With the growing trend of introducing digital odometers in electric vehicles (EV) also contributes to the market growth. Regulatory frameworks for strict odometer verification and mileage-based taxation, along with advanced GPS-enabled and real-time mileage tracking systems, facilitate market expansion. Innovations include things like blockchain-based history recording of vehicles and AI-powered insights for predictive maintenance.

In addition, investment in high-resolution digital displays complemented by automated calibration techniques is an imperative ongoing endeavor among companies to increase the accuracy of odometers. Moreover, the adoption of connected vehicle odometers are increasing on a large scale owing to the booming sector of fleet operations, public transport, and ride-sharing services, which complements the adoption rate of connected vehicle odometers in the UK. Moreover, the shift towards EVs and intelligent transportation systems, is further accelerating the demand for next-generation odometers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.8% |

The European odometer market is led by Germany, France, and Italy, as these countries have strong capabilities in automotive manufacturing, increased regulatory enforcement on mileage fraud prevention, and rising demand for high-precision vehicle tracking systems. The continued investment in digital odometer authentication and real-time mileage recording, along with stringent policies on vehicles and vehicle types to be used under the European Union, bolsters market growth. Smart odometers with over-the-air OTA updates, encrypted data storage, and even AI-powered predictive analytics to diagnose vehicle faults remotely and enhance fleet efficiency.

Additionally, the increasing adoption of tamper-proof, multi-functional odometer in passenger cars, commercial vehicle and shared mobility services is also positively impacting growth in the global market. The rise is also assisted by the expansion of the European Union's road safety regulations and partnerships between carmakers and tech companies to develop smart odometers. Furthermore, the growing adoption of vehicle-to-infrastructure (V2I) communication is propelling innovation in odometer systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.9% |

The Japan odometer market is also witnessing growth owing to the country being at the forefront of automotive electronics, and growing technological adoption for advanced digital odometers as well as the increasing adoption of real-time vehicle data tracking. Market growth is fueled by the increasing demand for AI-based odometer systems across autonomous and electric vehicles. The emphasis on precision engineering, along with other advances in hybrid vehicle odometers, cloud-based mileage visualization and registration and holographic display technology, is driving innovation within the country.

Additionally, government regulations mandating odometer accuracy combined with rising investments in smart mobility solutions are motivating companies to develop next-generation odometer systems. The increase in demand for high-durability, anti-counterfeit odometers in used vehicle sales, leasing, and insurance telematics is also driving the expansion of this market in Japan's automotive sector. Moreover, Japan’s investment in connected car infrastructure and smart dashboard displays will bring new dimensions to smart odometer applications in the future.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.1% |

Moreover, with the growing trend of digitalization in instrument cluster solutions, rising demand for advanced driver assistance systems (ADAS) and presence of major players focusing on effective solutions, South Korea represents a significant market for odometers. Stringent regulations to prevent odometer fraud along with growing investments in cloud-integrated vehicle diagnostics can drive the infiltrated development of market. Also, the country's emphasis on improving odometer conjunction with IoT based vehicle monitoring systems, real-time GPS location, and 5G-enabled connectivity is enhancing competitiveness.

The adoption of the market is also driven due to increasing demand for AI-powered predictive maintenance, mileage-based insurance models, and automated fleet monitoring. From ultra-precise digital odometers to biometric vehicle verification systems and intelligent dashboard displays, firms are pouring money into making driving both easier and safer. The emergence of autonomous mobility, smart-city infrastructure, and shared-transportation networks in South Korea is pushing for the need of advanced odometer solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.0% |

Electronic odometers are now used in most cars as they are more accurate and provide a digital readout as well as work with diagnostics in the vehicle. Electronic odometers are designed to ensure accurate mileage recording and high-speed communication due to microprocessor use, on-line data collection with real-time capability, and their advanced sensors integrated into the onboard vehicle management system.

Growing integration of electronic odometers in passenger and commercial vehicles is driven by increasing incorporation of digital dashboards, telematics solutions, and advanced driver assistance systems (ADAS) in vehicles. Moreover, breakthroughs in GPS-enabled odometer tracking, tamper-proof mileage logging, and AI-powered vehicle analytics are striving to fortify the reliability and security of electronic odometers.

Hybrid odometers, which integrate mechanical durability with digital precision, are another variant that is picking up popularity. You are limited to data up to the date of October 2023. As the demand for rugged, durable odometer systems in heavy-duty and off-road applications increases, the demand for hybrid odometers will also increase. Moreover, manufacturers are being driven toward greater integration of LCD-analog technologies, self-calibrating sensors, and real-time mileage synchronization with fleet management systems to optimize hybrid odometer functionality in new vehicles.

The vast majority of odometers are found in passenger vehicles such as hatchbacks, sedans, and SUVs. Digital odometers are now being fitted to the latest passenger cars, by an automaker that connects to car platform, navigation, and fuel efficiency features. The passenger vehicle category has seen a strong demand for telematics-based vehicle monitoring, user-friendly digital clusters, and smart mobility solutions, which is reinforcing the dominance of electronic odometers. Furthermore, growing adoption of electric vehicles (EVs), hybrid cars and AI-assisted vehicle diagnostics is propelling advancements in next-generation digital odometer technology.

Commercial vehicles including light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and buses & coaches utilize odometers for fleet management, regulatory compliance, and operational efficiency tracking. High-precision odometers integrated with real-time vehicle tracking, predictive maintenance systems, and performance monitoring software are needed for fleet operators.

The growth of logistics, e-commerce-driven transport and long-haul commercial applications has driven the demand for rugged, GPS-based odometers. As a further use case, the increasing uptake of blockchain-based mileage verification, AI-driven predictive analytics, and over-the-air (OTA) software updates are together taking odometer functionality to the next level in commercial vehicles.

Moving on to integration: Original equipment manufacturers (OEMs) are vital in incorporating intricate odometer systems within new automobile models, allowing for smooth interaction with vehicle diagnostics, safety tracking, and infotainment systems. Then, there are electronics makers and software developers who team up with automakers to create personalized odometer systems tailored for specific vehicle segments. We can also expect a greater shift towards intelligent vehicle ecosystems, AI-assisted maintenance alerts, and cloud-based storage of odometer data to share with OEMs, all additional factors solidifying OEM-driven innovations around odometer technology.

As a significant growth factor, the demand for odometer replacement, recalibration service and digital upgrading are expected to drive the growth of aftermarket segment. Therefore, aftermarket odometer solutions are relied upon by vehicle owners to rectify inaccurate mileage, ensure compliance with fleets, and upgrade older vehicles with digital cluster functionality.

The broad reach of e-commerce platforms, on-demand automotive services, and mobile-based vehicle diagnostics has significantly advanced the availability of aftermarket odometer products and installation services. The growth of plug-and-play digital odometer kits, tamper-proof odometer verification and AI-powered odometer recalibration tools further increases the aftermarket adoption rates.

The odometer market is projected to grow on account of increasing vehicle production, growing demand for digital as well as smart dashboard systems, and advancement in telematics and fleet management technologies. With the advent of technology, companies are emphasizing on the integration of odometers with GPS, IoT, and vehicle diagnostics to enhance the accuracy and functionality.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 18-22% |

| Visteon Corporation | 14-18% |

| Denso Corporation | 11-15% |

| Nippon Seiki Co., Ltd. | 8-12% |

| Yazaki Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Leading provider of digital and hybrid odometers with advanced connectivity and diagnostics features. |

| Visteon Corporation | Specializes in smart digital dashboards integrated with telematics and vehicle data analytics. |

| Denso Corporation | Develops high-precision analog and digital odometers for various vehicle applications. |

| Nippon Seiki Co., Ltd. | Offers advanced display technologies with real-time vehicle tracking capabilities. |

| Yazaki Corporation | Focuses on durable, high-accuracy odometers for passenger and commercial vehicles. |

Key Company Insights

Continental AG (18-22%)

Continental AG is the top odometer supplier, thanks to its digital and hybrid odometers with real-time diagnostics and connectivity. Their system is smarter than the average vehicle [and] it monitors, providing safety upgrades. With its continued focus on digital transformation and IoT-based vehicle solutions, Continental solidifies its market leadership position.

Visteon Corporation (14-18%)

Visteon creates smart digital dashboards, odometers paired with advanced analytics and telematics. The company specializes in AI-based interfaces and connectivity solutions that improve user experience. With experience working in innovation in vehicle electronics, Visteon has emerged as a major player in the automotive display market.

Denso Corporation (11-15%)

Denso manufactures high-precision analog and digital odometers for diverse automotive applications. The firm prides itself on quality, precision, and vehicle control system integration. Denso gives a competitive edge by its knowledge about vehicle electronics and strong OEM awareness.

Nippon Seiki Co., Ltd. (8-12%)

Based in the domestic market for 32 generations, Nippon Seiki is a top, integrated supplier of advanced display technologies, such as odometers with real-time tracking and diagnostic features. Olsam Technologies specializes in hybrid display solutions, which include both digital and analog readouts. Nippon Seiki enjoys a strong presence in the market due to its high-performance automotive instrumentation.

Yazaki Corporation (6-10%)

Yazaki supplies precise odometers for use in consumer and commercial automobiles. It focuses on quality and longevity by accurately measuring the mileage. Its robust presence in the regional scope of vehicle electronics and instrumentation further enhances the competitive arena of Yazaki.

Other Key Players (30-40% Combined)

These manufacturers background in innovation and connectivity, along with their durability make them the key to the growth of odometer market. Key players include:

The overall market size for odometer market was USD 2,921.54 million in 2025.

The odometer market expected to reach USD 6,916.34 million in 2035.

The demand for the odometer market will be driven by increasing vehicle production, rising demand for digital and smart odometers, growing emphasis on vehicle tracking and fleet management, advancements in automotive electronics, and stringent regulations on accurate mileage recording for safety and resale purposes.

The top 5 countries which drives the development of odometer market are USA, UK, Europe Union, Japan and South Korea.

Electronic and hybrid odometers drive market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA