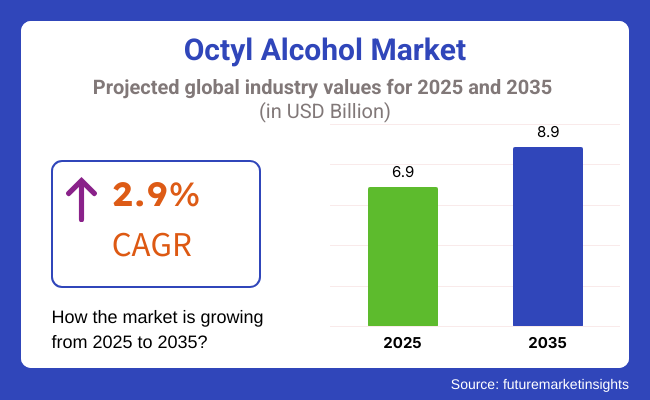

Global sales are likely to grow substantially between 2025 and 2035 as applications in Cosmetics, Pharmaceuticals, Cleaning Chemicals, Paints, Coatings are growing. Octyl alcohol is important for real estate in the fields of perfumer, medicine, and detergent. Demand for 2-ethyl hexanol (used in plasticizers and acrylic esters, complemented by a series of derivative products) remains strong.

Though North America leads in pharmaceutical sales, new drug sales are driven by the USA The Industry steady growth is in line with the growing demand for specialty chemicals in various end-use industries while retaining a strong CAGR.

Explore FMI!

Book a free demo

The global octyl alcohol industry was progressively growing at a CAGR of around 7.0% during 2020 to 2024 and was valued around USD 1 billion in 2019, owing to its massive utilization in the production of plasticizers, surfactants, and solvents.

This demand was mainly propelled by sections such as cosmetics, personal care, and pharmaceuticals which availed filaments properties of octyl alcohol to enhance their products formulations. A related trend was sustainability during ancient period, manufacturers used bio based octyl alcohol for following environmental regulations and consumers wants.

From 2025 to 2035, extra industryplace evolution awaits. The increased emphasis on sustainable products, will ultimately generate demand for bio-based octyl alcohol in within European and North American regions, which have several strict guidelines around eco-friendly products.

The rise of new technologies allows for these to be produced and distributed in less damaging and more cost-effective methods. Applying the earlier trends of its versatility and sustainability, along with the development of new applications as food additives, specialty chemicals and even more.

| Key Drivers | Key Restraints |

|---|---|

| Growing demand in cosmetics, personal care, and pharmaceutical industries | Fluctuations in raw material prices impacting production costs |

| Rising adoption of bio-based octyl alcohol due to sustainability concerns | Stringent environmental regulations restricting chemical usage |

| Expanding applications in plasticizers, surfactants, and solvents | Availability of alternative chemicals with similar properties |

| Increasing demand for specialty chemicals in emerging industrys | Supply chain disruptions affecting global distribution |

| Technological advancements improving production efficiency | High production costs for bio-based octyl alcohol limiting widespread adoption |

Impact Assessment of Key Drivers

| Key Drivers | Impact |

|---|---|

| Growing demand in cosmetics, personal care, and pharmaceutical industries | High |

| Rising adoption of bio-based octyl alcohol due to sustainability concerns | Medium |

| Expanding applications in plasticizers, surfactants, and solvents | High |

| Increasing demand for specialty chemicals in emerging industrys | Medium |

| Technological advancements improving production efficiency | High |

Impact Assessment of Key Restraints

| Key Restraints | Impact |

|---|---|

| Fluctuations in raw material prices impacting production costs | High |

| Stringent environmental regulations restricting chemical usage | High |

| Availability of alternative chemicals with similar properties | Medium |

| Supply chain disruptions affecting global distribution | High |

| High production costs for bio-based octyl alcohol limiting widespread adoption | Medium |

Demand for industrial-grade octyl alcohol will continue to grow owing to its extensive applications in inks and coatings, chemical and polymer manufacturing, etc. The food-grade octyl alcohol industry will show a stable growth, especially in the industries of flavors and fragrances and food processing individually. Specialized grades will also find use in the pharmaceuticals and cosmetics industries, where high purity and compliance with regulations are critical.

Octyl alcohol will continue to be important in several applications, including flavors and fragrances, pharmaceuticals, agroecological, resins, plasticizers, coatings, and fuel additives, across a range of industries. Growing demand for high-performance materials and sustainable chemicals, as well as the use of bio-based chemicals will further drive the sector. The intermediate role it plays in synthesizing chemicals and industrial formulations, will also ramp up its assimilation by various industries.

North America is projected to hold a prominent position in the industry owing to high demand from pharmaceuticals, coatings and industrial applications. Agrochemicals and resin applications will grow in Latin America. Northern & Western Europe- Sustainability to Make Octyl Alcohol Bio-Based. In Eastern Europe, industrial growth is targeted to help expand demand for plasticizers and coatings. Within South Asia and the Pacific the very fastest industrialization will lead to much higher levels of consumption.

The world will still be the factory of East Asia, which will be the industrial cockpit as we shift to innovation and R&D. With the increase in industrial activities in the region, the usage of octyl alcohol in coatings and fuel additives will be slowly growing in the Middle East and Africa.

In 2025, the United States octyl alcohol industry is projected to seamlessly grow, driven by its wide application in cosmetics, pharmaceuticals and cleaning agents. A majority of this growth is supported by the robust industrial base in the nation and the modernization of chemical production procedures. In addition, the growth in demand for personal care products and the growth of the pharmaceutical industry also sets the industry dynamics.

Sustainability has gained lot of focus in Canada in recent years and therefore, moderate growth is expected in the Canada octyl alcohol industry over the forecast period. Gains in bio-based octyl alcohol usage in cosmetic, cleaning product, and personal care applications align with eco-minded product demands and forecast to promote this segment. Rising government projects for eco-friendly chemicals are also propelling its industry potential.

From its use in various industries such as pharmaceutical and personal care demand, the UK octyl alcohol industry is estimated to thrive. In addition, with strong research and development initiatives in the UK, coupled with a well-developed pharmaceutical industry, and octyl alcohol applications are likely to see more innovations. Furthermore, increasing consumer demand for high-quality premium personal care products drives the industry expansion.

France octyl alcohol industry is also expected to grow in upcoming years due to application in cosmetics and perfumes. The acknowledged cosmetics industry within the nation is predicted on characteristics like high-quality products, further adding to the demand for octyl alcohol within the province. Furthermore, the trend of bio-based octyl alcohol is in synergy with the country to pay more attention to sustainable and natural ingredients.

In Germany, the octyl alcohol industry is expected to flourish at a rate due to its rising demand in the preparation of manufactured items in industry and the chemical sector. Germany's solid industrial base as well as growing progress in chemical origin encourages the rise of octyl alcoholic beverages within the country. Alongside this is the continued commitment of the country to manufacturing standards with which to drive industry dynamics.

With wide applications in personal care products and electronic items, the South Korean octyl alcohol industry is expected to expand. As of now, the nation is the top producer, line, and consumer of electronics and remains a solvent and intermediate requirements owner. In addition, the booming cosmetics industry, which is known for its advanced skincare solutions, is also contributing to the industry growth.

In industrial and pharmaceuticals, octyl alcohol is used, and hence, the demand for octyl alcohol is expected to increase in Japan. Octyl alcohol find its application during drug formulation process in Japan due to well-developed pharmaceutical sector, in addition to various chemical process in its production sector. Such tech innovation around several verticals of the nation drives the respective industry on a growth path.

Urbanisation and Industrialisation are aiding the growth of Octyl Alcohol Industry in China. Octyl alcohol will benefit the country's expanding production sector, especially coatings and plastics. On top of that, the increase in disposable incomes in emerging economies and Filiago is wearing good appearance products as well result in personal industry dynamics.

The octyl alcohol industry in India will see remarkable growth owing to its applications in agriculture and pharmaceuticals. With a vast agricultural industry, octyl alcohol is being used in agrochemical formulations for crop protection applications in the region, further boosting its demand in the country. Further signs of the average population increase is fuelling the requirement for healthcare, which in turn is propelling the pharmaceutical sector, hence driving the growth of the industry.

The octyl alcohol industry is driven by a multitude of factors in these countries, including industrial utility, rising consumer preference towards sustainable products, and technological evolution which will characterize this industry by 2033.

Through environment friendly solutions and ties-ups, Start-ups seem to be doing a lot of hocus pocus. For instance, Green Biologics invented plant-derived octyl alcohol and with its extensive demand-making number, it has a sustainable chemical use in pharmaceutical and personal care applications. Afterward, big industry companies are desired collaboration with the green alternative to add it to their product.

For example, a company like Eastman Chemical Company have launched new types of sustainable plasticizers with octyl alcohol as a key ingredient. The move into plastic essentially opens the door to a new line of products and caters to the growing industry for sustainable plasticizers that are increasingly part of automotive and construction.

These evolutions are part of a wider evolution that is course correcting the trajectory of the industry towards sustainability and innovation, with both incumbents and new entrants ramping up investment in research and cementing strategic alliances to meet evolving consumer preferences and regulatory requirements.

Saturated Octyl Alcohol Industry-The Key Demands of Tier Players Make up 90% of the Industry Share Top corporations developed robust global supply chains, sophisticated manufacturing capabilities, and extensive distribution networks. Intense Quality and Regulatory Standards For Greater Competitive Barriers: The vast quality and regulatory standards only act to solidify the position of the major players, keeping smaller rivals at bay. Nevertheless, updating to bio-based alternatives and sustainability-centric production methodologies are slowly opening avenues for new entrants.

Some of the key players in the industry are BASF SE, Sasol Limited, Kao Corporation, Ecogreen Oleochemicals, Oxea GmbH. BASF SE Reports Sustainable Production of Octyl Alcohol With Lower Carbon Emissions in 2024. In October 2023, Sasol Limited increased its production capability in Asia to meet the rising demand in the personal care and pharmaceutical applications. Kao Corporation launched a new grade of octyl alcohol designed for high-end cosmetic formulations. These trends reaffirm a focus on sustainability, capacity growth, and innovative solutions for high-performance components.

The demand is increasing due to its use in cosmetics, pharmaceuticals, plasticizers, and coatings.

Major industries include pharmaceuticals, personal care, agrochemicals, and plastics.

Regulatory restrictions and raw material price fluctuations are key challenges.

North America, Europe, and Asia-Pacific are the dominant regions.

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Pyrogenic Silica Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.