The nutraceutical packaging market is booming due to the increasing number of healthconscious consumers who are demanding safe, sustainable, and functional packaging solutions. Nutraceutical packagingunder which bottles, blister packs, sachets, and pouches fallenables product integrity, extended shelf life, and easier distribution to consumer points.

Global nutraceutical packaging is going to be worth more than USD 16.9 billion by 2035, at a compound annual growth rate (CAGR) of 5.2%. Companies innovate with environmentfriendly materials, the latest available technologies, and customized designs capable of meeting different product requirements. Packaging has now become an issue concerning both sustainability and functionality; nutraceutical packaging can offer solutions that serve the priorities for environmental and consumer health.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 16.9 billion |

| CAGR during the period 2025 to 2035 | 5.2% |

Summary

Thus, SWOT analysis illuminates the strength and strategies of the nutraceutical packaging market leaders. Amcor Plc, Gerresheimer AG, and Berry Global have all represented the nutraceutical packaging market's tremendous growth by emphasizing innovation, sustainability, and global presence. Raw material price volatility and stringent regulations provide opportunities for technological advancement and market diversification.

Amcor Plc

Amcor Plc is a leading nutraceutical packaging solution company with durable and recyclable products. The strong R&D capabilities and the global reach make it a leader in the market. However, fluctuating raw material costs pose challenges. The company can have substantial growth opportunities through expansion in emerging markets by designing costeffective solutions.

Gerresheimer AG

Gerresheimer AG offers highvalue packaging solutions suited to the pharmaceuticals and nutraceuticals industries. Manufacturing excellence combined with a customerdriven strategy is a winning platform. Entry into every geographic segment has not been completed. Biodegradable packaging business is gaining huge scope.

Berry Global

Berry Global has innovation in green, environmental friendly packages. Advantages include product line diversity and the portfolio along with green/sustainable initiative programs. This high operation cost has not helped yet. In general, however, an ever increasing need for lighter packaging is helping sustain these revenues in increasing manners.

| Category | Market Share (%) |

|---|---|

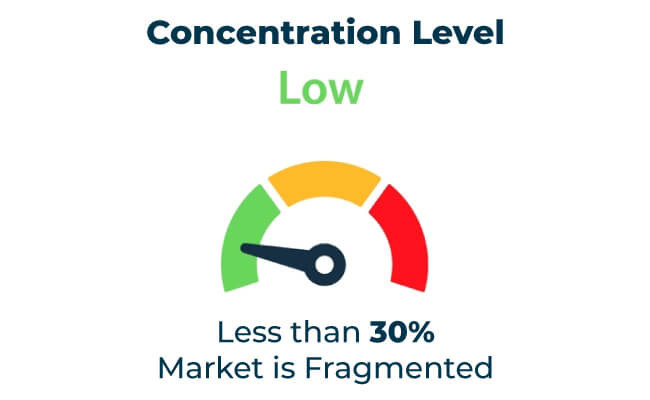

| Top 3 Players | 13% |

| Rest of Top 5 Players | 08% |

| Next 10 Players | 04% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 25% |

| Next 20 Players | 43% |

| Remaining Players | 37% |

Year on Year Leaders

Opportunities are plenty for Africa, Southeast Asia, and Latin America; consumer demand is also on the increase. More consumers are looking for healthier wellness products; the requirement lies in advanced as well as green nutraceutical packaging. Companies conforming to local regulatory environments as well as giving unique solutions stand out in competitive advantages.

In-House vs. Outsourced Manufacturing

The nutraceutical packaging market follows different regional trends, mainly led by consumer demands, regulatory regimes, and environmental imperatives. Businesses that position themselves according to the regional demands of their product are likely to generate maximum growth prospects.

| Region | North America |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Leadership in health-focused and sustainable packaging. |

| Region | Europe |

|---|---|

| Market Share (%) | 30% |

| Key Drivers | Adoption of circular economy practices. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 20% |

| Key Drivers | Rapidly growing health and wellness sectors. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 10% |

| Key Drivers | Expansion in emerging markets. |

The nutraceutical packaging industry will grow with smart technologies, green materials, and expansion into a global market. The companies focusing on sustainable practices and new age designs will have the highest leadership position in that industry.

| Tier | Key Companies |

|---|---|

| Tier 1 | Amcor Plc, Gerresheimer AG, Berry Global |

| Tier 2 | WestRock, Alpha Packaging |

| Tier 3 | Vetter Pharma, ProAmpac |

The nutraceutical packaging market shall go to offer great growth opportunities for industries as well as consumers where health, convenience, and sustainability have the top preference. Companies focusing on innovation, ecofriendly materials, and expansion of their market tend to become the leader of this dynamic future market. Further scope for growth also will be provided in markets as collaborations with dietary supplement, beverages, and pharmaceutical sectors continue.

Key Definitions

Methodology

This report combines primary research, secondary data, and expert insights. Findings are validated through interviews with industry professionals and end-users to ensure accuracy and reliability.

It includes the development and use of innovative, green, and functional packaging for the health and wellness market. It thus covers durability, customer ease, and green concerns.

Rising demand for safe, sustainable, and consumer-friendly packaging drives growth.

Global nutraceutical packaging is going to be worth more than USD 16.9 billion by 2035, at a compound annual growth rate (CAGR) of 5.2%.

Amcor Plc, Gerresheimer AG, and Berry Global are key players.

Regulatory compliance, high production costs, and market awareness are key challenges.

Opportunities lie in smart packaging, sustainable materials, and expanding into emerging markets.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Rigid Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Flexible Packaging Market

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA