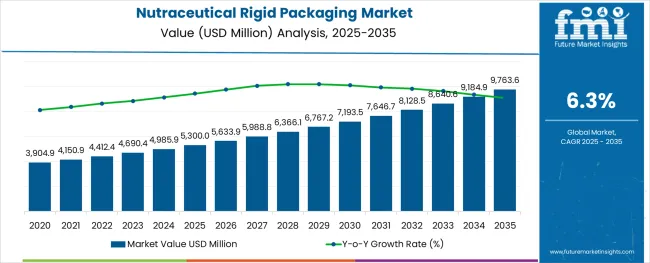

The nutraceutical rigid packaging market is expected to grow from USD 5,300 million in 2025 to USD 9,763.6 million by 2035, registering a CAGR of 6.3% during the forecast period. Year-on-year expansion increases steadily, starting at USD 333.9 million in 2026 and reaching USD 578.6 million by 2035.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 5,300 million |

| Projected Market Value (2035F) | USD 9,763.6 million |

| Value-based CAGR (2025 to 2035) | 6.3% |

This upward trend reflects rising demand for health supplements, greater focus on preventive wellness, and growing adoption of durable, high-barrier packaging formats. Momentum picks up after 2030 as sustainable rigid solutions such as PET and HDPE containers become more mainstream.

The decade-long trend shows no signs of decline, indicating strong market fundamentals. Innovation in bio-based materials and smart-packaging technologies is expected to drive premiumization, especially in high-growth regions like Asia-Pacific and North America.

The nutraceutical rigid packaging market makes up about 6-8% of the global nutraceutical packaging industry, which is worth around USD 100 billion. Rigid formats like bottles and jars are preferred for tablets and capsules because they offer better protection and shelf life than flexible pouches.

Although it holds a small share in the larger USD 1.2 trillion packaging industry, this segment adds strong value by supporting product safety and brand appeal. In the health and wellness sector, companies are moving toward recyclable materials like HDPE and glass. Premium supplement brands often spend 10% of product cost on rigid packaging to boost perceived quality. Online sales are also driving demand for sturdy, stackable packaging that’s easy to ship.

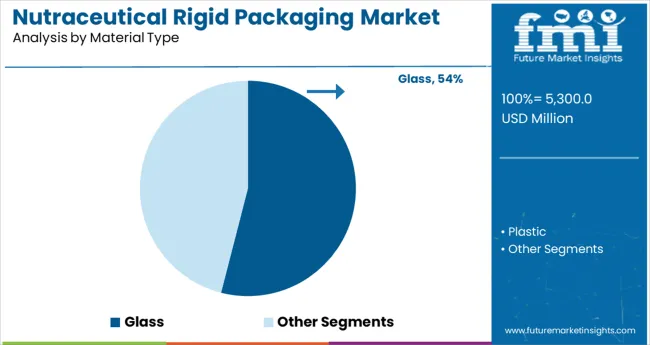

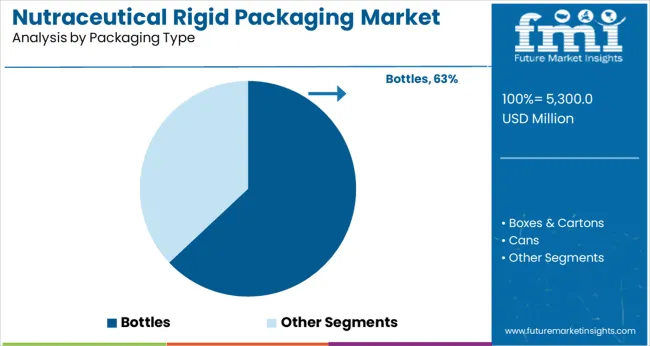

Sales of nutraceutical rigid packaging are accelerating due to the dominance of glass materials and bottle formats. The market is benefiting from consumer preferences for tamper-resistant, recyclable, and premium-looking containers across the supplements and functional food sectors.

Glass is expected to dominate the material type segment, accounting for 54% of the nutraceutical rigid packaging market by 2025. Known for its premium appeal, non-reactive properties, and superior barrier qualities, glass continues to be favored for packaging vitamins, supplements, and herbal extracts. High transparency and reusability also support its demand in eco-conscious consumer groups.

Bottles are projected to capture 63% of the market by 2025, making them the most popular packaging type for nutraceuticals. Their adaptability across dosage forms, including liquids, powders, and capsules, makes them ideal for broad-spectrum applications. Easy-to-use closures and improved shelf appeal further fuel their widespread acceptance.

The nutraceutical rigid packaging market is expanding due to rising demand for shelf-stable formats, tamper-evident features, and premium brand positioning. PET jars, HDPE bottles, and induction-sealed closures are dominating formats, while automation and lightweighting drive efficiency. Smart labeling and clean dispensing are further reshaping packaging lines across vitamins and powders.

PET Bottles Dominate Due to Durability and Clarity

PET rigid bottles accounted for 47% of nutraceutical packaging units sold in North America by mid-2025, up from 39% in 2023. Brands favor PET for its strength-to-weight ratio and transparency, which improved shelf visibility and consumer trust. Lightweighting efforts reduced resin use by 14% per bottle without compromising drop impact resistance.

Facilities using PET lines reported 21% faster fill rates and 17% lower rejection due to container deformation. Child-resistant, tamper-evident caps paired with PET bottles gained 36% higher uptake in immunity and brain health supplement SKUs. PET’s compatibility with both powders and softgels is reinforcing its lead across direct-to-consumer and retail formats.

Powder Packaging Pushes Demand for Wide-Mouth HDPE Jars

Wide-mouth HDPE jars saw a 31% YoY rise in demand for nutraceutical powders, particularly in protein, greens, and collagen formats. Manufacturers using 89 mm and 100 mm neck finishes reported 23% faster scooping and 27% fewer consumer complaints related to product access.

Induction-sealed closures extended shelf life by up to 18%, crucial for moisture-sensitive SKUs. Automation upgrades enabled 1.6× faster labeling on textured HDPE surfaces. Bulk powder SKUs between 500-1000 g are driving this shift, with over 62% of new launches using rigid jars instead of stand-up pouches. HDPE’s moisture resistance and resealability are key to its continued packaging preference.

| Country | CAGR (2025-2035) |

|---|---|

| South Korea | 6.0% |

| United States | 5.9% |

| European Union | 5.8% |

| United Kingdom | 5.7% |

| Japan | 5.6% |

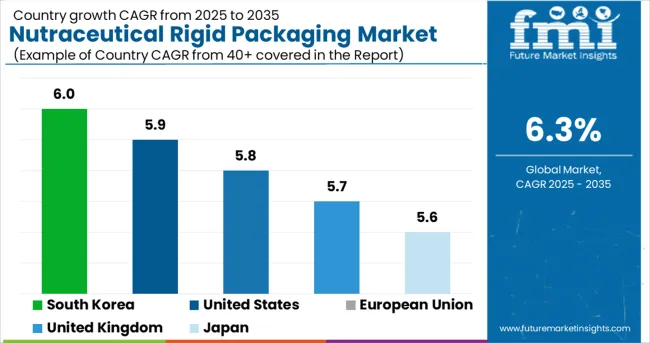

The global nutraceutical rigid packaging market is forecast to grow at a CAGR of 6.3% from 2025 to 2035. Growth in South Korea is projected at 6.0%, close to the global pace, driven by rising consumer focus on wellness and product safety, especially in premium supplement categories. The United States follows at 5.9%, where child-resistant closures and tamper-evident containers are seeing broader use amid evolving FDA labeling norms.

The European Union and United Kingdom post similar CAGRs of 5.8% and 5.7% respectively, reflecting steady market demand supported by EFSA guidelines and a strong base of eco-conscious packaging suppliers. Japan lags slightly at 5.6%, shaped by demographic-driven demand for senior health products in unit-dose packaging formats. While all these OECD nations are active contributors to global market development, their focus varies between regulatory-driven safety, clean-label positioning, and recyclable material integration within rigid formats.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Expected to rise at a CAGR of 6.0% through 2035, South Korea’s market is benefiting from growing interest in functional supplements and premium product aesthetics. From 2020 to 2024, demand was shaped by single-dose containers and opaque PET bottles that protect active ingredients. Future growth will be driven by the popularity of stackable HDPE jars and lightweight composite cans.

The US market is projected to expand at a CAGR of 5.9% from 2025 to 2035, propelled by rising supplement usage and evolving packaging compliance standards. Between 2020 and 2024, demand was focused on BPA-free PET and wide-mouth HDPE containers. Future growth is set to be influenced by demand for tamper-evident closures and smart-label integration.

The EU market is anticipated to grow at a CAGR of 5.8% through 2035, driven by increased regulatory oversight and demand for sustainable materials. During 2020–2024, growth stemmed from glass jars and rigid aluminum containers for botanical extracts. The next decade will see momentum in compostable caps and refill-ready hard shell packs.

Registering a CAGR of 5.7% during the forecast period, the UK market is evolving with the rise of personalized nutrition and e-commerce supplements. From 2020 to 2024, cylindrical HDPE bottles dominated, while 2025–2035 will see increased uptake of resealable snap-fit containers.

Forecasted to grow at a CAGR of 5.6% between 2025 and 2035, Japan’s market is responding to aging demographics and minimalist packaging expectations. During 2020–2024, sachets and blister packs held preference, but rigid PET containers are gaining due to their product visibility and barrier properties.

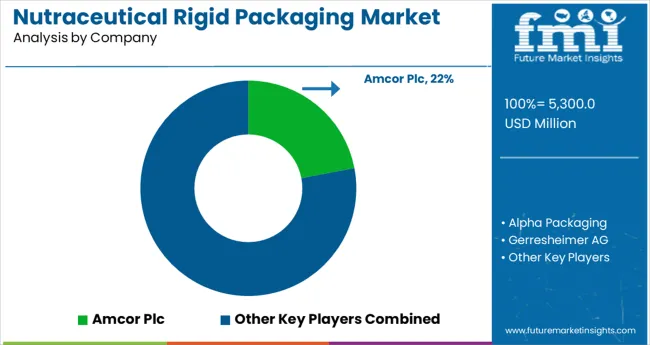

The global nutraceutical rigid packaging market is driven by high-performance material demand, regulatory compliance, and consumer preference for sustainability. Amcor plc leads the competitive field with an estimated 22% global market share, leveraging its broad PET and HDPE container portfolio, light weighting innovations, and wide distribution footprint across North America and Europe.

Gerresheimer AG holds approximately 17% share, dominating pharmaceutical-grade nutraceutical packaging with its precision-molded glass and plastic solutions, especially in the EU and U.S. Alpha Packaging commands around 12%, serving mid-sized supplement brands through short-run production and customization.

Graham Packaging and Sonoco each maintain 6–8% market share, focusing on proprietary closures and BPA-free packaging. RPC Group (part of Berry Global) continues to expand its 100% recyclable product lines, while Constantia and Parekh Plast are gaining traction in APAC through cost-effective rigid jars and caps tailored for Ayurvedic and plant-based nutraceuticals.

Recent Nutraceutical Rigid Packaging Industry News

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 5,300 million |

| Projected Market Size (2035) | USD 9,763.6 million |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Material Types Analyzed (Segment 1) | Glass, Plastic |

| Packaging Types Analyzed (Segment 2) | Bottles, Boxes & Cartons, Cans |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Alpha Packaging, Amcor Plc, Gerresheimer AG, Mondi Plc, RPC Group, Graham Packaging Company, Sonoco Products Company, Constantia Flexible Group GmbH, Wasdell Packaging Group, Parekh Plast India Ltd |

| Additional Attributes | Dollar sales supported by increasing dietary supplement demand, rising preference for PET and HDPE bottles, and regional expansion in pharma-grade nutraceutical packaging. |

The market is segmented into glass and plastic based on material preference.

Includes rigid formats such as bottles, boxes & cartons, and cans.

Covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The market is valued at USD 5,300 million in 2025.

The market is expected to reach USD 9,763.6 million by 2035.

The market is forecast to grow at a CAGR of 6.3% during the period.

Glass dominates the segment with a 54% share in 2025.

South Korea is projected to grow at the fastest CAGR of 6.0% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Nutraceutical Packaging Sector

Nutraceutical Flexible Packaging Market

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Rigid Foam Market Forecast Outlook 2025 to 2035

Rigid Box Market Forecast and Outlook 2025 to 2035

Rigid Sleeve Boxes Market Size and Share Forecast Outlook 2025 to 2035

Rigid Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Rigid IBC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA