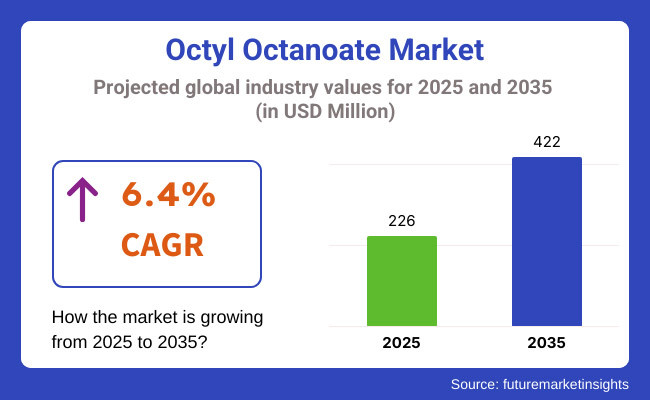

The octyl octanoate market is anticipated to grow immensely within the forecasted period 2025 to 2035, largely due to increasing applications in areas of cosmetics, personal care products, lubricants, and flavoring of foods. The market is anticipated to be USD 226 million in 2025 and is going to be USD 422 million in 2035 with a 6.4% compound annual growth rate (CAGR) within the period under consideration of the forecast period.

Market growth drivers are numerous. Among the key drivers is increasing consumer demand for natural and green emollients in personal care. Octyl octanoate, a skin conditioner, has applications in an enormous range of sunscreens, moisturizing creams, and age-protection lotions.

The lubricant market is finding opportunities for ester-based chemistries in high-performance industrial uses through improved oxidative stability. But regulation of synthetic esters for food use is an issue, which forces manufacturers to add food-grade certification requirements.

Octyl octanoate is also a highly effective chemical, which is employed in all industries due to its natural nature. It is an emollient and dispersing agent used in personal care and cosmetic applications, imparting non-greasy smooth feel in skin and haircare products, such as premium sunscreens with sun protection. In. Industrial uses notwithstanding, it also finds application in high-performance machinery synthetic lubricants like aviation engine lubricant and car transmission fluids due to its thermal stability.

The chemical is additionally used in food additives and flavoring, where it is employed as a flavour intensifier of citrus and fruity fragrances, and is used by food and beverage processors to create exotic and tropical fruit flavours in gourmet juice and blends. Other than this, octyl octanoate is also used as a carrier in drug excipients as a form of topical and transdermal, with penetration in the skin being a major consideration.

The North American market is one of the prominent markets for octyl octanoate with increasing demand from the cosmetics and personal care industry. United States and Canada are also witnessing increased use of octyl octanoate in organic beauty products and luxury skincare. Regional focus on industrial use bio-based lubricants in industries, especially in the aerospace and automotive sector, propels market growth. The other significant aspect is shifting towards FDA-approved food additives with key beverage firms manufacturing next-generation fruit flavoring products based on octyl octanoate.

Europe enjoys a market leadership, especially in Germany, France, and the UK, with well-developed food and cosmetic industries. The stringent European Union REACH regulations offer a scope for the European market of green, high-purity esters for food and personal care products. Volkswagen, Mercedes-Benz, and BMW use more and more bio-lubricants as transmission oils and gear lubricants in the automotive industry, which has an increasing demand for octyl octanoate-based formulations.

Asia-Pacific will see maximum growth via China, India, Japan, and South Korea. Increased disposable income and increased awareness towards premium beauty care and skincare products drive demand for octyl octanoate in personal care products. Increasing pharmaceutical activity in India is also driving its use in excipients in topical formulations. For use in food and beverage sector, Japan and China's food and beverage sectors utilize octyl octanoate to flavour soft drinks with fruits and confectionery flavour to satisfy evolving consumers' tastes.

