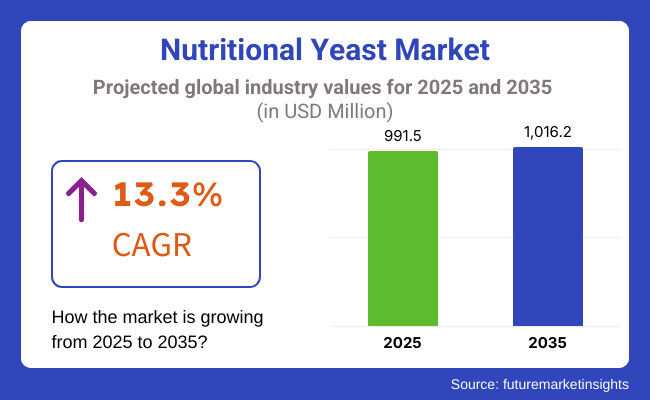

The demand for global Nutritional Yeast market is expected to be valued at USD 991.50 Million in 2025, forecasted at a CAGR of 13.3% to have an estimated value of USD 1,016.20 Million from 2025 to 2035. From 2020 to 2025 a CAGR of 12.6% was registered for the market.

A source of complete protein vitamins (particularly the B-complex) and minerals nutritional yeast is highly prized for its health benefits and fits in with changing dietary preferences and lifestyles. The Asia-Pacific market is expected to grow at the fastest rate by 2025 due to factors like increased health consciousness the growth of plant-based food industries and the growing number of vegans.

The connection is found in the way that nutritional yeast works well in both FAH and FAFH applications. Due to its many uses as a nutrient-dense and flavor-enhancing ingredient it is in high demand in both home kitchens and restaurants which helps to fuel its market growth.

Its use as a natural seasoning and flavor enhancer in processed foods presents a new opportunity for the nutritional yeast industry. A savory umami-rich profile that improves the taste of snacks sauces and ready-to-eat meals is provided by nutritional yeast which satisfies consumer demand for healthier clean-label substitutes for artificial flavorings. This is in line with the growing movement to cut processed foods artificial additives and sodium.

Its complete protein profile and high vitamin B content also make it a desirable ingredient in fortified foods targeted at consumers who are health-conscious. Businesses can take advantage of this by focusing on meal kits and convenience foods which are expected to grow in popularity as urbanization and hectic lifestyles increase worldwide.

Explore FMI!

Book a free demo

Demand for Plant Based Food is Driving the Market Growth

The growing consumer preference for plant-based and vegan diets which is being fueled by growing environmental sustainability and health consciousness is a major driver of the nutritional yeast market. With its high nutrient content complete protein B vitamins and trace minerals nutritional yeast is a well-liked substitute for dairy products in vegan diets.

Its deep umami flavor also makes it a versatile seasoning for food applications appealing to consumers looking for tasty and healthier ingredients. Innovations in the foodservice industry are also driving the trend incorporating nutritional yeast into a variety of menu items to meet the growing demand for clean-label functional food options.

With notable traction seen in the Asia-Pacific and North American regions these factors taken together increase its adoption across global markets.

During the period 2020 to 2024, the sales grew at a CAGR of 12.6%, and it is predicted to continue to grow at a CAGR of 13.3% during the forecast period of 2025 to 2035.

Given its high protein content nutritional yeast is a crucial component of a plant-based or vegan diet. The yeast is obtained as with bread and beer by growing it on molasses. Growing knowledge of nutritional yeasts advantages such as its low-calorie, sugar- gluten- and fat-free formulations in the upcoming years is anticipated to propel sales of nutritional yeast.

The market potential for nutritional yeast is anticipated to be favored by the growing emphasis on fitness and health, becoming more common. It is also expected that lifestyle diseases and disorders will encourage people to use nutritional yeast that has been fortified nutrition plans. Over the upcoming years organic nutritional yeast is expected to become increasingly popular.

It is expected that nutritional yeast popcorn will become more and more well-liked as a nutritious snack among vegans worldwide. Food allergies gluten intolerance and lactose intolerance are predicted to become more common significant need for nutritional yeast powder in the upcoming years.

Tier 1 companies comprises industry leaders acquiring a 40% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 30%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope.

As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and China come under the exhibit of high consumption, recording CAGRs of 10.9%, 8.8% and 14.8%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 10.9% |

| Germany | 8.8% |

| China | 14.8% |

Over the next ten years the USA nutritional yeast market is expected to grow at a compound annual growth rate (CAGR) of 10.9%. Deactivated yeast is a common ingredient in vegan diets as an umami-rich taste enhancer. For a cheesy taste vegan include it in their diet. Growing health concerns among the populace are the reason behind the rapid expansion of veganism across the United States.

Among Americans aged 15 to 70 one-fifth of the population is calling for vegan food. It is anticipated that deactivated yeast sales will rise in tandem with the growing vegan movement. Deactivated yeast has several advantages that are helping the local market such as raising stress and anxiety levels.

Through eMagazines health magazines and social media posts the benefits of eating this deactivated yeast are being promoted. More people will visit convenience stores or local hypermarkets to buy deactivated yeast for their upcoming culinary experiments as more recipes incorporating this yeast are created and disseminated on social media.

With a projected growth rate of 14.8% over the forecast period China is doing fairly well in the global market. The growing millennial populations preference for plant-based and vegan diets is contributing to Chinas market valuation increase. Angel Yeast a Chinese company that makes yeast extract is providing a sustainable wholesome and environmentally friendly option.

Currently a leading yeast producer in Asia this company was the first to invest in modern yeast production in China. To satisfy the needs of people and the environment the company provides a sustainable nutrient-dense and yeast and fermentation-focused food option.

The German nutritional yeast market is growing at a compound annual growth rate (CAGR) of 8.8% during the forecast period. One of Europes most profitable markets is this one. The market is expanding as a result of increased awareness of meat-borne illnesses like swine and avian flu which is predicted to increase demand for plant-based proteins like deactivated yeast and meatless products.

Deactivated yeast greatly benefits consumers with food allergies gluten and lactose intolerance or those following special diets. The food industry in Germany is also being disrupted by the influx of foodtech start-ups.

For example, ProteinDistillery an Ostfildern-based food technology startup uses microorganisms to create clean sustainable proteins for food companies. Beer brewing residue yeast which has a variety of uses without the need for artificial additives is the source of their protein.

| Segment | Value Share (2025) |

|---|---|

| Conventional (Nature) | 85% |

As a result of numerous studies revealing the high nutritional value of the organic version conventional deactivated yeast is becoming more and more popular. At the moment the market share accounts for 85% of the global market. Conventional versions are seeing an increase in sales due to consumer preference health consciousness and purchasing power.

| Segment | Value Share (2025) |

|---|---|

| Food Industry (End-Use) | 65% |

Due to the growing demand for plant-based products clean-label ingredients and vegan proteins the food industry segment has the largest market share in the nutritional yeast market. As nutritional yeast has a rich nutrient profile that includes vitamins B12 and B6 as well as complete protein it is frequently used in food products like vegan cheese snacks sauces and seasonings.

Its popularity as a flavoring and fortification agent in a range of food products is being driven by the proliferation of veganism plant-based diets and health-conscious eating. Furthermore, its use in dairy-free and gluten-free products enhances its standing in the food sector. The market dominance of nutritional yeast which offers both taste and nutritional value is also influenced by the expanding trend of functional foods.

New technologies are being developed by established players through research and development activities. Deactivated yeast is incorporated into new products and applications thanks to this. Prominent companies are also partnering and entering into strategic joint ventures with other businesses.

By bringing organic deactivated yeast to market companies are also reacting to the growing consumer preference for organic nutritional yeast. Participants in the industry are launching deactivated yeast-containing snacks sports drinks supplements and baked goods.

The market is expected to grow at a CAGR of 13.3% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 1,016.20 Million.

Demand for plant based food is increasing demand for Nutritional Yeast.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Biomin, Leiber GmbH, Cargill Inc and more.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.