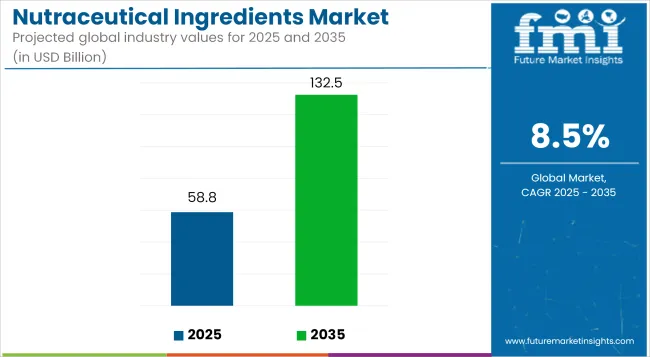

The nutraceutical ingredients market size was estimated at USD 54.15 Billion in 2024. The nutraceutical ingredients industry is expected to grow from USD 58.75 Billion in 2025 to USD 132.5 Billion by 2035. The nutraceutical ingredients market CAGR (growth rate) is expected to be around 8.5% during the forecast period 2025 to 2035.

This growth trajectory is fueled by the rising consumer demand for health-enhancing and functional food products, driven by the increasing incidence of chronic diseases such as obesity, diabetes, and cardiovascular conditions.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 58.75 Billion |

| Projected Market Size in 2035 | USD 132.5 Billion |

| CAGR (2025 to 2035) | 8.5% |

Shift is being further driven by the growing consumer interest in immunity-boosting solutions and preventive healthcare. The increasing emphasis on overall physical and mental wellness is pushing for greater innovation in these ingredients, with functional beverages and fortified foods serving as key drivers. Nutraceuticals are now integral to products like energy drinks, protein shakes, dairy substitutes, and snacks, reflecting the growing demand for convenient and functional food solutions.

Moreover, the shift toward clean-label, organic, and plant-based nutraceutical components aligns with the broader consumer demand for transparency and sustainability. This trend is prompting manufacturers to adapt their offerings, incorporating more natural ingredients to meet consumer expectations. Advancements in ingredient extraction, micro-encapsulation, and bioavailability enhancement are improving the effectiveness of these products, driving higher consumer satisfaction and adoption.

However, the market faces regulatory challenges, particularly with the variation in global regulations on health claims and labeling requirements. Additionally, supply chain disruptions and raw material cost fluctuations continue to pose risks.

Despite these challenges, the market is poised for sustained growth, supported by innovations in personalized nutrition and the increasing integration of e-commerce platforms, which are enhancing accessibility and driving adoption globally. In conclusion, while the market faces some headwinds, the ongoing evolution in consumer preferences and technological advancements offers substantial opportunities for market participants to capitalize on.

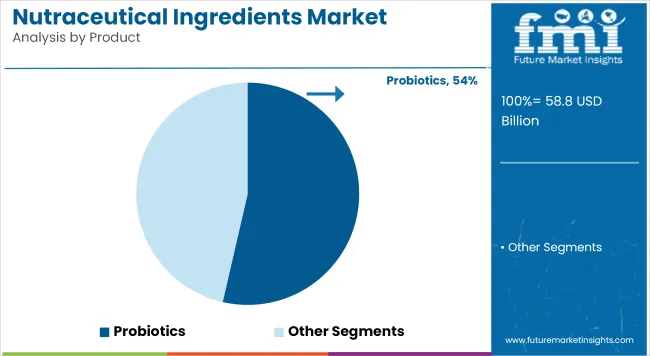

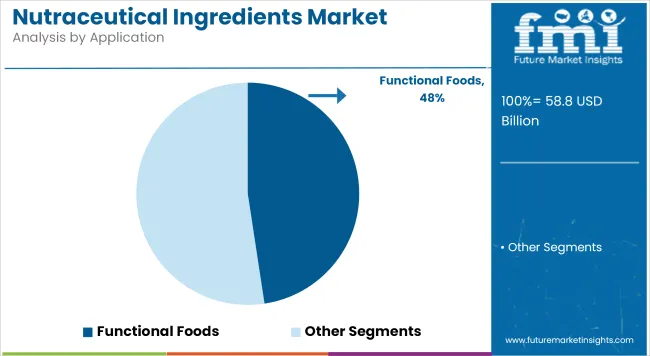

The nutraceutical ingredients market is growing rapidly, driven by key products like probiotics, prebiotics, vitamins, amino acids, and plant extracts. Probiotics dominate due to rising demand for gut health solutions. Both dry and liquid forms are widely used, with dry forms being more common in supplements. Major applications include functional foods, beverages, dietary supplements, and personal care. North America and Europe lead, with the Asia Pacific region experiencing significant growth due to urbanization and rising health awareness.