Challenge

Compliance with regulations and restriction on synthetic ingredients

With increasing demand for clean-label products, synthetic esters like octyl octanoate undergo rigorous regulatory testing in food and cosmetic applications. European Food Safety Authority (EFSA) and USA Food and Drug Administration (FDA) regulate food additives closely, compelling manufacturers to produce compliant, high-purity products. It is a burdensome regulatory requirement that compels companies to invest in sophisticated extraction and manufacturing processes.

Opportunity

Growth of Green and Bio-Based Alternatives

Growing need for greener alternatives in green chemistry offers room to manufacturers to produce bio-sourced octyl octanoate from renewable feedstocks such as coconut oil and palm oil. Manufacturers going into making green esterification technology can benefit from higher business volume from accelerating market demand for natural cosmetics and greener production lubricants. Second, advances in microencapsulation also improve stability and performance for pharmaceutical and food applications with more development space for new products.

Octyl octanoate experienced strong growth between 2020 and 2024 owing to increasing consumer awareness and technological developments primarily for cosmetic, industrial lubricant, and food flavour purposes. The industry experienced massive investments being infused for the manufacturing of bio-based esters and top companies launching sustainably produced and biodegradable products.

From 2025 through 2035, some prominent trends will shape the market across various sectors. Natural and sustainable personal care ingredients will command a larger market as customers desire more skin-friendly and environmentally friendly personal care items. Synthetic lubricant formulation innovation will be a driving force of innovation and impact the aerospace and automotive industries with the maximization of efficiency and performance. Bio-based esters application in foods and pharmaceuticals will increase in parallel with the overall sustainability trend. Extremely stringent regulatory environments will propel the manufacture of high-purity ester products to meet increasingly rigorous specifications. Moreover, novel encapsulation technologies will enhance the stability and scope of application of most products, leading to improved performance.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory control for synthetic esters such as octyl octanoate was primarily on food-grade and cosmetic use. Adherence to food safety requirements (FDA, EFSA) continued to be a prime necessity. |

| Technological Advancements | Esterification process innovations enhanced yield effectiveness while lowering energy usage. Cosmetic and personal care sectors used octyl octanoate more commonly as an emollient. |

| Cosmetic & Personal Care Industry Trends | Octyl octanoate was popularized as a non-greasy emollient for use in hair and skincare preparations. Demand grew on the strength of premium product formulations emphasizing hydration and texture enhancement. |

| Food & Beverage Applications | Use in flavour preparations in confectionery, bakery, and dairy foods increased because it has a light fruity fragrance and is stable. |

| Pharmaceutical & Nutraceutical Applications | Octyl octanoate was investigated for drug delivery in controlled-release systems and as a nutraceutical formulation solubilizer. |

| Environmental Sustainability | Industry initiatives emphasized biodegradable packaging and waste reduction in ester manufacturing. |

| Production & Supply Chain Dynamics | Worldwide supply was affected by volatility in raw material supply, particularly by the interruption of the petrochemical industry. |

| Market Growth Drivers | Industry growth based on increasing personal care, food & beverage, and pharmaceutical sectors. Increasing consumer demand for mild and stable esters drove adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments around the world are implementing stricter controls on synthetic esters to make them sustainable and minimize dependency on petrochemical-based materials. Eco-certifications and bio-based procurement become industry norms. |

| Technological Advancements | Green chemistry concepts fuel innovation in the production of bio-based octyl octanoate. Enzyme-catalysed reactions and fermentation-based synthesis are on the rise, minimizing dependence on conventional chemical processes. |

| Cosmetic & Personal Care Industry Trends | The clean beauty trend drives the demand for naturally sourced esters. Increasing consumer demand for sustainable and biodegradable ingredients fuels market penetration in organic and vegan skincare. Transition towards natural and bio-identical flavoring agents increases the demand for octyl octanoate. Companies invest in formulating allergen-free and clean-label products to meet changing consumer trends. |

| Food & Beverage Applications | High-end formulation technologies enhance bioavailability of active ingredients through the use of octyl octanoate. Functional foods and nutraceuticals growth drives its use in dietary supplements. |

| Pharmaceutical & Nutraceutical Applications | Circular economy behaviours prevail, with a focus on sustainable sourcing, recycling of industrial by-products, and reducing carbon footprint in production processes. |

| Environmental Sustainability | Movement towards decentralized centers of production and investment in sustainable sourcing practices enhance supply chain robustness. Bio-based production approaches reduce dependence on volatile petroleum-based raw materials. |

| Production & Supply Chain Dynamics | Market growth driven by green chemistry breakthroughs, sustainability-based ingredient procurement, and regulatory pressure toward biodegradable and natural esters. The trend towards vegan and clean-label items drives demand in several industries. |

| Market Growth Drivers | Governments around the world are implementing stricter controls on synthetic esters to make them sustainable and minimize dependency on petrochemical-based materials. Eco-certifications and bio-based procurement become industry norms. |

American octyl octanoate market is rising slowly with the broad application area of octyl octanoate in the pharma, food flavour, and personal care markets. Cosmetics and skincare are substantial purchasers, using octyl octanoate due to its non-greasy characteristics and skin conditioning action. Clean beauty trend remains among the leading drivers of esters that are nature-sourced and biodegradable.

Food is also a major driver, and consumption of octyl octanoate is higher in recipes for natural flavour. Highly purified esters of very high grade that are regulated by the FDA as food-grade also contribute to market growth. In the pharma sector, octyl octanoate is being used as a solubilizer as well as an excipient to formulate pharmaceutical medicines, where it is stable in specialty application.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

UK octyl octanoate market is increasing with increasing demand from the food & beverages, pharmaceutical, and personal care industries. The greener and bio-based ester theme fits with the UK sustainability agenda, where companies are increasingly likely to make investments in clean production technologies.

The cosmetic industry is a large growth driver, with demand for natural emollients to add to hair and skin care formulations. Market regulation by bodies like the UK's Food Standards Agency (FSA) and REACH compliance focus on high quality and safety, once again to drive formulation of the product. The food & beverages industry also registers higher application of octyl octanoate as a clean-label flavouring as a response to consumer influence to consume natural products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

European Union is a significant market for octyl octanoate due to its widespread applications in food, personal care, and pharma markets. REACH and EFSA regulations grant the power to sustainability and favour the employment of bio-based esters which compel industries to invest in R&D green chemistry.

Germany, Italy, and France are key contributors as a result of the large cosmetics and food processing industries in these countries. Octyl octanoate use in high-end skincare products, natural flavoring components, and pharmaceutical excipients gives consistent demand. Furthermore, higher EU prohibition of artificial additives spurs the move to naturally occurring and bio-compatible esters.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.4% |

Japan's market for octyl octanoate is slowly transforming with demand being attracted from food, pharma, and cosmetic sectors. Japan's high-end beauty market, renowned for successful skincare, still uses octyl octanoate in gentle, long-lasting items.

The Japanese food industry also finds octyl octanoate acceptable as a natural flavoring compound, and it is also well compatible with being utilized in the confectionery and beverage industries. Safety studies on controlled-release drug and nutraceutical also support the utilization of the compound in health-oriented applications. Governmental organizations like the Ministry of Health, Labour and Welfare (MHLW) prefer green and safe ingredient utilization, as well as bio-based ester creation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

South Korea octyl octanoate market expands with increasing demand from food & beverage, pharmaceutical, and cosmetics sectors. Korean cosmetics industry, global trendsetter, uses octyl octanoate in premium products for the smoothness and moisturizing effects.

Government policies toward natural and eco-friendly personal care products facilitate acceptance of biodegradable esters and facilitate green skincare to be boosted by consumer demand. In the food industry, natural flavour enhancers and clean-label trends are pushing business growth at a more rapid rate. Pharmacy applications too improve, as octyl octanoate is added to new drug-delivery and nutraceuticals formulation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

Market-best highest purity (>98%) octyl octanoate is mostly used on broad-range applications in high-end perfumes of fragrances and pure-quality essential oils. It ensures higher stability and homogeneity with purest for high-end perfumes since longevity and essence purity are the top priorities there. All high-end perfume companies throughout North America and Europe use ≥98% purity octyl octanoate instead of others to provide normal smell properties in product lines.

In the business of essential oil, ≥98% pure octyl octanoate is a significant carrier material utilized to provide stability and solubility to natural extracts. Demand for the compound in the market exists in aromatherapy and therapeutic oil mixtures, where chemical purity equates to efficacy and scent quality of the end product. Another proof of its market demand is its utilization as a high-purity octyl octanoate in specific industrial uses such as lubricant additives and drug formulations.

≤98% purity octyl octanoate enjoys a large market share, especially where ultra-high purity is not necessary. It is favoured in industrial grade fragrance construction, mass market flavour chemicals, and general-purpose essential oil uses where low-level impurities are not impacting performance.

Lower-purity octyl octanoate is most commonly found in the food and drinks sector, where it is used as a cheap flavoring chemical, contributing fruity and creamy flavoring to foods and drinks like dairy desserts, confectionery, and soft drinks. Small-scale perfume manufacturers also use ≤98% purity octyl octanoate in air freshener and cleaning supplies, where economy rather than purity standards are the norm. Increased need for affordable but effective fragrance ingredients in the emerging economies is driving the consistent consumption of this segment.

The perfumes sector is the largest application field of octyl octanoate because it is one of the most important ingredients for perfume base, cologne, and body mist. Octyl octanoate possesses a waxy, fruity, and sweet odour and thus also applies to large market perfumes and niche perfumes on a large scale. Perfume industries across the globe, especially in Europe and the Middle East, use octyl octanoate to produce long-lasting and strong fragrances.

One of the industry's big consumers is also personal hygiene, and the octyl octanoate appears in scented creams, deodorants, and lotions. Natural, environment-friendly, and fragrance chemicals are more desired by consumers, and this increased demand further pushed demand because the manufacturers are seeking biodegradable and non-poisonous chemicals to substitute as fragrance chemicals.

Octyl octanoate is found to be utilized intensively as a flavoring substance, mainly in fruit foods and dairy foods. On account of its rich, sweet, and creamy nature, it is a good additive in bakery foods, milk flavour, yogurt, and confectionery. Increased consumption of natural and nature-identical flavoring compounds in foodstuffs has also increased its demand.

When used as a flavouring agent, octyl octanoate enlarges the flavour and aroma of alcoholic beverages, syrups, and fruit drinks that grow in tropical parts of the globe. Growing levels of consumption of processed foods on a global front and greater approbation of regulation of flavoring ingredients originated from ester are likely to drive growth within this sector.

Essential oils are another fast-emerging application for octyl octanoate, where it is used as a stabilizer and fragrance enhancer. Due to its suitability with herbal, floral, and citrus essential oils, it is extensively applied in natural cosmetics, well-being products, and aromatherapy mixtures.

The growing usage of holistic care treatment and growing usage of the essential oils in order to overcome stress and as a therapeutic cure are fuelling demand for octyl octanoate. Also, natural and organic personal care companies employ the ester for use in creams for skin, massage oil, and perfumed oils in order to enhance sensory attractiveness.

Apart from conventional use in perfume and flavour, octyl octanoate has uses in specialty markets. It is used in lubricant systems, plastic additives, and chemical intermediates for specialty coatings. It also has industrial applications as a solvent and dispersing agent.

With continuous innovation in bio-based esters and green chemistry, octyl octanoate is becoming more of a green option across industries. Ester molecules with non-toxic and biodegradable needs will continue to drive business growth in the next few years.

Octyl octanoate is a competitive market with leading world producers and domestic producers fuelling industry expansion. Market leaders possess strong market positions, calling for product purity, formulations, and environmentally friendly sourcing innovations. The companies trade in products from the cosmetics, personal care, industrial lubricant, and fragrance uses. The market comprises established companies and new entrants, each influencing industry trends as far as technological innovations and specialty product customization are concerned.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 14-19% |

| Kao Corporation | 10-15% |

| Ashland Global Holdings Inc. | 8-12% |

| KLK Oleo | 5-9% |

| Wilmar International | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Manufactures high-purity octyl octanoate for personal care, fragrance formulations, and industrial lubricants. Invests in bio-based alternatives to meet sustainability goals. |

| Kao Corporation | Produces octyl octanoate-based emollients and surfactants for skincare and haircare applications. Develops innovative, skin-friendly formulations. |

| Ashland Global Holdings Inc. | Specializes in ester-based ingredients for cosmetics, leveraging proprietary technologies for improved sensory experience and stability. |

| KLK Oleo | Supplies octyl octanoate for specialty lubricants and personal care emulsifiers. Focuses on RSPO-certified palm-based derivatives. |

| Wilmar International | Develops octyl octanoate from renewable feedstocks, catering to eco-conscious cosmetic and industrial lubricant manufacturers. |

Key Company Insights

BASF SE (14-19%)

BASF SE leads in octyl octanoate with its production of high-purity esters used in industrial lubricants, personal care products, and fragrance mixtures. BASF SE is a front runner in bio-based solutions with top leadership in initiatives for sustainability. Its gigantic investments in R&D allow for high-performance ester production as custom-made as markets around the globe demand. Its strong manufacturing foothold and presence worldwide are reasons for its leading position in specialty chemical solutions.

Kao Corporation (10-15%)

Kao Corporation is a prominent industry driver for the personal care segment, making octyl octanoate-derived surfactants and emollients utilized for high-end skincare and haircare. It has a reputation as a safe house in dermatology and spends lots of money in research to introduce new, safe-for-skin products. Having a strong presence in Asia and increasing presence in Europe and North America, it is a top-notch industry driver.

Ashland Global Holdings Inc. (8-12%)

Ashland is a pioneer in ester-based chemicals such as octyl octanoate for the beauty industry. Ashland uses proprietary technology to optimize sensory profile, stability, and shelf life of personal care products. Ashland's past alliance with custom solutions with world-leading beauty brands has made Ashland a leading specialty high-performance ingredients provider.

KLK Oleo (5-9%)

KLK Oleo exports octyl octanoate to specialty lubricants and emulsifiers for skin care. KLK Oleo is a leader in sustainable palm oil derivatives and has RSPO-certified supply chains. Its oleochemical innovation strengths enable it to manufacture industries that require biodegradable and skin-compatible esters.

Wilmar International (3-7%)

Wilmar International is producing octyl octanoate from renewable feed stock targeting the green and sustainable option. Vertically integrated supply chain process of its provider offers the cost advantage as well as product homogeneity, leading it to become a market supplier for cosmetic and industrial lubricant use.

Other Market Players (45-55% Combined)

There are several other players together having a combined market share forcing innovation, economy of cost, and sustainability of production processes. These include:

The overall market size for the octyl octanoate market was USD 226 million in 2025.

The octyl octanoate market is expected to reach USD 422 million in 2035.

The increasing demand from the fragrance, cosmetics, and food & beverage industries, along with its growing usage as a plasticizer in polymer manufacturing, fuels the octyl octanoate market during the forecast period.

The top 5 countries driving the development of the octyl octanoate market are the USA, China, Germany, Japan, and India.

On the basis of application, the fragrance and flavoring segment is expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Octyl Alcohol Industry Growth By Type, Application and Region 2025 to 2035

Isooctyl Alcohol Market Growth - Trends & Forecast 2025 to 2035

Oxo-octyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

Di-n-octyl Sulfide Market Size and Share Forecast Outlook 2025 to 2035

Para-tert-Octylphenol (POTP) Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA