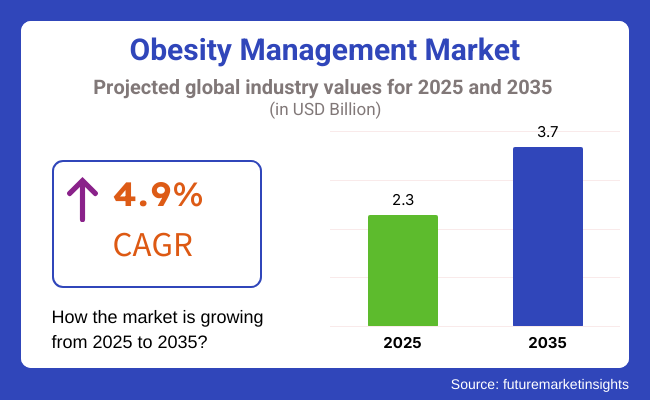

It is estimated that the global obesity management market will grow at a healthy CAGR between 2025 and 2035 owing to the increasing prevalence of obesity, rising awareness regarding health and medical treatment advancements.

Obesity is a major contributor to chronic diseases such as hypertension, diabetes, cardiovascular disease, and the governments’ response to the healthcare agencies has been to step up weight management programs and to broaden the range of therapeutic agents available for managing these conditions.

The market is expected to attain USD 3.7 Billion by 2035, recording a CGAR of 4.9% over the forecast period, credible to be valued at USD 2.3 Billion in 2025. The rise in obesity is primarily related to changes in lifestyle and genetic predisposition. The market growth factors includes the burgeoning usage of prescription weight-loss drugs, bariatric surgeries, and behavioural therapy programs.

In addition to that, the emerging digital weight loss programs, AI-based exercise applications, and telehealth solutions have transformed the global obesity management landscape. Furthermore, developments in minimum invasive weight loss procedures and high potency medication therapies will boost the market growth.

Healthcare spending, infrastructure, and drug discovery for obesity are all leading to continued growth in the obesity management market.

Explore FMI!

Book a free demo

North America Obesity Management Market is dominating market share, with United States and Canada holding the prominent share attributed to high obesity population, as well as well an established infrastructure health care, along with government-led public health initiatives. More than 40% of Americans are now categorized as obese, and nationwide healthcare expenses related to obesity-linked diseases are increasing.

The growing demand for FDA-approved anti-obesity drugs, individualized programs to manage obesity, and bariatric procedures influence the market dynamics. The increasing insurance coverage for weight-loss treatments, as well as corporate wellness programs based on fitness and nutrition, has led to the growing adoption of obesity management solutions across the health care landscape.

Also, the North America is observing the emergence of digital health platform that integrates wearables, AI-powered fitness tracking as well as online weight management consultations. Instead of providing generic solutions that are costly and ineffective, these solutions provide individuals with tailored coaching, meal plans, and workout routines thus making weight management possible for the majority.

Key regional players like Novo Nordisk, Eli Lilly and Johnson & Johnson are rolling out next-generation drugs - such as GLP-1 receptor agonists - that have shown dramatic weight-loss results. The scenario as North America stands to fortify core market position with surge in clinical research investment and regulatory approvals for emerging anti-obesity medications.

Germany, the UK, France, and Italy are driving the adoption of weight management programs and obesity treatments in one of the largest markets in the world - Europe. Rising Incidence of Obesity-Associated Disorders & Government-Funded Public Health Campaigns Accelerating Market Growth

The pharmaceutical industry's research into obesity medications is gaining traction, supported by the European Medicines Agency (EMA) and national healthcare authorities, a trend which is increasing revenue in the weight-loss medication segment. EU healthcare systems also increasingly reimburse obesity treatments, leading to growing availability of bariatric surgeries, prescription weight-loss drugs and lifestyle modification programs.

However, in line with a wider trend, the growth of digital health platforms throughout Europe is influencing weight management trends. Apps for AI-enabled health coaching, portable fitness equipment, and mobile diet management make it possible for individuals to lose weight efficiently and easily. Moreover, governments are encouraging nutritional education and exercise programs and are letting the market profit even more from preventative healthcare.

And increasing funding for obesity research in Europe is spurring new treatment advances, including gene-based obesity treatments and weight-loss drugs that target gut microbiomes. Given the older population and growing obesity levels in Europe, there is still a surety of growth ahead for the frontiers of obesity management.

Growth in the obesity management market in the Asia-Pacific region is expected to be fastest through the report period, with China, India, Japan and South Korea already facing a rising incidence of obesity, owing to changing dietary patterns, urbanization and sedentary lifestyle. Major growth drivers include wider reach of health services, rising disposable income and growing awareness regarding health hazards caused by obesity.

The rates of obesity in China and India are rising sharply, especially among urban dwellers. With the growing significance of being healthy, the market for weight loss drugs, dietary supplements, and non-surgical weight-loss techniques is booming.

Fitness centres, health clubs and retreat wellness sectors in the region are rapidly growing; allowing to the diet control programme specifically aimed at weight control. Nations like Japan and South Korea steadily built wellness cultures that fuelled the demand for scientifically devised dietary solutions and naturally formulated fat-burning supplements.

Digital health solutions are also transforming obesity management across Asia-Pacific. Those places are becoming more accessible for obesity treatment thanks to the popularity of mobile-based weight loss programs, AI driven health coaches and telemedin consultations. Also, government obesity prevention campaigns in China and India are stimulating public health initiatives that address the disease burden related to obesity.

Challenges

Opportunities

The obesity treatment market boomed from 2020 to 2024 during which health care providers, pharmaceutical companies, and digital health platforms created new weight control solutions to address the global obesity epidemic. Obesity-related comorbidities are a growing challenge (eg, type 2 diabetes, cardiovascular disease, metabolic syndrome, etc.), thus, effective evidence-based obesity treatment programs are needed.

Then governments and health bodies - including the World Health Organization (WHO); the USA Food and Drug Administration (FDA); and the European Medicines Agency (EMA) - closed in on guidelines, launched public health campaigns and opened up regulatory pathways for anti-obesity medications, bariatric surgeries and digital weight loss interventions.

It contributed to the emergence of advanced weight loss drugs - GLP-1 receptor agonists, lipase inhibitors, metabolic enhancers (that not only improved the result of weight management, but also promoted patient adherence to therapy. The emergence of therapies using these glucagon-based treatments as well as dual-hormone weight loss therapies offer new horizons for treating obesity medically; such agents offer safer and more effective pharmacologic options than earlier weight loss drugs.

Medicines - as well as dietary advice, lifestyle changes and even behaviour therapy - are rapidly becoming the personalised treatment regimens medical providers are increasingly making available for long-term weight loss.

But so did advances in technology - in AI-based platforms for weight management, digital therapeutics (DTx), metabolic health monitoring and the rest - and those changes revolutionized obesity treatment - and made it possible to reach and engage the patient population, as well.

These steps are enabled by mobile applications (apps) and wearable devices; real-time calorie tracking, personalized meal planning and AI powered fitness recommendations proved their worth in assisting not only patients with motivation but perhaps most critical with the process of adherence all the way to long-term adherence.

This nuance was supplemented with smart glucose monitors, metabolic rate analysers, as well as AI-enabled, digital weight-loss coaches that advised on how to tweak a diet and exercise programme in real-time for precision obesity management. Just as telemedicine and virtual weight loss programs were surging around the country, helping improve access to obesity specialists, registered dietitians and behaviour modification therapists.

But the market is also plagued by the expensive prices of cutting-edge obesity treatments alongside restrictive and marginal insurance coverage and the stigma attached to medical weight loss treatments. Medical interventions to treat obesity have had limited impact due to lack of accessibility of affordable weight loss programs and pharmaco-therapeutic regimens, especially among patients from the low-income and poorly served communities.

Other barriers to acceptance included concerns about long-term use of anti-obesity drugs, adverse events linked to bariatric surgery, and varying policy approaches to regulation. Meanwhile, as pharma houses, tech companies, and health providers poured billions into AI-augmented metabolic surveillance, non-invasive weight-loss therapies, and sustainable obesity treatment paradigms, management of obesity grew with broader, personalized, and data-centric solutions.

Obesity Management will be revolutionized with AI paving the path for metabolic reprogramming; this decade the long search to the genie for obesity would lead to a renaissance of the gene therapies for weight loss, fixation of genes for obesity and turning those to better treatment outcomes; as long term control of obesity will start to be the outcome of the future.

In the modern world, we will eventually see standardization of recommending personalized weight loss plan using AI metabolic profiling platform and genomic, gut microbiome and hormonal profiling for the doctors. AI-assisted precision medicine platforms will analyse an individual's genetic predisposition for obesity, metabolic efficiency, and responsiveness to feeding in real-time to inform pharmacotherapy and lifestyle tailored to the individual.

Quantum computing can thus enable metabolic simulations to produce bespoke weight reduction through personalised treatment responses grounded in the patient’s bio-physiology and habits.

Gene therapy and metabolism-engineered CRISPR will know better than to perpetuate the false problem of sustainable long term weight management and will never succumbed to the travesty of contemporary pharmacotherapy until we would realize that diabetes would be history just with sustainable, durable very good weight loss.

Chronic Treatment for metabolic derangements associated with overweight and Obesity: Engineers. Moreover, bioengineered gut microbiome transplants would be same as it would have the ability to regulate hormones as well as promote digestion for better homeostasis on a metabolic pathway and weight maintenance in a natural manner. Synthetic metabolic boosters, AI-optimized fat-burning algorithms, and bioelectronics appetite-modulating devices even superb non-invasive options will find themselves enhanced.

The loss of weight will be supported by AI and block chain based and real time responses with the ability to track metabolic metabolism in real time will provide an effective way for the management of remote obesity with AI driven coaching and block chain powered dietary adherence monitoring.

Wearable metabolite analysers of the next generation would enable continuous profiling of both fatty acid and glucose oxidation and their effector hormones, providing real-time feedback on the effectiveness of nutritional and physical activity interventions.

Following that, with the emergence of artificial intelligence technologies, we will develop intelligent meal planning systems, based on the knowledge of the metabolic processes taking place in our bodies, and tailored specifically for the individual human body, so that еvеrybody can obtain recommendations on the consumption of dishes with favourable properties that allow you to optimize metabolic weight loss processes in a free and unconstrained manner in a matter of months, to spend as different as the body fat deposit collected together over half a lifetime as maximally efficient where one can burn.

On the side, VR assisted behavioural therapy will also focus on interlocutory overcoming of triggers of emotional eating and to get motivation that will foster healthy eating habits to ensure long term weight loss.

The next wave of obesity treatment will be efficient in cost, broadly accessible and sustainable. And with potentially ai-driven automated obesity management platforms, lean, mean, sustainable weight loss supplement manufacturing, and decentralized metabolic health optimisation centres, we'll be able to reduce treatment costs and open access to disruptive obesity therapies, treatments will be both affordable and much more widely available.

However, block chain-based tracking systems that can aid in providing individualized treatment for weight loss adherence for obesity management in real-time have the power to bring all the mentioned parameters for pre and post-data metrics and efficient costing metrics, while also having long term success rate metrics equitable across settings literature has proposed best practice standards, for global standardization for obesity management protocols.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Digital platforms for weight loss such as, including Digital weight loss platforms, GLP-1 receptor agonists, considering recent advances in bariatric surgery. |

| Technological Advancements | We improved obesity management with AI powered fitness tracking, pharmaco surgical weight loss and telemedicine based behavioural therapy. |

| Industry Applications | They were used extensively in pharmacologic therapy for obesity, procedures for bariatric surgery and virtual-based training for weight loss. |

| Adoption of Smart Equipment | GLP-1 weight-loss medication, A.I.-powered telemedicine for obesity coaching and metabolic health trackers had become the elixir for hospitals and clinics on weight management. |

| Cheapness vs keeping our planet sustainable | However, the introduction of digital obesity coaching and AI-powered metabolic diagnostics made this process much more efficient, although high cost and limited accessibility initially made implementation difficult. |

| Functionality and Tools of Data Analyst | With this AI metabolic analytics, predictive analytics and behaviour prediction helped for tracking of weight loss, dietary planning and predictive modelling. |

| Production & What Lies Behind Supply Chain Dynamics | The former categorized obesity drugs as costly to make and weight-loss supplements as constrained by supply chains, and pointed to insurance coverage issues. |

| Market Growth Drivers | Rising incidence of obesity, rising demand for the GLP-1 weight-loss drugs, high uptake of AI-based weight management software and mobile applications were the high-impact rendering drivers pushing growth. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | The future, will see AI precision metabolic monitoring regulation policy and Gene therapy secured Obesity treatment and block chain secured metrics of weight loss tracking or not. |

| Technological Advancements | In prospect are: quantum-enhanced metabolic optimization, gene-editing weight loss therapies, AI-powered smart meal planning. |

| Industry Applications | AI-driven precision obesity care, regenerative metabolic therapy and virtual reality-based behavioural modification are going to take the industry by storm. |

| Adoption of Smart Equipment | Novel wearables enabled wireless metabolic assessments with AI-guided big data for smart control of obesity, and prominent block chain-enabled that can tracking weight management compliance will reiterate personalized care. |

| Cheapness vs keeping our planet sustainable | AI based personalized pricing and block chain synergy to end shed block chain powered standardization in obesity management and sustainable metabolic health nutraceuticals. |

| Functionality and Tools of Data Analyst | Using quantum simulations of weight loss will allow us to better define obesity prevention strategies as will real-time endpoint populations for AI-enabled models of environmental interventions and predictive models of genetic predisposition to obesity. |

| Production & What Lies Behind Supply Chain Dynamics | Combine this with AI driven manufacturing of weight loss drugs, decentralized models for delivering obesity treatment and block chain powered delivery of metabolic treatment. |

| Market Growth Drivers | The treatment market growth in future is expected to be driven by the advancing gene therapy and emerging gene therapy based obesity treatment and AI assisted individualized weight management and metabolic precision medicine. |

Market Incipience: United State Obesity Management Market is growing modestly on account of increasing prevalence of obesity, growing acceptance of pharmacological and surgical weight management solutions, and government attested obesity prevention programs. Obesity, with as many as 42% of the adult population being regularly described as obese by the Centres for Disease Control and Prevention, is one of the key stresses on America which in turn is creating a very high demand for medical weight management goods.

Some of the key factors anticipated to drive the market growth comprise the growing utilization of prescription anti-obesity drugs, particularly the highly efficacious glucagon-like peptide-1 (GLP-1) receptor agonists (Segovia, Ozempic) and other appetite suppressants, for the treatment of excess weight and obesity alongside its comorbid conditions.

Thus, the fact that various types of these bariatric surgical procedure are readily available such as gastric banding, gastric bypass, and sleeve gastrectomy is yet another contributing factor that is making international patients pick bariatric surgery for obesity as a long-term solution.

Medicare and USA health insurers are also expanding access to treatment programs for obesity, as well as medically supervised weight loss programs and digital health tools that include, for instance, A.I.-enabled diet and training apps.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

This is due to the increase in obesity rates and NHS-funded weight reduction programs in the Country which is due to an impelling growth in the UK obesity management market.

Some 28 percent of adults in England and 20 percent of children are classified as obese, according to estimates from the UK government, driving demand for medical interventions, including prescription weight-loss medication and lifestyle change programs.

The National Health Service (NHS) has begun funding obesity prevention and treatment programs and expanded coverage for the use of GLP-1 weight loss drugs and bariatric surgery in patients with severe obesity.

The growing use of digitally enabled, AI-driven weight management solutions including dietary planning and distant coaching and are driving through the shift to personalized obesity management plans.

Furthermore, the UK-led sugar reduction campaign and tougher regulation on unhealthy food marketing is an important part of preventive strategy in the treatment of obesity.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

Robust Obesity Management Market in European Union re synchronous, Government funded, prevention programs with the significant expansion of pharmaceutical weight-loss treatments.

Germany, France, and Italy: The prescription weight loss medications, meal replacement therapy, and bariatric procedure options are dominant in this region.

These AI-driven personalized obesity treatment programs enable precision weight management by incorporating these into the genetic profiling, metabolic rate, etc.

Furthermore, increasing initiatives of childhood obesity prevention, and workplace wellness programs is driving the early adoption of weight management and in turn driving the growth of the global weight management market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.9% |

Rise in Obese Population and Government Supported Wellness Programs Mounting Obese Population the Japan Obesity Management Market is witnessing an increase in body mass population, government-backed health programs, and growing usage of digital weight management solutions.

Japan already has one of the lowest rates of obesity in the world (around 4% of adults are considered obese) but the rising number of adults tipping into the overweight category and the rise of metabolic syndrome has led to increasing demands for preventative obesity treatments.

These data-driven, paid digital health coaching platforms often incentivise the timely updating of personalised dietary recommendations and remote weight management programmes, with better nail down of weight control in the early phases of obesity.

The growing interest of functional and nutraceutical foods in Japan is driving the demand for functional beverages, dietary supplements and meal replacements to increase the metabolism.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The South Korea Obesity Management Market is an expanding market due to the rising prevalence of obesity and the increasing demand for pharmaceutical weight loss therapies, coupled with government-sponsored wellness programs.

The increasing acceptance of the use of prescription weight loss medications and meal replacement therapies will demand medically supervised weight control programs.

The advent of popular digital obesity management platforms (e.g. through wearable devices and AI-driven fitness coaching) for obesity management has been shown to enhance population-level compliance to customized diet and exercise programs.

The burgeoning market for bariatric surgery in South Korea is also pushing up the numbers of gastric balloon procedures and endoscopic weight loss treatments, particularly among the severely obese.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

As healthcare providers, obesity experts, and pharmaceutical companies rely more heavily on medication-based weight loss methods as a possible solution to rising obesity-related health disorders, the Bupropion and Naltrexone drug segments as well as the Liraglutide drug segment hold prominent positions within the obesity management market.

They are vital for issues such as weight loss, appetite control, and metabolic diseases, as they lead to effective, long standing treatment of normalised weight and reduced comorbidities.

The most obvious examples of this include agents such as Bupropion and Naltrexone, which has become one of the most common prescribed pharmacotherapy for obesity due to its double mechanism-mediated appetite and reward-based eating .

Unlike standalone medications to induce weight reduction, this combination therapy has a unique dual-action mechanism designed to modulate central nervous system pathways implicated in hunger and food craving and has demonstrated enhanced long-term weight loss in further studies.

Obesity is a growing crisis, and Bupropion and Naltrexone-based therapy markets will only surge further powered by the need of the healthcare providers to offer non-surgical options for patients with high BMI and obesity-related comorbidities including type 2 diabetes, hypertension, dyslipidaemia, etc.

But the mechanism through which Bupropion and Naltrexone works has been clinically validated as a way to help people better cope with the emotional eating habits and binge-eating disorder so that they are the perfect combo for a weight loss miracle for those with behaviour weight loss issues. This combination therapy strongly decreases caloric intake, generates higher levels of satiety, and improves adherence to caloric restriction diets.

The demand for obesity management as multi-dimensional treatment paradigm is further cemented by the integration of Bupropion and Naltrexone with lifestyle modification programs including nutritional counselling, cognitive behavioural therapy and exercise programs.

Improvements in tolerability and persistence, aided by long-acting formulations and individualized dosing regimens, have supported more sustainable weight loss outcomes over time and improved patient compliance to treatment.

Although this combination appears to show additional clinical advantages, the side effects of Bupropion and Naltrexone should not be underestimated: nausea, contraindications in patients with seizure disorders, and the need for physician supervision for dose adjustments.

However, novel approaches in person-centric weight loss therapy modalities, and AI-powered obesity risk assessment algorithms, as well as next-generation appetite suppressants are enhancing therapy continuity, compliance and efficacy, and, consequently, propelling the growth of market for Bupropion and Naltrexone-based obesity medications.

The accelerated acceptance of Liraglutide in the markets is largely attributed to the ever-increasing reliance of medical practitioners on weight reducing the GLP-1 receptor agonists, which demonstrate beneficial impacts on glycaemic regulation and generating sense of fullness in obesity related metabolic disorders (Diabetes Mellitus Type II, Insulin Resistance etc.) patients.

Unlike traditional weight loss medications that target metabolism, liraglutide mimics natural GLP-1 effects by slowing gastric emptying, suppressing hunger signals, and controlling glycaemia post-prandially leading to long-term weight loss.

The recent approval of formulations of higher-dose Liraglutide to manage obesity (independent of diabetes management) has firmly established Liraglutide as first-line agent in the armamentarium of agents for chronic weight management on the pharmacotherapy spectrum. GLP-1 receptor agonists have become a cornerstone of modern approaches to treating obesity, thanks to the drug’s safety, long-acting efficacy and low risk of serious heart problems.

Moreover, innovations in monthly use injectable formulations, in combination treatments with other categories of metabolic drugs, and the development of artificial intelligence-based monitoring systems for patient adherence have resulted in higher levels of treatment personalization, flexible dosing, and longer-term retention of patients on treatment, with the ultimate aim being support of best outcome for patients looking for strategies to lose weight in a sustainable way.

Moreover, despite the growing use of Liraglutide-based therapies, there are still limitations, which include high treatment costs, insurance reimbursement restrictions, and gastrointestinal side effects. However, competition persists with the continuous development of oral GLP-1 analogs formulations, AI-enabled metabolic health monitoring, and expanded insurance coverage for obesity medications; these will make it easier and cheaper to treat obesity patients empowering a better long-term adherence should guarantee the steady growth of oil market Liraglutide in the treatment of obesity.

Two of the observer leading segment segments of the global bariatric surgery market gas a gastric bypass surgery and gas a gastric sleeve surgery as hoists, gas a bariatric surgery, centres, and gas a metabolic surgeons increasingly conduct minimally invasive bariatric as to provide sustainable, long-lasting as a solution as for morbidly obese individuals.

Market for Gastric Bypass Surgery Leads in to Weight Loss Demand Inspired by Long-Term Weight Loss Success Rates

Gastric bypass surgery is one of the most frequently performed bariatric procedures ever since its development in 1967 because it ensures strong and permanent weight loss by changing gastrointestinal anatomy in a way that prevents calories absorption and causes early satiety. Unlike restrictive-only weight loss surgeries, gastric bypass uses both restrictive and malabsorption mechanisms that then lead to rapid weight loss and improved metabolic enhancement.

Given the rising prevalence of severe obesity and obesity-associated illnesses, gastric bypass surgery is increasingly being CRS precluded as a robust surgical candidate for patients in whom significant and sustained weight loss is not achieved through dietary, exercise or pharmacological means.

Advancements like laparoscopic gastric bypass techniques have decreased post-operative complications while streamlining the process where it can be as safe, accepted, and have reduced inpatient hospital days as possible. Gastric bypass surgery has been associated with the following characteristics according to the research: 60-80% of excess body weight mean sustained weight loss; reduced risk of the onset of type 2 diabetes mellitus, hypertension and dyslipidaemia; resolution of obesity-related metabolic syndrome.

Additions include robotic-assisted bariatric surgery, AI-powered patient selection tools, veterinary care programs, weight management optimization, weekly weight planner, optimal ergonomics of all procedures, latest lifestyle aids methods post-surgeries et.al targets overall patient compliance, outpatient program adherence ensures negligible obesity recurrence.

The gastric sleeve has gained a significant foothold and market penetration in people requesting a low-complexity, though still highly efficacious, surgical mechanism for weight reduction since this procedure reduces gastric volume, yet maintains normal GI physiology. In contrast to gastric bypass, gastric sleeve surgery resects the stomach vertically, reducing food intake without altering the routes for nutrient absorption, thereby reducing long-term dietary restrictions and the surgical risk.

Gastric sleeve devices are also used in minimally invasive, laparoscopic procedures, with growing evidence of patient preference for procedures for faster recovery times and fewer post-operative preventative measures, as well as low-cost weight loss without intestinal rerouting. Research indicates that tongue in relation with gastric sleeve surgery results in 50-70% excess weight loss within 2 years after surgery, advanced metabolous function and less inflammation in obesity.

The available technologies, such as robotic-assisted sleeve gastrectomy, Artificial Intelligence (AI)-based surgical planning approaches, and automatic weight loss monitoring devices during post-surgical visits, in addition, provide a little more precision when preventing complications and guarantee a successful long-term adherence to losing weight plans that improve the weight loss results and health improvements.

Although gastric sleeve surgery is gaining popularity, due to its higher success rate than gastric banding and fewer complications directly related to the procedure, potential for renourishment along with several risks associated with gastric dilation still exist, and most insurances do not cover elective bariatric surgery.

That said, post-surgical dietary management, metabolic monitoring technologies, and AI-powered patient engagement are leading initiatives to drive long-term weight maintenance for patients while minimizing surgical complications and providing individualized solutions to help patients succeed in the long-term, making gastric sleeve surgery a newly expanding market.

Global prevalence of obesity is rising, as are the number of weight loss medications on the market for obesity management, minimally invasive bariatric procedures, and AI-driven digital health solutions. There is a specific emphasis on pharmaceutical know-how, surgical procedures, and behavioural therapy applications to optimize long-term weight management, minimizing the effects of comorbidities, and improving patient outcomes.

The market consists of global pharmaceutical companies, medical device manufacturers, and digital weight management platforms, all offering aspects of holistic obesity treatment approaches.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novo Nordisk A/S | 20-25% |

| Eli Lilly and Company | 12-16% |

| Johnson & Johnson (Ethicon & Bariatric Surgery Division) | 10-14% |

| Medtronic plc | 8-12% |

| Allurion Technologies | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novo Nordisk A/S | Those are GLP-1 receptor agonists (Segovia®, Saxenda®) for pharmaceutical weight loss management. |

| Eli Lilly and Company | Tirzepatide, Mounjaro™, next generation of weight loss drugs, metabolic disorders treatments and combination therapies |

| Johnson and Johnson (Ethicon & Bariatric Surgery Division) | Manufactures laparoscopic bariatric surgical solutions, gastric banding systems, sleeve gastrectomy devices. |

| Medtronic plc | Offers gastric electrical stimulation therapy (Enterra®) and minimally invasive metabolic surgery solutions |

| Allurion Technologies | Pioneered non-invasive Gastric Balloon technology (Allurion Balloon) for short-term weight loss therapy |

Key Company Insights

Novo Nordisk A/S (20-25%)

Segovia® and Saxenda® are the GLP-1 receptor agonists marketed by Novo Nordisk, the leading player in the obesity management industry, aiding in appetite control and metabolic processes. The firm is growing AI-based digital weight management system.

Eli Lilly and Company (12-16%)

Eli LillyThis model specializes in Tirzepatide (Mounjaro™), an innovative dual GIP receptor agonist/GLP-1 receptor agonist that works on metabolic signaling to ensure sustained weight loss. The company has focused on developing next-generation anti-obesity drugs.

Johnson & Johnson (Ethicon) (10-14%)

J&J offers a range of bariatric surgical devices and innovations in metabolic surgery, including laparoscopic gastric bands and novel surgical techniques in the minimally invasive surgery space. It specializes in surgical weight loss operations for severe obesity.

Next-generation weight loss therapies, AI-driven behaviour programs, and minimally invasive obesity treatments are due to contributions from several pharmaceutical, medical device, and digital health companies. These include:

Buy This Report Obesity Management Market- was USD 2.3 Billion in 2025.

The expected market size of the Bio based Obesity Management Market by 2035 is USD 3.7 Billion.

The Obesity Management Market is driven by USA, UK, Europe Union, Japan and South Korea.

Gastric Bypass Surgery and Gastric Sleeve Surgery fuel growth to hold substantial share during the assessment period.

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

SPECT Scanning Services Market Growth - Trends & Forecast 2025 to 2035

Preventive Medicine Market Growth - Trends & Forecast 2025 to 2035

Hadron Therapy Market Growth - Trends & Forecast 2025 to 2035

Wound Irrigation Systems Market Growth – Trends & Forecast 2025 to 2035

Western Europe Medical Recruitments Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.