Probiotics lead with a market share of 53.6% in 2025. The growing consumer awareness of digestive health and the importance of a balanced microbiome is the primary factor driving the growth of the probiotics segment.

Functional food is expected to hold the largest market share, 47.6%, as the demand for food-based products that promote health continues to grow. These products are rich in probiotics, prebiotics, vitamins, and plant-based nutrients, all of which contribute to improved health outcomes.

The growing demand for fortified foods is driven by rising consumer health consciousness and the prevalence of lifestyle-related diseases. However, high production costs, particularly for natural ingredients, hinder widespread adoption. Technological innovations like 3D printing are advancing personalized nutraceutical products, while consumer distrust remains due to safety and efficacy concerns.

Increased Demand for Fortified Foods Due to Rising Consumer Health Consciousness

As lifestyle-related diseases become a growing concern, consumer awareness about healthy food products has boosted the market for fortified foods. Factors such as aging populations, rising life expectancy, and chronic diseases contribute to changes in dietary habits. Fortified foods, recognized as a fast-growing health food category, are essential in addressing global malnutrition. Leading institutions like the WHO emphasize food fortification as a key strategy against malnutrition. The rise in consumer health consciousness and demand for nutritious meals has further fueled market expansion.

Higher Cost of Fortified Products Discourages Widespread Adoption

The high cost of fortified foods, driven by factors like the origin of ingredients (synthetic vs. natural), bioavailability, and packaging, discourages mass adoption. Natural ingredients, although of higher quality, are more expensive due to seasonal availability and manufacturing costs. Proprietary ingredients and specific packaging requirements further increase costs. Despite these challenges, food fortification is seen as a low-cost innovation with long-term benefits, especially in addressing micronutrient deficiencies in basic foods like rice and flour.

Product and Technology Advancements in the Nutraceutical Ingredients Industry

The demand for nutraceutical products surged during the pandemic, prompting the industry to offer tailored diets and supplements. Technological advancements, such as 3D printing, have enabled the creation of personalized nutraceutical products. This includes custom supplements and functional foods designed to meet specific nutritional needs, enhancing their effectiveness. Innovations in delivery systems and personalized nutrition are expected to drive significant growth in the nutraceutical sector.

Technology Makes Use of 3D Printing in Nutraceuticals

3D printing has emerged as a game-changing technology in the nutraceutical industry, enabling the creation of personalized nutrition products. This technology allows for tailored delivery of functional foods and supplements, specifically targeting individual dietary needs. For example, it has been used to create sugar alternatives and functional foods for people with conditions like diabetes, revolutionizing the way nutraceutical products are customized for specific health needs.

Consumer Distrust of Nutraceutical Products

Despite the growing availability of nutraceuticals, consumer skepticism remains high due to concerns over their efficacy and safety. The lack of regulation and oversight in the industry has contributed to doubts about the quality and authenticity of these products. As a result, many consumers view nutraceuticals as medications rather than dietary supplements, leading to caution in their adoption. In response, companies are innovating with new formats like gummies and soft chews to increase consumer acceptance and trust.

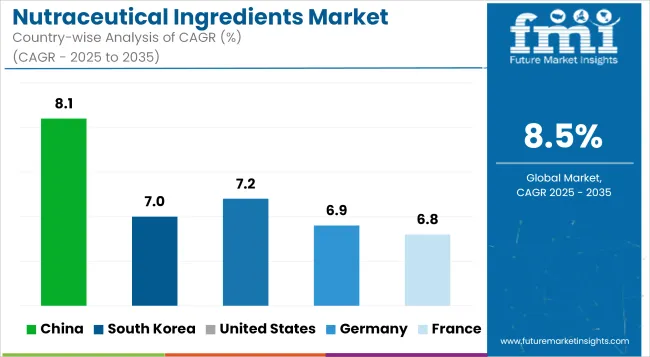

With a CAGR of 8.1%, China leads the market, driven by urbanization, the rise of e-commerce, and the integration of TCM. South Korea follows with a 7% CAGR, fueled by functional nutrition and beauty trends. The USA and Germany both experience strong growth at 7.2% and 6.9% CAGRs, respectively, with increased interest in personalized nutrition, clean-label products, and aging populations. France, with a 6.8% CAGR, benefits from the demand for organic, preventive health solutions, particularly in functional foods and botanicals.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 8.1% |

| South Korea | 7% |

| United States | 7.2% |

| Germany | 6.9% |

| France | 6.8% |

The nutraceutical ingredients market in China is set to grow at a CAGR of 8.1%. Urbanization, a rising middle class, and greater health awareness are key drivers of this growth.

The nutraceutical ingredients market in South Korea is expected to expand at a CAGR of 7%. The industry benefits from a strong focus on functional nutrition, beauty trends, and personalized nutrition solutions.

Sales of nutraceutical ingredients in the United States are forecasted to grow at a CAGR of 7.2%, driven by increasing consumer focus on preventive health and personalized nutrition. The plant-based and organic nutraceutical trend is further propelling market growth.

Demand for nutraceutical ingredients in Germany is projected to grow at a CAGR of 6.9%. The market’s growth is largely driven by the strong pharmaceutical and food industries. An increasing elderly population seeking joint and mental care has spurred demand for functional foods containing collagen and omega-3 ingredients.

The nutraceutical ingredients market in France is expected to register a CAGR of 6.8%. The demand is driven by the popularity of organic and natural food products.

The primary strategy for leading players in the nutraceutical ingredients market has been strategic collaborations, followed by expansions and new product releases. These tactics have assisted them in expanding their footprint in various geographies and industrial sectors. Companies are increasingly working on expanding their footprint through partnerships and alliances, which has enabled them to establish a robust presence across North America, Asia Pacific, and Europe. These companies are also investing heavily in manufacturing facilities and extensive distribution networks in these regions.

Recent Nutraceutical Ingredients Industry News

In August 2024, Nestlé Health Science and Seres Therapeutics, Inc. (Nasdaq: MCRB) announced that they have reached an agreement for Nestlé Health Science to acquire the VOWST business. This acquisition grants Nestlé Health Science complete control over the continued development, commercialization, and manufacturing of VOWST (fecal microbiota spores, live-brpk) capsules, both in the USA and globally.

By product, this segment is further categorized into probiotics, prebiotics, vitamins, amino acids, carotenoids, phytochemicals & plant extracts, protein, EPA/DHA, minerals, and fiber & carbohydrates.

By form, this segment is further categorized into dry form and liquid form.

By application, this segment is further categorized into functional food, functional beverages, dietary supplements, personal care, and animal nutrition.

The industry is expected to generate USD 58.75 billion in revenue by 2025.

The industry is projected to reach USD 132.5 billion by 2035, growing at a CAGR of 8.5%.

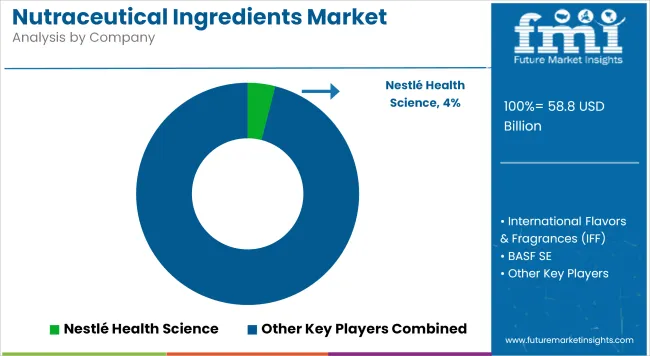

Key players include Nestlé Health Science, International Flavors & Fragrances (IFF), BASF SE, Archer Daniels Midland (ADM), Glanbia Nutritionals, DSM Nutritional Products, Kerry Group, Lonza Group, Ingredion Incorporated, and Cargill Inc.

North America and Asia-Pacific, driven by rising health-conscious consumers, growing demand for plant-based and natural ingredients, and advancements in functional food formulations.

Vitamins and minerals dominate due to their essential role in immune health, energy metabolism, and overall wellness, followed by proteins and probiotics for gut and muscle health.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Rigid Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Key Companies & Market Share in Nutraceutical Packaging Sector

Nutraceutical Flexible Packaging Market

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Marine Nutraceutical Market – Growth, Demand & Functional Benefits

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA