The Oceania Commercial Ice Machine Market is expected to witness steady growth from 2025 to 2035, driven by increasing demand for efficient cooling solutions across hospitality, foodservice, and healthcare sectors. With rising tourism activities, expanding foodservice establishments, and stringent food safety regulations, commercial ice machines have become essential.

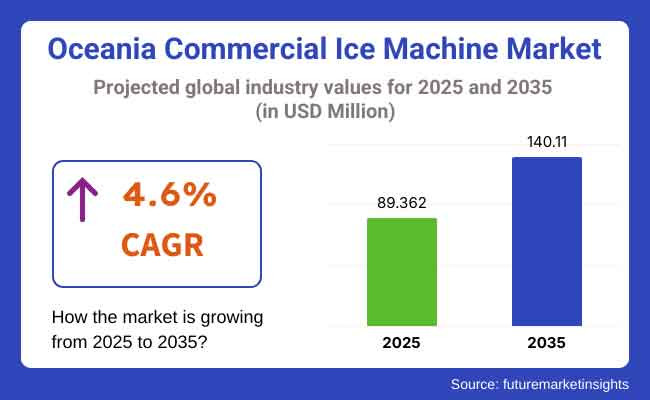

The market is projected to exceed USD 140.110 Million by 2035, growing at a CAGR of 4.6% during the forecast period.

Technological advancements, including energy-efficient and environmentally friendly ice machines, are enhancing adoption rates, the growing trend of premium beverages and specialty drinks in cafes and bars is fueling the demand for high-quality ice production solutions.

The North American commercial ice machine market is driven by a robust hospitality industry, a burgeoning foodservice industry, and the need for energy-efficient refrigeration solutions. The United States is ahead, because it has increased consumption of icy drinks and food safety regulations, the DRM from FDA-based regulations becoming even more stringent in recent years with new ones tending towards such strictness.

Furthermore, fast-casual dining is surging case after base and with that elite man ship embraced in bars and cafes. Canada is also getting better, cities are expanding and tourism is a major growth driver for new ice machine installations at hospitals as well as other institutions of specialized medical care as well those that serve up this particular healing potion.

Europe is currently showing large demand for commercial ice machines, supported by a mature foodservice sector and low-carbon product development. Germany, the UK, France and Italy are all major markets, fuelled by hotels, catering and quick-service restaurants. The EU's stringent environmental regulations are forcing corporations to use environmentally friendly ice-making techniques. The rise of luxury dining and special food and drink service further drives this trend across the continent.

The Asian-Pacific region will be the fastest-growing market, driven by increasing urbanization, a growing middle-class population and the expansion of hospitality as well as food service industries. One example is that China, India, Japan and Australia are beginning to commercialize ice machines: Restaurants around the world have chains and one can see local ones establishing themselves in convenience stores also being part of such growth sector hotel business.

The increasing use of iced drinks and the growing interest in cold chain logistics for food pharmaceuticals has also led to widespread adoption energy-efficient industrial ice machines in modern forms.

Challenge

High Energy Consumption and Operational Costs

As a consequence of high energy consumption and operational costs, Oceania's commercial ice machine market faces challenges. Commercial ice machines require a lot of electricity to maintain the freezing cycles, particularly in the hot, sunny environment of some parts Oceania such as Australia's coast.

As electric prices go up and both power conservation and efficiency become more important, this makes businesses under mounting pressure to install machines that are both sustainable and economical in terms of energy outlay.

Stringent Environmental Regulations

Stringent environmental regulations on refrigerants and energy standards pose another problem. Many outdated models use hydrofluorocarbons (HFCs), which are the object of an international program to eliminate. Environmental policies such as the Kigali Amendment and local sustainable development directives stipulate that manufacturers must move to new, eco-friendly refrigerants and develop more environmentally responsible technologies.

Opportunity

Growing Demand from Hospitality and Foodservice Sectors

The flourishing tourism and hospitality industry throughout Oceania fuels the demand for commercial ice machines. Whether for restaurants, hotels, bars or event locales, they can now only thrive if they depend on stable ice sources that don't simply disappear from under a group or crowd of visitors. This opens up opportunities for manufacturers serving high-volume users by offering multiple solutions.

Innovation in Energy-Efficient and Eco-Friendly Ice Machines

Energy-efficient and earth-friendly technology innovation and commercial ice machine manufacturers are capitalizing on modern advances. New models which are still being hung with earth-friendly refrigerants, utilize advanced insulation, and have smart controls for optimizing energy consumption are taking off. Manufacturers such as Electrolux that invest in sustainable innovation as well as intelligent supervision systems are where the smart money’s going because their target customer is looking for carbon-reducing, cost-efficient solutions.

Within 2020 to 2024 the Oceania Commercial Ice Machine Market gained steadily, tourism and foodservice industry returning to normal after the pandemic being the main cause. Companies focused on upgrading outdated equipment to models capable of meeting evolving environmental standards so that they have developed a strong presence in the market now.

Manufacturers worked hard to extend product line with energy saving features and offered such services as preventative maintenance that would lengthen the life of equipment. The market trend in Japan during these years centered around air conditioning products, although this was not a base model of wealth as such and there was major fluctuation from year to year.

From 2025 to 2035, the market will see further evolution as smart, IoT-based ice machines allow remote monitoring, predictive maintenance and energy optimization. Sustainable machine trends such as low-GWP refrigerants and solar power for refrigeration units will come rising up. Companies committed to energy efficiency, environmental compliance and tailor-made solutions for a range of industries will become the new leader in the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with basic energy efficiency regulations and phasedown of HFC refrigerants |

| Market Demand | Demand driven by tourism recovery and foodservice industry growth |

| Industry Adoption | Shift to energy-efficient ice machines with basic smart features |

| Supply Chain and Sourcing | Focus on conventional component sourcing and regional supply chains |

| Market Competition | Competition among traditional equipment manufacturers |

| Market Growth Drivers | Demand for reliable ice production in hospitality and foodservice |

| Sustainability and Energy Efficiency | Early focus on reducing energy consumption and HFC replacement |

| Integration of Digital Innovations | Limited use of digital monitoring tools |

| Advancements in Technology | Incremental improvements in ice production capacity and efficiency |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Implementation of stricter environmental policies and mandates for eco-friendly refrigerants |

| Market Demand | Expansion fueled by smart and sustainable ice machine adoption across hospitality and healthcare sectors |

| Industry Adoption | Widespread use of IoT-enabled machines with predictive maintenance and remote diagnostics |

| Supply Chain and Sourcing | Increased localization of supply chains and adoption of sustainable materials |

| Market Competition | Rise of green technology firms and smart appliance innovators |

| Market Growth Drivers | Push for low-energy, low-carbon solutions and smart-enabled commercial ice machines |

| Sustainability and Energy Efficiency | Broad adoption of natural refrigerants, solar power integration, and net-zero operational goals |

| Integration of Digital Innovations | Full integration of smart controls, cloud-based monitoring, and AI-driven energy optimization |

| Advancements in Technology | Technological advancements in eco-friendly design, modular construction, and automated energy management |

In the USA market, demand from the foodservice and hospitality sectors is particularly strong, especially for quick-service restaurants and hotels. End-users tend to prefer machines which have been certified by ENERGY STAR in consideration of both energy consumption and water use. This trend therefore tends to shape equipment preferences. In addition, health care institutions and convenience stores continue to be major pushers for demand.

Although the rising adoption of compact but more importantly modular machines can be used in all sorts of different applications helps to keep supply chain disruptions and high costs for advanced unit’s only minor problems for now. The USA market has numerous advantages such as its traffic arteries and consumer focus on operational efficiency. In the long run, one can be optimistic about its prospects.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

In the UK, the trend now is toward green Oceania solutions. The UK market is benefiting from the strong growth in catering and hospitality. People’s increasing demand for high-quality drinks are also driving pub and upmarket restaurant sales of special ice-making machines. Tight water and energy usage regulations favour innovation ice-making solutions that are greener.

In addition, the rising trend of "food to go" and delivery has led to commercial ice machines being used more and more in small catering enterprises. But intermittent energy costs and the heavy initial outlay for a performance-grant machine friendly to the environment both constitute problems.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The market for commercial ice machines in the European Union tends to be good and steady, because people are concerned about ecological things now. Countries like Germany, France, and Spain occupy the forefront in Europe, where tourism and hospitality are important industries Demand is instead being stirred by the upswing in tourism, ever-rising standards for food and drink, and a compelling force on all sides to save energy and water.

Equipment with new and sensible blessings such as being water-efficient and environmentally friendly downstream ring might greatly prejudice patterns of buying in the future in identified EU countries.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

South Korea’s commercial ice machine market is also definitely influenced. As in the example of a highly developed industry with traditions particular to but one locale, even small changes can bring about quite big results. Sturdily, the market is supported by Oceania improving its product offerings in keeping with energy-efficient trends and introducing technological advances. One after another Tilburg, Gouda and all those cities not with the usual manufactory build, file and other traditional sectors have since long flourished in service sector.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Modularity or a built-in ice machine holds the lion share of Oceania market largely thanks to versatility and adaptability across different commercial ice maker application fields. These machines are designed to generate large quantities of ice, and usually equipped with ice storage tanks which means they are very suitable for environments of high demand like hotels, major restaurants, catering services and medical centres.

The modular design allows businesses to scale ice production capacity in line with seasonal or operational requirements, a far cry from restaurants that have to face fluctuations in customer numbers. In addition, modular ice machines may be installed in various locations as required with comparatively little effort whereas all one gets with a free standing system would be a big chunk of wasted space and the kind headache caused by inefficiency. Energy efficiency of ice makers in Oceania's foodservice and hospitality sectors is being increasingly in demand

In the Oceania commercial ice machine market, the largest share is taken up by hotels and restaurants. This area is fed by hospitality industry pros who have helped turn it into something major. In the setting of hotel and restaurant, good quality ice is in high demand: here service standards are paramount and guest satisfaction counts most. People in different industries use ice machines extensively: to chill drinks, keep in good presentation condition foodstuffs before serving them at table, store perishable goods in kitchen refrigerators.

These Oceania countries, especially Australia and New Zealand, attract large numbers of foreigners. The growth of international tourism in these two areas triggers more hotels and restaurants: like everywhere, it results in people going out for dinner so that the hotel restaurant business should be expanding rapidly.

Furthermore, as fine dining establishments and five-star hotels increasingly favour clear, high-quality ice for cocktail ingredients and gourmet presentation, demand for ice-making equipment has never been stronger. Again as we slowly shake off the effects of the pandemic, and the hospitality industry gets back on its feet, demand for clean and efficient ice machines that are also cheap in cost and easy to manage grows.

The Oceania commercial ice machine market is experiencing steady growth, driven by rising demand in the hospitality, healthcare, and food service sectors. Increased tourism, expansion of the food and beverage industry, and a growing preference for energy-efficient and hygienic ice production solutions are fueling market expansion.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Hoshizaki Corporation | 20-25% |

| Manitowoc Ice (Welbilt Inc.) | 15-20% |

| Scotsman Ice Systems | 12-16% |

| Ice-O-Matic | 8-12% |

| Follett LLC | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Hoshizaki Corporation | High-capacity commercial ice machines, environmentally friendly refrigerants, and innovative sanitation features. |

| Manitowoc Ice (Welbilt Inc.) | Modular and undercounter ice machines, smart diagnostics, and energy-efficient designs. |

| Scotsman Ice Systems | Versatile ice makers with self-monitoring capabilities and a wide range of ice cube sizes. |

| Ice-O-Matic | Commercial ice machines with built-in antimicrobial protection and eco-conscious technology. |

| Follett LLC | Compact ice dispensing systems for healthcare and hospitality, with high-performance ice makers. |

Key Market Insights

Hoshizaki Corporation (20-25%)

Hoshizaki holds the largest share in the Oceania market, offering advanced commercial ice machines with high reliability and energy savings.

Manitowoc Ice (Welbilt Inc.) (15-20%)

Manitowoc Ice is known for its modular designs and smart functionality, supporting various industries with flexible ice production solutions.

Scotsman Ice Systems (12-16%)

Scotsman provides efficient ice-making systems with innovative features tailored for hospitality and healthcare applications.

Ice-O-Matic (8-12%)

Ice-O-Matic offers durable machines equipped with antimicrobial technology, contributing to safe and hygienic ice production.

Follett LLC (5-9%)

Follett specializes in niche markets, offering compact dispensers and healthcare-oriented ice machines with premium performance.

Other Key Players (30-40% Combined)

Additional participants in the Oceania commercial ice machine market include:

Table 01: Market Value (US$ Million) Forecast, By Machine Type, 2018 to 2033

Table 02: Market Volume (Units) Forecast, By Machine Type, 2018 to 2033 ;

Table 03: Market Value (US$ Million) Forecast, By Ice Capacity, 2018 to 2033

Table 04: Market Volume (Units) Forecast, By Ice Capacity, 2018 to 2033

Table 05: Market Value (US$ Million) Forecast, By Condensing Unit, 2018 to 2033

Table 06: Market Volume (Units) Forecast, By Condensing Unit, 2018 to 2033

Table 07: Market Value (US$ Million) Forecast, By End Use, 2018 to 2033

Table 08: Market Volume (Units) Forecast, By End Use, 2018 to 2033

Table 09: Market Value (US$ Million) Forecast, By Ice Type, 2018 to 2033

Table 10: Market Volume (Units) Forecast, By Ice Type, 2018 to 2033

Table 11: Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 12: Market Volume (Units) Forecast, By Country, 2018 to 2033

Figure 01: Market Value (US$ Million) and Volume (Units) Analysis, 2018 to 2033

Figure 02: Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 03: Market Value (US$ Million) and Volume (Units) , 2018 to 2033

Figure 04: Market Absolute $ Opportunity (US$ Million) 2022 to 2033

Figure 05: Market Value (US$ Million) and Volume (Units) Forecast 2022 to 2033

Figure 06: Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 07: Market Volume (Units) Analysis by Machine Type, 2018 to 2033

Figure 08: Market Y-o-Y Growth (%) Projections, By Machine Type, 2023 to 2033

Figure 09: Market Attractiveness by Machine Type, 2022 to 2033

Figure 10: Market Value (US$ Million) Analysis by Ice Capacity, 2018 to 2033

Figure 11: Market Volume (Units) Analysis by Ice Capacity, 2018 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections, By Ice Capacity, 2023 to 2033

Figure 13: Market Attractiveness by Ice Capacity, 2022 to 2033

Figure 14: Market Value (US$ Million) Analysis by Condensing Unit, 2018 to 2033

Figure 15: Market Volume (Units) Analysis by Condensing Unit, 2018 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections, By Condensing Unit, 2023 to 2033

Figure 17: Market Attractiveness by Condensing Unit, 2022 to 2033

Figure 18: Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 20: Market Y-o-Y Growth (%) Projections, By End Use, 2023 to 2033

Figure 21: Market Attractiveness by End Use, 2022 to 2033

Figure 22: Market Value (US$ Million) Analysis by Ice Type, 2018 to 2033

Figure 23: Market Volume (Units) Analysis by Ice Type, 2018 to 2033

Figure 24: Market Y-o-Y Growth (%) Projections, By Ice Type, 2023 to 2033

Figure 25: Market Attractiveness by Ice Type, 2022 to 2033

Figure 26: Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 27: Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 28: Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 29: Market Attractiveness by Country, 2022 to 2033

The overall market size for Oceania commercial ice machine market was USD 89.362 Million in 2025.

The Oceania commercial ice machine market is expected to reach USD 140.110 Million in 2035.

The Oceania commercial ice machine market demand will be driven by growing hospitality, foodservice, and healthcare sectors, increasing fast food and convenience store chains, and rising demand from hotels, restaurants, bars, and catering services requiring efficient and diverse ice production solutions.

The top 5 countries which drives the development of Oceania commercial ice machine market are USA, European Union, Japan, South Korea and UK.

Modular/Built-in Machines demand supplier to command significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.